Relying on marginal market prices to provide the incentives for the production and delivery of electricity means that all of the biophysical things enrolled in the supply-and-demand chain, from Texas landscapes to human lives, are vulnerable to the vagaries of electric prices.

In the wee morning hours of February 15, a deep freeze in Texas triggered a surge in demand and a plunge in supply that brought the electric grid to within minutes of a catastrophic system failure. The grid operator, the Electric Reliability Council of Texas (ERCOT), averted disaster by imposing blackouts that lasted for several days, thereby contributing to widespread human suffering, including injuries and deaths as well as contaminated water and just plain freezing cold. When the lights came back on, some unfortunate Texans found themselves with electric bills in the thousands of dollars. Amidst the massive toll of property damage and financial losses, some electric suppliers have filed for bankruptcy.

On the surface, this story looks like one of colossal market failure. The Texas authorities chose a particular market design that failed to deliver power when Texans needed it most. Yet it was also a supply failure: the state froze itself out of natural gas—literally—and in Texas it is that natural gas that fuels much of the electricity. In fact, the market failure and the supply shortfall are intertwined in a distinctively Texan combination of faith in markets, disdain for the federal government, reverence for self-reliance, and privilege for the oil and gas industries.

At a deeper level, the authorities’ failure to prepare for such a rare yet predictable weather event reflects a propensity to design markets and government regulations without proper respect for the hard constraints imposed by the material, biophysical world.

Market Failures

All markets are human constructions, so they must be crafted in some sense. But electricity markets are special: they require an extraordinary level of conscious design to operate at all, and considerable expertise and ongoing adjustment to function well. Electricity cannot be stored efficiently, so an electric grid operator has to match supply and demand instantly. ERCOT orchestrates electronic auctions in day-ahead and real-time electric energy markets, like the other six US regions that have competitive wholesale markets.

The Texas system has done some things well, such as providing incentives for the development of the largest fleet of wind energy in the country and paying for the transmission lines to bring that wind to state population centers. But the Texas markets also have some distinctive features that contributed to this particular crisis.

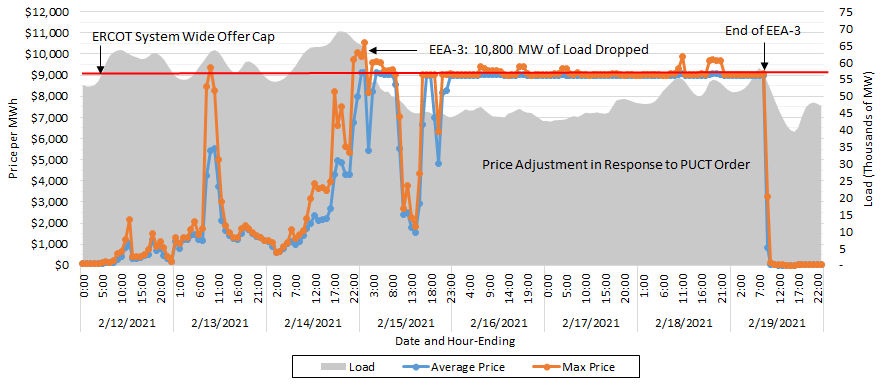

Most critically, the Texas model relies on wholesale electricity price surges to give generators the incentive to have electric supply on hand during hot and cold spells and other emergencies. ERCOT boasts the highest price cap in the country at $9000/MWh, around 400 times the usual market price. And the authorities allowed the power companies to charge those rates for several days during the February crisis, resulting in a massive wealth transfer from users to providers.

Figure 1: Electricity Prices (8 ERCOT Load Zones) and Load During the Cold Weather Event, February 12-19, 2021, showing prices before, during and after the Energy Emergency Alert Level 3 when ERCOT dropped load, i.e. instituted a series of blackouts.

Source: Carl Pechman and Elliott J. Nethercutt, “Regulatory Questions Engendered by the Texas Energy Crisis of 2021,” NRRI Insights (March 2021).

Some architects of the markets insist that the huge spike in prices suggests that the markets functioned as planned. There is just one big problem with this theory: the incentives were evidently not big enough to motivate the generators to weather-proof in advance, and they were positively useless once the plants and pipes were frozen. Moreover, there is a very real possibility that the model created perverse incentives for generators to weather-proof some facilities but not others so that they could exacerbate the supply shortfall and then profit even more from their plants that managed to operate through the emergency.

Texas’s wholesale electric market prices are not regulated by the federal government. That’s because Texas is the only state aside from Alaska and Hawaii with its own electric grid—a design chosen nearly a century ago specifically to avoid oversight from the federal government.

The Texas model also comes with a retail twist: the state allows consumers the “Power to Choose” whether to pay a fixed rate that protects them against surge prices, or a lower rate that leaves them vulnerable if prices spike. It is the latter group that landed with those astronomical bills following the cold spell.

Biophysical Limitations

Ultimately, markets must prompt action in the tangible, physical world to move goods from supply to demand—even if those goods travel via seemingly intangible electrons. The physical aspects of supply and demand may confound the most carefully crafted models, or they may simply not be considered.

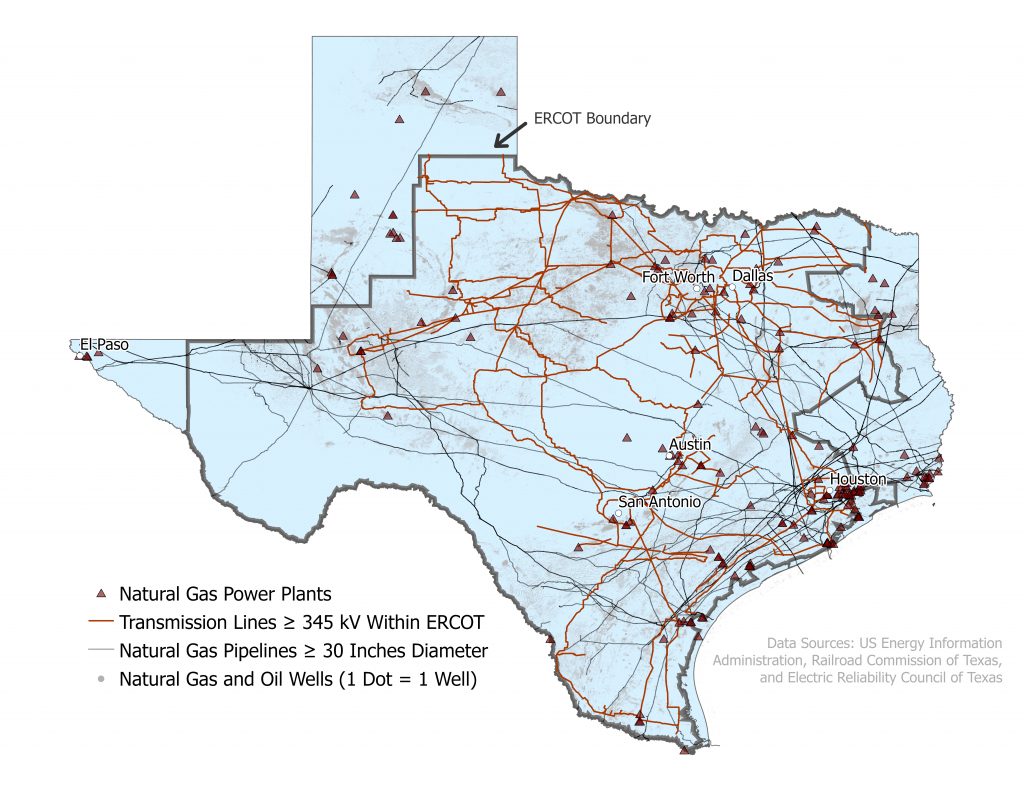

On the supply side: For your light to turn on when you flip a switch, there must be interconnected wires all the way to where a generator is making electricity. If that generator is gas-fired, it must have a natural gas supply. In most of the United States, gas is delivered with something close to a just-in-time supply. Starting from complex systems of underground wells and processing plants, gas travels through pipelines which often must cross hundreds of miles, even within Texas. In February, much of this infrastructure froze. But it did not have to: In other parts of the country, the natural gas infrastructure is weatherized. And just to ERCOT’s west, grid managers prepared for frigid weather by shifting to alternate fuel sources.

Figure 2: Physical infrastructure of the natural-gas-to-electric energy supply system in Texas. Only the very large pipelines and transmission lines are shown, the “super-highways” for natural gas and electricity. Gas lines are shown for the entire state, transmission lines for ERCOT. The blue represents the entirety of Texas that was below freezing temperatures during the Valentine’s Day storm. Source: Original map by Emily Piersiak and Lucy Cousins.

On the demand side: As the cold set in, many factories, commercial enterprises, and downtown office buildings kept running until—and even past—the forced blackouts. ERCOT, like other regional grid managers, has a system to pay electric customers to turn off non-essential lights, heaters, and machines at times of peak demand, but in Texas, this demand response system is limited. Outside of forced blackouts, Texans were left with the governor’s appeals for people to lower their thermostats and some voluntary cancellations of sporting events. In addition, the spike in demand when the temperatures dropped would have been less sharp had Texas been willing to pay for greater investments in energy efficiency. Energy efficiency in the form of insulation would have had a secondary benefit, too: when the power did go out, houses would have stayed warm and livable for much longer.

In addition, distributed energy resources and microgrids, which use emerging technologies like solar power paired with batteries, could keep the power running even when the larger grid goes out, potentially saving lives, money, and resources.

The defenders of the Texas model claim that this storm was an unpredictable once-in-a-hundred years event—but it was not. Earlier cold spells in 1989, 2011, and 2014 offered clear warnings. Moreover, some climate models suggest that as Arctic sea ice melts, the kinds of polar weather that froze Texas last month may descend into mid-continents more frequently and linger for longer.

“Ultimately, the Texas authorities’ faith in their markets reinforced their propensities not to plan, coordinate, and invest; to favor low costs over resilience; and to privilege industry profits over the protection of retail consumers.”

Governance Options

Market skeptics might argue that this crisis represents the definitive failure of market-based models of electricity provision. In December 2020, the North American Electric Reliability Corporation assessed all North American regions for their vulnerability to extreme winter weather. The three regions with the most serious concerns were Texas, New England, and California: three regions with advanced wholesale markets.

More fundamentally, relying on marginal market prices to provide the incentives for the production and delivery of electricity means that all of the biophysical things enrolled in the supply-and-demand chain, from Texas landscapes to human lives, are vulnerable to the vagaries of electric prices. And when those markets fail to deliver, there may be no backup.

Still, it is hard to hold up the old systems of vertically integrated utility generation and cost-based energy pricing as a model. A number of the non-market regions are inching toward competitive markets to benefit from the advantages of cost, efficiency, rapid resource-sharing, and innovation, as well as opportunities for profit.

Other electric market regions have ensured reliability and resilience more effectively. Some created capacity markets, with incentives to retain back-up capacity and alternative fuels. Some developed strong demand-response programs. Some market regions and states imposed weatherization requirements and checks. Some are promoting the development of storage that can rapidly supplement generation supply, or beginning to actively coordinate with distributed generation efforts. Almost all created better systems of inter-jurisdictional and inter-regional coordination, some with broad sets of stakeholders involved in planning as well as market design and regulation.

Ultimately, the Texas authorities’ faith in their markets reinforced their propensities not to plan, coordinate, and invest; to favor low costs over resilience; and to privilege industry profits over the protection of retail consumers. Yet the market design flaws were not so fundamental that the system could not have avoided massive blackouts with a little bit of good old-fashioned planning, coordination, regulation, and public investment. Now Texan leaders need to get ready for the next big cold weather event, since one is coming for sure.