Anti-corruption regulation originating in developed countries is effective in changing corporate behavior and has a positive economic impact on developing countries.

Countries with large natural-resource endowments are often less developed and more poorly governed than countries with fewer resources, a phenomenon economists and policymakers call the “resource curse.” Corruption plays a central role in the recourse curse because the need to secure access rights to deposits makes resource extraction (i.e., precious metal mining and oil drilling) inherently prone to corruption. While resource extraction might have a positive direct impact on economic activity, the corruption that often accompanies it can divert resources from local development projects, decrease the efficiency of resource allocation, and reinforce extractive political regimes, thereby attenuating the positive growth effects of extractive activities.

Recognizing the costs of corruption in the developing world, governments in many developed countries have enacted regulations to curb corrupt business practices—the most prominent and widely enforced being the US Foreign Corrupt Practices Act (FCPA).

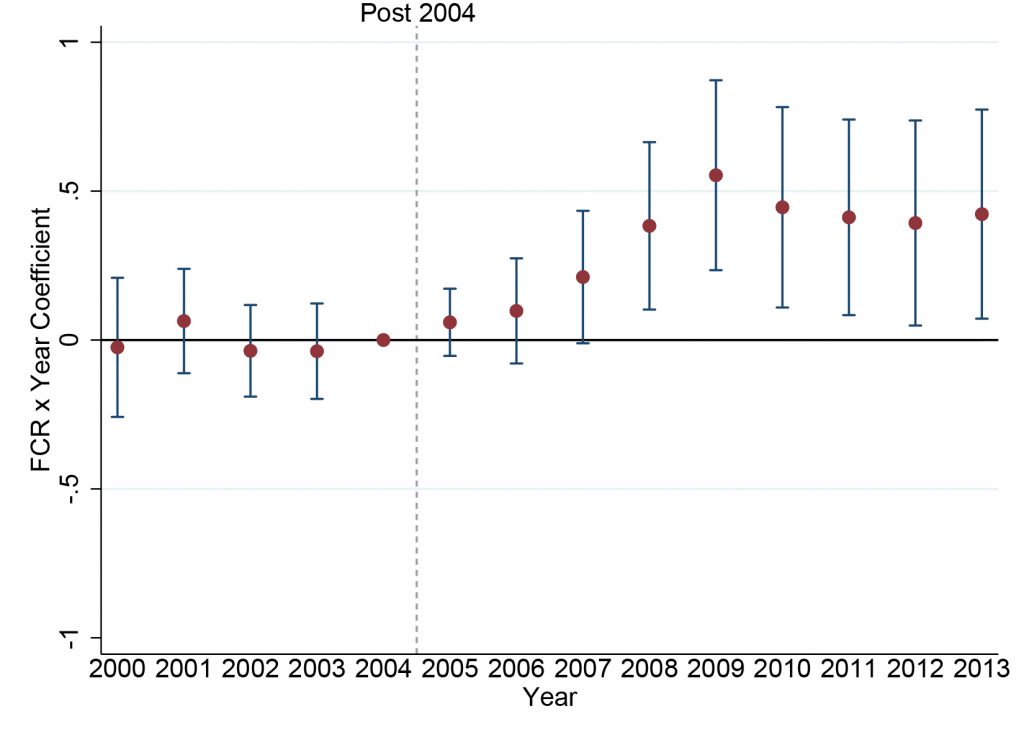

US enforcement of the FCPA against both US and non-US firms under US jurisdiction has increased dramatically since 2005. Recent research has shown that anti-corruption regulations have deterred investment that otherwise would have occurred. In some countries with inefficient bureaucracies, corruption can provide a gateway to engage in business. However, the net economic impact of foreign corruption regulation also depends on how much the regulation decreases corruption, what regulated firms do instead of paying bribes, and whether the marginal investments forgone because of the regulation would have had a positive impact on development.

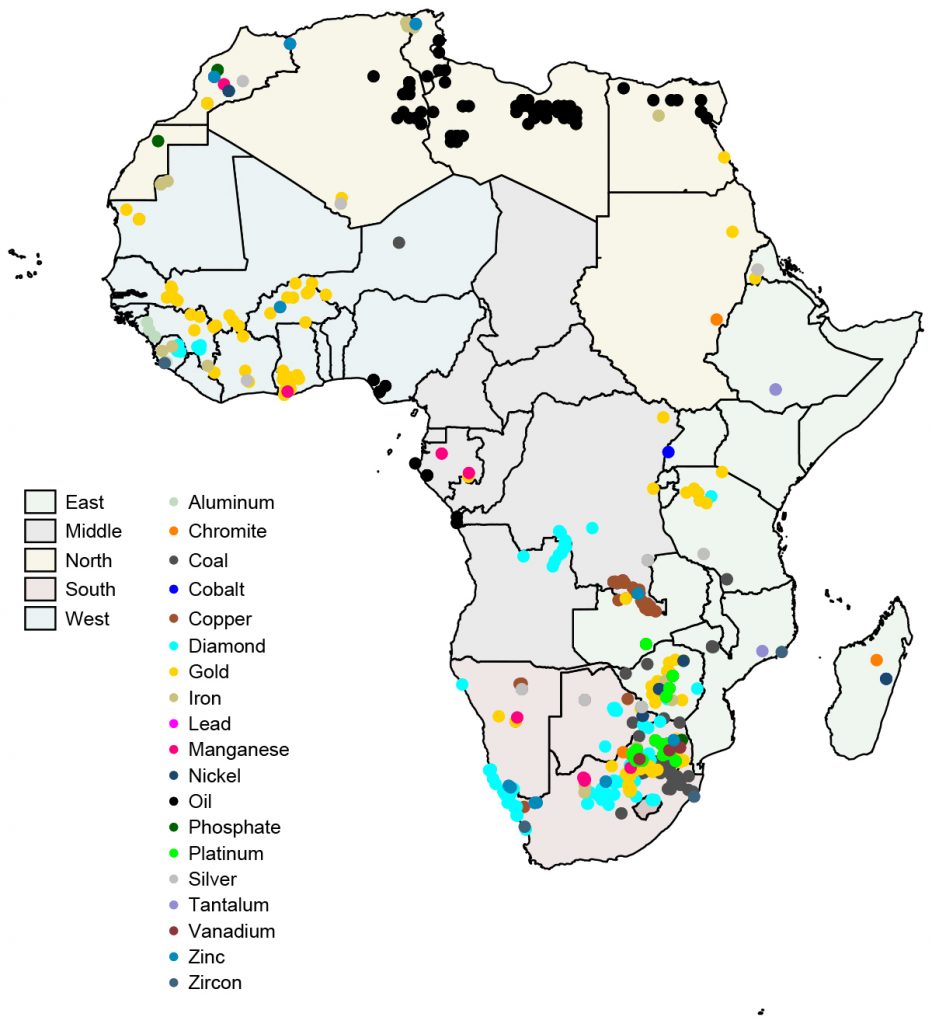

In a new paper on the impact of foreign corruption regulation, we examine changes in economic activity—as measured by nighttime light emissions (i.e., luminosity)—in African communities near large resource extraction facilities following an increase in US FCPA enforcement in the mid-2000s.

Compared to other measures of economic development (e.g., GDP), luminosity reflects the level of economic activity more broadly, and thus is likely more indicative of the overall well-being of people throughout the community. In our research design, we exploit the fact that, for reasons related to the feasibility of enforcement, FCPA cases are almost exclusively limited to firms under US jurisdiction that are headquartered in OECD countries. Consequently, the enforcement shock likely impacts only the subset of African communities located near extraction facilities with an ultimate beneficial owner that is under US jurisdiction and headquartered in an OECD country. This feature of the setting allows us to estimate the effect of foreign corruption regulation benchmarked against a control sample of likely unaffected communities (i.e., those located near an extraction facility with an owner that is not subject to the FCPA).

We find that, in the years after 2004, geographic areas with an extraction facility whose owner is subject to the FCPA gradually exhibit higher levels of economic activity relative to areas surrounding extraction sites that are not subject to the regulation. As we increase the length of the radius of the cell surrounding the extraction site, the estimated effect monotonically declines; falling from a 40 percent increase in luminosity within 10 kilometers of the site (where the extraction industry plays a central role in the economy, directly employing nearly 20 percent of the total workforce) to an increase of two percent within 100 kilometers.

To the extent that corruption negatively affects economic development, the observed increase in local economic activity following the increase in FCPA enforcement could be explained (in part) by a reduction in corruption. Yet, measuring corruption is difficult given the incentives of both the bribe payer and receiver to conceal their corrupt activities. As an alternative, we use microdata on local residents’ perceptions of corruption from the Afrobarometer survey. Our results indicate that individuals living near extraction sites whose owners are subject to the FCPA are eight percent less likely to perceive their government as corrupt after 2004.

Further analyses indicate that the observed positive association between foreign corruption regulation and economic development is not explained by a decline in activity in the extraction sector (i.e., we find that production and employment levels in the extraction sector remain relatively stable). This suggests the observed increase in development and reduction in perceived corruption are driven (at least in part) by a change in how firms in and around the extractive sector behave.

To assess this possibility, we estimate the contribution of extraction firms’ activities to economic development. If, as a result of foreign corruption regulation, extraction firms engage in activities that are more beneficial (or less detrimental) to the local community, we expect the association between resource production and economic activity to increase. Indeed, we find that the introduction of foreign corruption regulation increases the elasticity of luminosity to resource production by 37 percent within a 10-kilometer radius of an extraction site. Additional analyses indicate that the increased contribution of the extraction sector to local economic activity is not explained by ownership changes (i.e., new, less corrupt firms moving in).

Overall, our results suggest that the increase in development in areas subject to foreign corruption regulation is driven (at least in part) by existing extraction firms engaging in activities that are more beneficial to the local communities surrounding their operations. Although micro-level data on most facility-level firm activities are unavailable, plausible changes include these firms no longer engaging in locally detrimental activities that require bribes (e.g., polluting), increased pay and training of local workers, more support for local infrastructure projects (e.g., roads), hiring contractors based on efficiency rather than political connections, and promoting a widespread reduction in corruption throughout their supply chain to ensure compliance with the FCPA’s internal control requirements.

For policymakers, our evidence suggests that foreign corruption regulation can be an effective instrument for changing corporate behavior and that, despite any increase in the costs of operating in high-corruption-risk countries, anti-corruption regulation originating in developed countries can have a positive impact on growth. This is important because developing countries may not themselves have the institutional strength or political will to address misconduct by multinational corporations.