Do labor markets in Europe or the United States and Canada experience more monopsony power? In a new paper published in the University of Chicago Law Review, Satoshi Araki, Andrea Bassanini, Andrew Green, Luca Marcolin, and Cristina Volpin provide comparisons of monopsony power between the two regions, documenting similar levels of concentration across labor markets despite generally stronger protections in Europe. They also discuss the effects of such concentration on employment and wages, ending with potential regulatory reforms to address these issues.

While monopoly in the product market is much scrutinized and closely monitored by competition authorities across the globe, monopsony in the labor market has traditionally received far less attention in many jurisdictions. Until very recently, a paucity of enforcement activity in European labor markets was particularly noticeable in contrast to the recent pickup of antitrust enforcement in the United States labor market. Although there are substantial differences across the Atlantic in labor market institutions and regulations, we argue there is wide purview for European competition authorities to address employer monopsony power in labor markets.

Competition authorities have long overlooked labor markets

Employer monopsony power is the unilateral ability of employers to reduce demand for labor and pay wages below the competitive level. Similar to a monopoly, monopsonies result in inefficiently low output and employment and harm workers with lower wages and worse working conditions.

However, for years competition policy has conventionally assumed labor markets to be competitive and thus enforcement actions against employer monopsony power have been rare. In Europe, up until a couple of years ago and with only a few exceptions, there has been practically no enforcement on the supply side of labor markets. Even in the U.S., where competition authorities have been acting more aggressively to tackle employer monopsony power, the number of antitrust cases related to labor markets remains disproportionately lower than for product markets.

Labor markets are not as competitive as conventionally thought

Mounting empirical evidence suggests monopsony power in labor markets is more pervasive than had been previously anticipated. In a recent study, we document the magnitude of labor market concentration—a measure of the extent to which a labor market is served by a limited number of employers—in the U.S., Canada, and 12 European countries, using a comparable methodology and definition of labor market.

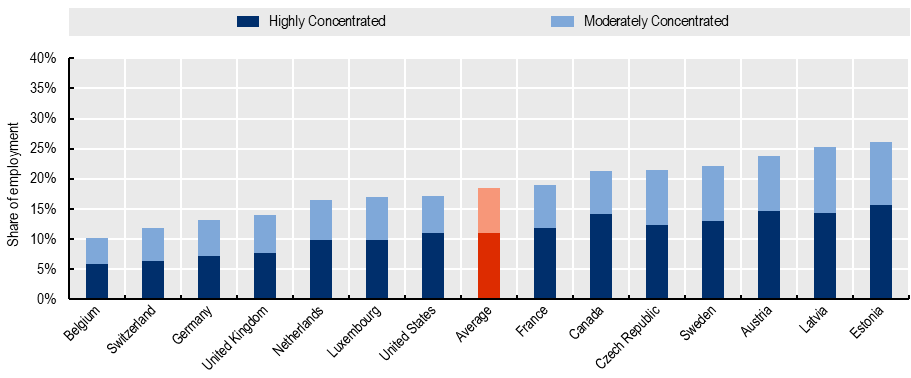

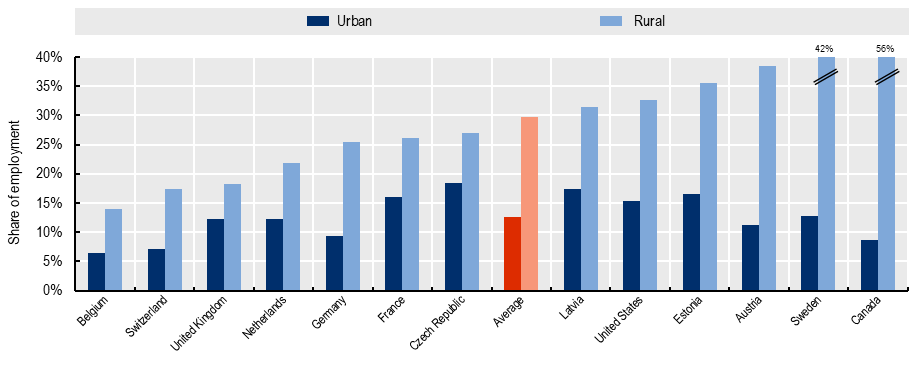

Our results offer the largest cross-country comparable evidence of labor market concentration to date. We find that 18% of workers in the 14 countries considered are employed in labor markets that can be deemed at least moderately concentrated according to the criteria widely used by competition authorities, and 11% of workers are employed in highly concentrated labor markets (see Figure 1). Notably, labor market concentration is similar in both Europe and North America: the share of workers in concentrated labor markets in the U.S. and Canada is on a par with the average of the 12 European countries for which the data are available. Differences emerge within countries: workers in rural geographies are twice as likely to be in concentrated labor markets in North America (see Figure 2).

Figure 1. The share of employment in moderately or highly concentrated labor markets, 2019

Source: Lightcast, the European Union Labour Force Survey (European Union countries, Switzerland and the United Kingdom), U.S. Current Population Survey, and Canadian Labor Force Survey and authors’ calculations.

Figure 2. The share of employment in moderately or highly concentrated labor markets by urban geography, 2019

Source: Lightcast, the European Union Labour Force Survey (European Union countries, Switzerland and the United Kingdom), U.S. Current Population Survey, and Canadian Labor Force Survey and authors’ calculations.

Concentrated labor markets translate into lower employment and lower wages

The literature shows a link between concentration in the labor market and lower local employment and wages. In our survey of studies on horizontal mergers of firms, which tends to be more likely to result in increased concentration, we find that employment levels are lower in merged firms than before the merger: e.g., in Finland, Sweden, the United Kingdom and the U.S. Although merger studies often confound product market competition and labor market competition, Marinescu et al. and Popp isolate the latter and report large negative effects in France and Germany, respectively.

As for salaries, a 10% increase in concentration is estimated to decrease wages in the U.S. by 0.1% (see, for instance, Benmelech et al., Rinz, and Schubert et al.) to 1% (according to Arnold, Azar et al., and Qiu & Sojourner). For European countries, these effects are closer to the lower bound of the U.S. estimates. Pooling data for Australia, Costa Rica, Denmark, France, Finland, and Spain, the OECD finds an effect around 0.3%, while Bassanini et al. report cross-country comparable elasticities for Denmark, France, Germany, and Portugal, ranging between 0.2% and 0.3%. Other studies find comparable estimates for single European countries: e.g. France, Germany, Norway, and Portugal.

Hence, there is empirical evidence that both the level and some effects of labor market concentration are broadly similar on both sides of the Atlantic, despite generally stronger labor market institutions and protections in Europe.

Competition authorities, especially in Europe, should vigorously tackle labor market monopsony

While antitrust enforcement may not be the only solution to monopsony power, particularly when such power is not originated by a reduction in competition between market players but by other factors (e.g., linguistic barriers or workers’ aversion to switch jobs), it is an essential tool in addressing labor market monopsony under EU competition law.

Collusion—including wage-fixing, no-poach, and no-solicitation agreements, as well as exchange of commercially sensitive information—can be qualified as “by object” or “per se” anticompetitive under competition law. In the U.S., competition authorities are more proactive and have issued guidance on such agreements. Canada has also recently adopted an amendment to its competition law that enables it to impose criminal sanctions on these behaviors. In Europe, several investigations into employer collusion have been recently brought on by national antitrust authorities (e.g., in France, Hungary, Lithuania, the Netherlands, Poland, Portugal, Spain and Switzerland), while the European Commission has not yet had any labor case at the time of writing.

The abuse of non-compete agreements, which prevent workers from working for a competitor after they separate from their employer, also hampers job mobility and thereby significantly increases labor market power on the employer side. The use of non-competes is widespread in the U.S.—see OECD and Araki, Bassanini, Green & Marcolin—even when it is not legally enforceable. Meanwhile, unlike Section 1 of the Sherman Act in the U.S. which addresses “restraint of trade,” the EU equivalent refers to agreements between undertakings. As employees do not normally constitute “undertakings,” competition authorities cannot currently bring enforcement action against the unjustified use of non-competes under this provision. Consequently, a regulation to restrict the use of non-competes to procompetitive grounds may be worth consideration within the current EU framework.

It is worth noting that European competition authorities are opening more and more investigations to sanction collusive behaviors by employers. Even so, while authorities in the U.S. have also now started to analyse the effects of mergers on labor markets, labor market impacts have never been assessed in merger control in the EU. However, much like for restrictive agreements, the EU competition law framework is flexible enough to allow this scrutiny, and it seems it is only a matter of time before the right case comes in.

In conclusion, competition authorities have made progress on both sides of the Atlantic to enforce competition in labor markets more systematically. We anticipate a greater role of antitrust authorities in these labor markets in the coming years.

Authors’ Note: This commentary expresses the personal views of the authors. It does not necessarily reflect the official views of the Organisation for Economic Co-operation and Development or any of its member states. The authors are grateful to the participants of the 2022 University of Chicago Law Review Symposium on Law and Labor Market Power for comments and suggestions.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.