How prolific is the revolving door issue at the federal level? In a new paper, Joseph Kalmenovitz, Siddharth Vij, and Kairong Xiao analyze the prevalence of revolving door behavior in the United States government and discuss the impacts of limiting private sector job prospects for regulators.

Regulators can leave their government position for a job in a regulated firm. This “revolving door” phenomenon is the subject of intense public debate. On the one hand, the option for government officials to leave for the private sector could incentivize them to regulate markets differently if it might help them gain employment in the future, for example, by showing excess leniency toward regulated firms. On the other hand, closing the revolving door could deter talented individuals from entering public service in the first place if it means they won’t be able to translate their know-how and connections into more remunerative employment after leaving the government. Despite the importance of the topic, there is little evidence on the prevalence of the revolving door incentive, its causal impact on the behavior of regulators, or the efficacy of policies which aim to limit that effect.

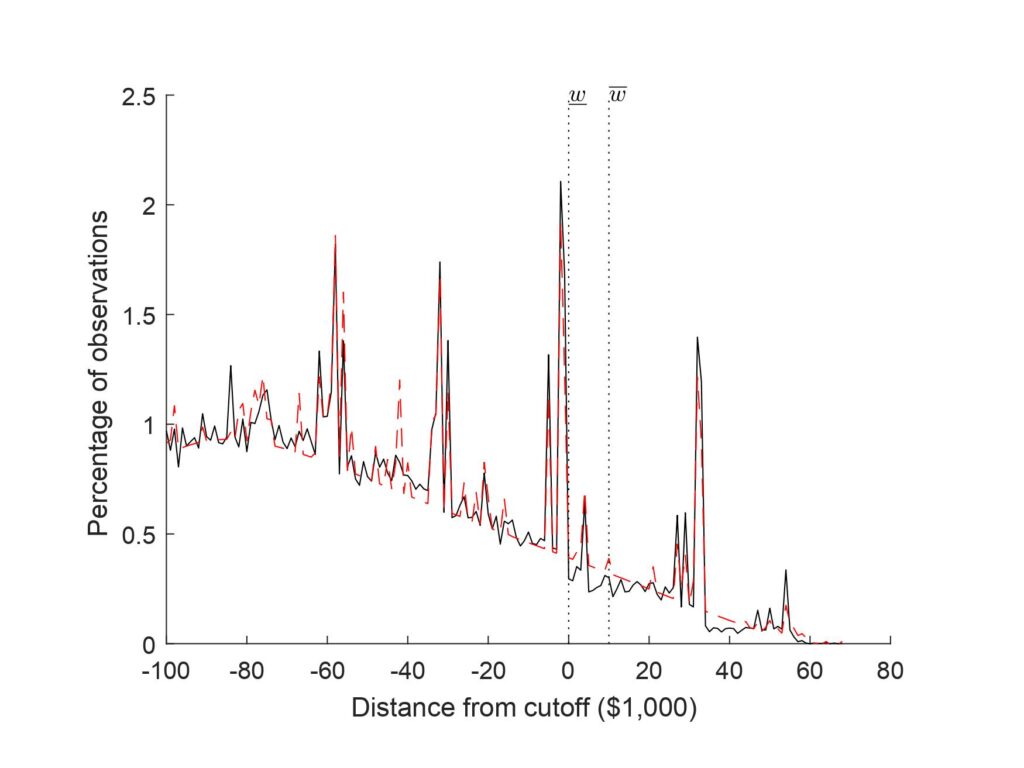

In a recent paper, we use a novel dataset and a unique legal setting to start filling in the gap in the literature. We obtain the employment records of 22 million federal employees over two decades and exploit the fact that post-employment restrictions on federal employees trigger when the employee’s salary exceeds a threshold. We document significant bunching of employees just below the threshold, consistent with a deliberate effort to preserve their outside options. Bunching regulators show leniency by pursuing fewer enforcement actions and reducing the compliance costs of many rules. Finally, we incorporate our findings into a structural model and evaluate the consequences of alternative policies.

The Revolving Door’s Impact and Potential Interventions

A special post-employment restriction covers senior federal employees: they are barred for one year from communicating on matters that pertain to their former agency and from representing or advising foreign entities (Section 207(c) and Section 207(f) of the U.S. Code, Chapter 18). Any violation is subject to criminal and civil fines and up to five years in prison. Crucially, the restrictions are triggered by a salary threshold that equals 86.5% of the second-highest level of the salary schedule used for high-ranking appointed officials in the executive branch. This threshold equaled $172,400 in 2021. This restriction offers a rare opportunity to study how federal regulators respond to the revolving door: if they wish to preserve their outside option, they should stay below the cutoff salary and thus avoid triggering the post-employment restrictions. We test this possibility using a novel dataset that covers the entire civilian workforce in the federal government. Obtained through repeated Freedom of Information Act requests, it contains comprehensive information on 22 million employees who worked in the federal government at any point between 2004 and 2021.

We start by documenting causal evidence for revolving door incentives. Using a formal bunching estimator, we identify statistically significant bunching below the salary threshold in 33 federal agencies. This includes financial regulatory agencies such as the Commodity Futures Trading Commission, Securities and Exchange Commission, and Federal Deposit Insurance Corporation. This group also includes agencies responsible for managing and distributing government funds, such as the Farm Credit Administration and the Federal Retirement Thrift Investment Board. On average, 49% of the personnel in the 33 federal agencies respond to revolving door incentives and accept a $6,400 pay cut to stay below the threshold, or 7.4% of the average salary.

Figure 1: Sensitivity to Outside Job Opportunities

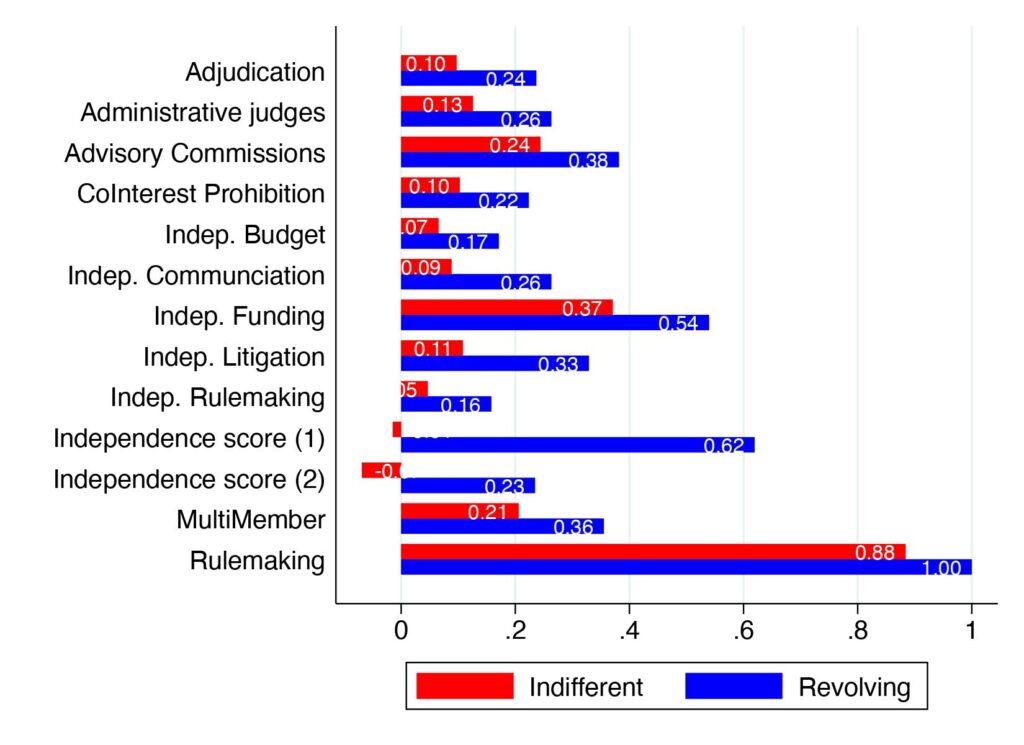

We also show that revolving agencies have greater autonomy to exercise their regulatory powers—filing enforcement lawsuits independently, for instance—and attract more lobbying expenditures by industries that offer higher average pay.

Figure 2: Structural Differences Across Agencies

Subsequent tests confirm that bunching is a strategic response by agents who wish to preserve their outside option. For example, bunchers exhibit superior performance during their government stint by earning more promotions and bonuses. However, as they come closer to the threshold, they accept fewer promotions and a slower salary progression. Bunchers are more likely to exit from the government and, conditional on exiting, they are more likely to turn to the lobbying industry. Bunching is not explained by potential promotion bottlenecks: there are no material changes in responsibilities around the threshold, and bunching occurs if and only if the threshold triggers a post-employment restriction. For example, the SEC was exempt from the restriction until 2013, and indeed we observe bunching at the SEC only from 2014 onward. Combined, those tests confirm that bunching is a strategic choice of regulators who seek to preserve the value of their outside option.

In the second part of the paper, we examine whether the revolving door motivates regulators to change regulatory burdens. Existing studies offer two broad perspectives. On one hand, it could lead to regulatory leniency, for example, if regulators seek to curry favor with potential future employers (regulatory capture). On the other hand, regulators might choose to vigorously fulfill their duties to build their reputation and human capital (regulatory schooling). Our analysis is largely consistent with the former perspective. First, using new data on regulatory burdens, we show that a typical revolving agency imposes 8.9 fewer rules, 9.5 million fewer paperwork forms, and 2.1 million fewer compliance hours. Moreover, we exploit the introduction of the post-employment restriction at the SEC in 2014, which limited the outside job opportunities of SEC employees who were above the salary threshold. The newly imposed restriction led to increased enforcement activities by SEC attorneys who were above the threshold and thus had fewer outside options. Overall, the evidence is consistent with regulatory capture theories, which suggest that revolving door incentives can lead to regulatory leniency.

In the last part of the paper, we analyze possible policy responses to the revolving door incentives using a structural model calibrated to our estimates. We show that imposing post-employment restrictions alleviates the incentive distortion while reducing labor supply to the public sector. A counterfactual policy that increases the post-employment restriction to two years would reduce the leniency by 0.5% while decreasing the labor supply by 0.13%. This occurs as the attractiveness of the private sector option diminishes with a longer restriction period, making government roles less enticing. Conversely, eliminating these restrictions might boost recruitment by 0.2%, but it would escalate regulatory leniency by 1.7%. However, the broader economic implications of these policies remain limited, given that employees can strategically position themselves just below the threshold.

Alternative strategies may prove more impactful. For example, we consider a scenario with stronger governance mechanisms, such that regulators who show leniency are twice as likely to be caught and reprimanded. In this scenario, leniency declines by 50% but labor supply to the public sector declines by 4.1%. Intuitively, a government position can help obtain an even more lucrative position in the private sector. With stronger governance this advantage is reduced, leading to fewer new entrants to the public sector.

Analyzing Revolving Door Incentives When Agents Are Still Regulators

Our work provides the first systematic evidence of revolving door incentives in the federal government. Concretely, we offer four contributions. First, existing studies typically observe the revolving door only after the employee leaves the government. In contrast, we identify the causal response to the outside option among those who are still employed in the federal government. Second, existing papers focus on the revolving door between specific agencies and specific industries, such as bank supervisors and patent examiners, and how that affects agency-specific regulatory actions. This narrower analysis leaves open the question of how widespread and consequential the revolving door phenomenon is. In contrast, we study the entire federal workforce and connect revolving door incentives to general metrics of regulatory burden. Third, we assess the efficacy of policies related to the revolving door using a structural model and offer two novel insights. The first is that threshold-based policies are prone to manipulation if agents can alter their position relative to the threshold. In fact, a more stringent policy will lead to even more manipulation. Second, any policy will require a trade-off between labor supply to the public sector and regulatory leniency. Our results quantify this trade-off and can thus inform the debate on how to improve the performance of regulatory agencies further. Our fourth contribution is to the debate between regulatory capture and regulatory schooling hypotheses. Our findings are mostly consistent with theories of regulatory capture and demonstrate that the outside option leads to a reduced regulatory burden on companies.

More broadly, our work relates to the literature on incentives and performance of regulatory agencies. Prior studies have explored the role of salaries and promotions, and organizational features such as the geographic distribution of field offices and jurisdictional overlap. We focus on a powerful incentive, the option to work in a regulated firm, and illustrate how this incentive may draw individuals into public service while also possibly distorting their regulatory decisions.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.