A 1980s memo from Richard Posner and George J. Stigler to President-elect Ronald Reagan sheds light on their policy advocation for the President’s antitrust agenda.

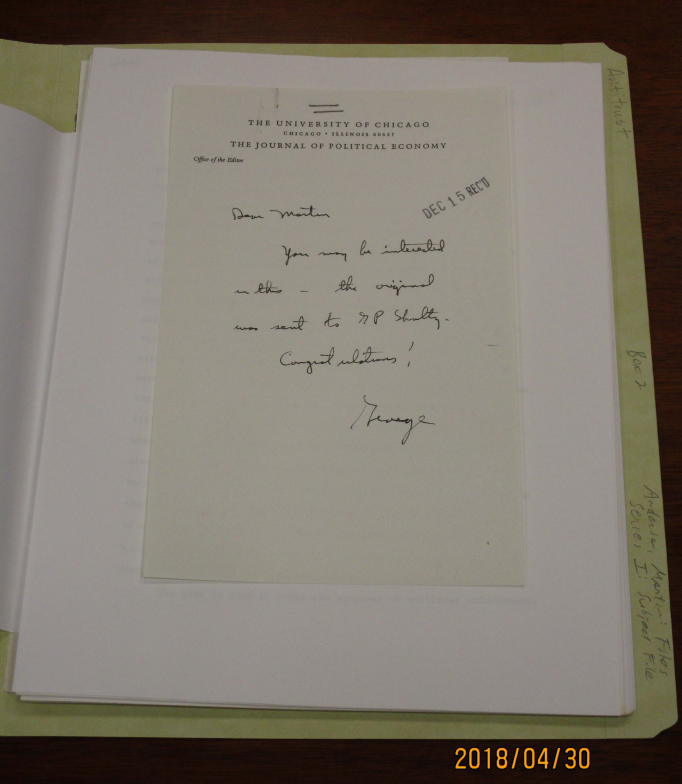

A ProMarket contributor, Erik Peinert, recently unearthed a memo from the Ronald Reagan Library written by Richard A. Posner and George J. Stigler. The memo was sent to Martin Anderson, an economist on Ronald Reagan’s transition team.

At the time, both of the memo’s authors were professors at the University of Chicago. Posner was a law professor, not yet appointed to his position as a federal appellate judge on the US Court of Appeals for the Seventh Circuit. Stigler was an economist who had not yet won the Nobel Prize.

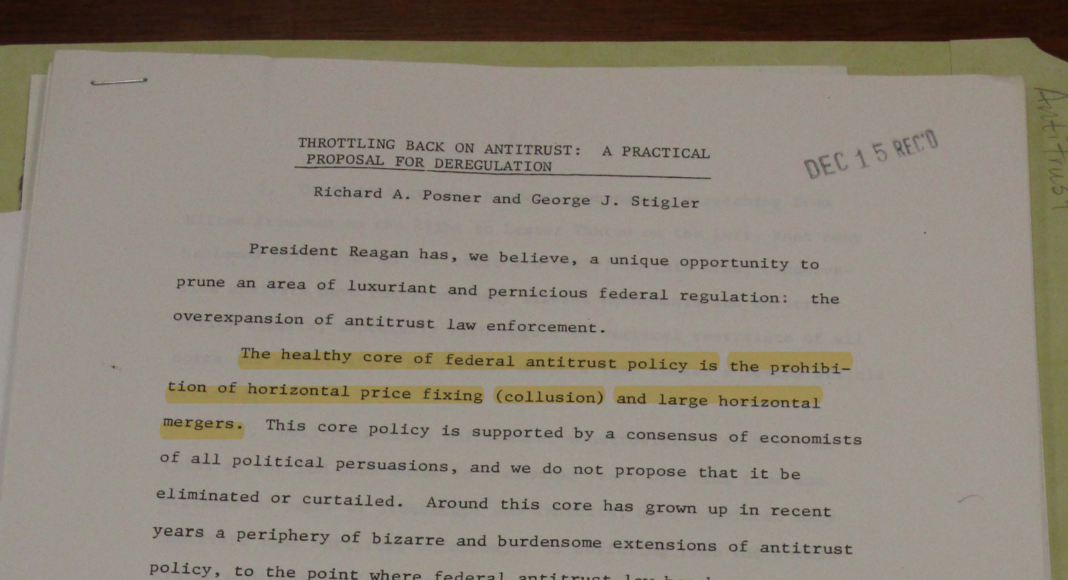

The memo itself is not dated, but was recorded on December 15th, 1980. Images are provided, and the memo’s full text follows at the end of this post.

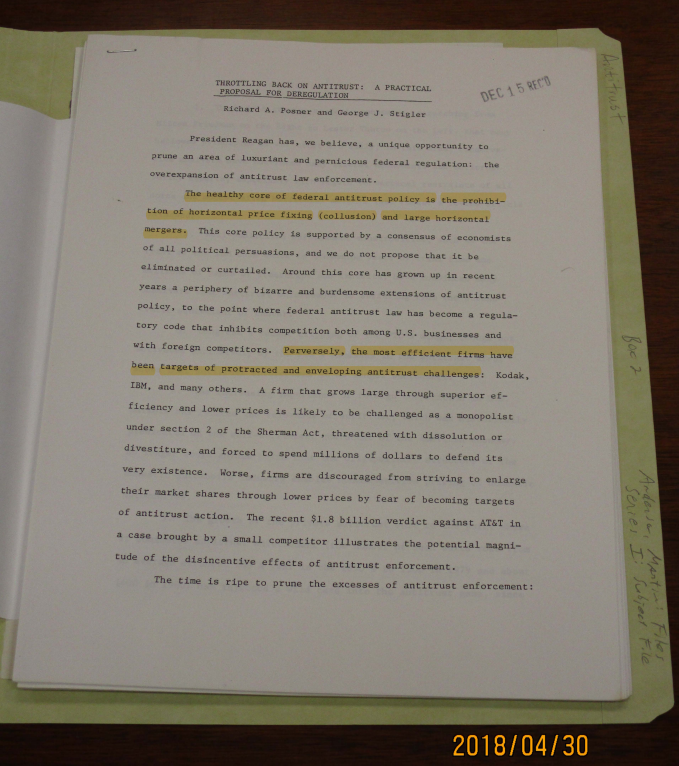

President Reagan has, we believe, a unique opportunity to prune an area of luxuriant and pernicious federal regulation: the overexpansion of antitrust law enforcement.

The healthy core of federal antitrust policy is the prohibition of horizontal price fixing (collusion) and large horizontal mergers. This core policy is supported by a consensus of economists of all political persuasions, and we do not propose that it be eliminated or curtailed. Around this core has grown up in recent years a periphery of bizarre and burdensome extensions of antitrust policy, to the point where federal antitrust law has become a regulatory code that inhibits competition both among U.S. businesses and with foreign competitors. Perversely, the most efficient firms have been targets of protracted and enveloping antitrust challenges: Kodak, IBM, and many others. A firm that grows large through superior efficiency and lower prices is likely to he challenged as a monopolist under section 2 of the Sherman Act, threatened with dissolution or divestiture, and forced to spend millions of dollars to defend its very existence. Worse, firms are discouraged from striving to enlarge their market shares through lower prices by fear of becoming targets of antitrust action. The recent $1.8 billion verdict against AT&T in a case brought by a small competitor illustrates the potential magnitude of the disincentive effects of antitrust enforcement.

The time is ripe to prune the excesses of antitrust enforcement:

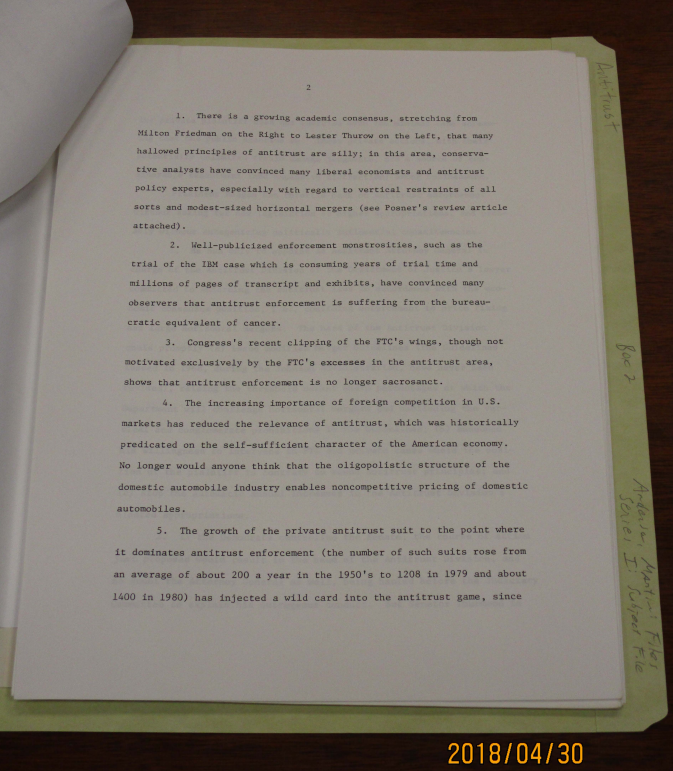

- There is a growing academic consensus, stretching from Milton Friedman on the Right to Lester Thurow on the Left, that many hallowed principles of antitrust are silly; in this area, conservative analysts have convinced many liberal economists and antitrust policy experts, especially with regard to vertical restraints of all sorts and modest—sized horizontal mergers (see Posner’s review article attached).

- Well—publicized enforcement monstrosities such as the trial of the IBM case which is consuming years of trial time and millions of pages of transcript and exhibits, have convinced many observers that antitrust enforcement is suffering from the bureaucratic equivalent of cancer.

- Congress’s recent clipping of the FTC’s wings, though not motivated exclusively by the FTC’s excesses in the antitrust area, shows that antitrust enforcement is no longer sacrosanct.

- The increasing importance of foreign competition In U.S. markets has reduced the relevance of antitrust, which was historically predicated on the self—sufficient character of the American economy. No longer would anyone think that the oligopolistic structure of the domestic automobile industry enables noncompetitive pricing of domestic automobiles .

- The growth of the private antitrust suit to the point where it dominates antitrust enforcement (the number of such suits rose from an average of about 200 a year in the 1950’s to 1208 in 1979 and about 1400 in 1980) has injected a wild card into the antitrust game, since actions, with their potentially unlimited treble damage judgments, are a source of considerable resentment (and expensive distraction) among businessmen.

President Reagan can throttle back on antitrust enforcement without asking for new legislation or higher appropriations, and probably without antagonizing politically influential constituencies.

- He has only to appoint as Assistant Attorney General in charge of the Antitrust Division of the Department of Justice a lawyer committed to enforcing the antitrust laws in accordance with the economic consensus position, i.e., confining enforcement to price fixing and large horizontal mergers. The head of the Antitrust Division could promptly (a) issue modified Merger Guidelines (the Guidelines issued In 1968, during the Johnson Administration, have never been revised), the raising the threshold market share percentages at which the Department will challenge horizontal mergers and abolishing the vertical and conglomerate prohibitions in the Guidelines; (b) announce his willingness to intervene in FTC and private cases where the position of the plaintiff is contrary to sound antitrust principles; and (c) stop the automatic annual increases in the Antitrust Division’s bloated appropriations.

- If the Democrats controlled the Senate, the course of action just proposed would result in the head of the Division, and no doubt the Attorney General as well, being hauled before the Judiciary Committee to explain his outrageous conduct. But Senator Thurmond is a conservative in antitrust matters, and should not the suggested reforms.

- Partially to offset the dyspeptic tone of above, the Assistant Attorney General could and should affirm his commitment to act as a vigorous spokesman of the competitive interest throughout the federal government, and especially before other government agencies — the ICC, FCC, FERC, International Trade Commission, etc.

- When a vacancy next occurs on the FTC, the President should appoint as Commissioner (and designate as Chairman) a like—minded person who would move the FTC the same direction that is suggested above for the Antitrust Division.

- These appointments not directly affect the private antitrust suits brought by private plaintiffs. But the indirect effects will be enormous, and wholly beneficial. Although we do not have figures, our impression is that a large fraction of private suits are piggyback on prior government suits, so curtailing the latter lead in time (pretty quickly) to a dramatic fall—off in private suits. Further, many courts would probably defer to the announced positions of the Justice Department, viewed as a responsible enforcer of the antitrust laws, on questions of antitrust policy arising in private suits.

Richard A. Posner and George J. Stigler, “Throttling Back on Antitrust: A Practical Proposal for Deregulation,” Rec’d December 15, 1980, Series I, Box 2: Subject File, Martin Anderson Files, Ronald Reagan Library.