Tommaso Valletti, the former Chief Competition Economist of the European Commission, reflects on the intersection of academic economics and policymaking and offers advice to young scholars.

Author’s note: The other day, while having coffee on a Sunday morning in London, I wrote a tweet on the interplay between research in economics, policy advice, and lobbying. Luigi Zingales read it and asked me to elaborate on it, as it touches on several themes that are also dear to the Stigler Center. I am happy to contribute to this debate on ProMarket.

Disclaimer: I am an IO academic and I speak mainly to my field. I held a policy role as Chief Competition Economist of the European Commission between 2016 and 2019. I have not done any consulting for private companies since I left the Commission, and I am not planning to.

Research on market power, its causes, and its consequences has received a welcome revival in the past few years. A group of excellent scholars has managed to make progress on rather hot competition policy topics. What’s more, this research was accepted for publication in journals considered to be at the very top of the profession.

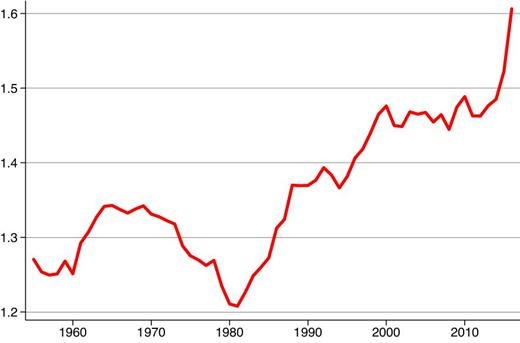

Among these, I have selected three that have made a real impact. The work of De Loecker et. al (2020, Quarterly Journal of Economics) provides evidence of a historical increase in markups (that is, the ability of firms to sustain prices above their variable costs; see Figure 1 which shows in particular that this rise has been quite dramatic starting from the 80s) as well as in firms’ profit rates.

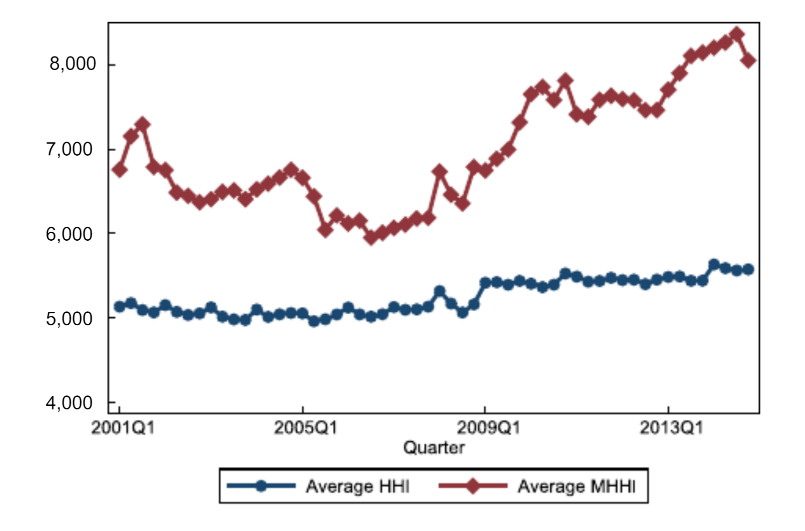

Azar et al. (2018, Journal of Finance) study the role of large asset management firms, such as BlackRock or Vanguard. They show that, in the airline industry, competing airlines are actually jointly held by a small set of such common owners (see Figure 2, where a standard measure of concentration—the Herfindhal Hirshman Index, or HHI—is modified into an index called MHHI that accounts for such linkages). They also show that, when common ownership within specific airline routes goes up, ticket prices also increase along those routes. Hence, airline travelers seem to lose from the presence of common owners.

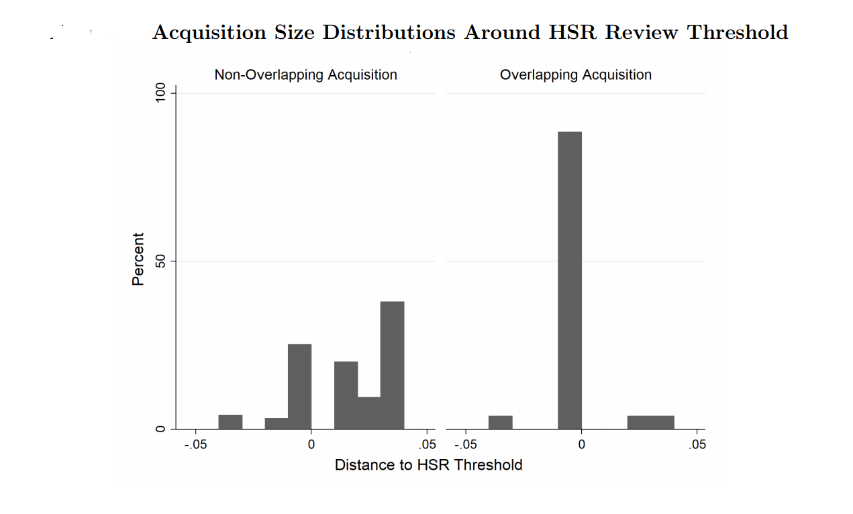

Finally, Cunningham et al. (forthcoming, Journal of Political Economy) analyze acquisitions in the pharmaceutical industry. Using very detailed data, they show that some of these are “killer acquisitions,” in the sense that the acquirer buys the target solely to discontinue its project and preempt future competition from emerging. This is particularly true when the target’s drug overlaps with the acquirer’s existing product portfolio, and when the acquirer’s market power is large. These acquisitions also disproportionately occur just below the thresholds for antitrust scrutiny, so that they are not vetted by antitrust authorities (the so-called Hart-Scott-Rodino, or HSR, review threshold; see Figure 3).

These are all interesting and thought-provoking topics. The papers bring a wealth of data in each case, and, of course, have all been subject to rigorous vetting by the journals they have been published in. But, what’s interesting and unusual for most of the academic work in economics, is that they generated a real panic elsewhere. As they were been written while I was at the European Commission, I can testify that they caused a real furor (I was also happy to contribute to their dissemination in many public fora where I was invited to speak).

Both the industry (Big Pharma, “passive”[1] investors, and industry associations at large), and especially their consultants that dictate the policy discussion both in Brussels and in Washington, DC (the real gatekeepers are the lawyers), tried in all sorts of way to diminish the importance of these findings that were coming from academia. In some cases, they attacked and harassed.[2]

As these actors (the corporations and the lawyers) do not know what academic research really is in economics, they often have to employ proxies. As someone who basically arrived to policy from the ivory tower of academia, this was something new for me. I discovered a whole set of “research” centers that were constantly producing policy notes, organizing seminars, workshops, and training events. Policymakers, of course, were be regularly invited and attend these events. You can hardly find a “regular” academic there (in the sense of someone regularly publishing in the field’s academic journals), other than someone who was there as a paid consultant (too often, while omitting to disclose their conflict of interest). I never encountered a junior academic: they are just too busy writing papers to get their tenure (something I will return to below).

These lobbying—sorry, research—centers don’t publish anything in any academically meaningful sense, and never will, but they produce glossy pamphlets with very polished words (they know how to write) and, often, with serious misinterpretations of economics. In fact, very few of these pamphlets are written by economists with credentials. Basically, these centers use envoys under semi-academic camouflage. Their funding is opaque. Two names that come to mind in the context of antitrust and competition policy are the Global Antitrust Institute (GAI) at George Mason University, and the International Center for Law & Economics in Portland, Oregon.

These organizations do not care about an academic reputation. That’s not their game. Their goal is not to speak to an academic community. Rather, they need to throw smoke and doubt in front of the policymakers, because they know extremely well how to interact with them. The access these lobbying centers have to people in power is remarkable.[3]

A corporate lawyer working for a Big Pharma, or for BlackRock, who is very worried when some academic is challenging what they do, really wants to hear: “OK. There is paper A saying this, but look: there is another paper B saying that. So the jury is still out, no reason to fret!” And especially no reason to have any impact on a real case that needs to be decided within the next few months. And who cares if paper A comes from unbiased research and is published in an elite journal, and paper B is just a pamphlet uploaded with no vetting on SSRN (but of course paid for by the corporates, and with no disclosure)? One for one, it’s a draw, the bar does not need to move.

This is, of course, an old strategy. There is even a term for this: “agnotology,” which is the study of how ignorance is deliberately produced by corporate funding. A well-known example comes from the tobacco industry which, in the 60s, actually did fund specific research on cancer with the purpose of giving the impression that the hazards of cigarette smoking were still an open question (Cummings et al., 2007). Robert Proctor, a science historian from Stanford University, reports of a secret memo written in 1979 by the Brown & Williamson tobacco company, which has since been revealed to the public. It states: “Doubt is our product since it is the best means of competing with the ‘body of fact’ that exists in the mind of the general public. It is also the means of establishing a controversy.” The tobacco companies knew already 60 years ago that smoking causes cancer, but it took the rest of us half a century to get there, due to their tactics that “more evidence was needed.”

The New York Times recently published a very long article about the Global Antitrust Institute’s operations and its funding, which comes from giants such as Google, Amazon, or Qualcomm. This money is being used to write pamphlets, but also to organize training courses for judges, antitrust enforcers, and sector regulators. In events organized in fancy places with lavish entertainment, these enforcers are being taught “law and economics” that does not reflect what the discipline has actually produced in the last 40 years. These enforcers hear that markets are competitive, that mergers produce efficiencies, and so forth, almost irrespective of the case at hand (and they typically have to deal with a very special sample of firms with massive market power, where those generalizations are unacceptable and cannot be the starting point of a serious discussion).

At times, we enter the paradox that judges, trained by GAI and through their distorted lenses about economics, rule on cases that involve companies that fund the very same GAI, and the judgement is made on the basis of (often unpublished) papers written by GAI affiliates and possibly used in the training too.[4]

“Too often, we end our papers with the phrase: ‘We need more research.’ This is okay in academic writing, but it’s a death sentence in policy.”

I don’t know how to fix this problem, other than exposing it and raising awareness, which is what I am trying to do with this op-ed. But I want to offer some advice to academics that are interested in policy (not everyone is, which is fine, of course).

First, you need to think how to write your papers. Possibly, next to the academic piece, you should try to have a policy piece where you explain your findings to the policymakers.

Alas, this may not give you immediate academic credit (a policy paper will probably not count in your tenure package), but it will have impact. Try to achieve a balance between academic stature and policy relevance that isn’t 100/0. Furthermore, such a policy piece should not just be a layman version of your specific research. If it has a policy angle, you will have learned a lot about the general policy topic. In the end, you’ve thought seriously about that topic for 5 years, if not more, so it’s legitimate to ask the question: On balance, where do you stand?

Second, academic gatekeepers of elite publications must reflect on what research we as a discipline want to encourage. I do not shy from making controversial statements, so here is another one that deserves fuller discussion: my field (IO) has become too parochial. For the past 20 years, we have taught that there is one way of publishing in the field: structural modeling of narrow questions using frontier statistical methods (e.g., “BLP” for demand estimation). This cannot be right. Aren’t we competition economists? Don’t we have an obligation to speak to the big issues competition policymakers are actually facing? Until papers relevant to actual policymaking get published at the top (and the publishing lags for our papers are borderline ridiculous: Five years? Seven years?), new generations of scholars will keep crunching the same models, becoming more and more complicated, harder to understand, and leading to a growing irrelevance of the field (citations in IO are going down compared to other fields in economics). I want these gatekeepers, which are serious colleagues and excellent scholars, to reflect on one thing: The BLP framework was introduced to better model demand substitutability, something that could genuinely help policymakers make decisions, to be relevant, and to make an impact. In my three years as Chief Economist at the EC, I have not encountered a random-coefficient BLP model a single time.

Third, uncertainty is inherent in policy, but it is not a justification for inaction. Policymakers need to make decisions in finite time, often within a few months. So, please do not be naïve. Too often, we end our papers with the phrase: “We need more research.” This is okay in academic writing, but it’s a death sentence in policy. It means the status quo will not change. And this has consequences too. So, if overall you think a policy is bad and should change, be explicit about it. If, on balance, you think scenario A is 70 percent likely and has some policy implications, that’s probably good enough to go ahead and give advice. Waiting to be 100 percent certain is too late for policy and just not practical. A perfect example of this would be mask-wearing during the pandemic. How many lives would have been saved if the scientific community recommended mask-wearing before waiting for the ultimate evidence?

Instead, surface the uncertainties and say: this is what we know; what we don’t yet know; what we will likely never know. Learn to live with that and say where you stand. And, of course, revisit plans as new evidence emerges.

My final piece of advice: consider that policymakers are very risk-averse. They fear the courts, and courts work on the basis of precedents. Policymakers also speak a lot to corporations and consultants—because they are organized—and almost never to academics, for all the reasons I explained above. They do not all know how to tell the difference between a top publication and a funded working paper put on SSRN—to be fair, that should not be their job. Revolving doors between policy and the corporate world are plenty. But, ultimately, most enforcers are well motivated to do the right thing. They really are. So you—we—need to help them with clean arguments, with evidence, and with precedents.

As I concluded my original tweet: Our brains are our greatest asset. Keep doing great research!

References

- Elliott Ash, Daniel Chen and Suresh Naidu, 2020, Ideas have Consequences: The Effect of Law and Economics on American Justice, mimeo

- José Azar, Martin C. Schmalz and Isabel Tecu, 2018, Anticompetitive Effects of Common Ownership, Journal of Finance, 73(4)

- Michael Cummings, Anthony Brown and Richard O’Connor, 2007, The Cigarette Controversy, Cancer Epidemiology, Biomarkers and Prevention, 16(6)

- Colleen Cunningham, Florian Ederer and Song Ma, forthcoming, Killer Acquisitions, Journal of Political Economy, forthcoming

- Jan De Loecker, Jan Eeckhout and Gabriel Unger, 2020, The Rise of Market Power and the Macroeconomic Implications, Quarterly Journal of Economics, 135(2)

[1] I write “passive” in quotes because every time I had a discussion about their role (e.g., I considered common ownerships and their potential anti-competitive effects in the agrochemical industry when Bayer merged with Monsanto in 2018, and when Dow merged with Dupont in 2017), the response was invariably that they cannot affect in any way the workings of the companies they invest in, as they are passive. However, when I hear their CEOs speaking at Davos, promising that they are instrumental for models of capitalism to become more inclusive, green, deliver value to society, and so forth, all of a sudden they can make an impact. Passive for bad but active for good—an interesting curiosity.

[2] Martin Schmalz has tweeted about his stressful experience (even involving being covered by a private detective) while he and his co-authors were writing their research on common ownership. Another recent case concerns a Law Professor interested in employment rights in the gig economy that clashed with the interests of Uber and Lyft, see https://www.latimes.com/business/story/2020-09-02/uber-lyft-veena-dubal-twitter-bullying.

[3] I attended only one small event organized by GAI while I was in Washington for the annual meeting of the American Bar Association in the spring of 2019 (I did not receive any funding, but I was offered a lunch, and I disclosed it to the European Commission as I had to). Attending that lunch, I counted one US Supreme Court Judge, another US Senior Judge, and at least five heads of National Competition Authorities, plus many other senior officials.

[4] I made fun of this circularity in a tweet that refers to a recent case. But the consequences of this brainwashing are far more reaching, as found by Ash et al. (2020).