David Ennis evaluates how well the Affordable Care Act has met its expectations and where it has fallen short ten years after its implementation.

The Affordable Care Act (ACA, and better known as “Obamacare”) was signed into law on March 23, 2010, and began implementation of insurance coverage on January 1, 2014. The ACA had many important provisions but there were two main elements: (1) the expansion of Medicaid healthcare coverage for individuals below 138% of the poverty level; and (2) a system to purchase private health insurance on exchanges with subsidized premiums based on income (for those not eligible for expanded Medicaid).

The ACA was the most significant healthcare legislation since Medicare (federal insurance for those older than 65 or those with disabilities) and Medicaid (state/federal insurance for the poor) in 1965. Studies have since found that the ACA, now ten years into implementation, successfully expanded health insurance to previously uninsured individuals, resulting in improved financial security and mental wellness. However, it has not resulted in improved physical health outcomes for Medicaid recipients, suggesting we need complementary initiatives to tackle healthcare issues that disproportionately affect the poor, such as diabetes, cardiovascular disease, and obesity. Furthermore, the provision of subsidized premiums for middle- and low-income households above 138% of poverty level have come at a high cost due to the relatively weak bargaining power of private health insurers in negotiating prices with hospitals and doctors. The affordability goals of the ACA would be achieved at a more cost-effective price (and thus save taxpayers) if the government made a Medicare option available to the ACA-eligible population above the 138% threshold.

Medicaid expansion

The original intent of the ACA was to expand Medicaid coverage nationally. However, many states objected, and the Supreme Court ruled that the federal government could not mandate expansion. Consequently, only 28 states used the ACA’s funds to expand coverage in the bill’s first year of implementation in 2014. Since then, 12 more states have expanded coverage but ten remain holdouts. This has created a natural experiment for economists to measure the impact of the new Medicaid coverage by comparing similar populations across states that did and did not expand coverage.

Previously, there had been one other major study of the impact of Medicaid expansion prior to the ACA known as the “Oregon Experiment.” This study remains one of the best and largest randomized controlled trials studying the impact of expanded healthcare ever undertaken and it covers the same population that was targeted by the ACA, which makes it worthwhile here to revisit. The state of Oregon wanted to expand its Medicaid program to low-income adults but did not have the funds to cover everyone. So, 10,000 individuals were selected at random to receive coverage beginning in 2008. Economists then studied the effects of coverage by comparing those who had obtained coverage in the lottery to those who applied for the lottery but were not chosen. The results were surprising in some ways: after two years, there was increased use of healthcare services (including a 40% increase in emergency department visits). This resulted in (1) reduced rates of symptoms of depression and increased financial security but (2) no impact on measures of physical health, including diabetes (despite increased rate of diagnosis and medication), hypertension, and cholesterol levels.

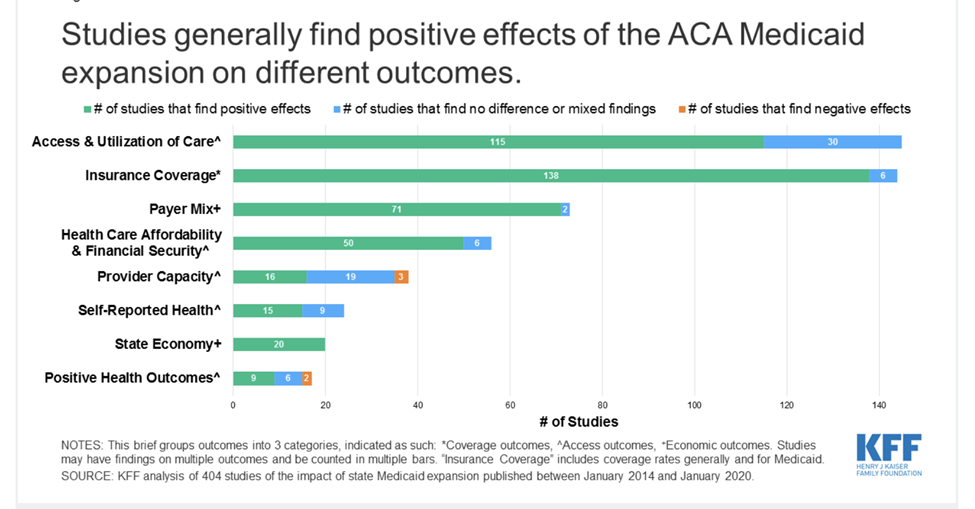

Similar findings to the Oregon study have since been produced in numerous studies examining the impact of the ACA. One monumental meta-study by the Kaiser Family Foundation (KFF) summarized the results of 404 studies conducted from 2014 to 2020 (Figure 1).

Figure 1

Like the Oregon experiment, the KFF found that many of the underlying studies showed that the program met many of the ACA’s goals: expanded insurance coverage, increased access and utilization, improvements to the state economies, as well as improved financial security. The percent of the population without insurance fell from 15.5% in 2010 to 8% in 2022. However, like the Oregon experiment, the 17 studies that measured health outcomes returned mixed results, with about half showing improvements and half showing no change, mixed, or negative results. Some of the positive results were very important, such as statistically significant reductions in mortality rates for certain groups, particularly older, non-white adults. It is necessary to point out, though, that these results are correlational, not causal, and so cannot be attributed to expanded coverage. The Oregon authors had indicated that two years may not be enough time to see improved physical outcomes in their study but, after ten years of the ACA, we still see no compelling evidence that Medicaid coverage causally improved physical health outcomes.

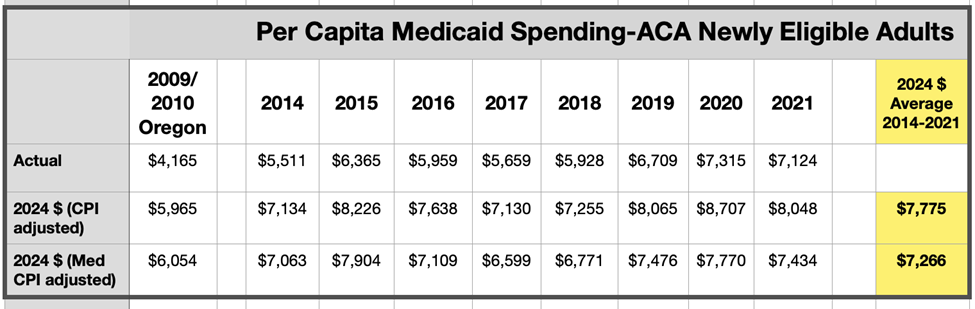

So, the ACA has seen many benefits, including expanded coverage, access, utilization, financial security, and improved mental health but marginal benefits in physical health outcomes. The benefits of any public policy must be weighed against its costs, so let’s turn there next. The chart below shows data on actual expenditures from the Center of Medicare and Medicaid Services (CMS). The average annual Medicaid expenditures for adults newly eligible for Medicaid coverage has been about $7,500 (in 2024 dollars) since 2014. This is consistent with the findings of the 2009/2010 Oregon Experiment, where per capita expenditures were about $6,000 (in 2024 dollars). Now, we know that newly covered individuals used health services through hospital emergency rooms, outpatient centers, and private physician offices prior to Medicaid coverage, so it would not be accurate to infer that $7,500 is the incremental social cost of the program.

Table 1

The Oregon Experiment, in still the most sophisticated fashion to date, estimated the marginal social cost of signing an individual to Medicaid through extensive personal interviews to estimate prior utilization and by assigning a cost to each inpatient and outpatient event. Through this methodology, the authors estimated an incremental 35% impact of the Medicaid program expansion in Oregon. Meaning, individuals in Oregon used 35% more healthcare services by price after signing up to Medicaid. If this rate of increment spending is also true of the ACA Medicaid expansion, that would be a marginal cost of about $2,700 annually per newly eligible enrollee above the cost of the healthcare services consumed prior to insurance coverage.

Conventional wisdom says that insurance coverage should improve health by providing access to primary care. Chronic diseases will be detected and treated and preventive care will reduce the incidence of future disease. However, studies of the ACA have shown this not to be the case. So, we need to find other programs that can directly address serious issues of diabetes, obesity, hypertension, depression, and other common medical problems, particularly for low-income populations, where the prevalence of these disease symptoms is much higher (see, for example, Table 2 in this study from the National Library of Medicine). We have shown large public health programs can be effective—the smoking campaigns of the 1970s and ‘80s, for example. If we are going to improve the health status of the Medicaid population and prevent major longer-term health problems (particularly cardiovascular disease), we will need to find creative public health solutions to complement insurance coverage. However, such initiatives require substantial resources. A major barrier is that our current excessive spending on our traditional healthcare system ($14,000 per capita in 2023) may crowd out these kinds of public health investments. A partial solution to this problem is a corporate income tax on “non-profit” hospitals, particularly those with market power that generate economic rents, with the proceeds earmarked for funding innovative public health initiatives that can demonstrate cost-benefit effectiveness.

Private insurance through the exchanges

A major focus of the ACA was to make health care insurance affordable for middle- and lower-income households. KFF has estimated the average premium cost of family coverage in employer group insurance is $24,000 (not including co-pays and deductibles). Adding deductible costs of $3,600 on average, this represents 31% of median household income ($90,000 for <65) for 2023. For those individuals and families who do not qualify for Medicaid coverage or employer group coverage, the legislation provides for market exchanges where well-defined insurance plans can be purchased with federal subsidies based on income. Private insurance companies choose in which markets they would offer their plans, within strict regulations about coverage and premium levels. It is a very complex program that works surprisingly well.

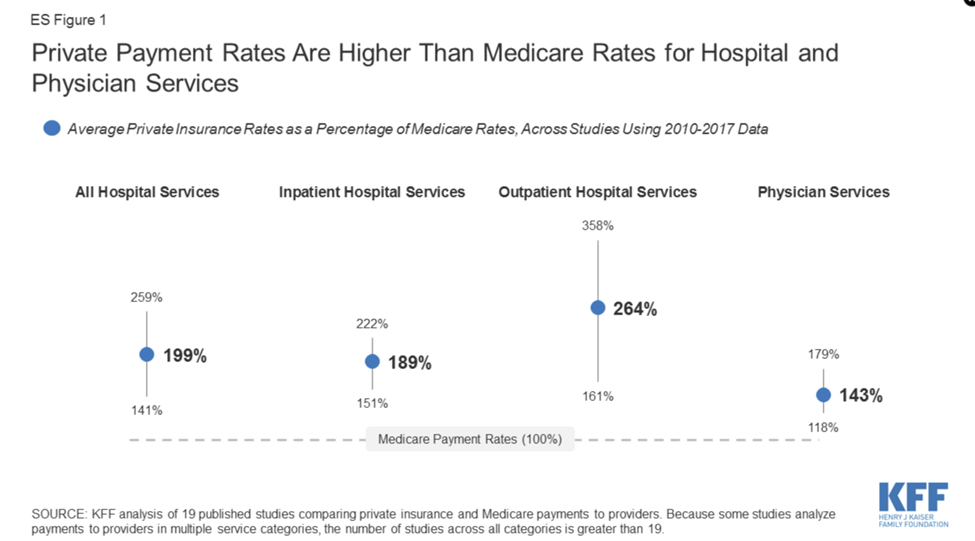

The problem, though, is that private insurance is very expensive due to the extremely high cost of healthcare in the U.S. While the government is able to pay far lower prices for people with Medicaid and Medicare due to its monopsony (buyer) power, insurance companies don’t have that same power against an increasingly consolidated hospital and physician market. The chart below from the KFF summarizes the results of several studies between 2010 and 2017 that compared the prices paid to hospitals and physicians by private insurance to prices paid by Medicare for identical services.

Figure 2

The average among the studies showed that private insurance paid hospitals about double (199%) the Medicare prices, with a slightly lower ratio for inpatient services (189%), a much higher ratio for outpatient services (264%), and 143% for physician services. The higher rates for outpatient services are not inconsequential, in that patients use outpatient services far more than inpatient and must pay higher prices toward deductibles and copays. From the standpoint of the insurance companies, their payout risk for outpatient can be limited through higher deductibles and copays, while there is little they can do to limit payout risk for inpatient services. From the standpoint of the hospitals, outpatient services can be far more profitable than inpatient services, particularly at higher volumes where marginal costs are low and profit margins high.

Since the data for these ratios are ten years old, it is likely that insurance companies pay even more for hospital services compared to government insurance plans due to the significantly consolidated hospital and physician markets. There is an important need for researchers to analyze the current levels of these ratios.

When the ACA was under development in 2009, it was well known that prices paid by private insurance were substantially higher than Medicare. It is not known whether the ACA planners realized that those margins would continue to increase significantly. In early discussions, President Barack Obama supported a single-payer option or Medicare-buy in that would have allowed anyone to sign up for Medicare. These were dropped for political reasons.

The result is that taxpayers are paying much higher prices in the ACA exchanges than would be the case with an expansion of Medicare to individuals under 65, where actuarily fair premiums (i.e., where premiums reflect the projected cost of services consumed) could be offered to those individuals and families whose income qualifies, with federal subsidies based on income. This alternative could be achieved by making a Medicare option available on the exchanges to those ACA-eligible, with participation by the private insurance industry in the same way that the Medicare Advantage program operates. The Medicare Advantage private option that began in 2003 has been very successful, with over 50% of Medicare beneficiaries currently receiving their health insurance coverage through private companies.

The American Rescue Plan Act of 2021 expanded subsidies and eligibility for private insurance on the ACA exchanges through 2025. The Congressional Budget Office has now estimated that the taxpayer-financed subsidies for the private health insurance exchanges will be $1.1 trillion over the next ten years—and more if the enhanced benefits expiring in 2025 are extended. As I have shown, the price tag for tax payers would be far lower if those eligible for the subsidies could buy their insurance directly from the federal government. Why rely on expensive private insurance to make healthcare insurance more affordable rather than an expansion of Medicare? I suspect the reason is the work of the strong lobbies and political contributions of the hospital, physician, and insurance industries. George Stigler would not have been surprised.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.