In new research, Nolan McCarty and Sepehr Shahshahani find that, contrary to the concerns of Neo-Brandeisians, market power does not correlate with political power via outsized lobbying.

Does increasing market power and economic concentration undermine democracy by shifting power from regular citizens to those in charge of large corporations? This possible political implication of economic power has been a long-running concern in American political thought and was in the mix of considerations leading up to the passage of the Sherman Antitrust Act in 1890. Two decades later, future Supreme Court Justice Louis Brandeis famously voiced similar concerns by warning of the “Curse of Bigness.”

Today, a new generation of policy and legal academics who self-style as “Neo-Brandeisians” have taken up these warnings. One plank of the Neo-Brandeisians’ reform program is the linking of economic concentration to political or democratic harms. Among the most prominent members of this school is Lina Khan, the current chair of the Federal Trade Commission, who has written (with Zephyr Teachout) that “ever-increasing corporate size and concentration undercut democratic self-governance by disproportionately influencing governmental actors.” Neo-Brandeisians argue that antitrust should look beyond the economic harms of concentration, such as higher prices and reduced quality, and also consider concerns about democratic equality.

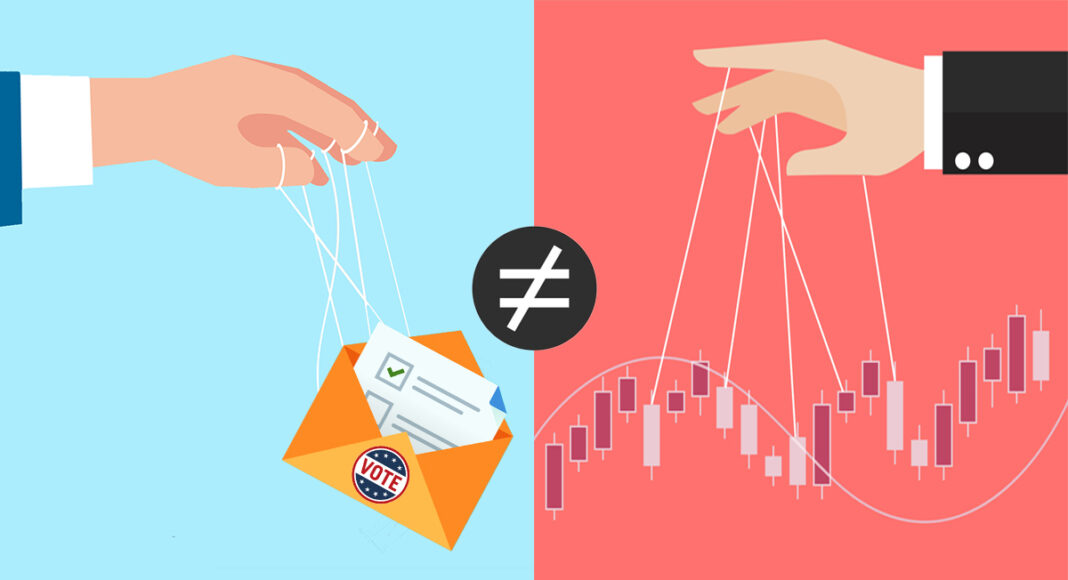

But the connections between market power and political power may not be as straightforward as the Neo-Brandeisians would have it. In a recent paper, we examine some implications of their arguments—that industry concentration breeds concentration of policy-influence activities such as lobbying, and that these activities become more concentrated in large firms as those firms become more dominant within their markets. To address these questions, we link data on firms’ federal lobbying expenditures to data on firm size and market concentration.

We find no positive correlation between an industry’s economic concentration and its concentration of lobbying expenditures—meaning economically concentrated industries are not necessarily politically concentrated in terms of lobbying. This casts doubt on the premise that economic concentration breeds concentration of political influence. We also find no correlation between an industry’s economic concentration and the share of industry revenue dedicated to lobbying (a result that is forthcoming in a new version of the paper). This goes against the idea, advanced by legal scholar Tim Wu and other Neo-Brandeisians, that concentration makes it easier for firms to coordinate and devote greater sums to influence-buying activities.

Our analysis of firm-level data similarly challenges Neo-Brandeisian claims about firm size and political concentration. While we do find that larger firms spend more than smaller firms on lobbying in total dollars, we find little evidence that large firms devote a disproportionate share of their revenue to lobbying. In fact, we find that the share of revenues allocated to lobbying falls as firms get bigger. The elasticity of lobbying expenditures with respect to revenue is below one, even for top firms. This means that as firm size grows in our dataset, companies spend more dollars on lobbying but a smaller share of their revenue. In addition, we find that the revenue elasticity of lobbying expenditures is the same for top firms and other firms in an industry.

These findings show that the lobbying of large firms grows relative to small firms only to the extent the top firms are growing faster economically—there is no evidence of large firms’ “disproportionate” policy-seeking activity, contrary to Neo-Brandeisians’ warnings. What’s more, our findings cut against the idea that large firms get “more bang for the buck” in lobbying; in a model with greater returns to spending for larger firms, we would not expect elasticities to be the same for top firms and other firms.

Of course, lobbying is only one of the many ways economics can influence politics. Other avenues including campaign contributions, the revolving door between politics and industry, cultural influence, and policymakers’ dependency on business investment and employment await more systematic investigation. But lobbying is important. As we document in the paper, there is a rich academic literature linking lobbying expenditures to favorable policy outcomes, and lobbying is where U.S. businesses spend the most money to influence politics. The scale of firms’ spending on campaign contributions, for example, pales in comparison with their lobbying. That is presumably why Neo-Brandeisians have singled out lobbying when complaining about the undemocratic influence of economic concentration, as we document in the paper. What is more, the latest research suggests that different ways of seeking political influence work as complements, not substitutes, so it seems unlikely that our findings on lobbying are indicative of firms pursuing other avenues of influence-seeking instead.

Ultimately, our findings do not support the core Neo-Brandeisian premise of a positive association between economic concentration and the concentration of political power, at least in the important area of lobbying. These findings do not show that economic resources cannot be used to gain political influence, but they suggest that the focus on large or high-market-share firms may be misleading.

The Curse of Mediumness

A shortcoming of the Neo-Brandeisian focus on the political influence of the largest firms is that it neglects the considerable political resources of small and medium-sized firms. The recent failures of Silicon Valley Bank (SVB) and Signature Bank reveal this blind spot. Many observers have linked these bank failures to the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA) passed by Congress in 2018. This legislation rolled back several banking regulations that were contained in the Dodd-Frank Act passed in the aftermath of the 2007-2008 Financial Crisis. With the exception of a few minor provisions, the regulatory relief was afforded only to small and medium-sized banks such as SVB and Signature.

Perhaps the most important of these provisions was one that reduced the frequency with which banks with assets between $100 billion and $250 billion must submit to stress tests by the Federal Reserve. Since banks like SVB and Signature fall into this range, the Act directly reduced the regulatory scrutiny of their balance sheets. Of course, it is impossible to know whether the rolled-back regulations would have prevented the collapses at SVB and Signature, but a strong case can be made that the stress testing repealed by EGRRCPA would have uncovered the risks associated with rising interest rates and forced the banks to recapitalize earlier.

Two points are worth highlighting in this connection. First, the EGRRCPA passed following an intensive lobbying campaign by regional banks and their political allies. The management of SVB and Signature were deeply involved in these efforts. SVB President Greg Becker provided written testimony to a congressional committee arguing that if SVB was not exempted from the standards faced by large banks, “SVB likely will need to divert significant resources from providing financing to job-creating companies in the innovation economy to compl[iance].” For its part, Signature Bank added Barney Frank, an author and namesake of the original Dodd-Frank framework, to its board after Frank became a leading advocate of regulatory relief for regional banks.

The second point is that the EGRRCPA is hardly the ideal policy for the largest banks, especially for the 12 that remain over the $250 billion threshold. Many items on the mega-bank wish list were left out of the bill, and an outcome where the biggest banks face competition from less-regulated, slightly less-big banks was a clear loss. Despite the high levels of economic concentration in the banking sector, mega banks were not able to use their economic power to prevent a significant policy loss.

It is perhaps an irony that the EGRRCPA might be defended in Neo-Brandeisian terms. After all, it was designed to force big banks into more competition with regional and community banks. While presumably few Neo-Brandeisians would actually make such an argument on behalf of the EGRRCPA, regional bank executives and lobbyists certainly touted ideas about restoring competition to rein in the power of big banks. In any case, the episode shows how a fixation with the Curse of Bigness can blind us to the political power of smaller firms and its economic consequences.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.