A new paper finds that when interparty competition in state legislatures is high, well-connected and influential incumbent firms are best able to take advantage of this opportunity to influence and transform the competitive landscape.

When politicians and policymakers distribute tax breaks, subsidies, and regulatory favors, the beneficiaries are often large, established businesses. These giveaways can reinforce the advantages that these powerful firms have over smaller or younger businesses. However, while these policies often have meaningful effects on markets, often times they are driven more by political conditions rather than considerations of economic welfare.

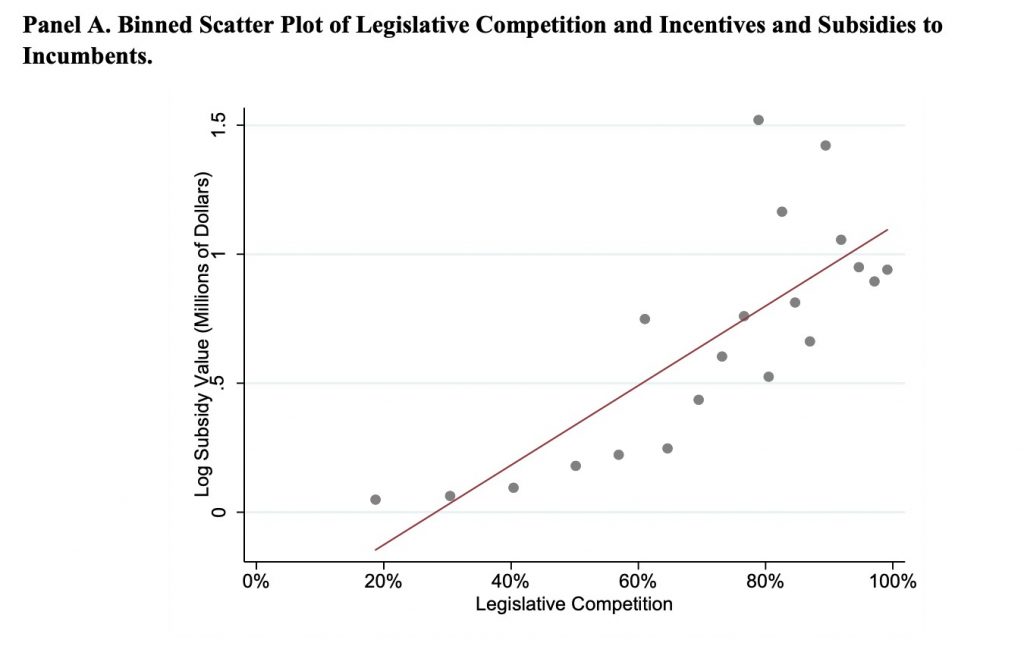

In a recently published paper in the Strategic Management Journal, I consider how political conditions can affect the provision of subsidies to established incumbent firms and the resulting consequences for entrepreneurial activity. I find that states with higher interparty competition within state legislatures grant more subsidies and incentives to incumbent firms, and then experience higher rates of young firm mortality.

As legislatures become more competitive, policymakers are more able to acquire policy favors for favored business interests. When a legislative body has a small majority, each member has far more bargaining power, since neither party can afford to lose votes. This can be seen right now in the US Senate, where the Democrats’ thin majority has provided moderates, like Senators Joe Manchin (D-WV), Lisa Murkowski (R-AK), and Kyrsten Sinema (D-AZ) with tremendous power and influence in crafting policy (and led some to speculate that West Virginia may look very different by the time Manchin’s term is over). With these tight margins, every member is empowered to seek out their own reward, such as earmarks for local infrastructure projects or subsidies and incentives towards favored business interests.

A clear example of the above dynamic is the transformation of the Endless Frontier Act, a bill aimed at increasing funding for science and technology to bolster US competitiveness against China, as it has moved through the legislative process. Despite the bipartisan nature of the bill, congressional logrolling (adding amendments or exchanging policy favors for votes) in the tightly-divided US Senate has broadened the scope of the bill and allowed individual legislators to acquire policy benefits for their constituents. For example, Senator Maria Cantwell (D-WA) pushed for and acquired an amendment to the bill adding $10 billion to NASA’s budget and mandating that NASA funds the development of a second lunar lander. It is not a coincidence that the company most likely to benefit from this amendment is the Washington-based Blue Origin.

In addition to being more able to acquire policy favors, when legislative competition is high, policymakers have a greater incentive to acquire these favors as well. Corporate giveaways and business subsidies build political capital for the politicians that acquire them, and such political capital is especially valuable when majority power is in the balance.

When competition in state legislatures is high, well-connected and influential incumbent firms are best able to take advantage of this opportunity to influence and transform the competitive landscape. Due to their reputation, familiarity, and networks, entrenched incumbent firms are far more likely to use strategies such as lobbying to try and obtain policy benefits, and tend to have far greater influence on policy than start-ups or young firms. As part of this project, I interviewed a number of state legislators and state legislative aides; respondents repeatedly emphasized the role of relationships in communicating with policy-makers and obtaining policy favors. One respondent noted that “newer businesses and start-ups don’t [communicate with legislators] in the same way [as incumbents] because they don’t have those established relationships and the experience in navigating these channels.” Another similarly stated that “it’s a very relationship-driven model in terms of power and influence” and that the businesses that were most likely to sway legislators tended to be “deep-seated.”

As a result, as competition increases within state legislatures, entrenched incumbent firms are able to leverage this increased competition to obtain incentives and subsidies, as seen in the below figure. (Note that I document no such increase for startups or young firms.)

These subsidies granted to incumbents appear to have consequences for other firms in the market. Essentially, politicians appear to “double down” on established businesses and reinforce their existing competitive advantage over smaller or younger competitors. My results suggest that higher levels of competition within state legislatures leads to greater exit for young firms and that this relationship is partially accounted for by the subsidies and incentives that are granted to well-connected incumbents. In further analyses, I also show that higher levels of legislative competition are also associated with lower levels of self-employment and business dynamism.

These findings may come as a bit of a surprise: for the most part, we tend to view political competition as a good thing that can hold politicians accountable for their actions. While I agree that political competition is likely to make politicians more responsive to their constituents, a reality of political economy is that concentrated interests often prevail over diffuse interests. Awarding large and well-known firms with subsidies or rewards is likely to be politically popular and easier than figuring out how to efficiently distribute funds to a larger number of smaller, young firms.

“Economic policy is not necessarily always constructed to maximize public welfare, but instead can be used as a political cudgel to win points with the public and reward favored constituents.”

It is worth noting that this research does not necessarily suggest that incumbents or older firms will always benefit from political competition. For example, a recent study finds that increased political competition in mayoral races leads to deregulation and increased entry in the ridesharing industry. At the end of the day, the policies constructed may depend on what is politically expedient for the politicians making them. In the case of the ridesharing industry, deregulation may be popular with voters and Uber and Lyft have tremendous political clout, so rewarding these companies may be most politically beneficial for politicians facing increased competition. In a more general setting, looking across industries, protecting older and established firms may be more politically advantageous than funding upstart firms. In either case, the unfortunate takeaway is that economic policy is not necessarily always constructed to maximize public welfare, but instead can be used as a political cudgel to win points with the public and reward favored constituents.

One potential solution to this problem is to avoid targeted subsidies, incentives, or regulations that are designed to help or harm specific firms or industries. There is no evidence that such directly and tightly targeted programs provide spillover benefits to other firms or cities. Instead, as a state senator I spoke to told me, such policies “pick winners and losers” and construct “different standards for different groups.” As long as such programs exist, well-connected insider firms are far more likely to obtain them and will continue to have the ability to tilt the competitive environment in their favor.