Are the antitrust enforcement agencies in the United States sufficiently stringent in challenging mergers? In a new working paper, Vivek Bhattacharya, Gastón Illanes, and David Stillerman inform this debate by examining the price and quantity effects of U.S. retail mergers and modeling the implications of alternative antitrust regimes.

Has antitrust policy in the United States been too lax? This is a matter of significant debate between academics, industry participants, and policymakers. Answering this question requires a systematic analysis of what effects completed mergers have had in the U.S. and a prediction of how these effects would change under alternative antitrust regimes. In a new NBER working paper, we provide evidence on both these issues.

We find that U.S. retail mergers raise prices by 1.5% and decrease quantities sold by 2.3%, on average, but there is substantial heterogeneity in these effects. A quarter of mergers decrease prices by at least 5.1%, while another quarter increase prices by at least 5.8%. Using the observed merger effects and a model of antitrust enforcement, we estimate that, on average, U.S. antitrust agencies (the Department of Justice Antitrust Division and the Federal Trade Commission) block mergers that are expected to raise prices by between 8-9%. At this threshold, many anticompetitive mergers are allowed to proceed while procompetitive mergers are rarely blocked. We find that tightening the threshold of enforcement can reduce the probability that anticompetitive mergers are approved without a large change in the probability of procompetitive mergers being blocked. That said, the number of cases challenged by the antitrust enforcement agencies would increase, suggesting that tightening standards is not without cost.

What have mergers done?

Retrospective analysis of mergers is frequently subject to two forms of selection bias. First, mergers selected for analysis are often those of particular interest to researchers or to policymakers, meaning these mergers may not be representative of all consummated mergers. Second, deals that were studied must have been approved by the antitrust enforcement agencies and thus may not be representative of the types of mergers approved in alternate antitrust regimes. Our analysis tackles both these sources of bias. We analyze all (sufficiently large) mergers in consumer packaged goods products in the U.S from 2006-2017, which ensures that our sample is representative of mergers in one industry. We then develop an economic model to analyze selection into merger approval and predict outcomes in alternate antitrust regimes.

We use data from NielsenIQ, which provide weekly prices and quantities at the product level for a large set of stores. We then use SDC Platinum, a comprehensive dataset of M&A activity in the U.S., to identify all transactions with deal sizes larger than $280 million involving products likely to be sold in the stores in our dataset. This includes companies that sell food, electronics, cosmetics, and pharmaceuticals. Each deal involves companies that may compete in multiple product markets: Conglomerate A and Conglomerate B may both sell pickles and ketchup, for example. We treat each product market of a deal in which the two parties both sold products before the transaction as a separate merger. We end with a sample of 126 mergers coming from 50 separate deals.

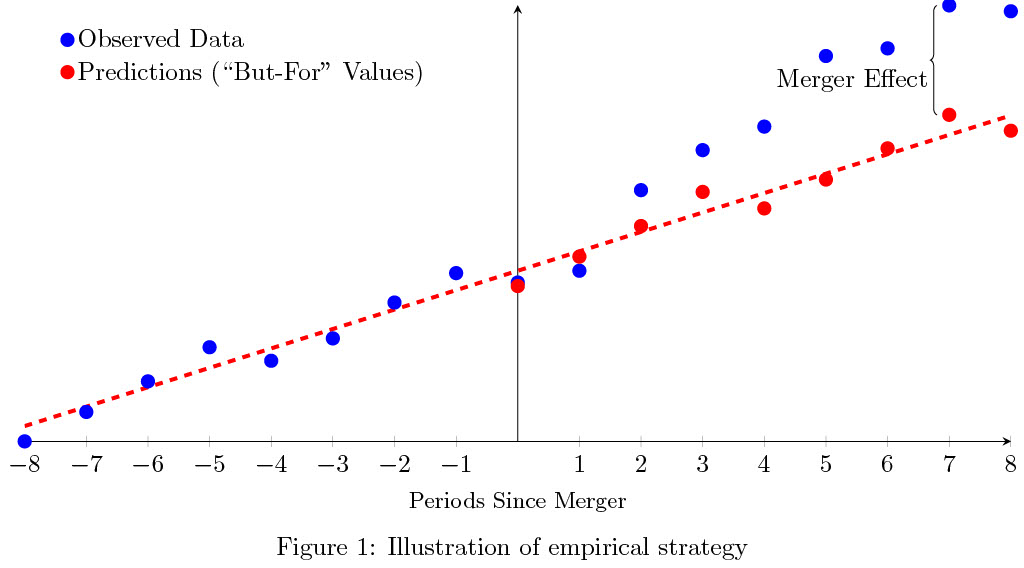

In our baseline specification, we estimate the mergers effects using a before-after comparison of prices illustrated in Figure 1. We use data from the two years before the completion date of the merger to estimate (i) a brand-specific time trend, (ii) seasonality effects, and (iii) UPC-geography-specific differences in price levels. This allows us to predict a “but-for” price for each product for each geography after the merger. The difference in the observed price and the but-for price, averaged across products and geographies over the two years after the merger, is our estimate of the effect of the merger.

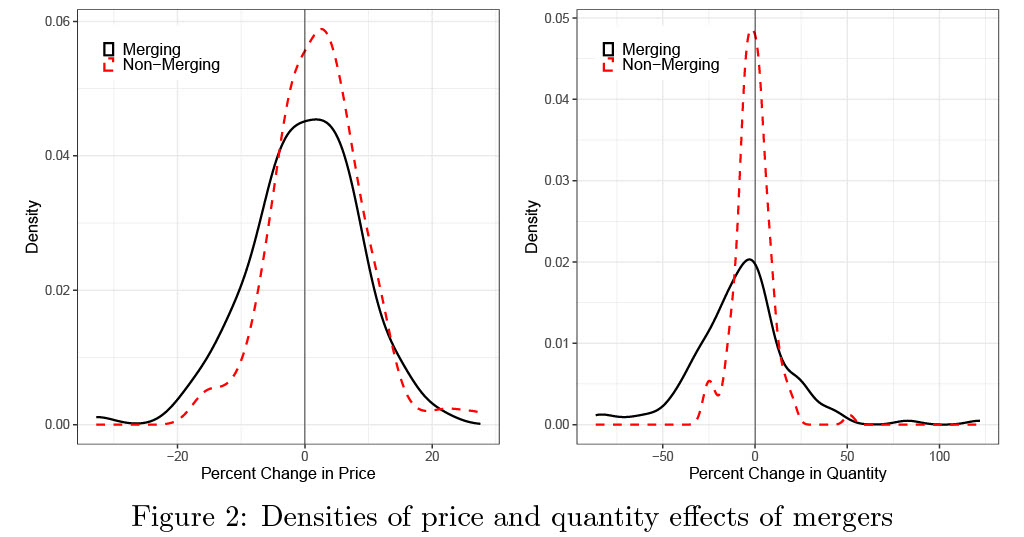

Figure 2 plots the distribution of price (left panel) and quantity (right panel) effects of mergers separately for merging parties and their competitors. The average price effects of completed mergers are rather modest: the mean change is -0.1% for merging parties and 2.1% for non-merging parties, corresponding to a 1.5% increase overall. This stands in contrast to estimates from meta-analyses of the literature, which find average price increases around 5-7%. The quantity effects are larger. A striking finding from our paper is that, on average, quantities sold by merging parties decrease by 7.6%. The distribution in outcomes for non-merging parties is much tighter.

Moreover, there is significant heterogeneity in the outcomes of mergers: Over 25% of mergers lead to a price decrease for merging parties of more than 5.1%, and another 25% lead to a price increase of more than 5.8%. Similar heterogeneity exists for the quantity effects. This heterogeneity plays an important role in our analysis of antitrust policy, and it hints at the difficulty of the problem enforcement agencies face: mergers can be both significantly procompetitive (leading to price decreases) or significantly anticompetitive (leading to price increases).

How do current guidelines align with these effects?

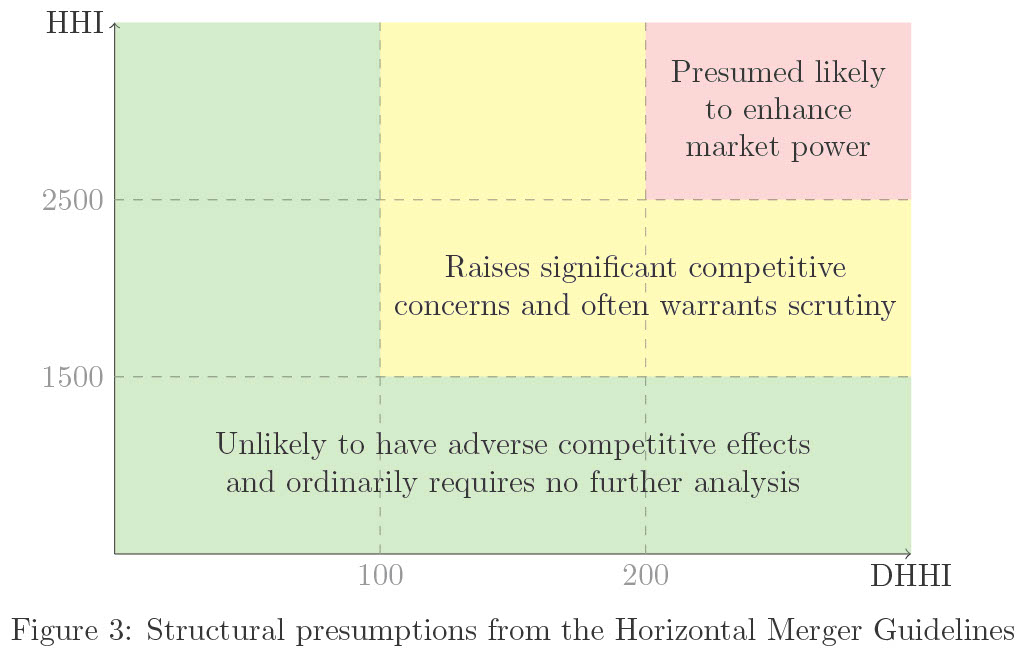

To assist with the difficult task of identifying harmful mergers, the Horizontal Merger Guidelines codify the so-called “structural presumptions” the agencies use in conducting their assessments of whether a merger is anticompetitive. These presumptions use both the Herfindahl-Hirschman Index (HHI) of the merger—the sum of the squares of the market shares of companies in the market—and the change in the HHI induced by the merger (DHHI).

Figure 3 shows the HHI and DHHI regions outlined in the 2010 revision of the Guidelines along with the language used to describe each region. In July 2021, President Joe Biden issued an executive order to revisit these Guidelines, to which many economists submitted comments, and these regions are expected to be reassessed.

We correlate our estimated price changes with market structure to evaluate the effectiveness of these structural presumptions in identifying anticompetitive mergers. At the national level, we find that DHHI is indeed related to increases in prices: mergers with DHHI between 100 and 200 have overall price increases that are 2.9 percentage points larger than those with DHHI below 100, and those with DHHI above 200 are 5.1 percentage points larger.

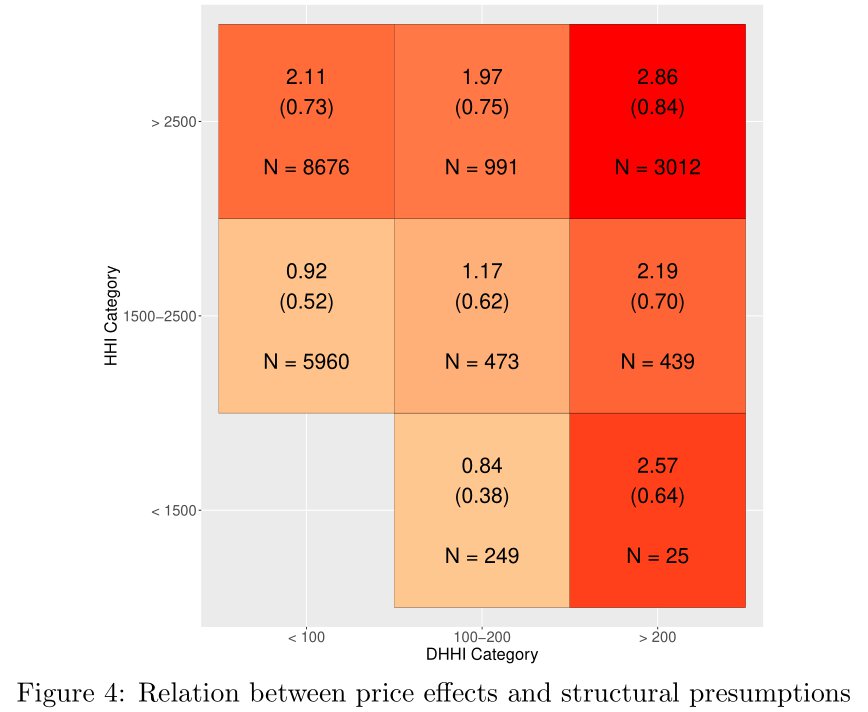

Even if mergers do not lead to considerable changes in market structure nationally, they still may present competitive concerns in a subset of geographic markets. We repeat our analysis by estimating price changes at the merger-geography level and correlating these changes with geography-level metrics for market structure. Figure 4 shows the difference in prices for each bin of HHI-DHHI, relative to the bin where HHI is less than 1500 and DHHI is less than 100, in a format that mirrors Figure 3. This analysis controls for the overall level of price changes in a merger using a merger fixed effect. We find that typically both larger DHHI and HHI correlate with larger price changes, consistent with the presumptions in the Guidelines.

How would alternative antitrust policy perform?

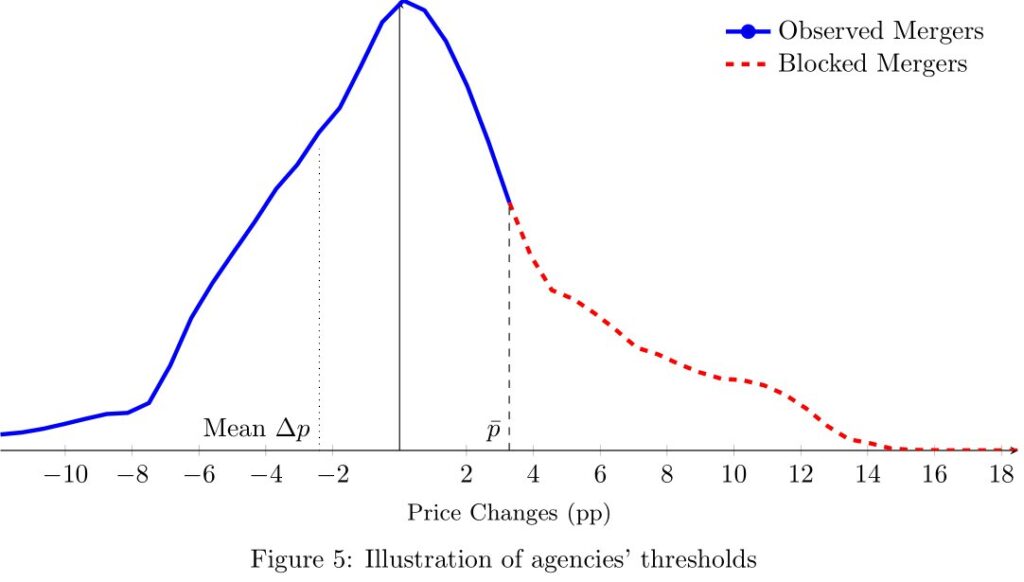

Finding small average price changes does not mean that current antitrust policy is strict. Figure 5, adapted from Carlton (2009), illustrates this point. The entire distribution (blue and red) corresponds to the price effects of all potential mergers. Suppose that the agencies can predict the price change of a merger exactly and block all mergers with a price change larger than p. Then, the agencies’ threshold would be p and, since we do not observe any blocked mergers, the average price change estimated in the data would be the average of the blue part of the distribution (denoted Mean Δp).

Asking how strict antitrust enforcement is, in this model, is tantamount to asking what p is. We estimate a more realistic version of the model, allowing for agencies to have uncertainty over the price change that a merger will induce. To estimate both the threshold and the uncertainty, we conduct the following thought experiment. Given the agency has limited resources, suppose that if it faces two mergers with identical market structures, but one of them happens to be larger in terms of sales, it focuses its enforcement efforts on the larger merger. If it challenges a lot of large mergers, then it must have a strict threshold for these mergers. Now, if the realized price distribution of the large mergers that are allowed by the agency looks a lot like the price distribution for the small mergers (which go largely unchallenged), then the agency must have a noisy signal of the price change a merger would induce. If the price changes for large mergers are smaller than the price changes for small mergers, then the agency must have a reasonably precise estimate of price changes and thus is able to target the most harmful mergers.

We formalize this model mathematically and estimate it by connecting the estimated price changes from above and enforcement actions by the DOJ and the FTC. For the purposes of our analysis, we take an enforcement action to be either a divestiture or a complaint that leads the parties to withdraw the merger. We find that on average, the agencies aim to challenge mergers that they expect will increase prices by more than 8-9%. We also find that agencies have a moderately precise signal of the price changes induced by the merger.

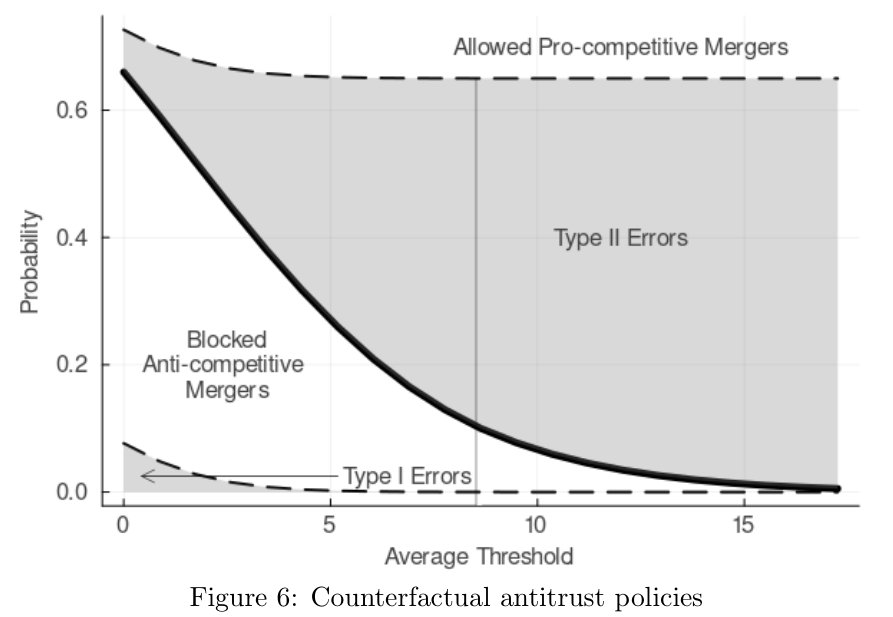

Figure 6 explores what this means for alternative antitrust policy by plotting the probability of a challenge along with the probabilities of making one of two types of errors: blocking procompetitive mergers (“type I error”) or allowing anticompetitive mergers (“type II error”). Agencies allow mergers above the solid line and challenge them below. We find that moving to a 5% price change threshold from the current one (marked by a vertical line) would not have a large effect on blocked procompetitive mergers and would significantly reduce the probability of allowing anticompetitive mergers. However, it would almost triple the number of mergers the agencies would have to challenge.

With these findings, we can go back to the question with which we started the paper: is antitrust policy too lax? At the current level of stringency, many anticompetitive mergers go through while essentially no procompetitive mergers are blocked. We find that agencies could screen out these mergers, but it would entail a significant increase in their workload.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.