Despite the overwhelming importance of digital platforms, and the chatter around their recent rise, our understanding of digital ecosystems is still limited. As such, we risk plunging into a regulatory debate without having first properly analyzed the nature of the problem. We need more grounded empirical work on digital competition and power.

As regulatory discussions on both sides of the Atlantic gather pace, the question is not whether digital platform-based ecosystems will be regulated, but how.

In 2019, three influential reports—in the UK (Furman), the US (Stigler Center), and the EU (Cremer et al)—identified many of the key aspects of competition that our existing frameworks were ill suited to address. Regulation proceeded apace in 2020, with the EU pushing ahead with its development of the Digital Services Act and Digital Markets Act, Australia putting forth a new framework for the negotiation between Big Tech firms and the media, and the US moving forward through key lawsuits (in particular, against Google and Facebook) and an encompassing report by the House Judiciary Committee on platform power. The BRICS countries have been pondering over a Draft Report released in September 2019, while the UK government has already made proposals for a new competition law regime for tech giants.

More recently, a number of high-profile cases have been introduced in the US, EU, UK, France, and China against digital platforms, showing that recent regulatory efforts are a complement rather than a substitute for traditional competition law tools. The year 2021 promises to be one of intense lobbying and regulatory discussion, with both Big Tech firms, whose power and market capitalization have increased through the pandemic, and governments, alarmed and emboldened by popular reaction, gearing up for a standoff.

Even as we reckon with platform firms and the ecosystems they spawn, we still lack the shared terminology, phenomenology, and articulation of the theories of harm to competition that we really need. Instead, policymakers and regulators rely on ad hoc solutions.

“While markets, digital platforms, and network effects have been thoroughly studied, ecosystems have been relatively neglected.”

We believe that despite their overwhelming importance, and the chatter around the recent rise of digital platform-based ecosystems, our understanding of them is still limited. As such, we risk plunging into a regulatory debate without having first properly analyzed the nature of the problem: what can existing regulatory tools address, and what regulatory innovations are required? Our recent article for the 2021 Special Issue of Industrial & Corporate Change on regulating platforms and ecosystems tackles these issues. We sum up the key take-aways below.

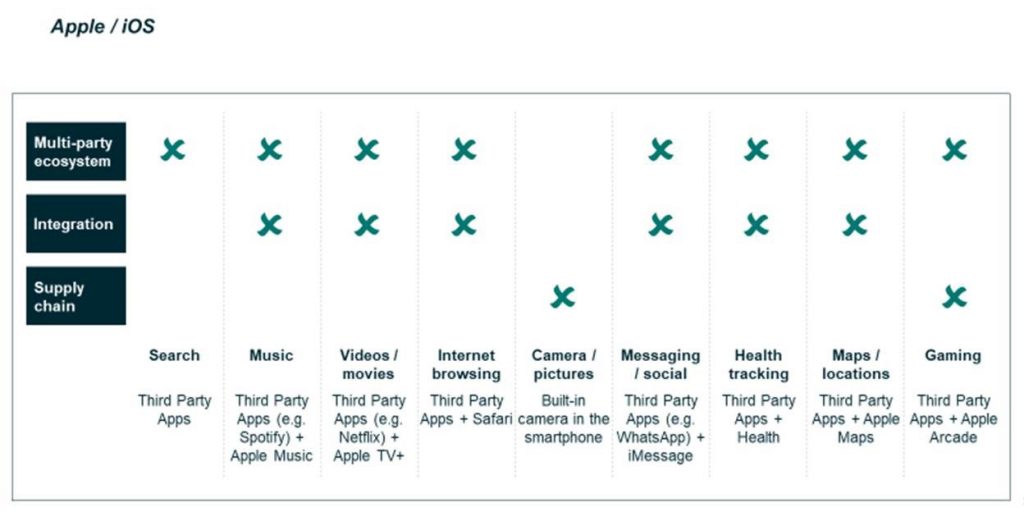

While markets, digital platforms, and network effects have been thoroughly studied, ecosystems have been relatively neglected. Though ecosystems are referred to as a single concept, two distinct types are used by Big Tech and others: 1) multi-product ecosystems, which combine a number of different products and services to offer a (novel) package or “solution,” and 2) multi-actor ecosystems, a novel way to organize where a powerful orchestrator sets the stage for a series of partners and complementors to produce something of value-add to final customers. Multi-product ecosystems, which often lock customers in, also enhance the power of orchestrators, who use multi-actor ecosystems to enhance their offerings as they branch out into new domains. Big Tech firms use, simultaneously, both types of ecosystems as the example below illustrates, showing Apple’s multi-product ecosystem, which employs a number of different and distinct multi-actor ecosystems.

We need more grounded empirical work on ecosystem competition and power. For instance, while ecosystems compete with each other horizontally, they also tend to find ways to collaborate and divide the pie among themselves—as we saw from the recent yearly multi-billion-dollar payments Google made to Apple to “acquire traffic.” Also, multi-actor ecosystems are often characterized by a significant exercise of vertical intra-ecosystem power—a blind spot of current theory and practice, illustrated by the recent Apple vs Epic lawsuit. While the EU’s DMA has tried to rein in such power by arguing that all-powerful gatekeepers should be held to higher account, the very concept of “gatekeeper” is up for grabs. The DMA uses absolute measures, which capture some key firms but leave open questions such as “What are the firms in question gatekeepers to?” or “What makes a gatekeeper powerful?” The issue is that we have yet to develop a systematic understanding of ecosystems and the issues they raise. We do not yet have a theory of “ecosystem failure” akin to “market failure.” And we need one.

Traditionalists might contend that all this is superfluous. Why can’t we just stretch our existing constructs to encompass ecosystems? Why focus on ecosystems at all, when we can redefine the concept of a “relevant market” and then leverage the existing analytical arsenal offered by competition analysis?

The answer is that sticking with traditional frameworks obscures the nature and exercise of power in ecosystems. For example, a “relevant market” framework does not capture the impacts of complementary and distinct firms engaged in an ecosystem. It misses the structural aspects of the power of ecosystem orchestrators, whose ability to govern an ecosystem in an increasingly exploitative manner can remain relatively inconspicuous due to the dynamic, indirect ways in which it concentrates power..

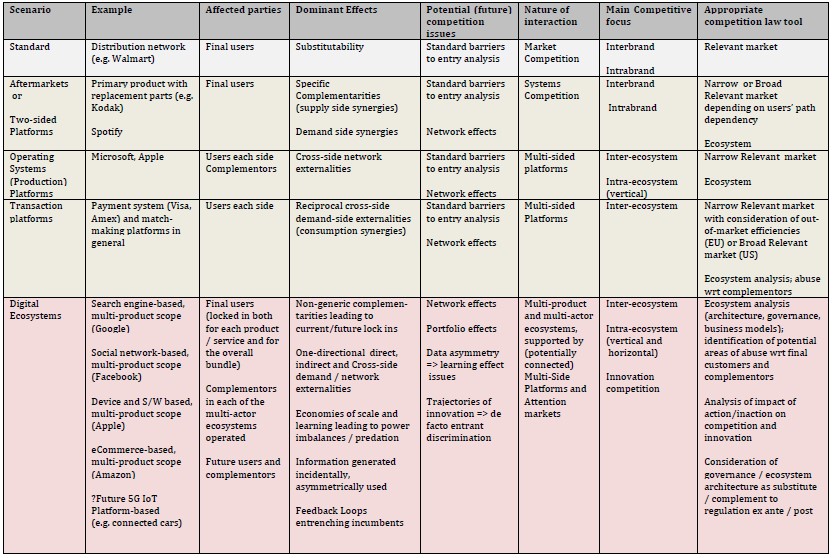

This gap between a narrow, archetypical conception of a phenomenon and empirical reality has happened before. In response, competition law updated and expanded its purview. For example, the 1992 US Supreme Court Kodak case was instrumental in defining aftermarkets for antitrust analysis; in the EU, the Microsoft and Google Search (Shopping & AdSense) and Android cases on operating systems later that decade and in early 2000s helped regulation tackle cross-side network externalities; and more recent cases like Cartes Bancaires in the EU and Amex in the US helped to crystallize our view of multi-sided platforms. We think the time has come for a similar broadening of our regulatory framework to make it fit for a complex economy, as Table 1 below suggests.

Table 1: From Relevant Market to Ecosystem Analysis in Competition

Taking ecosystems seriously helps us ground our work in empirical reality. It guides us to focus on ecosystem architecture, which can be engineered and is often set unilaterally by powerful ecosystem orchestrators (even more than industry architecture). In particular, we need to consider ecosystem governance and the business models that each ecosystem implies—monetization in particular. Such an approach reveals potential issues very clearly, as illustrated by the CMA’s recent report on digital advertising. Architectural analysis helps identify potential areas of abuse—not only of final customers, but also of complementors. We can then compare the impact of action on competition and innovation with that of inaction. Given the proclivity of ecosystems for tipping and network effects, such a reconsideration of the mechanics of regulatory intervention is essential.

Ecosystems should be interrogated precisely because of their potential to drive collective value-add and underpin innovation—and because uncompetitive practices may curtail both what innovation comes about, and who is able to innovate. While ecosystem competition to date might have evolved without much regulatory intervention, the increasing concentration in Big Tech, and the growth of incumbents through M&A, raises questions we need to address.

To illustrate, dominant ecosystem actors can potentially leverage their relationship with the final customer, unilaterally restricting access, choice, innovation, or even privacy. Apple, for instance, is leveraging its new phone operating system iOS14 to reshape what its ecosystem partners are allowed to do, and continues to have a heavy hand on its complementor rules, from exacting a 30 percent commission, to prohibiting App developers to have in-App payment systems. Google and Facebook impose a take-it-or-leave it exchange at zero price to their users, which restricts the latter’s ability to monetize their data in data markets or to protect their privacy. Powerful orchestrators such as Big Tech can monetize the knowledge they gain from consumer usage patterns, either to directly benefit their own activities (or those they broker) or by selling information about customers, and access to them, through advertising. They can also gain an unfair advantage when entering adjacent markets, further assisted by opportunities offered by AI and real-time experimentation and the funding offered by the capital market in anticipation of these benefits. The motives and the ability to exercise such power depends, in turn, on the business model and the architecture and governance of the ecosystem. It is thus incumbent upon us to articulate them and ensure they can be part of a systematic analysis of “ecosystem failure”: the intellectual counterpart of “market failure,” adapted to the current mode of organizing.

“Ecosystems should be interrogated because of their potential to drive collective value-add and underpin innovation—and because uncompetitive practices may curtail both what innovation comes about, and who is able to innovate.”

The next question, then, is how can we achieve this? The first approach would be to employ the conventional competition law framework—perhaps the normal first step for any paradigm challenged with a structural change. Yet for all the use of the term and desire to tackle the issues, in the absence of new theory, we can only analyze ecosystems within the context of market definition, which inevitably focuses on substitutability. The metric used to measure power, market share, fails to address intra-ecosystem competition, and competition from rents emerging from complementarities. If, for instance, the world’s economy comprised just three colossal firms—Apple, Google, and Amazon—all of which offered the full spectrum of goods, traditional metrics would find no fault.

The second approach, which acknowledges that we need to update our toolkit, has emphasized the use of ex ante approaches to tackle ecosystems. This is exemplified by the European Commission’s proposals on the Digital Services and Digital Markets Acts, or its operational Platform-to-Business Regulation. The goal is to identify, and prohibit, a set of practices that are deemed to be potentially harmful to consumers, ecosystem members, and innovation. The challenge, of course, is that absent a clear sense of the ecosystem architecture, of the related monetization and business models, it is hard to articulate the nature of fault. (In contrast to the EU, such issues have been clearly picked up by the UK’s CMA, and a few researchers.) We need to have a clear sense of the industry and ecosystem architecture, the potential bottlenecks, and the rents to be had, so as to gauge the incentive and opportunity for competitive abuse. We should also explicitly consider the impacts of such regulation in practice.

Finally, a third approach is to combine ex ante specification of what should or should not be allowed with a more traditional ex post framework for policing and remedying competitive issues. In Germany, for instance, the Bundeskartellamt has already taken remedial action against abusive conduct in ecosystems, in its Facebook investigation, and a provision in the 10th amendment of the German Competition Law provides the BKA with the possibility of acting against digital conglomerates that control an entire digital ecosystem comprising several distinct markets—though this has yet to be fully instituted. A number of other national authorities are working on establishing legislation that provides them the ability to regulate ecosystems—including Greece, where we both served in the law preparation committee that proposed the new Article 2A, a novel approach that addresses the abuse of a dominant position in an ecosystem which is of paramount importance for competition in Greece.

This approach, detailed in our recent paper, provides, we believe, a balanced tool: It requires the competition authority to explain the nature of the ecosystem failure, establish there is an abuse of a dominant position, and pinpoint the practices at fault, while also acknowledging that power may reside at the level of an ecosystem. To do so, it must consider both business models and the architecture of the ecosystem in question.

Regulating ecosystems is fiendishly complicated, but burying our heads in the sand helps no-one. The same two forces driving broader economic change—digitization and the dissolution of industry boundaries—have changed industrial demography and power while highlighting the shortcomings of our existing regulatory apparatus, with its focus on market definition. For better or worse, the problems that antitrust is called upon to resolve have changed. Regulation has to evolve with the times, and we need to reassess what power in today’s ecosystems consists of, what distortions in can potentially create, and how it can be dealt with. This is an urgent agenda, where independent research and vigorous debate are needed, as the stakes are high.

Disclaimer: Michael G Jacobides has advised companies active in digital markets on strategy and competition policy, as well as competition authorities.

This article represents the personal views of the authors and does not represent the views of the HCC.