American households accumulated a large stock of savings during World War II, much of which was held in the form of war bonds. After the war, inflationary episodes eroded the purchasing power of these bonds, contributing to a backlash against the incumbent Democrats. In new research, Gillian Brunet, Eric Hilt, and Matthew S. Jaremski study the impact of post-WWII inflation on voting outcomes using data on the sales of savings bonds during the war.

After winning in a landslide in 1932, the Democratic Party dominated American presidential elections for more than a decade. The Republicans had presided over the collapse of the economy into the Great Depression, and Democratic President Franklin D. Roosevelt’s New Deal formed the basis of a broad and stable political coalition. Yet after strong victories in 1936, 1940, and 1944, the Democrats nearly lost the 1948 election, and in 1952 and 1956, the Republican candidate, Dwight D. Eisenhower, won by large margins. In a new paper, “Inflation, War Bonds, and the Rise of Republicans in the 1950s,” we show how the high inflation that prevailed in the post-World War II years, particularly how it eroded voters’ savings held in war bonds, likely contributed to the Republicans’ success in those elections.

War Bonds, Patriotism, and Household Finance

Under FDR and Harry S. Truman, the Democratic administrations’ marketing of series E savings bonds to households was a key element of the American war finance program in WWII. Sales of the bonds served multiple objectives: they channeled household resources into long-term savings vehicles, holding down wartime inflation by reducing demand for scarce consumption goods; they raised funds to support the war effort; and, perhaps most importantly, they created opportunities to present the public with propaganda touting the importance of the war, encouraging participation in rallies and parades supporting the American war effort. Through a payroll deduction program and a series of eight bond drives, the FDR and Truman administrations persuaded households to purchase war savings bonds at very high rates, with around 80% of households subscribing. About a third of households’ liquid assets after the war was held in the form of war bonds.

The bond marketing campaigns sought to convince Americans that it was their patriotic obligation to “back the attack” and buy war bonds. Yet the campaigns also appealed to financial motives, claiming war bonds were excellent investments. Posters promoting the bonds depicted newly built suburban homes and children wearing graduation gowns. Surveys from the period indicate that households were persuaded by this messaging and considered the bonds to be the key to their financial futures. Households typically intended to use the war bonds to start businesses or buy homes, rather than to finance ordinary consumption.

Post-War Inflation Devalued the Bonds, Leading to Electoral Backlash

Yet two major episodes of inflation following the war, in 1946-48 and 1950-51, substantially eroded the purchasing power of the bonds. Households and professional forecasters generally anticipated the inflation of 1946-48 following the relaxation of wartime price controls, though it lasted longer than some knowledgeable observers initially expected. Both survey data and narrative evidence from economists at the time indicate they expected deflation to follow this immediate burst of post-WWII inflation. Instead, an unexpected surge in inflation followed the outbreak of the Korean War in 1950, eventually making clear that there would be no prolonged deflation to restore the purchasing power of war bonds and other savings.

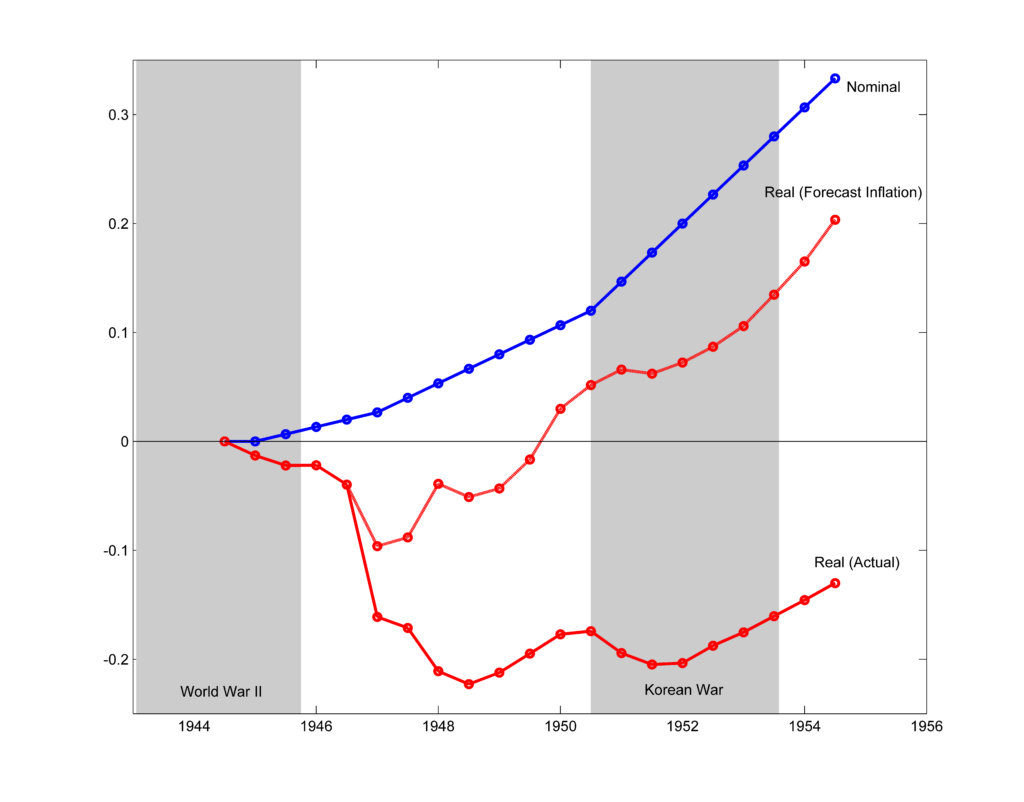

The impact of the postwar inflation on the purchasing power of war bonds is illustrated in Figure 1, which presents cumulative nominal and real (inflation-adjusted) returns for a bond purchased in mid-1944. The blue line depicts the nominal return, which was about 2.9% per year if held for the full 10-year maturity, producing a total cumulative return of about 33%. The red line shows the real returns, which quickly became deeply negative after the war, and were never greater than negative 13%. In the figure we also include cumulative real returns calculated from expected inflation, rather than actual inflation, as the dashed red line. These are much higher than the actual real returns, indicating that the unexpectedly high inflation eroded the purchasing power of the bonds significantly.

Figure 1: Cumulative Nominal and Real Returns for a War Bond Purchased June 1944

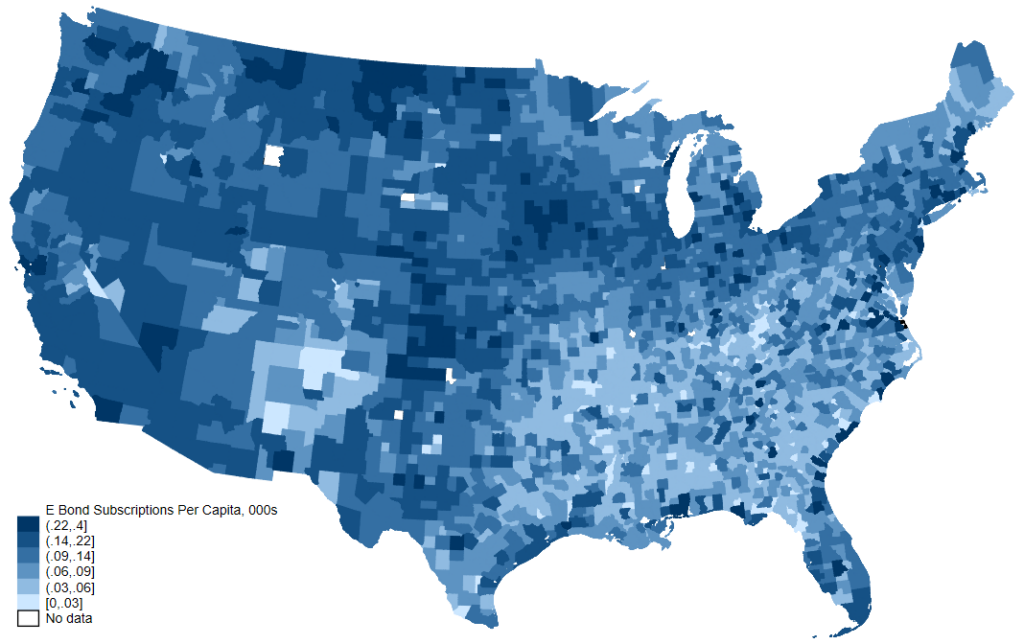

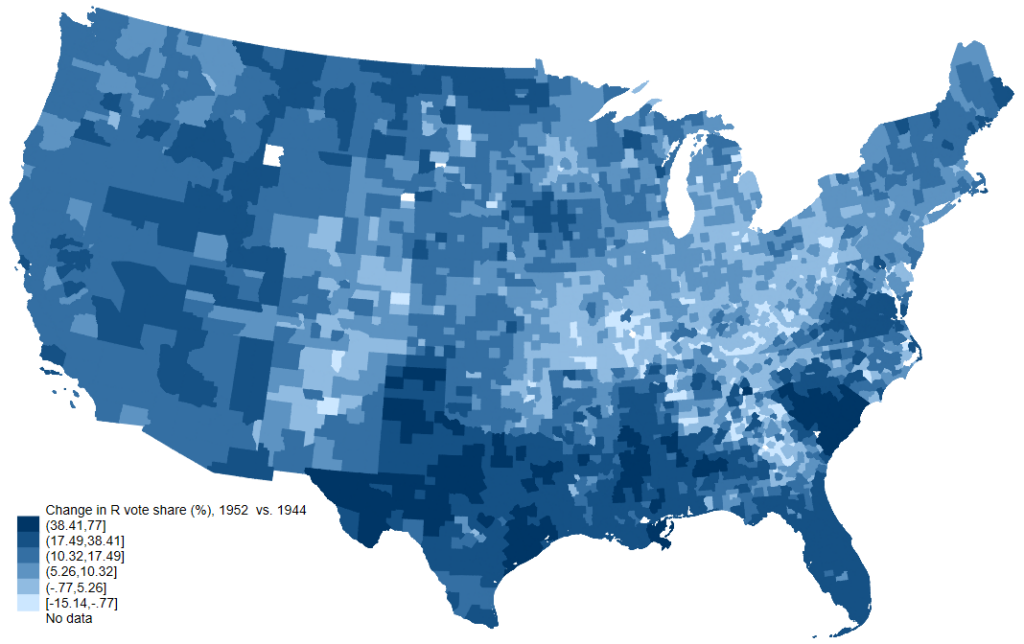

In our new paper, we study the impact of these bouts of inflation on voting outcomes. To do so, we use data on purchases of war savings bonds across counties. Figure 2 illustrates the broad patterns in the data. The top part, Figure 2a, shows a map of U.S. counties shaded in proportion to per capita sales of war bonds in 1944. The bottom part, Figure 2b, shows the change in the Republican vote share in presidential elections from 1944 to 1952, and is shaded so that areas where support for Republicans increased more are darker. There are many similarities between the two maps. The darker areas in the war bond map, such as parts of Iowa, northern counties in the plains states, and some counties in the far west correspond to places that shifted toward the Republicans at high rates. Likewise, the lighter areas of the war bond map, such as much of New Mexico, Missouri, Kentucky, and West Virginia, did not shift toward the Republicans. Yet there are also some significant differences; the general trend towards the Republicans in the South does not correspond to high war bond subscription rates in those places, and we are careful to control for this in our analysis.

Figure 2a: War Bond Subscriptions Per Capita, 1944

Figure 2b: Change in Republicans’ Vote Share in Presidential Elections, 1952 vs. 1944

When we statistically compare the voting behavior of counties over time in a regression framework that adjusts for general regional trends, we find that after the war, places that had purchased more savings bonds did indeed turn toward the Republicans at higher rates relative to the elections of the late 1930s and early 1940s. Consistent with the greater importance of the unexpected inflation of the early 1950s, we find that the impact on the 1952 election was much larger than on the 1948 election.

President Truman’s efforts in 1951 to pressure the Federal Reserve to continue to peg interest rates at low levels, rather than pursue a policy change aimed at curtailing inflation, likely strengthened the association between the Democratic Party and high inflation. In the 1952 election, Eisenhower and the Republicans won with a platform that argued that the Democrats would “further cheapen the dollar, rob the wage earner, impoverish the farmer and reduce the true value of the savings, pensions, insurance and investments of millions of our people” if they remained in power. The 1952 Republican platform also called for “a Federal Reserve System exercising its functions in the money and credit system without pressure for political purposes from the Treasury or the White House,” calling attention to Truman’s efforts to force the Fed to maintain lower rates.

Inflation peaked prior to the 1952 election and remained low over the next four years. In 1956, Eisenhower won again, with a party platform that boasted of having “fulfilled our 1952 pledge to halt the skyrocketing cost of living.”

Unsurprisingly, we also find that money allocated to bank accounts, whose value was also eroded by inflation, contributed to the shift toward Republicans as well. Yet the impact of those funds on voting patterns was much smaller than that of funds allocated to war bonds. This result is consistent with the special salience of the war bonds in the minds of their owners.

To rule out the possibility that some other factor correlated with war bonds may have driven the pattern on voting shifts we observe, we use county participation rates in the liberty bond drives of World War I (WWI) as a source of exogenous variation in war bond purchases in World War II. Variation in WWI liberty bond subscription rates was driven in part by the local approaches taken to marketing those bonds, with some counties adopting a centralized system that was quite effective. The bond drives of WWII were modeled on those of WWI, and the local lessons learned from the liberty loan drives were remembered and adopted in the promotion of WWII savings bonds. This creates local variation in WWII savings bond subscriptions that is not due to factors such as wartime income or investment demand.

Liberty bond participation rates predict WWII savings bond purchases quite well across counties. In addition, liberty bond participation rates only predict changes in the Republican vote share after 1944, which rules out the concern that counties with higher liberty bond participation had a general preference for Republicans. Our results using this methodology produce estimates reasonably similar to those obtained without it. This suggests that variation in unobservable factors that could have been responsible for both higher E bond subscriptions and subsequent changes in political preferences are unlikely to be responsible for our results.

In the aftermath of the recent COVID-19 pandemic, American households accumulated large stocks of savings, from decreased consumption expenditures combined with increased income resulting from the social safety net programs adopted during the pandemic. One reason why the recent inflation may have aroused such a strong response from voters to the dismay of the current Biden administration is that, as with WWII bonds in the postwar years, households had hoped their savings would improve their economic status until high inflation dimmed that hope.

As recent commentators have noted, in 1948 Truman narrowly won reelection in spite of the high inflation that prevailed after the war, and his efforts to blame Congress for the inflation may have helped his chances. Yet to understand the political implications of the post-World War II inflation, it is important to look beyond 1948. It was the outbreak of a second major wave of inflation in 1950 that doomed the Democrats in 1952, and Truman’s attacks on the Fed in 1951 compounded his party’s political problems. In 1952, inflation was regarded as a much more important issue by voters than in 1948, and the Eisenhower campaign pioneered the use of television advertisements with a campaign that focused on inflation. In the 2024 campaign, any new outbreak of inflation, or any policy stance perceived as contributing to inflation rather than curtailing it, would likely have significant impacts on Biden’s prospects for reelection.

Articles represent the opinions of their writers, not necessarily those of ProMarket, the University of Chicago, the Booth School of Business, or its faculty.