The effectiveness of tax policy depends on whether sellers pass on changes in tax rates to consumers through changes in price. In new research, Felix Montag, Robin Mamrak, Alina Sagimuldina, and Monika Schnitzer investigate how this tax pass-through in turn depends on how much consumers know about prices. They show that if consumers are not aware of how prices for the same product vary between sellers, then they will be unaffected by tax changes intended to increase or decrease consumption.

Policymakers frequently implement tax policies with the aim of changing consumers’ behavior. For example, many countries have introduced carbon pricing to address climate change by charging firms for carbon emissions, or they levy sin taxes on products like tobacco, alcohol, and sugar to discourage consumption and improve public health. Similarly, some governments temporarily reduced sales and value-added taxes in response to the Covid-19 pandemic to stimulate the economy. In all these cases, tax policy will only affect consumer behavior if firms pass the tax (change) on to consumers through a change in price rather than absorb it into their profit margins.

In a recent working paper, we study how imperfect consumer information about prices affects the pass-through of commodity taxes. While most prior studies on tax pass-through assume that consumers know the prices of all sellers in a market for the same product (perfect consumer information), this assumption is often unrealistic in practice. In our study, we focus on the retail fuel market in Germany and France. This market features a high degree of price transparency, as consumers can easily access real-time prices of all stations on price comparison apps. Yet, many consumers do not use these apps and, hence, they lack knowledge about prices.

The key intuition for why consumer information matters is simple: if consumers do not know the prices of competing sellers, they are unlikely to switch to cheaper sellers. This softens competition in the market and allows sellers to derive market power from the lack of consumer information, which ultimately affects tax pass-through.

Our results have three key policy implications. First, the more consumers know all prices, the higher is the price change in response to a tax change. Second, pass-through can be small even when there are many sellers in a market. Therefore, the number of sellers is not necessarily a good predictor for the intensity of competition. Finally, our results suggest that taxation affects different consumer groups differently: tax savings are passed through more to informed consumers, whereas pass-through to uninformed consumers is small. This can have distributional implications and limit the possibility of stimulating the economy through (temporary) tax reductions. Overall, these implications may change the attractiveness of taxes relative to other policy instruments such as regulation.

We begin our research by setting up a theoretical consumer search model, where a fraction of consumers is fully informed about prices, but others need to search for prices sequentially at some cost. In the retail fuel market, informed consumers correspond to app users, while non-users would need to drive from station to station to learn about prices. Theoretically, informed consumers buy from the lowest-price seller, whereas uninformed consumers buy from the first seller that they encounter. Therefore, sellers face a trade-off between which consumer type they should target when setting their prices. By choosing a low price, a seller serves its share of uninformed consumers and attracts informed consumers but earns a low margin. Conversely, when setting a higher price, informed consumers buy from another station, but the seller earns a higher margin from its share of uninformed consumers.

One important implication from this model is that it predicts random price dispersion within a market, meaning that sellers are indifferent between targeting informed or uninformed consumers and consequentially choose their prices with some degree of arbitrariness. We show that there is substantial price dispersion within local fuel markets in Germany that is completely unpredictable to consumers. This indicates that imperfect consumer information plays a relevant role in the German retail fuel sector.

Another key feature of the German fuel market is the existence of different fuel types. The broadest distinction is between diesel and gasoline, which consumers cannot substitute. In addition, there are two different types of gasoline, E5 and E10, that can be used by almost all gasoline vehicles in Germany. They do not differ in quality, but E10 has an ethanol share of 10% compared to 5% for E5.

We find evidence suggesting that consumers of different fuel types differ in the degree to which they are informed about prices. As diesel vehicles statistically have around double the mileage of gasoline vehicles, diesel drivers have a greater incentive to become informed about prices to save money. Similarly, among gasoline drivers, those fueling E10 are typically better informed about prices, as E10 is usually 4-6 cents per liter cheaper than E5. Yet, many gasoline drivers use E5 despite its higher price, indicating that these consumers are not very price sensitive. Using search data from one German price comparison app, we confirm that app usage is most common among diesel drivers and least prevalent among drivers buying E5.

With this model in hand, we can test its predictions using rich data on all fuel prices at all stations in Germany and France. We focus on a temporary reduction in the German value-added tax (VAT) from 19% to 16% that was implemented in July 2020 in response to the Covid-19 pandemic. To estimate the pass-through of this tax decrease as well as the subsequent tax increase in January 2021, we compare the evolution of fuel prices at German and French stations. We use France as a control group, since it is similar to Germany in market characteristics but did not experience any tax change in the relevant period.

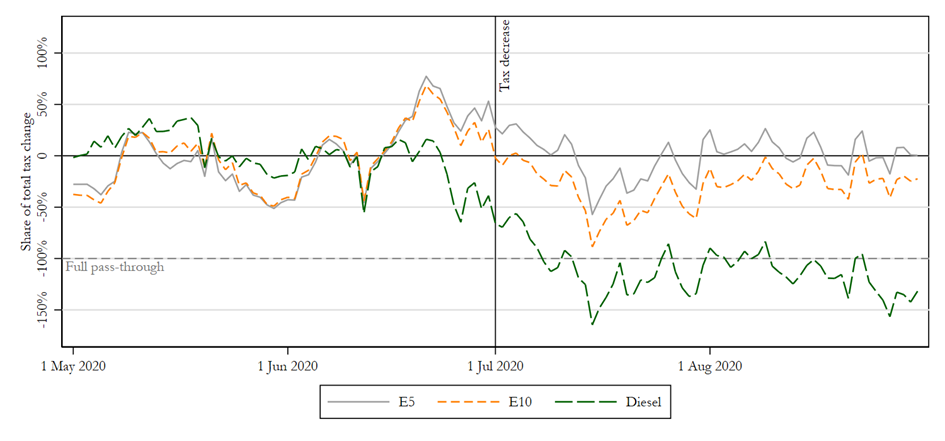

Our study yields three main findings. First, a tax cut translates into lower prices when the share of well-informed consumers is larger. Similarly, a new tax translates into higher prices when there are more well-informed consumers. In theory, this is because a higher degree of consumer information intensifies competition between sellers. Empirically, we find that pass-through of both the tax decrease and the subsequent tax increase was highest for diesel, followed by E10 and E5. This is consistent with the fact that more diesel drivers use price comparison apps and are well informed about prices, and that there are more well-informed drivers purchasing E10 than E5. The result is illustrated in Figure 1 for the tax decrease on July 1, 2020, which depicts the average daily difference in fuel prices between Germany and France, normalized by the average difference in the two months prior to the tax change and divided by the size of the tax change. The figure shows that German diesel prices decreased by around the same magnitude as the tax change, whereas there was close to zero pass-through for E5.

Figure 1: Price changes in Germany vs. France

Second, we find that the pass-through is higher for well-informed consumers than uninformed consumers. We empirically estimate the difference in pass-through rates between the minimum and average price in a local market and find that this difference is positive in most cases.

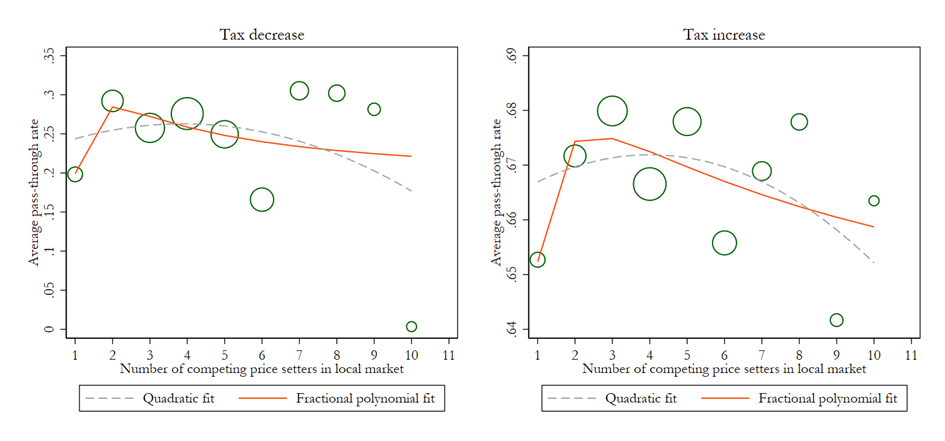

Our third key result is that more sellers can sometimes lead to higher and sometimes to lower pass-through rates. This contrasts with the standard models of full information, which generally predict that pass-through increases as the number of competitors increases. However, when accounting for imperfect information, there is a countervailing effect that raises the price as the number of sellers increases. With many competitors, there is less of a chance that any one seller offers the lowest price and attracts all informed consumers. This incentivizes sellers to charge a higher price instead, which reduces pass-through. The resulting relationship between the number of sellers and the pass-through rate is illustrated in Figure 2 for the case of E5. The size of the circles corresponds to the relative frequency of each market size in Germany. The fitted lines point to an inverse-U or hump-shaped relationship both for the tax decrease on the left and the tax increase on the right. This pattern is consistent with simulations of our theoretical model and looks similar for the other fuel types.

Figure 2: Pass-through by number of competitors (E5)

Our results are widely applicable beyond just fuel prices. For instance, other studies used models of competition with imperfect information to explain price differences between online and offline retail stores. Our work builds on this approach to shed light on how imperfect consumer information affects tax pass-through.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.