Chicago Booth alumnus and retired health care consultant David W. Ennis responds to ProMarket’s recent coverage on antitrust and the US health care system. According to Ennis, market power and the dysfunctional nature of the health care services market are the main drivers of high prices.

In May 2003, the late Princeton health economist Ewe Reinhardt and colleagues published a frequently-cited paper titled “It’s the Prices, Stupid: Why the United States is So Different From Other Countries”. This paper evaluated the reasons that the United States had more than double the median per capita health care spending of other OECD countries, at $4,631 compared to $1,983 in 2000.

The authors found that the United States had higher use of some high-tech diagnostic/treatment services but had proportionately fewer physicians and slightly fewer physician visits per capita, fewer hospital beds for every 1,000 people, and 30 percent lower use of hospital inpatient services. Given the lower use of health care services across most measures, the authors concluded that the higher expenditures in the US can only be explained by high prices. These high prices have led to incredibly expensive health care insurance, with the average premium for family coverage in employer-sponsored plans at $20,576 in 2019. This compares to median household income of $68,703 for that same year.

So, do the higher prices translate to higher quality? A 2018 study by the Commonwealth Fund compared the US to the wealthiest 11 OECD countries. Their findings: among the 11 countries, the US has the lowest life expectancy, the highest chronic disease burden, the highest number of hospitalizations from preventable causes, the highest rate of avoidable deaths—and the highest per capita expenditures.

How did we get to this price point? Market power and the dysfunctional nature of the market for health care services are the main drivers.

Physician Market Power

The physician story could be a poster child for George Stigler’s teachings. It begins with the publication of the Flexner Report in 1910. Conducted by the Carnegie Foundation in close collaboration with the American Medical Association (AMA), which had deep concerns about the lack of quality standards for medical schools, the Flexner Report recommended that all schools should be science-based and, ideally, located within a university. The AMA seized on this report to campaign in all of the states for licensure rules that required graduation from an AMA-approved medical school as a condition for licensure (all existing physicians were grandfathered in).

This report affected the closure or merger of the majority of existing schools from 162 in 1906 to 85 in 1920 to 66 by 1933. The result was a long-term decline in the population per physician as grandfathered physicians retired and were not fully replaced. In 1910, there were 677 persons per physician. By 1940, this metric increased to 909 persons per physician. The AMA was given direct control over the supply of physicians as part of a legitimate regulatory endeavor to increase the quality of physician training. This resulted in the physician incomes achieving economic rents, as shown by Milton Friedman in his PhD studies.

While the number of medical schools has increased over the past fifty years, the supply of physicians is no longer based on medical school output but on the number of residency training positions in hospitals. These are funded largely by the federal government and have increased only minimally since 1997. There are real, ongoing supply constraints that continue to support higher prices for physician services.

Nonetheless, physicians have faced downward pressure on their fees as commercial insurance companies have taken advantage of their market power to negotiate discounts from “Uniform, Customary, and Reasonable” (UCR) rates. The response has been two-fold: (a) the formation of large specialty groups that achieve monopoly or oligopoly power in a market and (b) the acquisition of physician practices by hospital medical systems that use their market power to maintain higher rates. By 2018, over one-half of practicing physicians had become part of hospital systems.

“Among the 11 countries, the US has the lowest life expectancy, the highest chronic disease burden, the highest number of hospitalizations from preventable causes, the highest rate of avoidable deaths—and the highest per capita expenditures.”

Hospital Market Power

Hospitals have taken an entirely different route to market power. Rather than constraining supply, the American Hospital Association (AHA) actively campaigned for the 1946 Hill-Burton Act, which provided grants and loans for the construction of hospitals, with a goal of achieving four beds for every 1,000 people and expanding the supply of hospital beds all over the country.

Despite growing private insurance coverage in the post-WWII era, prior to Medicare and Medicaid hospitals struggled financially to support the high number of poor and elderly patients who were uninsured. The passage of Medicare and Medicaid in 1965 was a game-changer: hospitals now had a reliable source of revenue for almost all of the elderly and many of the poor patients under their care. Suddenly, it became possible to generate some profitability.

Then, as now, the level of profitability depended on the proportion of patients with private insurance that often paid billed charges. So, location was paramount, with suburban hospitals financially outperforming central city facilities. But, as competition in health insurance grew, private insurers began negotiating for discounted rates with individual hospitals. This was the beginning of the market power story for hospitals.

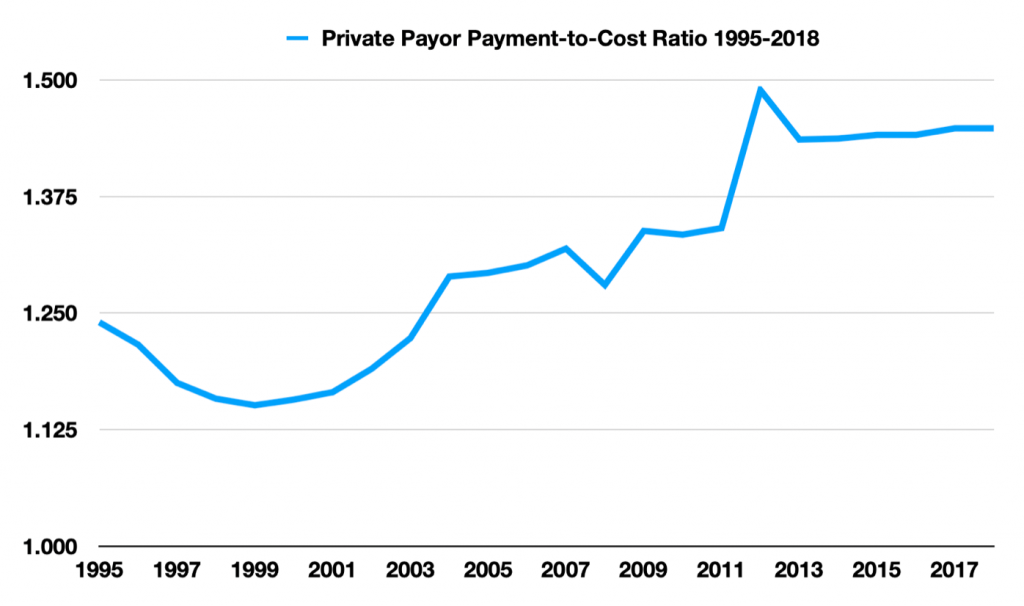

Hospitals cannot negotiate with the public payers. The commercial payers are another story: Unless there are credible alternative providers in a local market, even the large national insurance companies have little leverage in negotiations. And, market consolidation increases market power. As hospitals have consolidated over the past 30 years, prices paid by commercial insurance companies have risen steadily relative to the rates Medicare pays. The chart below demonstrates the substantial increase in private insurance payment rates relative to cost in recent years:

But a groundbreaking 2019 paper, “The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured,” demonstrated that: (a) large price differences between Medicare and private insurers (for identical serves), (b) the wide variation in private insurance prices both within and between healthcare markets, and (c) the increase in prices in markets as the level of concentration increases. Quite simply, market power generates higher prices and market power has been increasing. The growing consolidation among healthcare providers has been discussed recently in ProMarket.

This 2019 paper showed that inpatient prices paid in 2011 by private insurers were on average 2.2 times those of Medicare after risk adjustment. Two common outpatient procedures were studied in depth. Colonoscopy payments, averaging $1,834, were 2.7 times Medicare (and ranged from $520 to $4,878). Lower Limb MRI payments, averaging $1,343, were 3.7 times Medicare (and ranged from $270 to $3,251). The marginal cost to the hospital of a Lower Limb MRI is probably less than $200, so getting paid $2,000 dollars (or more), as a high market power hospital is able to do, is extremely profitable and helps explain hospitals’ enthusiasm for vertical integration with physicians to gain more control over referrals to these high-priced outpatient services. These bizarre findings of price variation speak to the dysfunctional nature of healthcare markets. Furthermore, these numbers are from 2011 and the AHA data shown above indicate that the private insurance payment rates have continued to escalate since that time.

Not all hospitals have market power. The payer ratios discussed by Cooper et al. are averages with wide variance. In denser central city markets where there is some price competition, hospitals are not so fortunate, both because they have a lower proportion of private payers and have limited leverage to negotiate private payer rates (the exception being Academic Medical Centers). And rural hospitals, even though they often have local monopolies, have such low numbers of privately-insured patients that they are not a market power concern.

Policy Response

Given the magnitude of the price problem in healthcare, it is surprising that there has been very little public policy to address it. Economist and Harvard professor Leemore Dafny has recommended revisions to anti-trust enforcement going forward but, frankly, most of the damage has been done and unwinding ill-advised historic mergers would do more harm than good. UC Hastings Professor Tim Greaney suggests the need for price controls, limiting private payer rates to some ratio of Medicare. This is a reasonable policy to consider but would be subject to massive ongoing lobbying and substantial increased contributions to political campaigns, with no assurance that appropriate rate limits would get established.

The Policy We Need

The addition of a robust public option to the Obamacare exchanges would be transformative if implemented properly. Medicare could be priced at actuarily-sound premiums and pay providers at Medicare rates. The expansion of a Medicare option would need to be carefully staged over a number of years to give providers the opportunity to adjust their cost structures to the Medicare standard of compensation. First, it could be made available to individuals on the exchanges, then available to small and medium groups, and, finally, available to large groups. This would require that Medicare pay fair rates to providers; i.e., the rates required for an efficient provider to be financially sound. The antitrust price problem with mergers and acquisitions would be largely moot, and providers could consolidate for the legitimate purposes of efficiency and quality.

The public option has major advantages:

1. It is a market strategy where no one is forced to enlist in a government-sponsored program—everyone is free to choose among the private and public options.

2. It would allow for participation by the private insurance industry in the same way that Medicare Advantage (MA) works. MA now accounts for over 40 percent of the Medicare-eligible population and has been given generally good ratings on cost efficiency relative to traditional Medicare.

3. It would allow for long-term phasing to protect against damaging revenue shocks to providers. Providers would have a very clear roadmap to guide their operational adjustments to the new revenue structure over the years of implementation.

There were several legislative proposals for a public option during the Obama Administration. All failed, including its proposed inclusion in the Affordable Care Act. This actually exacerbated the price problem by expanding private insurance among the uninsured. The recent proposal being developed by Senator Patty Murray (D-WA) and Congressman Frank Pallone Jr. (D-NJ) appears to have the support of the Biden administration but, if history is any guidance, this will be strongly opposed by the industry, and any substantive legislation will likely fail.