A new working paper explores the increase in labor market power in the US and what’s driving it. It shows manufacturing workers were paid their competitive value in 1972, but only about 50 cents on the dollar by 2014, pointing to technological change as the key driver.

Does antitrust have a labor market problem? The last few years have seen growing interest among academic scholars in the causes and effects of concentration in US labor markets. Concurrently (and not unrelated), there has been an explosion of interest among policymakers and the general public in the impact that firms with market power may have on wages and working conditions. What do the data say regarding employer concentration and its effect on workers? Is antitrust in its current form equipped to address issues related to labor market power? In an attempt to answer these questions and more, we have decided to launch a series of articles on antitrust and the labor market.

“The Great Decoupling,” “The Big Quit,” “Striketober”—recent news from the American labor market highlights a general resentment with the widening gap between how much is produced and how much goes to labor. Economic research justifies it: The share of US income that goes to labor has fallen since the 1980s by 6 percentage points.

In our recent working paper, we explore how much rising labor market power might explain these trends. We focus on a labor market that was hit especially hard: production line workers in manufacturing. The fall in the labor share was three time sharper in manufacturing, with production workers bearing the brunt of it.

Our central finding is that manufacturing workers were paid their competitive value in 1972, but only about 50 cents on the dollar by 2014. Our evidence also points to technological change as the key driver.

To reach these conclusions, our paper is divided into two parts. The first part is all about measuring the rise of labor market power in US manufacturing; the second part is all about exploring what’s driving it.

In the first part of the paper, we start by looking at total costs in the manufacturing sector. If we just look at payments to labor, we have another big candidate that might cause a fall: rising markups. Markups–prices over marginal costs–are a common measure of product market power. As a benchmark, we could compare payments to labor relative to payments to another variable input like materials. With markups, firms restrict both labor and materials. But with labor market power, they restrict labor relative to materials.

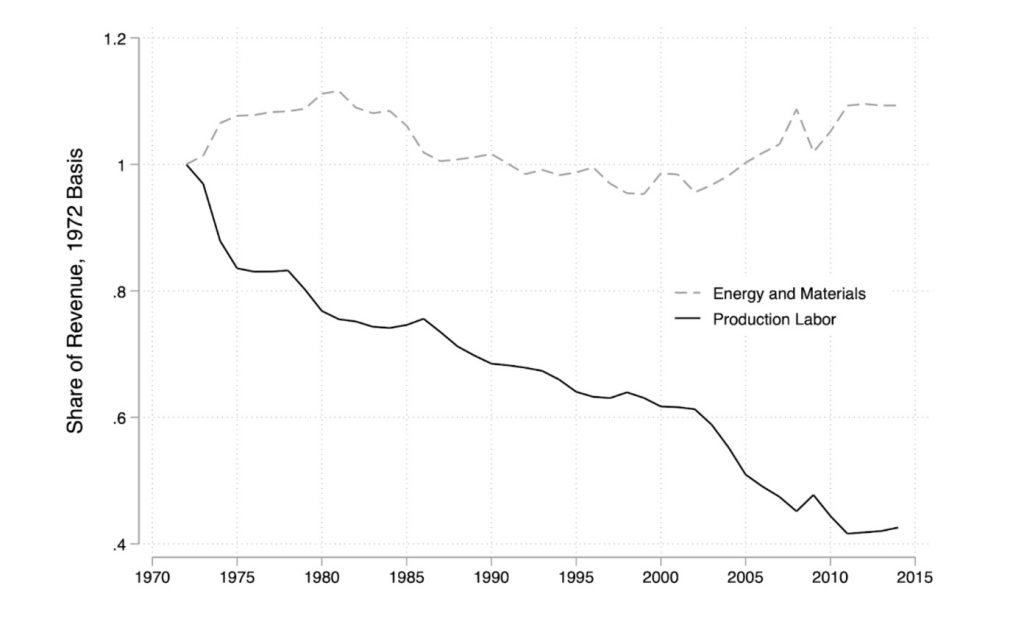

Fortunately, you can use public data to look at total costs in the US manufacturing sector. Figure 1 plots the trends in variable input costs as a share of revenues from 1972 to 2014. The lines track the amount that firms spent on (dashed gray) materials and (solid black) labor. While materials have remained stable as a share of revenue, labor has declined to less than half its 1972 value.

So in cost data alone, we have strong suggestive evidence that there was a big increase in labor market power. What else might be going on? The other big candidate that might cause a fall in payments to labor is that workers have become relatively less valuable to firms. To measure that, we use frontier statistical methods to account for changes in the value of labor.

Our evidence points to a “value creation, value capture” narrative: we find that worker values accelerated starting in the 1990s, but wage growth remained stable. Plants invested in new technologies like automation, which made their workers more productive. But these plants didn’t pass on the profits to worker wages like they would in a competitive labor market.

For the second part of the paper, we dig deeper by exploring the causes of labor market power. Surprisingly, we find growth in local labor market power is uncorrelated with growth in local labor market concentration. In fact, our evidence suggests geography-based explanations, like growing labor market concentration, are not the lion’s share of what’s going on. Instead, we find evidence for industry-based explanations. For example, automation might generate labor market power, and it swiftly became widespread in select industries (e.g., automobile manufacturing). We find industries explain over 80 percent of the differences in labor market power across plants, but geographies only explains about 10 percent.

Our results underscore technological change as an essential driver of labor market power. Labor market power is strongly correlated with direct measures of information and communication technologies and with indirect measures of managerial and automation technologies. At the plant level, the proportion of revenues passed on to the workers is strongly correlated with technology-related expenditures on computers and communications, in both levels and changes.

“Our results underscore technological change as an essential driver of labor market power.”

This narrative makes a lot of sense: Worker bargaining positions deteriorate as firms develop the threat of replacing workers with robots; and as workers gets displaced, firms also develop the threat of replacing the remaining workers with their recently-displaced friends.

We also find evidence that union membership mitigates firms’ power over wages. Industries that saw the greatest growth in labor market power also saw the greatest fall in union rate. Paired with our other evidence, this result suggests unions might mediate rapid technological change.

Overall, we conclude labor market power comes from technology, whereby plants capture most of the surplus from increased labor productivity. This result suggests scope for policy action to counteract technology-driven rises in labor market power. But it puts policymakers in a nuanced position–technological change itself is also remarkably beneficial for productivity. The challenge: Can we develop rules to promote technological change while incentivizing firms to share the gains with workers?

Disclosure: All expressed views are those of the authors and not of the US Census Bureau; results have been reviewed to ensure no confidential information is disclosed. All views stated are solely the authors’ and do not reflect those of Analysis Group.

Learn more about our disclosure policy here.