In new research, Ga-Young Choi and Alex Kim show that tax audits work to deter firm tax avoidance, but with unintended costs for investment and employment for the firm and the broader economy.

Previous studies show how tax audits compel executives to reevaluate risk and strategize tax planning. The influence of these audits is substantial, but so far, a comprehensive understanding of their economic implications remains elusive, primarily due to the lack of detailed public data. In a recent study, we develop a novel firm-level tax audit measure by analyzing corporate disclosures with generative AI. We begin by examining whether tax audits in fact deter tax avoidance at the firm level in the United States. We also identify which firms receive tax audits from which tax authorities and when. During the course of our study, though, we also find that tax audits have additional implications for firms, including for innovation and stock price volatility, and macroeconomic consequences for employment and growth.

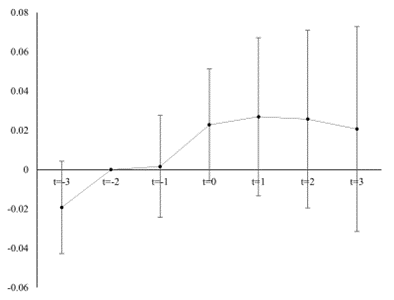

Consistent with prior studies, we find that firms reduce their level of tax avoidance by 4.23% following tax audits. Notably, we show that firms tend to maintain this lower level of tax avoidance even after the audits are concluded for at least three years (upper left graph of the following Figure 1). Further, this effect becomes stronger when firms receive tax audits from multiple tax authorities (e.g., the IRS and foreign tax authorities performing the audits simultaneously). Relatedly, we find that larger firms, firms with more R&D expenditures and unrecognized tax benefits, and foreign-operating firms are more likely to be subject to tax audits.

Figure 1

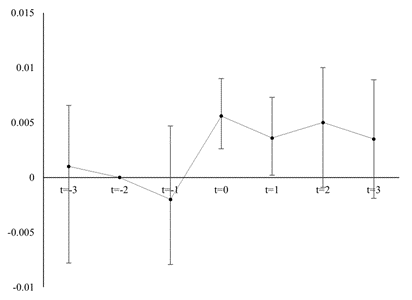

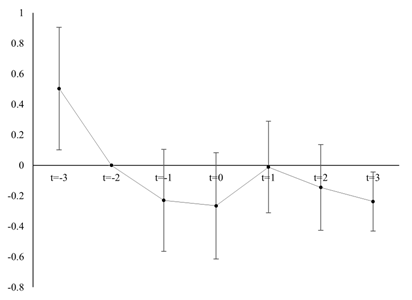

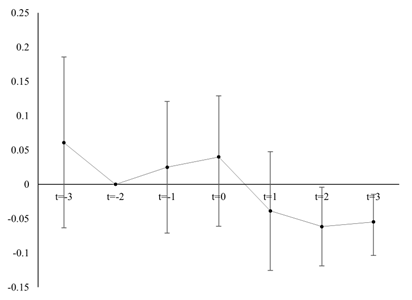

Notes: These figures show the time-trend of tax avoidance (cash effective tax rate, upper left), stock return volatility (upper right), investment (lower left), and debt issuance (lower right). T=0 denotes audit initiations. We set t=-2 to be zero and plot the relative changes. We observe an increase in cash effective tax rates (lower tax avoidance), an increase in stock return volatility, a decrease in investment, and a decrease in debt issuance.

However, we also find that tax audits fulfill their stated purpose but not without economic burdens imposed on the target firms. During tax audits, tax authorities may challenge firms’ tax-planning vehicles. For example, tax authorities may scrutinize firms’ confidential documents to determine whether their operations in tax havens are for legitimate business activities or for tax evasion. As a result, firms face uncertainty regarding how much they may have to pay to settle a potential fine or tax liability. This increased operational uncertainty translates into uncertainty about the firm’s future operating cash flows, which then leads to an increase in stock price volatility. Further, theory suggests that an increase in stock return volatility is associated with an increase in the cost to raise capital.

Consistent with this theoretical explanation, we uncover some unintended negative economic consequences of extensive audits. First, we show that stock price volatility increases sharply by around 3% following tax audits. This abrupt increase in volatility quickly stabilizes but remains heightened as uncertainty regarding the firm’s outlook becomes resolved soon after the audits (upper right graph of Figure 1). Volatility may remain heightened for at least three years from the initiation of tax audits because the dispute with tax authorities remains unresolved or informational uncertainty about subsequent regulatory action lingers.

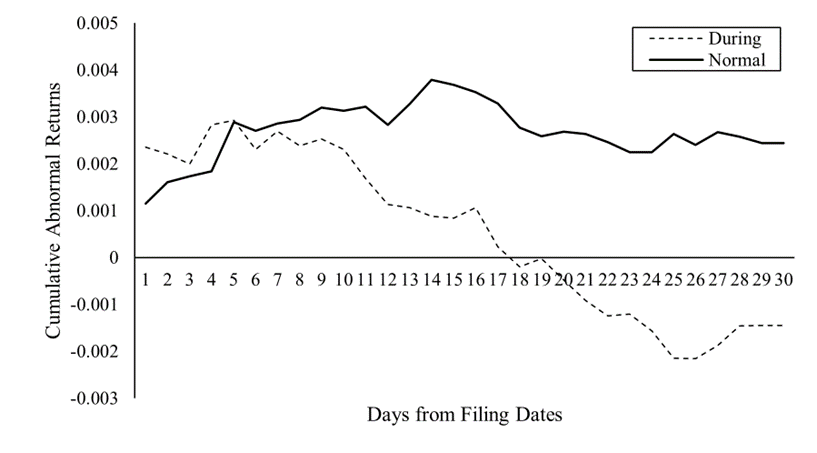

Similarly, we find a decrease in abnormal stock price returns, or returns not explained by average market returns, around the dates that the tax audits are publicly announced. This trend suggests that the market responds negatively to the uncertainty and potential financial implications of ongoing audits. Such negative reactions are long-lived and the negative trend in abnormal returns persists over a 30-day period from the information release.

Figure 2

We also investigate whether firms curtail investments and stop issuing new debt in response to an increase in the cost of capital. We find that firms decrease their investments into assets such as buildings and equipment during the audits and, notably, do not recover their original level of investments even after the audits are concluded (lower left graph of Figure 1). This decrease in investment cannot be entirely explained by the decrease in operating cash flow due to tax settlements. In addition, it is likely that operational uncertainty stalls planning and implementation in other facets of the business until any settlements, including alterations to tax and other business planning, is clarified.

Lastly, we explore some potential macroeconomic implications of tax audits. We compute a state-level tax audit intensity measure by calculating the average portion of firms that are undergoing tax audits in a certain state. We find that when more firms in a given economy are undergoing tax audits, the economy tends to experience a lower investment level, higher unemployment rate, and slower GDP growth. Although one should exercise due caution in interpreting the results in a causal manner, these findings suggest that tax audits can have a ripple effect on local economies, influencing a range of economic indicators.

Our results ultimately indicate that tax audits fulfill their purpose, but with some economic costs. These costs are sizable at the firm-level and we even observe some adversarial macroeconomic outcomes associated with intense tax audits. It’s not clear if there are ways in which policymakers and regulators can mitigate the macroeconomic effects of tax audits. One possibility would be to speed up the process of tax audits to reduce the period of uncertainty for businesses, during which they reduce investments. Our results underscore the importance of meticulously assessing the economic benefits and costs when administering extensive tax audits.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.