The looming ecological disaster means that it is time for competition researchers, policymakers, lawyers, and economists to devise competition policies that focus on the well-being of citizens and the planet, that strike down unsustainable business conduct as anticompetitive, that promote cooperative models of progress and innovation, that do not value maximizing output and profit for the sake of it, and promote an equitable downscaling of material and energy throughput.

Can sustainability play a role in antitrust enforcement? And should it? Can competition policy be a viable tool to fight climate change, and should antitrust enforcers take climate change into consideration? In the past few years, these questions have been the subject of a growing debate among policymakers and scholars, particularly in Europe. In an attempt to answer these questions and more, we have decided to launch a series of articles on the relationship between antitrust and sustainability.

How often do competition researchers, policymakers, lawyers, and economists take a moment to think what competition is for? When they peel back—one by one—the layers of jargon, convoluted economics, complex models, fanciful theories of harm, and elaborate econometric tests, from their rather technical, inaccessible, and incomprehensible field of practice and study, what remains?

Robert Bork’s apophthegm that “antitrust policy cannot be made rational until we are able to give a firm answer to one question: What is the point of the law—what are its goals?” begs for an answer still, today, as it did in 1978. That answer matters tremendously, as it can reveal what economic model we want to pursue and what—and how much—we can do with competition policy to help solve the interconnected crises brought about by inexorable growth: climate and environment emergency, pollution, inequality, oppression, exploitation, extinction.

My research, as well as that of an increasing number of scholars such as Ariel Ezrachi, Simon Holmes, FTC Chair Lina Khan, Suzanne Kingston, Ioannis Lianos, Michelle Meagher, and Julian Nowag (to name a few), provides an answer to that question and offers a roadmap for how to future-proof competition policy for the reconfiguration of societal relations that solving the crises we have created will result in.

Large Corporations as Keystone Actors

Human impact on the planet is now so significant that it has probably caused an anthropogenic regime shift, pushing Earth from the Holocene’s stable conditions, into a new geologic era, the Anthropocene. Human beings are now a sizeable force of nature—ironically a self-destructive one so far—changing our environment and climate to such an extent that we may soon end up on an irreversible trajectory towards our own extinction by pushing our planet beyond its boundaries.

The term Anthropocene, however, lumps together the impact of all humans, disregarding the fact that not all anthropoi are equally responsible for the great acceleration that has pushed the Earth into an unsafe and unjust state. Consider, for instance, how just 100 companies are responsible for 71 percent of global industrial greenhouse gas emissions since 1988, or that just 20 companies are responsible for most single use plastic waste, or that 20 fossil fuel companies can be directly linked to more than one-third of all greenhouse gas emissions since 1965, when the problem was already known.

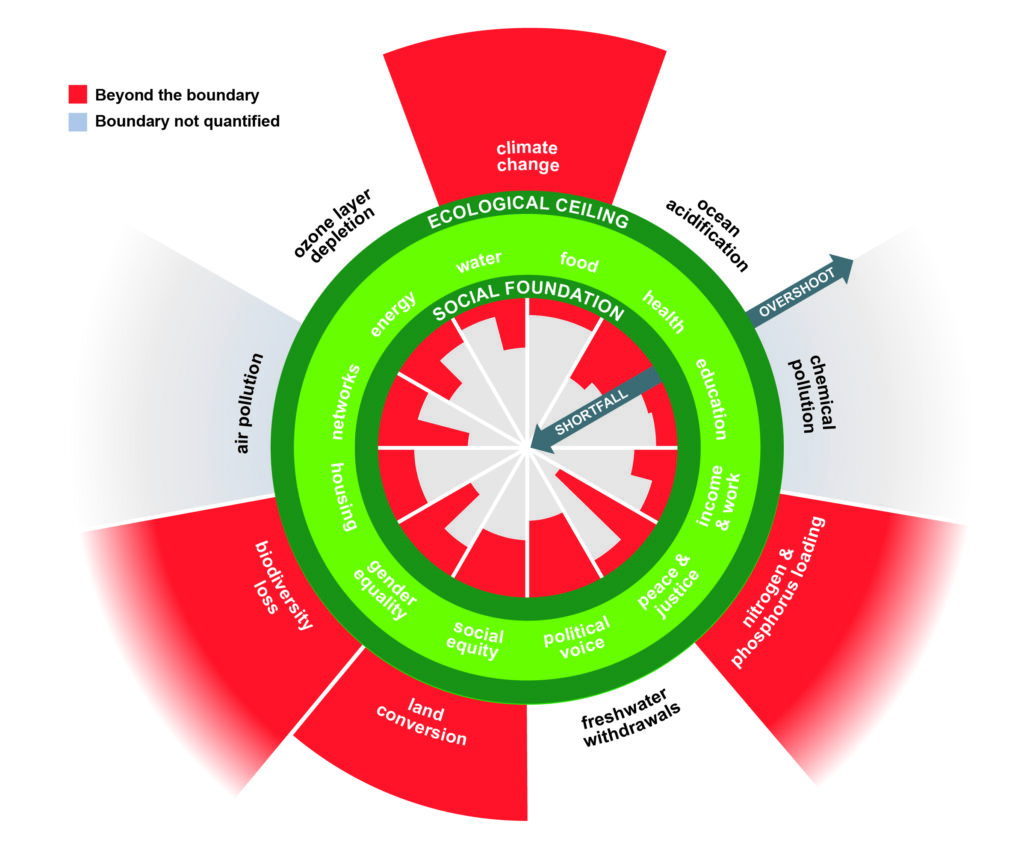

The “Doughnut” of social and planetary boundaries. By DoughnutEconomics, own work. [CC BY-SA 4.0]

Some companies grow so large that they effectively control critical functions of the biosphere. These companies can be understood as keystone actors, alluding to keystone species that have a disproportionate influence on the structure and function of ecosystems. Large corporations’ negative impact on people and planet is disproportionate; but this also presents an opportunity in disguise, as their power can be harvested to precipitate change for the better. That is where competition policy comes in.

Dominance and Unsustainable Practices

Despite the large power they yield, big companies’ unsustainable practices are not necessarily covered by our antitrust rules. This is because “bigness”—i.e., absolute power in the economy—does not necessarily equal the sort of market power that is relevant for antitrust rules (“dominance”), if that power is not large relative to competitors in a given relevant market, as revealed by market shares, entry barriers, etc. This poses a challenge for those who would like large corporations to be held accountable for precipitating the climate and environmental crisis using competition rules.

Together with socioecologist Chris Vrettos, we tried to demonstrate that companies which had previously been found to be dominant for the purposes of EU competition rules, had also engaged in what we defined as unsustainable business practices. Our definition was based on ecological economist Kate Raworth’s “Doughnut Framework,” a heuristic tool that combines planetary boundaries with the UN Sustainable Development Goals (SDGs), which we operationalized for undertakings by using the principles of the UN Global Compact for corporate sustainability. Thus, “unsustainable” for us is any practice that contributes to the transgression of the planetary boundaries or contravenes the SDGs—in other words, any action that pushes the world towards a more unsafe and unjust space.

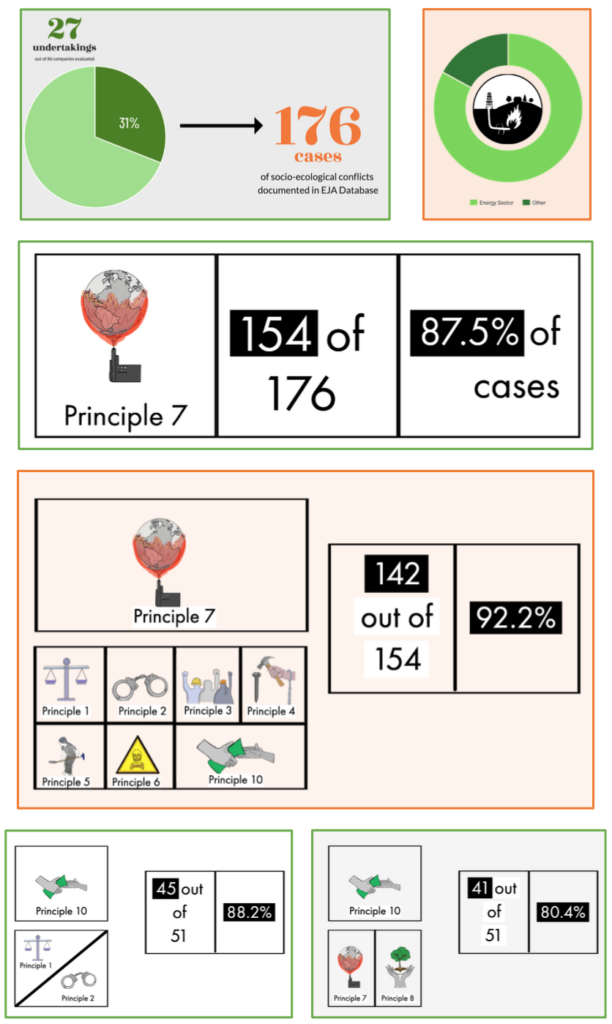

We first collected all of the European Commission’s directorate general for competition (DG COMP) cases on Article 102 TFEU with findings of dominance. We identified 86 unique dominant undertakings in the decisional practice and we categorized them in six sectors. We then cross-checked how many of these featured on the Environmental Justice Atlas (EJAtlas), which systematically collects and maps socio-ecological conflicts from across the world, analyzing the actors behind each conflict, as well as the relevant impacts on society and the environment.

We found ample evidence of an overlap between market dominance and unsustainable business practices (31 percent of dominant undertakings also featured in the EJA and were involved in 176 cases of socio-ecological conflict) across all sectors, and an overlap between environmental damage and violations of human rights, disregard for basic labor standards, and corruption (see figures below). The wide prevalence of breaches of environmental protection indicate that dominant firms systematically contribute to ecological breakdown. Moreover, the pervasiveness of corruption and rent-seeking lobbying shows that competition law can have a significant role to play, even in the presence of regulation.

Key findings from matching exercise between DG COMP’s enforcement of Article 102 TFEU and Environmental Justice Atlas. Source: Iacovides and Vrettos, 2022.

Unsustainable Practices as Abuses of Dominance

How do these unsustainable business practices relate to the concept of “abuse” of dominance? Abuse of dominance, which is prohibited by the EU’s competition rules, is conduct that does not correspond to competition on the merits, similar to monopolization in US antitrust law. Through practice and economic research, the law recognizes various types of abuse, among them margin squeeze, predatory pricing, refusal to supply, exploitative prices, etc. Unsustainable business practices can either be integrated into these types, or they can be shown to lead to distortions of competition in their own right.

Overall, unsustainable practices result in making production inputs (e.g., raw materials, labor and energy) cheaper than they ought to be, as they involve externalities that are not accounted for. Lower standards result in lower production costs. Through such practices, firms gain a competitive advantage over more sustainable competitors. All sorts of conduct that is typically abusive, such as cross-subsidies, loyalty-inducing rebates or margin squeeze are enabled by unsustainable practices. They may also result in raising barriers to entry for competitors or become part of a strategy of raising rivals’ costs. Additionally, they may reduce incentives to innovate.

Such conduct constitutes unfair competition and may result in both the exclusion of competitors and the exploitation of customers or consumers. Recognizing such conduct as “abusive” (and, thus, illegal) also corresponds to most peoples’ intuitive notions of what is fair competition between companies. Bribery, extortion, human rights violations, social dumping, pollution, destruction of habitats and livelihoods, and exploitative salaries and working conditions cannot be considered “normal” and “meritorious.” Yet, our competition rules have been indifferent to these practices, thus enabling and tolerating this type of toxic competition.

Competition, Yes. But What For?

This brings us back to Bork’s question. What is competition law for and what, or who, does it protect? There is extensive literature (summarized and reviewed here) that attempts to answer that question. Extensive empirical research by Konstantinos Stylianou and myself into the practice of EU competition law has shown a variety of overarching goals: efficiency, welfare, freedom to compete, market structure, fairness, market integration, and protecting the competitive process. No goal emerges as being predominant, and EU competition law seems to prioritize process (e.g., fairness, equality of opportunity, level playing field) over outcome (e.g., efficiency, welfare). This indicates that EU competition rules could also be used to further sustainability goals, as suggested by Simon Holmes. And it may even be mandated by EU law, as Vrettos and myself have argued.

Instead, EU competition law has been focused on a Chicago School–inspired narrow “consumer welfare” standard and has been fixated on maximizing output as a result of adopting a “more economic approach.” It has prized low prices and certain parameters of quality, but only if consumers are willing to pay for them. Thus, it has failed to recognize unsustainable business conduct as anticompetitive, given that such practices result as they do in low prices and increased output. This can be seen, for instance, in the agrochemical mega-mergers Bayer/Monsanto and Dow/DuPont, both approved in the last few years.

Competition policy in the EU thus promoted a model of cutthroat competition with low standards, outsourcing, unincorporated externalities and market failures, wage suppression, and inequality. Competition was to the benefit of large powerful corporations that were to be left as uninterrupted as possible to create wealth. Ideally, this wealth would help solve societal problems through innovation and would be redistributed through progressive tax policies. Needless to say, this has not really happened. Instead, we have been left with increasing inequality globally, increased concentration in many markets, and an imminent threat to people and planet.

“We found ample evidence of an overlap between market dominance and unsustainable business practices across all sectors, and an overlap between environmental damage and violations of human rights, disregard for basic labor standards, and corruption.”

A Green or Gray Transition?

Yet, change may finally be on the horizon as a result of the European Green Deal, the EU Climate Law, and the sudden flush of public money made available for the recovery from the economic downfall caused by the Covid-19 pandemic, some of which will also go toward the green transition. All policy areas will have to contribute to the Green Deal’s ambitious goals of transforming the European economy, and competition policy is no exception.

How much EU competition law would need to adapt will depend a lot on what model of sustainability the EU will eventually opt for. One option is a model that relies on techno-optimism and green growth—requiring, as it does, decoupling growth from material and energy use. This model will not require any significant shift from neoclassical economics and would be in line with how competition law is currently applied, with perhaps added emphasis on innovation and dynamic efficiency.

On the other hand, a model that would endorse degrowth policies would have more significant repercussions for competition law and practice. It would require us to reimagine competition policy for “a post-GDP welfare standard in which short-term consumer price effects are no longer the only indicator of economic welfare and social progress,” as one Brussels think tank recently proposed.

Dreams Are Maps

What would a reimagined competition policy look like? In our coming research, Vrettos and myself aim to answer that question by applying a degrowth lens to the Green Deal and related legislation. Broadly, it would be a competition policy (including state aid) that focuses on true citizen well-being: e.g., job guarantees, universal access to public services and goods, a sense of community and participation, less work, decent salaries. This proposed competition policy would also strike down unsustainable business conduct as anticompetitive, promote cooperative models of progress and innovation, will not value maximizing output and profit for the sake of it, and promote an equitable downscaling of material and energy throughput.

Concretely, to offer some examples, this might mean

- allowing for more research and development cooperation on things like crucial technologies for carbon capture;

- offering clearer guidelines on exemptions for cooperation; promoting sandboxes for experimentation without the fear of competition law violations; allowing state aid to be contingent on degrowth strategies;

- reconsidering what constitutes an “undertaking” and “economic activity” (e.g., certain not-for-profit or cooperative undertakings could escape antitrust rules altogether);

- integrating data on how a company meets sustainability goals into competitive assessments;

- using true costs in econometric tests such as the as-efficient-competitor test;

- taking into account whether low prices are the result of unincorporated externalities;

- not considering as efficiencies anything that results from such unincorporated externalities;

- taking into account broader social goals in merger assessment;

- allowing for common private standards or information exchange that reduce waste and increase interoperability;

- forbidding killer acquisitions that delay emergence of green technology; and many more.

Does that sound like too much for competition policy to do? Perhaps, but business as usual is simply not an option. The Anthropocene, beyond a possible geologic era, is also an era of crisis. It is a crisis of nature, but also a crisis of meaning. Importantly, it is also a crisis of action.

It is high time we finally take the time to reflect on what competition is for and how we can best use it to advance true wellbeing for people and for the planet.

Disclosure: Marios Iacovides has received a research grant for the co-led project on Goals of EU competition law from the Swedish Competition Authority and the UK Economic and Social Research Council. He acts as a remunerated expert advisor for the Hellenic Competition Commission on matters of sustainability. His research can be found @ SSRN or ORCID and he can be contacted on Twitter or LinkedIn.

Learn more about our disclosure policy here.