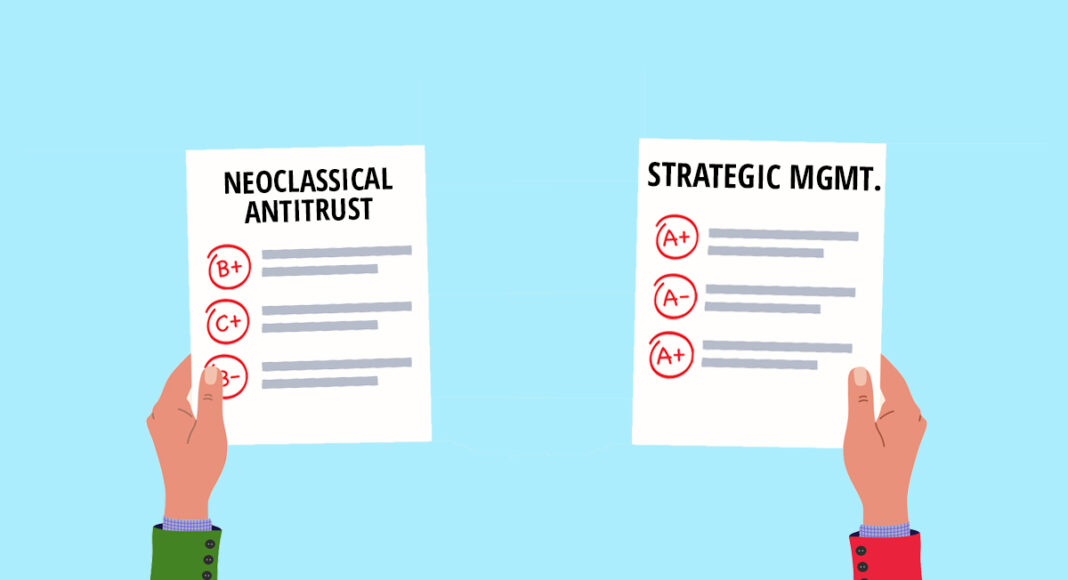

Antitrust, drawing on neoclassical economics, often demonstrates a poor understanding of firm behavior when reviewing mergers and acquisitions for effects on competition. Management studies and behavioral economics offer a more sophisticated understanding of firm behavior that can improve the accuracy of merger review, writes Shilpi Bhattacharya.

Neoclassical economics, which places the rational and well-informed actor maximizing utility at its foundation, underpins the dominant schools of thought on firm behavior in antitrust. Although neoclassical economics assumes that firms maximize profit, it has little to say on the actual decision-making processes within firms that drive firm conduct. In part, this is because neoclassical economists view the firm as a “black box,” whose decision-making behavior is too idiosyncratic or obscure to link to output and performance. At the same time, neoclassical assumptions about firm rationality and profit maximization mean that whatever these idiosyncratic behaviors of the individual firm may be, they are designed to maximize profit and returns to owners. Thus, firm decisions can be presumed to be rational.

Scholars of management studies, particularly those using behavioral approaches, have challenged these neoclassical assumptions. They observe that business managers are cognitively constrained, and their decisions reflect behavioral complexities beyond neoclassical calculation. For instance, management studies show that firm decision-making is a product of conflict between managers and departments, and that decisions often reflect internal firm power dynamics, bureaucracy, or the arbitrary triumph of one set of interests over another.

In a recent paper, I argue that viewing the firm from the lens of management studies can enrich how antitrust regulators and judges review firm behavior in merger and acquisition cases, particularly in cases of potential competition. Potential competitors are firms that are likely to compete with each other in the future, or are perceived by others to be a future entrant into a market and thus exert a pro-competitive influence on the market. Acquisitions that remove potential competitors or the threat of their entry may be deemed anticompetitive as they reduce competitive constraints operating on firms.

“Incentives and ability” as predictors of firm conduct

In its review of M&A, antitrust regulators and judges assess a firm’s “incentive and ability” to enter a market and enhance competition. However, regulators and judges have so far neglected to consider common errors and biases in decision-making that can make a firm unwilling to act even if the presumption of rationality would show them to have the incentive and ability to do so. The literature shows that firms employ a range of tools, including heuristics (rules of thumb), in their decision-making that cause departures from rationality. Some of these biases can be identified by examining a firm’s management practices, decision-making structures, and characteristics of key managerial personnel. Biases may arise from managerial hubris (managers’ over-estimation of their own abilities), availability bias (placing greater reliance on the most immediate example of an occurrence when evaluating the likelihood of that occurrence in the future), strategic momentum (a firm’s tendency to repeat its previous strategic decisions rather than trying something new), escalation of commitment (continuing with a decision because of past investments of time, effort and money even when it is no longer a good decision), risk aversion, etc.

For example, in the landmark United States Supreme Court judgment in United States v Falstaff Brewing Corp. (1973), the U.S. government challenged Falstaff’s acquisition of a New England brewery because it felt Falstaff was a potential entrant into the New England market and the acquisition eliminated competition that would have existed had Falstaff entered the market de novo.Falstaff argued that it would not have entered the market in any way other than by acquisition of a company with a strong distributorship. In its ruling, the district court relied on Falstaff’s statements to dismiss the government’s case. The Supreme Court disagreed with the lower court’s assessment of Falstaff as a potential competitor and remanded the case for reconsideration.

The interesting aspect of this case is Justice Thurgood Marshall’s concurring opinion in which he states that Falstaff’s statements about its likelihood of entry should not have been considered by the district court when the objective economic evidence showed that Falstaff had the incentive and ability to enter the market. One of Marshall’s concerns was that there was no way to verify the veracity of Falstaff’s managerial statements. Management studies provide us with tools to address this concern.

Falstaff’s prior conduct shows that they had successfully expanded into new markets through acquisitions. On the other hand, recent instances of de novo entry into Detroit and Chicago markets had been quite unsuccessful. According to management studies, Falstaff’s management would be more reluctant to attempt subsequent de novo entry into new markets due to availability bias. Instead, strategic momentum, i.e. falling back on what had previously worked, would have pushed Falstaff’s managers toward market entry via acquisition.

Ultimately, Falstaff was allowed to acquire the brewery, but despite the company’s best efforts, the acquisition was unsuccessful, and sales declined. Competition in the market remained intense post-acquisition and prices did not rise despite increasing costs. Hindsight thus showed that Falstaff was not a potential competitor whose entry via acquisition would reduce competition in the market, as argued by the U.S. government. Nor did the acquisition increase Falstaff’s market power. Instead, Falstaff’s market share and profits declined post-acquisition and it sold the brewery a few years later.

Sources of competitive advantage as indicators of potential competition

Another insight from strategic management is that firms generally prioritize sustaining competitive advantages rather than maximizing profits, contrary to assumptions of neoclassical economics. A firm has a competitive advantage when it implements a strategy which competitors are unable to duplicate or find it too costly to imitate. Firms search for opportunities to obtain a sustainable advantage over competitors, and acquisitions are one such tool in the hands of managers. However, no competitive advantage is permanent. Temporary advantages may play an important role in a firm’s strategic decisions as managers value relief from competition, even when it is short-term and costly. Thus, strategic acquisitions may not be profit-maximizing or value-enhancing, but a means of survival or competitive posturing.

When Facebook acquired WhatsApp in 2014, many competition authorities across the globe felt that the acquisition did not raise any competition concerns because WhatsApp did not directly compete with Facebook. The European Commission, for instance, categorized both companies as providing complimentary services.

To scholars of strategic management it would have been apparent at the time of the acquisition that the transaction would eliminate competition between potential competitors because WhatsApp possessed a key source of competitive advantage over Facebook in its growing numbers of highly engaged mobile phone users. The European Commission focused on the characteristics of the products provided by both parties and found them to be very different. Yet, the key source of Facebook’s advantage over competitors did not lie in the features of its product. Facebook’s concern, as evident from a number of its managerial statements, was that once WhatsApp created a large enough network, it would be relatively easy for it to build features into its existing app and to grow into a general social network that would replace Facebook due to its rising popularity and user numbers. Even Facebook’s Annual Report identified “mobile applications with competing social features including text messaging, voice, image, and video sharing as a key source of competition for the network.”

To scholars of strategic management, Facebook’s prior actions (such as its 2012 acquisition of Instagram), managerial statements, and market fundamentals would have made clear that Facebook viewed WhatsApp as a serious competitor because competitive advantage lay in creating a large network of engaged users on mobile phones. The different characteristics of the products, which formed the basis of the competition law analysis of this acquisition, were not significant sources of competition. This is evident from Facebook CEO Mark Zuckerberg’s statement about Facebook’s business when announcing the acquisition: “our mission is to make the world more open and connected. We do this by building services that help people share any type of content with any group of people they want.” Those familiar with business management would have understood the proper source of WhatsApp’s competitive threat to Facebook and advised regulators to block the acquisition.

In summary, behavioral and strategic views of the firm show that antitrust regulators and judges must pay greater attention to how firms are managed. This includes managerial experience, culture, biases, and hubris. An expanded understanding of firm behavior could enrich antitrust law in a number of ways. For instance, it may be possible to more accurately predict whether projected efficiencies or innovations will be achieved through mergers by examining the managerial styles of the transacting firms. Do the two firms have complementary organizational structures and strategies or will internal conflict make it harder for the firms to achieve cohesion? In addition, competition agencies should examine the likelihood of firms successfully executing decisions by considering the operational management of firms. Agencies may also consider strategic momentum as a factor that gives impetus to an acquisition decision. Managerial hubris and overconfidence may be at play when deal values are at a premium. Finally, competition agencies should consider that the ultimate objective of strategic firms is achieving sustained competitive advantage rather than profit maximization. Managers concerned about the survival or growth of their firms may be willing to go to great lengths to ensure their safety and security in markets where threats are perceived.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.