A new paper explores the conundrum that common ownership poses for antitrust enforcers and competition and corporate scholars and sheds light on the distinctive “passive mechanisms” that drive diffuse common ownership, wherein common investors hold small yet similar stakes in commonly-held firms.

The Controversy

Common ownership—the simultaneous holding of shares in competing firms by the same small group of large institutional investors—is the divisive apple of discord in the antitrust and corporate law world. The issue rose to the surface in view of recent empirical economic studies evidencing the anticompetitive effects of common ownership. The likely magnitude of effects—according to a recent study, equal to a deadweight loss of 4 percent of the surplus generated by US public firms and lowered consumer surplus by nearly 20 percent—and significance of the issue given the rampant growth of institutional investors—in particular, “passive” index funds, their growing role and influence in corporate governance, and the pervasive institutional ownership patterns of industrial competitors—soon caused alarm among antitrust enforcers. Subsequent legal analyses systematically outlined the antitrust threat—“the greatest of our time”. Policy proposals followed, suggesting case-by-case antitrust enforcement or a safe harbor for institutional investors exempting them from antitrust liability by limiting within-industry diversification or a complete ban on passive funds exercising voting rights in corporate governance.

Such proposals have encountered relative skepticism, not only for their contested merits but most importantly, because they arguably offer “a solution in search of a problem.” According to this line of reasoning, institutional shareholders and in particular the “Big Three” index funds are “passive investors” (although not necessarily “passive owners”) and if anything, “under-engaged” in the corporate governance of their commonly-held firms. The passive nature and miniscule size of their individual common holdings in competing firms thus undermines the plausibility of the common ownership hypothesis, or so the argument goes. In addition, corporate governance scholars have been vocal in calling into question the channels of influence and mechanisms through which common ownership is likely to produce competition concerns. Antitrust enforcers have been receptive to these arguments pondering on the “passive” harm theory by dispersed common shareholders.

Varieties of Common Ownership

In my article “Varieties and Mechanisms of Common Ownership: A Calibration Exercise for Competition Policy” published as part of a Special Issue on Common Ownership and Interlocking Directorates in the Journal of Competition Law and Economics, I engage with the conundrum posed by common ownership and address claims and defenses of both its proponents and critics.

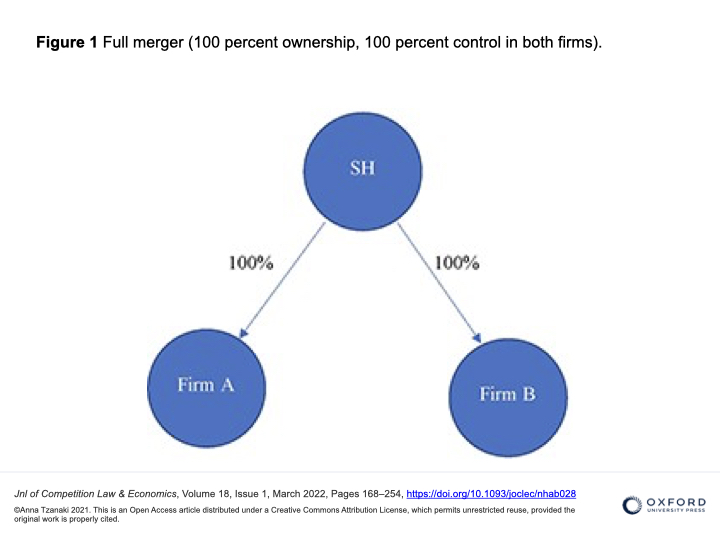

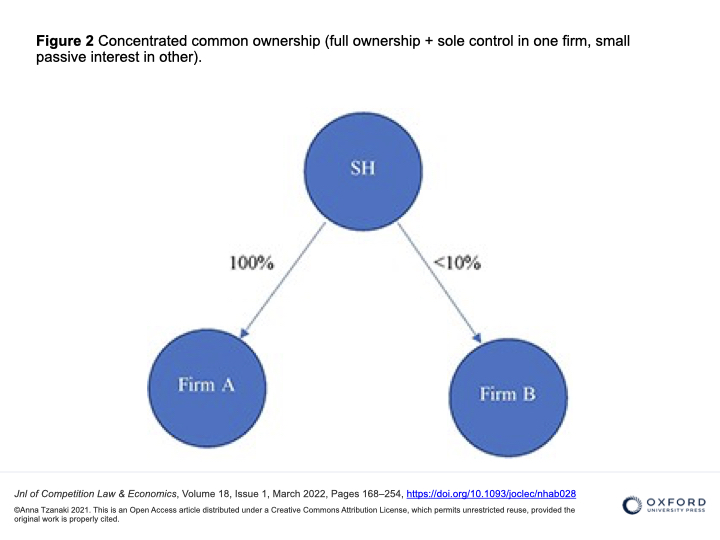

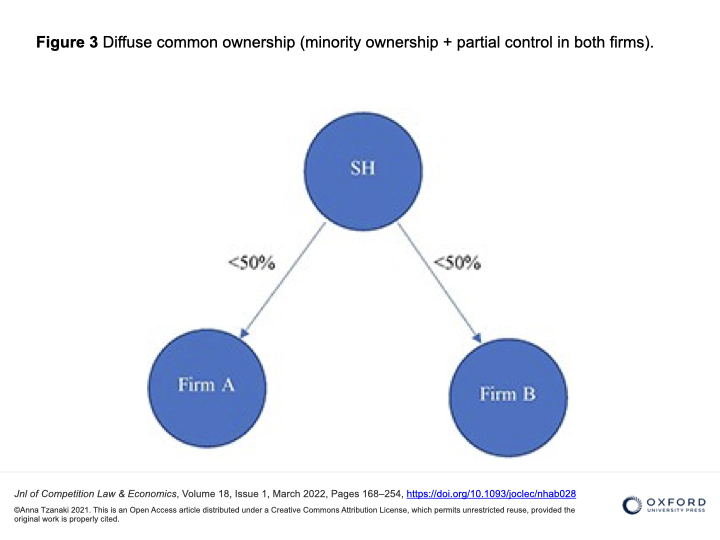

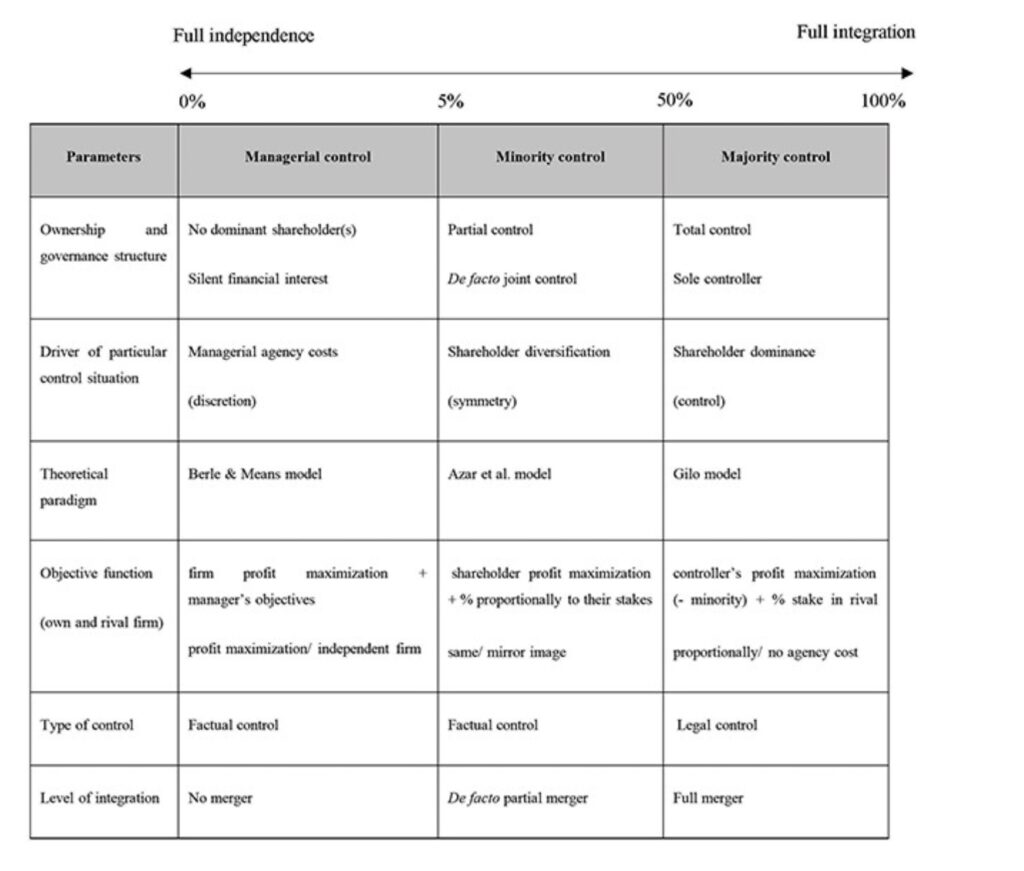

To begin, I make a clear conceptual distinction between two varieties of common ownership—the “concentrated” and the “diffuse”—whose defining qualities I illustrate by comparing and contrasting them with the characteristics of a full merger. The latter may also be conceived as a special form of common ownership with fully and perfectly overlapping shareholders. Unlike full mergers, overlapping ownership of competing firms under both varieties is critically partial. This, in turn, creates novel analytical and empirical questions to which traditional answers may not always be satisfactory or appropriate.

Although both kinds of common ownership imply partial overlap in the share capital of rival firms due to the presence of the same group of shareholders-investors, there is a major critical difference. Concentrated common ownership is asymmetric (common investors disproportionally own and control one of the commonly-held firms) whereas diffuse common ownership is symmetric (common investors hold similar stakes in the commonly-held firms). The paradigmatic example of the latter is fully diversified index funds, which are symmetrically invested across competitors in an industry. This implies the two types of common owners have different incentives to induce their firms to compete in product markets and may employ different strategies for engaging in corporate governance.

In the case of concentrated common ownership, governance is “firm specific” focused on the individual firm that is disproportionately owned as this is the relatively larger source of profit for the concentrated common owner(s). One way to think about this is by analogy to “controlling” partial acquisitions in a merger control framework. So far, so good and there is nothing new under the sun here. Both corporate and antitrust law doctrine and analytical tools are well apt to tackle these situations of common ownership. This is because the common owners’ control within firms and in markets is clear both from a legal and an economic perspective.

In contrast, diffuse common ownership is a wholly new phenomenon without historical precedence. While when assessed individually they could be conceived as “non-controlling” partial acquisitions in a merger control framework, these common holdings are not isolated occurrences but multiple, parallel, and compound in nature and effect. The novelty of the issues underlying the contemporary debate on common ownership heightens the stakes of getting the analysis right, both as a matter of theory and empirics. To that end, my article aims to shed light on the distinctive “passive mechanisms” associated with diffuse common ownership and the circumstances under which these may appear to be plausible and potentially give rise to material effects.

The Passive Mechanisms of Common Ownership

Diffuse common ownership is characteristic in situations where common institutional investors hold small (in absolute terms) but equal (in relative size) shares in most competitors in an industry. The question that arises then is to what extent these common investors are likely to internalize the interlinked profits flowing from their portfolio of competing firms, as common owners (internalization mechanisms) and whether and how they would be able to influence the corporate organs and decision-making of their firms, as common shareholders (transmission mechanisms).

My analysis clearly shows that even in the absence of formal “control” as perceived in antitrust and corporate governance scholarship, diffuse common shareholdings are not harmless or innocuous across the board. Indeed, industrial organization literature has long illustrated how even unilateral “non-controlling” or so called “passive” shareholdings in rivals may lessen incentives to compete in concentrated, oligopolistic markets, leading to competitive harm in the form of increased prices and reduced output. Similarly, in certain factual circumstances, such as in markets dominated by large, publicly traded firms with dispersed shareholder structure and with no disproportionately dominant non-common shareholder within the corporate governance of the commonly-held firms (no single block holder), the common investors may as a group come to exercise corporate control on an informal basis (de facto joint control), although standing alone they are presumed “passive.”

“My analysis clearly shows that even in the absence of formal “control” as perceived in antitrust and corporate governance scholarship, diffuse common shareholdings are not harmless or innocuous across the board.”

These passive mechanisms of diffuse common ownership are atypical but potent. First, they are atypical because they are unilateral. Meaning, they operate on the basis of unilateral effects, without need for explicit communication or coordination. Second, both mechanisms supporting diffuse common ownership are informal: one is based on pure incentives—passivity under antitrust law (absence of active influence); the other on partial minority control—that is, factual control under corporate law (absence of large, active investors). Third, the driver of the potential anticompetitive effects of diffuse common ownership is diversification and not investor concentration as such, as is the case in instances of concentrated common ownership.

At the same time, the power of the passive mechanisms behind common institutional holdings in rivals lies in their symmetry and aggregation. These characteristics make dependence on standalone control obsolete. On the one hand, no matter how small these minority shareholdings, their symmetry and parallelism make their size–or absence of outright control–inconsequential. In such conditions, the common interest to maximize the portfolio value of all their common holdings (rather than the firm value of individual firms) rationally prevails. Diffuse common owners are thus expected to employ “portfolio-wide” corporate governance strategies and influence firm decision making on the basis of their aggregate portfolio of common shareholdings. Besides, governance engagement following a portfolio approach or “selective omission” strategies (i.e., across-the-board or targeted passive transmission mechanisms) need not create conflicts with corporate law principles.

On the other hand, diffuse common owners having similar interests across firms may be willing and able to collectively exercise their corporate voting rights and influence the behavior of firms and managers under their de facto control. This type of common control is factual and “relative” but nonetheless solid. Passive institutional investors—in particular, the “Big Three” index funds—are disproportionately large and influential while also quasi-“permanent owners” compared to other passive but less “structurally prominent” retail investors in widely-held public firms. Hence, in the absence of dominant block holders or activists interested in maximizing individual firm value, diffuse common owners may plausibly possess effective “minority control” as a group and implement their portfolio strategies.

Figure 5: Spectrum and bounds of (economic) control—Corporate control by shareholders vs managers for varying levels of integration

This also means that absent a majority controller in the commonly-held firms’ governance (legal control), even large public corporations may not be fully de facto controlled by their managers. Rather, depending on their (cumulative) shareholding size and (relative) power, diffuse common owners may be at least partial controllers of the firms—i.e., partially disciplining corporate management (minimizing managerial agency costs) and imposing their own objectives (portfolio value maximization). Further, any (pro- or anti-) competitive effects of diffuse common ownership are produced on a cumulative basis: it is not individual minority shareholding participations in rival firms (that usually may be considered negligible) but rather their combination and aggregate effect due to the diffusion of common ownership across multiple competitors in an industry at the same time that may be (significantly) problematic.

As a result, it may be that “passive,” diffuse common owners have both the incentives and ability to alter competitive outcomes by acting upon their portfolio value maximization objectives.

Implications

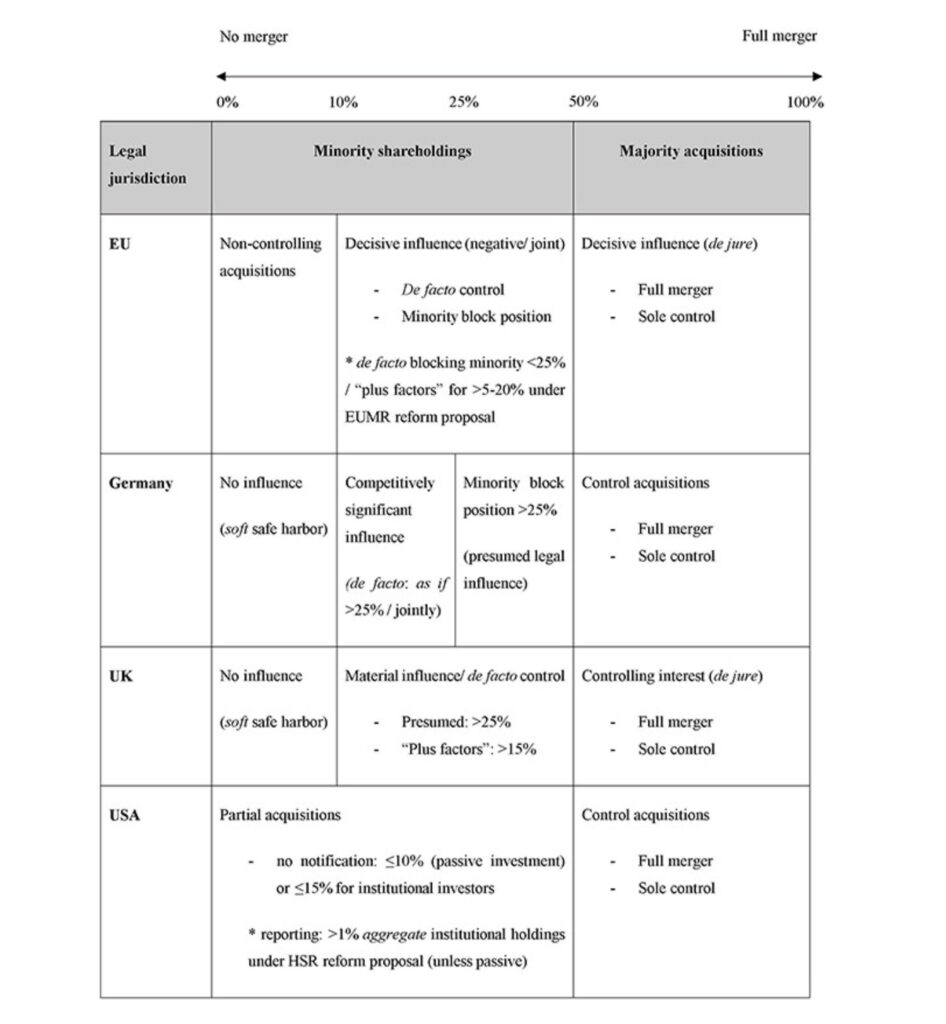

The implications of the common ownership thesis and this analysis are wide-ranging and nothing less than revolutionary in multiple respects. The exposition of the mechanisms underlying diffuse common ownership indicates that (under certain conditions) there is indeed a (new) problem that may be worthy of closer attention by antitrust policymakers. Yet, effective solutions to the problem may be tricky to devise. Diffuse common ownership may easily go under the radar of most existing merger control regimes, precisely due to its manifestation through “passive” mechanisms. Unlike concentrated common ownership (graphically equated to majority acquisitions) whose legal treatment is uniform across major jurisdictions, the picture is very fragmented when it comes to diffuse common shareholdings (minority acquisitions).

Figure 4: Spectrum of (legal) control or influence—Merger control test for varying levels of shareholding acquisitions

The challenge is that diffuse common ownership runs against both legal and economic “formalism” in antitrust. First, established benchmarks used either within antitrust (“single economic entity”) or corporate governance (“sole owner”) to determine independent market conduct or optimal investor engagement, are blind to the implications of simultaneously holding parallel financial interests in many firms when de facto minority control is exercised jointly by many investors. Second, traditional metrics and analytical tools used in merger control enforcement are not suitable in this case.

Smart merger control design would need to steadily adjust its analytical and jurisdictional tools to capture these newly revealed dynamics. My article puts forward a whole range of antitrust and merger control reform proposals touching upon both legal and economic aspects of the competition assessment. The key takeaway is that residual ex post antitrust enforcement based on refined structural and conduct screens may be needed to effectively wipe out any anticompetitive effects (ex post enforcement) but also the “profit motive” (ex ante deterrence) behind diffuse common ownership.

Competition agencies should recognize the basic distinction between the two varieties of common ownership, adjust their enforcement practices to account for the “passive” mechanisms and the novel “effects-based” theory of harm associated with diffuse common ownership, and develop clear guidelines on how to treat common ownership cases in the future.

Disclosure: This research was funded by the European Union’s Horizon 2020 research and innovation programme under the Marie Skłodowska-Curie grant agreement No. 846270. The author had acted as an external expert advising the Hellenic Competition Commission in a market investigation in the construction sector involving issues of common ownership. She had also been engaged on behalf of the European Commission to provide research input to the DG COMP final report “Support study for impact assessment concerning the review of Merger Regulation regarding minority shareholdings COMP/2015/007,” October 2016.

Read more about our disclosure policy here.