In a new paper, Bing Guo, Dennis C. Hutschenreiter, David Pérez-Castrillo, and Anna Toldrà-Simats study how large institutional investors impact firm innovation. The authors find that large institutional investors encourage internal research and development but discourage firm acquisitions that would add patents and knowledge to their firms’ portfolios, hampering overall innovation.

Innovation and technology drive economic growth. While boards of directors and managers run companies and make investment decisions regarding innovation, corporate shareholders have the power to affect firms’ decisions by using their votes, supervising managers, and influencing managerial incentives with compensation packages or via the stock market.

Institutional investors are large organizations that invest significant amounts of capital in corporations. The share of institutional investors’ ownership in United States-listed equities has dramatically increased in the last few years. Moreover, the number of shares that these investors hold in a single firm have seen an even more remarkable increase. Large investors are known to affect firm outcomes more effectively than investors that hold smaller stakes in firms. Hence, such a sharp increase in the concentration of institutional investors’ holdings in the last few decades allows us to study how institutional investors with large stakes impact firm innovation relative to institutional investors with smaller stakes.

The surge in large institutional ownership

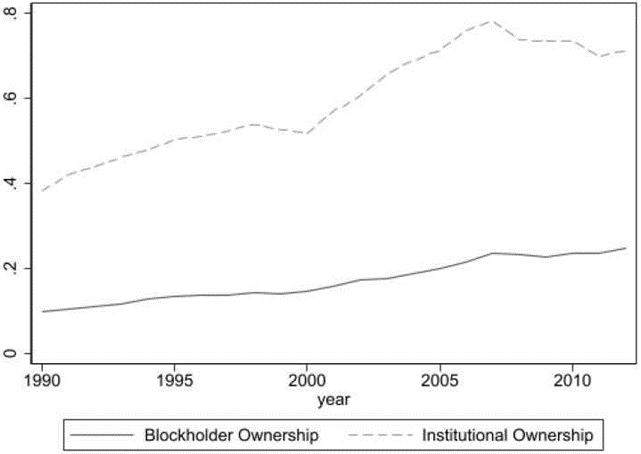

Institutional investors play a crucial role in the financial markets and the broader economy. Due to their large size and diversified portfolios, their strategic investments can have a far-reaching impact on the economy, society, and the overall well-being of individuals and organizations. In recent years, institutional investors’ ownership of U.S. firms has increased substantially, from 38% in 1990 to 71% in 2012. More interestingly, the concentration of holdings of U.S. corporations among institutional investors has also increased substantially, from about 10% to about 21% during the same period. Figure 1 below displays the evolution of institutional ownership (dashed line) and institutional ownership by large investors, which we call blockholders (solid line). We define blockholders as owners holding 5% or more of a firm’s shares.

Figure 1: Institutional and blockholder ownership in publicly traded US companies

On the one hand, blockholders, owing to their substantial ownership of company shares, hold more sway over corporate strategy and thus encounter fewer free-riding problems in supervising firms and participating in the decision-making. Consequently, they impact corporate decisions more effectively than investors with smaller stakes. On the other hand, blockholders’ concentration of power can raise concerns about their influence over corporate decision-making, potentially leading to conflicts of interest or decisions that prioritize short-term gains over long-term sustainability and value. Specifically, we investigate if blockholders encourage firms they have large stakes in to invest in innovation and future output.

Institutional blockholders can have different effects on firm innovation decisions and the final innovation outcome

There are several ways in which blockholders may impact firm postures toward innovation:

Blockholders may alleviate short-term pressure on managers and induce them to invest more in internal R&D. One way a firm can invest in innovation is by allocating funds to internal research and development (R&D). Typically, financial markets put pressure on managers to deliver short- term earnings, which induces managers to reduce R&D spending. This is because any decrease in R&D expenses directly translates into higher firm earnings, enabling managers to circumvent negative market reactions that occur when firms fail to meet the earnings forecasted by financial analysts. Blockholders, as large investors, may trade less frequently than investors with smaller and more liquid stakes. When trading occurs less frequently, managers experience reduced short- term pressure, which can discourage them from taking actions aimed solely at reducing earnings.

Blockholders may reduce firm investment in external innovation. In addition to R&D investment, firms can foster innovation by acquiring patents from other companies. This approach enables them to tap into external knowledge and expertise, which allows them to leverage their internal R&D efforts and facilitates the further development of their own patents and the production of new ones. But blockholders usually dislike acquisitions of other companies. First, blockholders fear that entrenched managers undertake acquisitions to increase their private benefits at the expense of shareholder value. Indeed, managers may propose acquisitions that make companies bigger to gain prestige (empire building), give them a lot of perks, or make them indispensable, thereby securing their positions as managers. These concerns may push blockholders to vote against acquisition proposals. Second, blockholders enjoy control due to their larger firm stakes. Hence, they may also oppose acquisitions because they dislike the potential dilution resulting from new share issuances needed to compensate target firms’ investors.

The overall impact of blockholders on firms’ innovation output may not be as positive as expected. Since blockholders may have a positive effect on internal innovation investment and a negative effect on investments in external innovation, the overall effect on firms’ final innovation output is unclear.

Methodology

In our research, we explore these ideas using a sample of U.S. public firms. In the empirical model, the challenge is to address the possible confounding factors that may affect both the institutional investors’ willingness to become large and firms’ decisions to invest in innovation. For example, some companies may be more attractive to blockholder investors because they have a more sustainable investment policy, and this, at the same time, affects these firms’ innovation strategy. In that case, we would observe a correlation between blockholder ownership and innovation, but it would be completely unrelated to the effect of blockholders. To address this type of problem, we exploit an exogenous source of variation in blockholder ownership due to the mergers of financial institutions, such as the merger of Wells Fargo & Co. and Benson Associates, LLC, that took place in 2003. Indeed, when two financial institutions merge, and both are investors in a given firm, the combined ownership stake of the merged entity is larger, leading to potential increases in the presence of blockholder owners in the firm. We exploit 38 financial institution mergers that took place between 1990 and 2008.

Results

We find that exogenous increases in blockholder ownership induce firms to increase their investment in internal R&D, measured as firms’ total R&D spending scaled by their total assets. We also find that blockholder owners tend to reduce acquisitions in general and, as a result, the acquisitions of external innovation. Overall, the effect of increases in blockholder ownership on firms’ future patents and citations is negative. Based on our tests, it appears that external and internal innovation are complements. Therefore, when blockholder institutional investors decrease their involvement in external innovation acquisitions, they hinder their ability to harness the potential of their internal innovation efforts, leading to a reduction in their future patents and citations. Overall, large institutional investors’ effect on firm innovation is not as positive as one may expect.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.