The Covid-19 pandemic has utterly discredited the false dichotomy of government vs. markets. Extensive government regulation is a prerequisite for the proper functioning of a modern market economy.

The Covid-19 pandemic may have finally dispelled the notion that the market needs to be “freed” from the government. It has brutally demonstrated that the free market cannot manufacture, procure, or deliver the key supplies needed to combat the virus, including tests, ventilators, and personal protective equipment. The market cannot keep businesses running or people working. And the private sector cannot make the massive investments required to design new therapies or to develop a vaccine on its own. We need the government for all of those things.

Yet the government is far more than an emergency back-up for the free market. Rather, it is the architect of the regulatory infrastructure that makes modern markets work in the first place.

I am not claiming that the government does everything right, that more regulation is always better, or that government regulation always supports markets. I am making a more basic point: extensive government regulation is a prerequisite for the proper functioning of a modern market economy. This role goes well beyond the minimal protection of property rights to include areas such as corporate law, financial regulation, labor regulation, antitrust policy, and intellectual property rights.

This may seem rather obvious. Yet many policymakers and pundits speak and act as if there were such a thing as a “free market” that would thrive without governance. They frame economic debates in terms of the false dichotomy of government versus market.

Market liberals such as Friedrich Hayek and Milton Friedman recognized that markets require some minimal rules of the game, including the rule of law and the protection or private property. Beyond that, however, they stressed that the government should leave markets to operate as freely as possible. Other scholars have countered that market systems are governed by a far more extensive web of institutions.

The free-market framing is so pervasive that even its critics have adopted its rhetoric and internalized its assumptions. For example, liberals and conservatives both describe the government’s role in markets as “intervention.” This language implies that the market could function without the government, and that government action is an external imposition on a separate realm of market exchange. But the government creates, sustains, and empowers markets, so it does not make sense to refer to this activity as intervention. Government regulation is not the alternative to market solutions—it is the market solution.

The government-versus-market dichotomy obscures the foundational role of government regulation in nurturing markets, undermining both analysis and policy. Markets require competition, and competition is by no means natural or automatic. As Adam Smith recognized, business people would prefer to collude than to compete. So the government has to make them compete.

Freer Markets Need More Rules

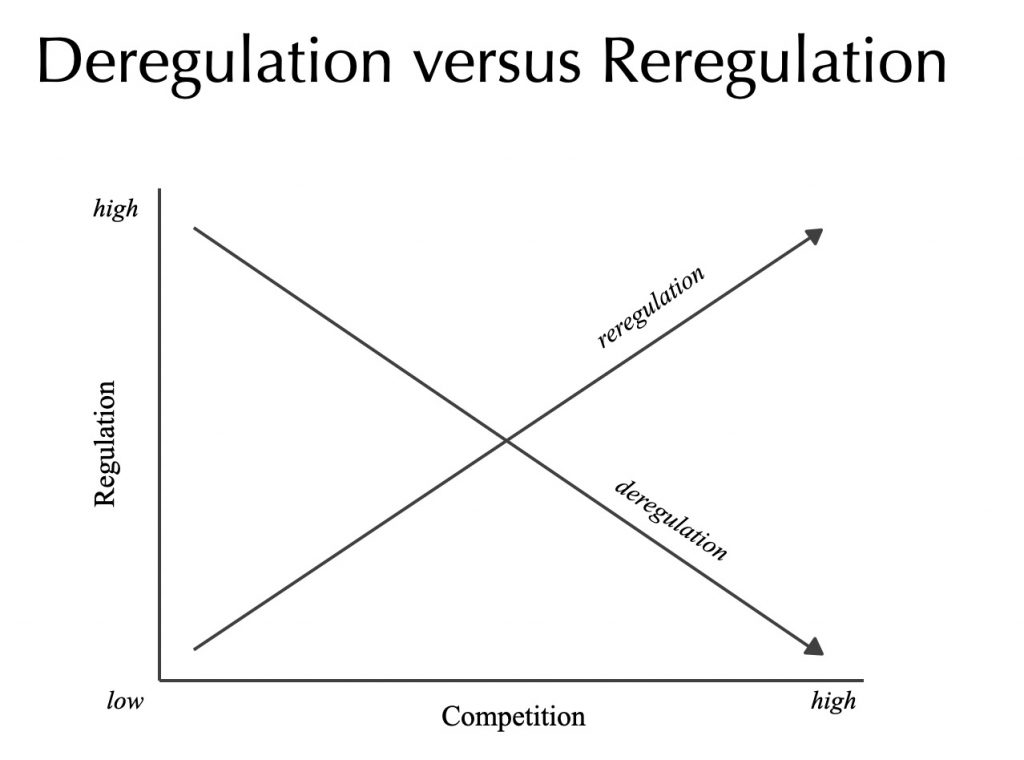

The deregulation movement offers a vivid example of how the government-versus-markets frame breeds conceptual confusion and policy failure. Proponents used the term “deregulation” to refer to the reduction of regulations and the enhancement of competition, as if the two were naturally associated (see Figure). This conflation led them to support policies to reduce regulation rather than to enhance market governance, and these policies brought us such fiascos as the California electricity crisis of 2000, when electricity prices soared and millions suffered blackouts due to market manipulations, and the global financial crisis of 2008.

In a world of governments versus markets, less regulation would mean more competition, and more regulation would mean less competition. But this is not how real-world markets work. In telecommunications, for example, the US and British authorities who introduced competition in the 1980s recognized—to their credit—that if they simply eliminated price and entry regulation, they would only entrench the incumbent, given the natural monopoly character of the sector.

They deployed powerful and intrusive regulation to create competition, forcing the incumbents to lease their own lines to their rivals on favorable terms. This policy spurred the competition that propelled the digital revolution.

But the US authorities have since lost some of their pro-competitive zeal, and that has allowed creeping concentration in the sector, resulting in some of the highest prices among the advanced industrial countries.

The United States came closest to true deregulation in the airline sector. Creating competition requires a combination of reducing anti-competitive regulations, such as price and entry controls (deregulation), and strengthening pro-competitive regulations, such as antitrust enforcement (reregulation). In airlines, the deregulatory elements of reform outweighed the reregulatory elements. The government substantially reduced regulation in 1978 and eliminated the primary regulatory agency, the Civil Aeronautics Board, in 1984. Fifty-eight new carriers entered between 1978 and 1990, yet only one of these remained by 2005. And by 2014, the sector was dominated by four carriers.

Most cases look more like telecommunications, however, with more competition requiring more regulation, not less. I refer to this as the phenomenon of “free markets and more rules”: the market reforms of the past four decades have produced more competition and more regulation overall.

Vlad Tarko of the University of Arizona has tested this thesis, and confirmed it as the dominant trend among industrialized countries. He finds a simultaneous increase in 1) economic liberalization, as measured by economic freedom and doing business indices, and 2) the number, budgets, and staffing of regulatory agencies, as well as the number of regulations.

Likewise, the rise of dominant digital platforms such as Amazon, Google, and Facebook has underscored just how much active government is required to sustain competitive markets. The platform firms have bought out potential rivals, engaged in predatory pricing, and leveraged their control over the market infrastructure to shut out competitors. The newly-released report from the House Antitrust Committee charges that the big tech companies have extensively abused their market power, and recommends a drastic overhaul of antitrust enforcement to rein them in.

The Marketcraft Solution

The need for regulation to support dynamic markets is not restricted to pro-competitive regulation and antitrust policy. The government plays a much broader role in creating, sustaining, and expanding markets. The critical substantive debates are not really about whether to govern markets, but rather how to do so. The government can grant limited liability to corporations or not, for example, but it cannot opt-out of providing a legal framework for corporations.

Market liberals might protest that even if there is no perfect free market, we should still posit it as an ideal, a target for policy, because moving toward this goal would augment both economic efficiency and personal liberty. Yet it is often unclear which policy option would be closest to a hypothetical free-market solution. If we loosen rules for the fair use of copyrighted material, for example, is that a move toward the free market or away from it? The effort to describe policy choices in binary terms of government versus market only obscures the real choices involved.

In practice, policymakers often evaluate options with reference to the free market. They assess the degree to which a government action would distort outcomes relative to a hypothetical free-market equilibrium, and they estimate the efficiency loss due to that distortion.

Yet there is no free market, but only real-world markets thoroughly contaminated by fraud, collusion, and imbalances of power. Government regulation does not necessarily add to the distortions, and it may even reduce them. The alternative to government regulation is not the free market but private-sector governance. And who would we rather have oversee financial markets: the government or the banks themselves?

The arcane rules of market governance ultimately determine how markets function and whom they favor. They have enormous ramifications for public welfare, encompassing everything from innovation to inequality. And some of the fastest-growing sectors in the economy—such as health care, finance, and information technology—are those that rely most on elaborate market governance.

I refer to market governance as “marketcraft” because it is a core function of government, roughly comparable to statecraft. Governments have to master the art of marketcraft to ensure prosperity, resilience, and sustainability. The free-market view proposes that the government should do less so that markets can do more. Yet we do not need less regulation to unleash markets but better market governance to empower them. Progressives and pro-market reformers should both support this goal.

“In a world of governments versus markets, less regulation would mean more competition, and more regulation would mean less competition. But this is not how real-world markets work.”

Regulatory Capture or Deregulatory Capture?

Casey Mulligan of the University of Chicago charges that government regulation is vulnerable to capture by political interests—and he is right about that. But private firms can seek “rents” (returns above value added) in the absence of government regulation as well. So deregulation does not necessarily reduce rent-seeking.

Let’s consider this in terms of George Stigler’s theory of regulation. Stigler argued that government agencies were often captured by the very industries they were supposed to regulate. The concentrated interests of an industry that would garner rents from protective regulation would prevail over the diffuse interests of consumers who would benefit from deregulation.

Stigler identified a very real problem, but this version of the theory leaves out the possibilities of antiregulatory or deregulatory capture. Powerful firms might lobby to enact regulations to secure rents, but they also might lobby against regulations that would impede them from capturing rents.

For example, Enron and other trading firms pressed for a model of electricity deregulation in California in the 1990s that would favor them in a supply shortage. After the reforms, they shamelessly gamed the market to boost profits even as consumers endured blackouts.

Likewise, financial institutions pressed for deregulation and the non-regulation of derivatives in the 1980s and 1990s. They took advantage of these developments to boost their own returns at the expense of borrowers, investors, and taxpayers. This manipulation contributed to the devastation of the global financial crisis.

The quality of government, in terms of both administrative capacity and autonomy from narrow political interests, is essential to the quality of markets. Unfortunately, the current administration rates low on both counts. But fortunately, regulatory capture and administrative incompetence are variables—and not constants—in US history.

Consider the digital revolution and the global financial crisis, arguably the greatest contemporary economic success story and the greatest economic failure—until the current Covid-19 pandemic, at least. Both are products of homegrown American marketcraft. In one case, government officials who were relatively insulated from short-term political pressures made critical decisions about public investment in research and development, antitrust enforcement, and pro-competitive regulation that fostered the digital revolution. In the other case, regulatory officials were beholden to the sector they regulated, and their regulatory lapses and missteps fueled a global crisis.

Government regulation plays a critical role in making markets work. Crafting it well requires a sophisticated understanding of the ways that the government and private actors interact to shape market performance. If we pretend that markets govern themselves, however, we relinquish the capacity to find answers to our greatest challenges.