According to the 18th-century French banker and philosopher Richard Cantillon, who benefits when the state prints money is based on its institutional setup. In the 18th century, this meant that the closer you were to the king and the wealthy, the more you benefitted, and the further away you were, the more you were harmed. The same is true today, with the Fed’s anti-pandemic liquidity measures benefitting hedge funds and private equity firms first.

Three weeks ago, the government passed a giant multi-trillion dollar bailout. Supposedly, it was money for a host of stakeholders, including hospitals, states, Wall Street banks, Big Business, the unemployed, and small businesses. Last week, the Federal Reserve built on top of Congress’s framework, announcing yet another multi-trillion dollar set of facilities, on top of what it already put out, to help cities, states, small businesses, main street businesses, and so on and so forth.

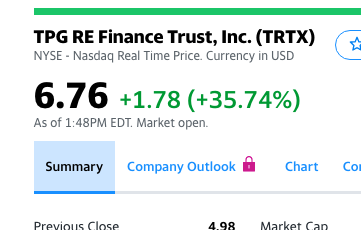

So what has happened so far? This is Thursday’s change in the stock price of a real estate venture run by one of largest private equity funds in the world:

A thirty-five percent jump in a day is… a lot. The reason the stock skyrocketed is because investors believe the new measures from the Federal Reserve will bail out the debt of this private equity fund. There’s a “monetary bazooka” aimed at the economy. And yet there’s a puzzle.

If there’s money for the entire economy, why is it that normal people and small businesses can’t access unemployment insurance and lending programs? To put it another way, why is the money meant for everyone only showing up in the stock market?

The reason is because money has to travel through institutions, and right now, the institutions for the powerful function well, and those for the rest of us are rickety and broken. So money gets to the rich first. Eventually, some money will get to the rest of us, but in the interim period before that money fully circulates, the wealthy can use their access to money to buy up physical or financial assets.

|

“If there’s money for the entire economy, why is that normal people and small businesses can’t access unemployment insurance and lending programs?” |

An 18th-century French banker and philosopher named Richard Cantillon noticed an early version of this phenomenon in a book he wrote called An Essay on Economic Theory.

His basic theory was that who benefits when the state prints a bunch of money is based on the institutional setup of that state. In the 18th century, this meant that the closer you were to the king and the wealthy, the more you benefitted, and the further away you were, the more you were harmed.

Money, in other words, is not neutral. This general observation, that money printing has distributional consequences that operate through the price system, is known as the “Cantillon Effect.”

In Cantillon’s day, the basis of money was gold, so he wrote about what happened when a nation-state discovered a gold mine in its territory. Increasing the amount of gold in the realm would not just increase price levels, he observed, but would change who had wealth and he didn’t.

As he put it, “doubling the quantity of money in a state, the prices of products and merchandise are not always doubled. The river, which runs and winds about in its bed, will not flow with double the speed when the amount of water is doubled.”

Cantillon went on to discuss how money would flow, basically noting that rich people near the mine would spend it on 18th-century luxuries like servants and meat pies, prompting a general rise in prices. Eventually, the money would get out to the populace, but until it did, working people would have to pay higher prices without access to the new money that mine owners had. So there would be inflation, with uneven distribution of purchasing power.

There’s also a China angle: Cantillon noted that a kingdom discovering gold would in the long-run erode its own manufacturing base, that the non-neutrality of money also had geopolitical consequences.

Here’s how he put it:

“When the overabundance of money from the mines has diminished the number of inhabitants in a state, accustomed those who remain to excessive expenditures, raised the prices of farm products and the wages for labor to high levels, and ruined the manufactures of the state by the purchase of foreign products by property owners and mine workers, the money produced by the mines will necessarily go abroad to pay for the imports.

This will gradually impoverish the state and make it, in a way, dependent on foreigners to whom it is obliged to send money every year as it is extracted from the mines. The great circulation of money, which was widespread in the beginning, ceases; poverty and misery follow and the exploitation of the mines appears to be only advantageous to those employed in them and to the foreigners who profit thereby

This is approximately what has happened to Spain since the discovery of the Indies. As for the Portuguese, since the discovery of gold mines in Brazil, they have nearly always used foreign articles and manufactured goods; and it seems that they worked the mines only for the account and advantage of foreigners. All the gold and silver that these two states extract from the mines does not supply them with more precious metal in circulation than others. England and France usually have even more.”

This dynamic is exactly what happened with the United States since the 1960s, if you replace the idea of gold mines with the ability to print dollars.

In 1971, Keynesian economist Nicholas Kaldor said that dollar hegemony would turn “a nation of creative producers into a community of rentiers increasingly living on others, seeking gratification in ever more useless consumption, with all the debilitating effects of the bread and circuses of imperial Rome.”

Today, what Cantillon observed is far more extreme than it was in the 1960s; it is hedge funds, private equity, and bankers who have benefitted from the money printing, and the foreigners who benefit from our money printing are increasingly Chinese and foreign manufacturers.

This theory doesn’t imply that money creation is always biased towards the powerful, only that how money travels matter. There is no inherent money neutrality; such neutrality must be constructed by institutional arrangements. Much of the New Deal in the 1930s and 1940s was designed to build alternative channels for lending so that small businesses, industry, and individuals could have access to money as quickly as big banks.

The Reconstruction Finance Corporation, government procurement, the Federal Housing Administration, the Federal Reserve, agricultural credit supports, Federal Home Loan Banks, credit unions, and regulations like Regulation Q were all mechanisms to ensure the flow of money would be neutral. The International Monetary Fund was originally created to ensure money neutrality on a global basis.

So we can now see that the hollowing out or subversion of these institutions since the 1980s is designed to ensure they would be non-neutral, and tilted towards the powerful.

Since 1981, increasingly the only channels that work to move money creation are the Federal Reserve to Wall Street, as well as the backstop to mortgages, who could get money to new homebuyers through mortgage lenders. Housing has been a key driver in both recessions and recoveries for a lot of reasons, but also for a simple one. It’s one of the few ways to get money into the hands of normal people in America at scale.

The Federal Reserve has usually seen its role as printing money and distributing it to the economy, largely by moving money to big banks and assuming they will, in turn, increase the amount of money available to everyone else equally. The 2008 crisis jarred this vision of neutral and frictionless money movement, because it became obvious that institutions matter.

In 2016, Federal Reserve Chair Janet Yellen gave an important speech on this topic. It turns out, she said, that who the Fed deals with matters. To paraphrase her speech, the bigger and powerful get money first, and the small and weak get money last.

That’s the dynamic we’re seeing in this bailout, with small businesses and the unemployed having trouble accessing funds and the big guys getting what they need when they need it. If you want the boring version of the speech, here’s a paragraph of Yellen explaining that the Fed economists were stupid and intellectually corrupt, but doing it so that anyone listening would fall asleep rather than get outraged:

“Economists’ understanding of how changes in fiscal and monetary policy affect the economy might also benefit from the recognition that households and firms are heterogeneous. For example, in simple textbook models of the monetary transmission mechanism, central banks operate largely through the effect of real interest rates on consumption and investment.

Once heterogeneity is taken into account, other important channels emerge. For example, spending by many households and firms appears to be quite sensitive to changes in labor income, business sales, or the value of collateral that in turn affects their access to credit–conditions that monetary policy affects only indirectly.

Studying monetary models with heterogeneous agents more closely could help us shed new light on these aspects of the monetary transmission mechanism.”

Saying ‘heterogeneous’ just means that the powerful and the powerless get and use money differently. In other words, Yellen was observing, in part, the Cantillon Effect.

And this brings us to today’s bailout and the meaning of institutions. Large banks, private equity corporations, and foreign central banks get dollars through the capital markets, by trading bonds and stocks. It turns out that the Federal Reserve is very good at working in these markets, and can move trillions of dollars relatively quickly. So that’s why the real estate arms of the largest private equity funds in the world are skyrocketing today. They know that the Fed turned the spigot on, and that spigot is instant and functional.

However, the Small Business Administration (SBA), unlike institutions in the 1930s and 1940s, does not have the workforce or ability to make direct loans to businesses. They have to guarantee loans made by banks, who in turn are supposed to make loans. Or that’s the theory, but in America, commercial lending institutions have hollowed out dramatically.

Neither the banks nor the SBA nor anyone else have the people to originate loans. We can’t do it. And our unemployment offices aren’t much better. The only functional bureaucracy that touches business and people is the IRS.

|

“If we want to be able to expand and reduce the money supply in a way that doesn’t benefit the already powerful and hurt everyone else, we have to have institutions to do so.” |

There are a bunch of aspects of the Cantillon effect that I don’t know how to translate. This is not an inflationary moment; the money printing is happening in a moment of severe deflation. So the issue is not that prices will rise, though of course, they could. And we do see shortages in certain products, which is a form of inflation.

I suspect purchasing power will matter more in who can afford to hold financial assets, not who can afford meat pies and servants. But the basic outline of the Cantillon Effect, that some people have more purchasing power and others have less in the same economy, if the channels of money creation make it so, is still operative.

And that’s the lesson we’re learning in this bailout. If we want to be able to expand and reduce the money supply in a way that doesn’t benefit the already powerful and hurt everyone else, we have to have institutions to do so.

There are many policies designed to fix this, including getting every American a debit card as Rep. Rashida Tlaib suggests, or using the IRS as a mechanism to extend payroll support to businesses, as Senator Josh Hawley seeks. With the technology we have today, moving money neutrally in an industrialized economy like ours should be a pretty simple undertaking. Our policymakers just have to decide to do it.

Matt Stoller is the author of Goliath: The Hundred Year War Between Monopoly Power and Democracy and Director of Research at the newly-founded American Economic Liberties Project. This column originally appeared in BIG, Stoller’s newsletter on the politics of monopoly. You can subscribe here.

ProMarket is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.