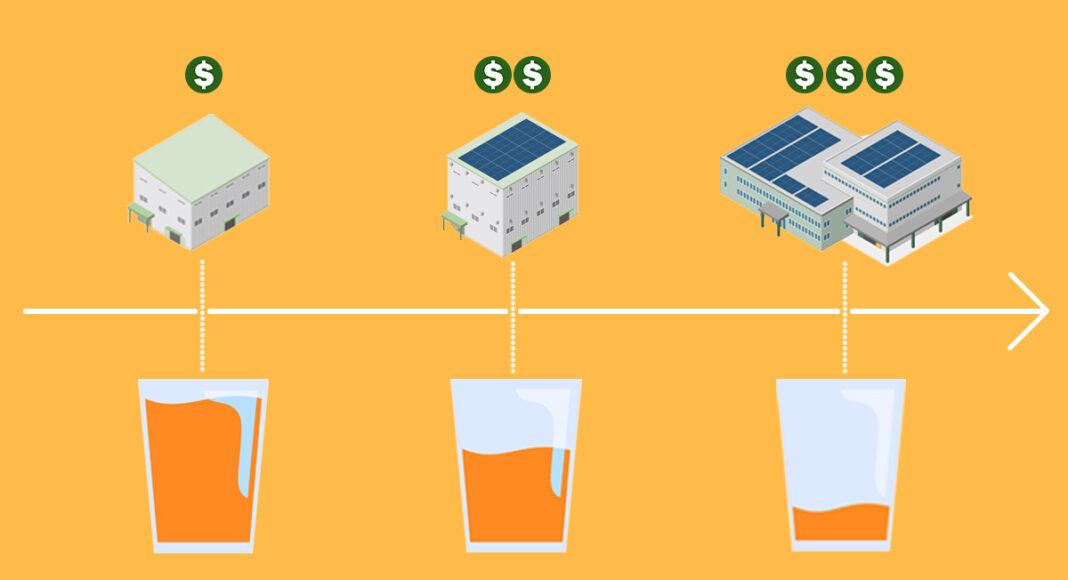

The United States has recently experienced shrinkflation. Many companies have downsized their products while keeping prices unchanged or even raising prices. This phenomenon is often associated with decayed market morality. Barak Orbach argues that competition typically drives shrinkflation. When supply shocks or other factors inflate production costs, businesses must pass on cost increases to maintain profitability. However, in competitive markets, direct price increases are risky. Under such conditions, businesses often choose to raise prices indirectly through downsizing.

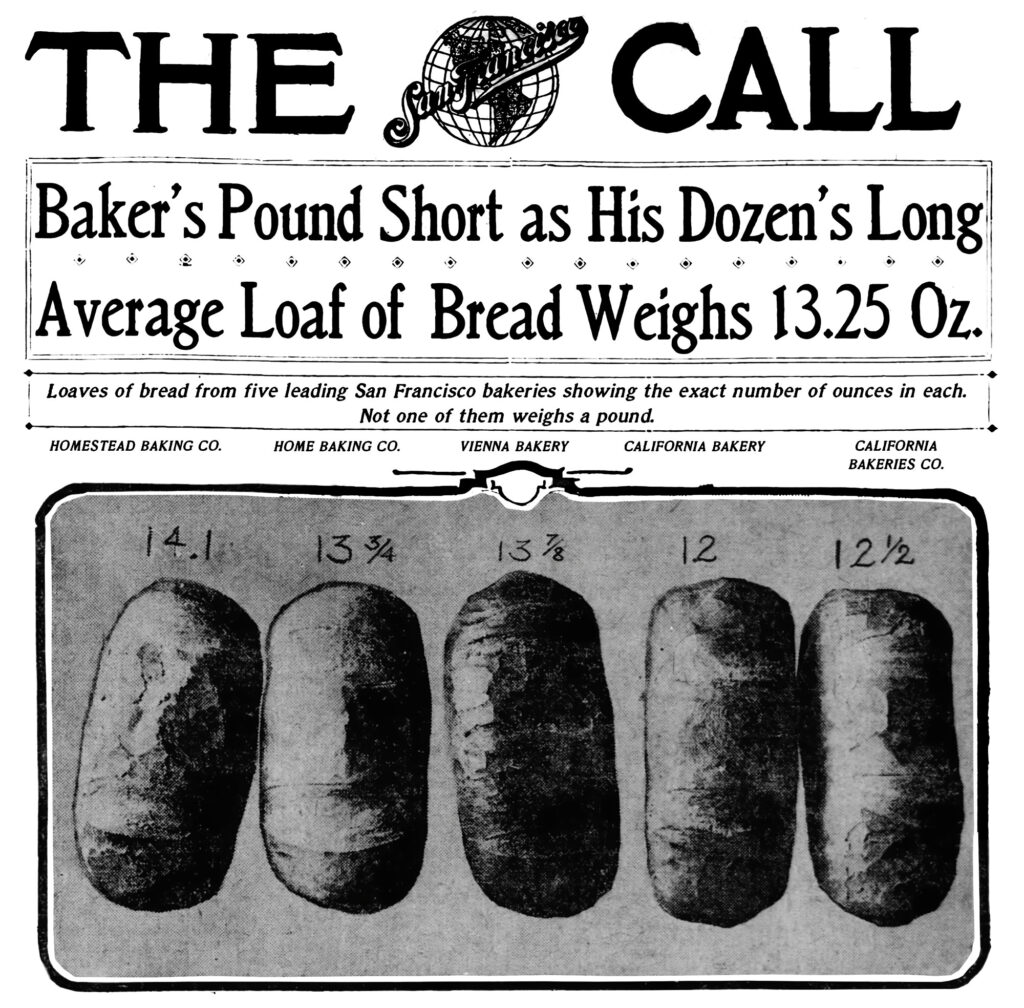

Over the past couple of years, as the United States has wrestled with high inflation, many businesses raised prices indirectly through quantity reductions. Manufacturers of packaged food and household goods, food establishments, and other businesses have downsized their products without lowering prices. This phenomenon of widespread downsizing, known since ancient times as a market reaction to cost increases, is called “shrinkflation.”

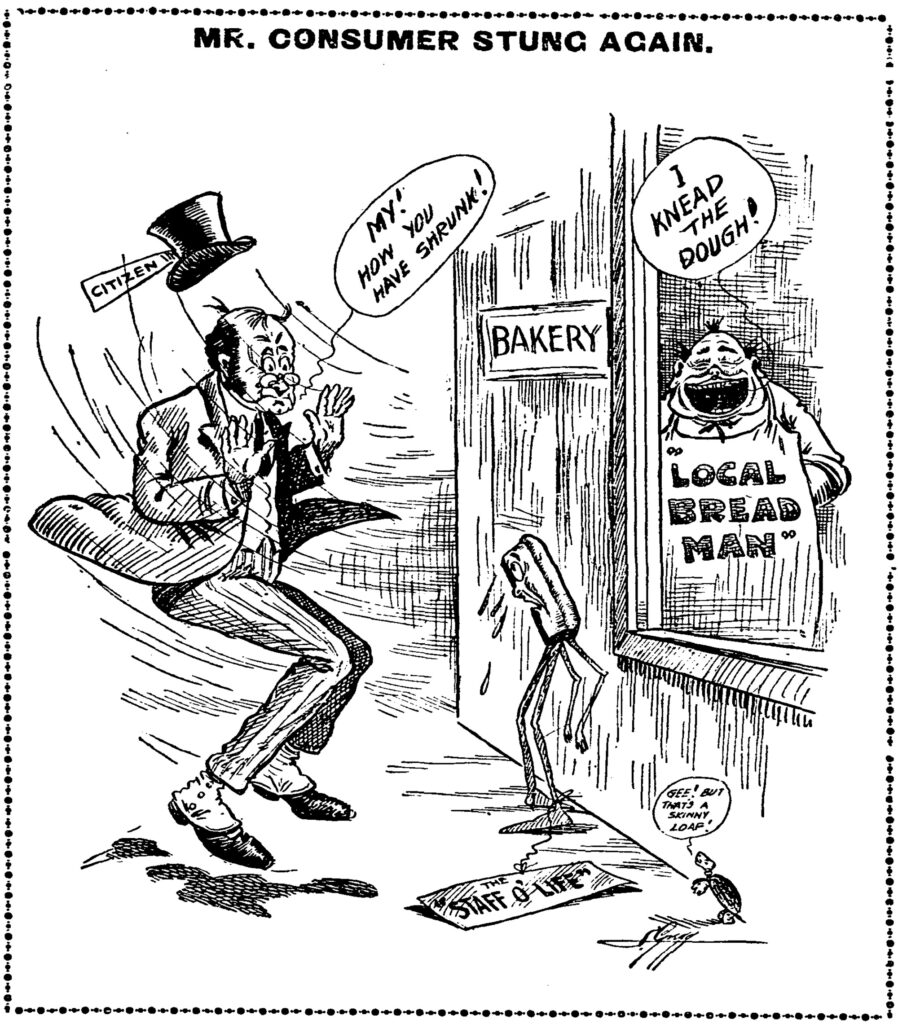

Economist Pippa Malmgren, who coined the term, argued that shrinkflation is a “signal” that “inflation pressures are building” and a costly phenomenon that “behaves like acid,” “destroys the value of money,” and “erodes faith in institutions.” Despite these negative connotations, shrinkflation is quite intriguing. It prompts us to question why, periodically, many businesses across the economy resort to questionable practices and whether competition fosters market morality or possibly motivates business dishonesty. Answers to these questions should inform antitrust and consumer protection policies.

Senior antitrust officials have recently claimed that the use of “technocratic language” by the “antitrust community” excludes the public from the “antitrust dialogue,” making its practice undemocratic. To address this concern, the technocratic discussion of shrinkflation will follow a discussion of the phenomenon in markets for chocolate bars.

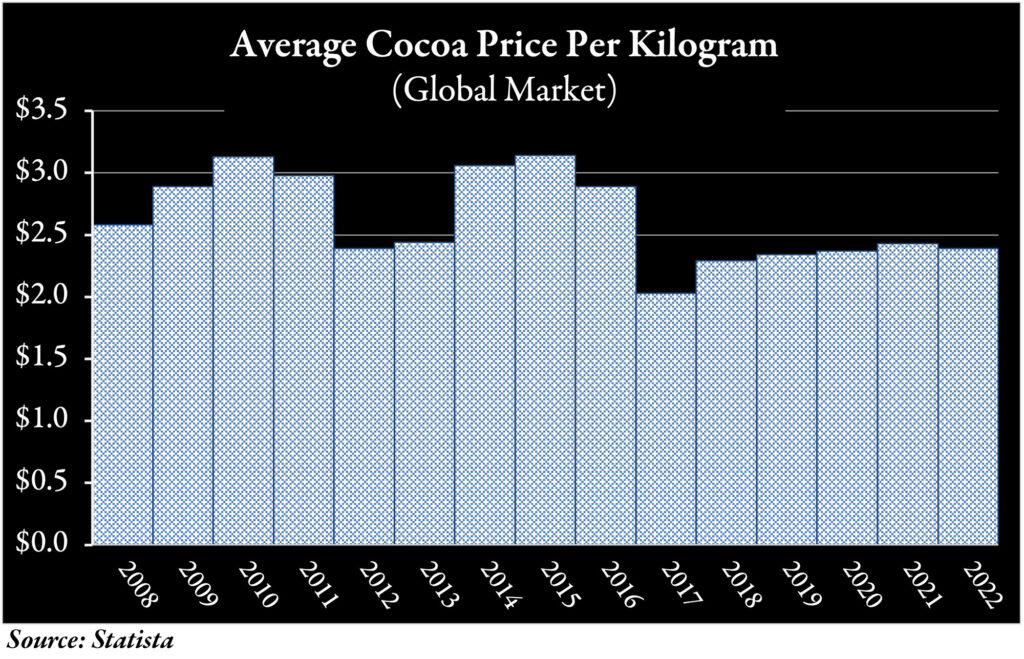

Cocoa beans are the primary ingredient of chocolate bars. Their prices persistently fluctuate due to weather conditions, geopolitical shifts, and other factors. When the price changes are sharp, they significantly impact the profit margins of chocolate confectioners, requiring them to strategize suitable responses. The competitive landscape is naturally one of the forces that guide these business decisions.

In the United States, Hershey and Mars dominate the mass markets for packaged chocolate bars. Nestlé, a global food conglomerate, is the third largest player, though its market shares pale in comparison to Hershey and Mars. Despite their dominance, neither Hershey nor Mars holds monopoly power in any submarket for chocolate bars. They compete in conditions of interdependence.

Hershey and Mars constantly monitor each other’s actions. Whenever one company contemplates adjusting its pricing or packaging schemes, it factors in the probable reactions of the other. As a result, parallel price increases are not necessarily indicative of unlawful price fixing. During the pandemic, when production costs surged, both companies resorted to direct price increases and downsizing. They defended these tactics, arguing that “inflation rates [had] driven up production costs and the price of ingredients like sugar, flour and milk” and the “cost of each of those items” had “outpaced the overall U.S. consumer inflation rate.”

What impact does downsizing have on the well-being of chocolate consumers? The answer depends on the relevant circumstances. To illustrate, assume the marginal cost of popular Halloween candies rises by 10%. A price increase of this magnitude will likely influence the purchasing choices of households entertaining trick-or-treaters. In contrast, a 10% decrease in the quantity of chocolate in packages may go largely unnoticed and would not enrage trick-or-treaters. In fact, parents might even appreciate a reduction in the amount of chocolate their kids collect.

Let’s tweak the hypothetical. Assume the mass markets for packaged chocolate bars are highly fragmented, and no chocolate maker holds more than a 10% market share in any product category. Under the standards articulated in President Joe Biden’s Executive Order 14036, “Promoting Competition in the American Economy,” recent statements of senior antitrust officials, and the 2023 draft Merger Guidelines, such a fragmented chocolate industry would inherently be more competitive than today’s industry. But would this fragmentation lessen the incentives to downsize products? The opposite outcome is more likely. In fragmented industries, companies often struggle to assess their rivals’ costs and markups. This means that direct price increases could be riskier than subtle downsizing through minor packaging manipulations. Moreover, small chocolate manufacturers are more exposed than larger ones to fluctuations in the cost of ingredients. Large manufacturers can offset these fluctuations through strategic diversification of suppliers. Under the principles of the Biden administration’s antitrust agenda, efficiencies of this kind presumably do not justify increases in market concentration.

The foregoing hypothetical offers four key insights. First, consumers tend to be more sensitive to price changes than to minor changes in quantity. Second, when welfare tradeoffs are considered, downsizing may be superior to direct price increases. Third, competitive pressures tend to shape business decisions regarding choices between direct price increases and downsizing and may tip the scales towards the latter. Fourth, efficiencies may mitigate incentives to downsize products.

Competition-Induced Shrinking

Now, for a more technocratic discussion of shrinkflation.

The marginal costs of many products are directly related to their size or another quantity dimension. In fragmented markets for such goods, competitive price pressures may build vulnerability to fluctuations in operating costs. At any given price, changes in input costs affect the seller’s markup (the difference between price and marginal cost). Specifically, input cost increases may require companies to act to maintain profitability or avoid losses. However, direct price increases can be risky due to the difficulty in assessing whether all rivals face comparable challenges and predicting their reactions. To tackle this problem, businesses sometimes downsize products, believing that indirect price increases of this kind are the best option available. Moreover, when all rivals experience comparable cost increases, downsizing can provide a competitive edge over competitors that opt to maintain or raise prices.

The necessary condition for profitable downsizing is that consumers either don’t notice the change in quantity or don’t see it as significant. To illustrate, consider a household goods company that sells its popular paper towel rolls to retailers for 40¢ per roll. The company faces a 5% surge in production costs and weighs three alternative adjustments:

Option A: Bump up the wholesale price by 5%, namely, by 2¢ per roll.

Option B: Reduce the number of sheets per roll by more than 5%, say from 100 to 93, and change the disclosure of the number of sheets per roll on the packaging materials, as required by the Fair Packaging and Labeling Act and related regulations.

Option C: Bump up the wholesale price by 2.5% and reduce the number of sheets per roll by 5%, namely selling 95-sheet rolls for 41¢ per roll, in compliance with mandatory disclosure requirements.

The company will try to evaluate likely consumer reactions to each option. This assessment may lead to the conclusion that Option B will likely be more profitable than Option A and that Option C will likely be even more profitable.

It follows that, although downsizing may be perceived as a dishonest business practice, it may still be a logical and lawful business tactic. Therefore, the recurrent emergence of shrinkflation demonstrates that competitive pressures can sometimes lead to the widespread adoption of business practices that may appear dishonest or unfair.

Lessons for Antitrust Enforcers

Shrinkflation is anticipated when production costs in the economy surge abruptly and competitive pressures limit the ability of businesses to pass on the cost increases to buyers. Indeed, it has always been known and understood that competitive pressures sometimes drive businesses and individuals toward questionable actions, even dishonest, unfair, or unethical ones. One of antitrust’s bedrock principles is that the question of “whether a policy favoring competition is in the public interest” does not and should not affect the evaluation of antitrust questions. Nonetheless, amidst the recent waves of shrinkflation, senior antitrust officials have relentlessly championed competition in fragmented industries as a means to uphold market morality, fairness, democratic norms, and other values. They seem to sidestep market realities.

To be clear, efforts to mask price increases through downsizing are rightfully viewed as deceptive, and shrinkflation raises valid concerns about eroding trust in market institutions. As such, there are compelling reasons to consider regulatory measures against misleading downsizing and to combat shrinkflation. Yet, assertions that failed antitrust policies have led to a moral decline in the marketplace are both misguided and misleading.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.