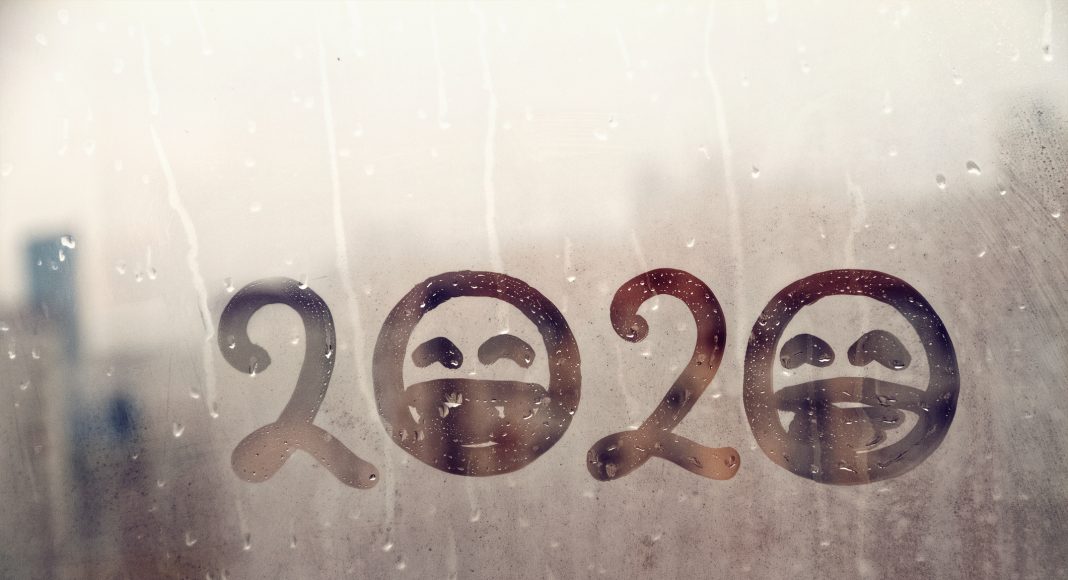

As 2020 draws to a close, we look back at ProMarket’s most-read and most-widely shared stories of the past year.

It should come as no surprise that Covid-19 dominated our coverage in 2020. What started as an epidemic in Wuhan, China soon became a global crisis, disrupting supply chains, killing thousands people a day, and changing the way we work forever. It is only fitting that the stories that resonated the most with ProMarket readers during this difficult year focused on the need for mass testing, called for bailing out people before corporations, and explored the childcare barriers to getting America back to work.

This year also marked the 50th anniversary of Milton Friedman’s influential New York Times piece on the social responsibility of business. Over the past few months, we hosted a lively debate on Friedman’s views. While only two pieces from the debate made it onto our top 10 list, all 28 pieces published in our Friedman 50 Years Later series have been compiled in a new eBook.

Below are our top ten most popular stories of the year. Happy reading!

1. Why Mass Testing Is Crucial: the US Should Study the Veneto Model to Fight Covid-19

The Italian experience suggests that locking downtowns is a necessary but insufficient condition to stop the spread of the disease. If 50 percent of the infected are asymptomatic, there is no hope of containing the disease unless we subject ourselves to massive testing. (March 17)

2. The World Bank’s “Papergate”: Censorship Is Not the Best Way to Stop Development Aid From Fueling Corruption

A new study of World Bank data finds that aid disbursement to highly aid-dependent countries coincides with sharp increases in bank deposits in offshore financial centers. According to The Economist, the World Bank refused to release the study. Afterward, its chief economist resigned. Here is the full content of the allegedly-censored paper. (February 18)

3. Captured Western Governments Are Failing the Coronavirus Test

In deciding on possible countermeasures, residents of Western democracies often hear only two opposite perspectives: Is the priority to minimize the loss of human lives, or to minimize the impact that the countermeasures might have on the economy? Even the simplest cost-benefit analysis suggests that the US government should be willing to spend up to $65 trillion and lock down the country to avoid extra deaths. (March 13)

4. Economics, Law and Finance Professors from Major Universities Write to Congress : “Bail Out People Before Large Corporations”

“Bailouts allow investors to keep all the profits in good times without bearing the losses in bad times. Instead, bailouts impose losses on taxpayers, including those most in danger of losing their paychecks,” over 230 leading economists argue in a letter to Congress regarding the $2 trillion package that’s meant to mitigate the economic impact of the coronavirus outbreak. (March 24)

5. Friedman’s Principle, 50 Years Later

In the mid-1980s, Milton Friedman’s view that the only social responsibility of business is to increase its profits became dominant in business and academia. Since the Great Financial Crisis, his views have increasingly been challenged. To mark the 50-year anniversary of Friedman’s influential NYT piece, we are launching a series of articles on the shareholder-stakeholder debate. (September 1)

6. “50 Years Later, It’s Time to Reassess”: Raghuram Rajan on Milton Friedman and Maximizing Shareholder Value

The biggest problem with shareholder value maximization is that it completely turns a tin ear to politics. The alternative is to maximize the value of long-term financial and non-financial investors in the firm—shareholders, of course, but also long-term debt holders, long-term suppliers, workers whose sweat equity is embedded in the firm, etc. It is important for the corporate board to make clear who these investors are, whose interests it will elevate above other stakeholders. (September 18)

7. Why the US Government Buys Overpriced Services From McKinsey

The Industrial Funding Fee pays $3 million a year for a 23-year old McKinsey employee instead of hiring an experienced person directly to do IT management. The government agency in charge of bulk buying isn’t paid for saving money, but for spending too much of it. (January 10)

8. The Childcare Barriers to Putting America Back to Work

Substantial fractions of the US labor force have children at home and will likely face obstacles in returning to work if childcare options remain closed. Under a policy where young workers return to work while schools remain closed, 35 million workers who are over 55 would not be able to return to work, and another 16 million who are under 55 would be constrained by childcare obligations. (May 12)

9. Tech Monopolies Are the Reason the US Now Has a TikTok Problem

Tech platforms like Facebook say we should protect, empower, and celebrate their concentrated power for the sake of America’s national security. But their history shows tech giants are structurally unable to defend American interests and should never be trusted with that task. (August 7)

10. The World After Covid-19: Inequality Within Rich Countries Will Increase, Globalization Will Reverse, Politics Will Remain Turbulent

The negative effects of the crisis on growth will be very strong. But it will not affect everyone in the same way. If the economic decline will be most severe in the United States and Europe— as it appears now—the gap between large Asian countries and the rich world would be reduced, leading to a reduction in global inequality. (April 8)