A new paper seeks to measure popular sentiment toward finance based on mentions of “finance” in millions of books, spanning eight languages and hundreds of years, finding that natural disasters like epidemics worsen attitudes toward the financial sector.

A few years back, Luigi Zingales posed a provocative question to the American Finance Association: Does finance benefit society? He provided evidence for and against, but also convinced many, including us, that public perceptions about finance can matter, especially if finance is beneficial for society.

In our paper Does Finance Benefit society? A Language Embedding Approach, we suggest a new way to measure popular sentiment toward finance based on mentions of “finance” in millions of books, spanning eight languages and hundreds of years. These books provide a window to distant times and places and allow us to measure whether the average writers and readers in each language in each year believe that finance benefits society.

The basic idea is to look at the context of the word “finance” in book sentences and ask whether they are closer to sentences like “finance benefits society” than to sentences like “finance damages society.” To do so, we rely on a recent language model (BERT) to embed sentences in a numerical vector space. Such “word embeddings” are used to reduce the dimensionality of text and are becoming increasingly better at capturing context.

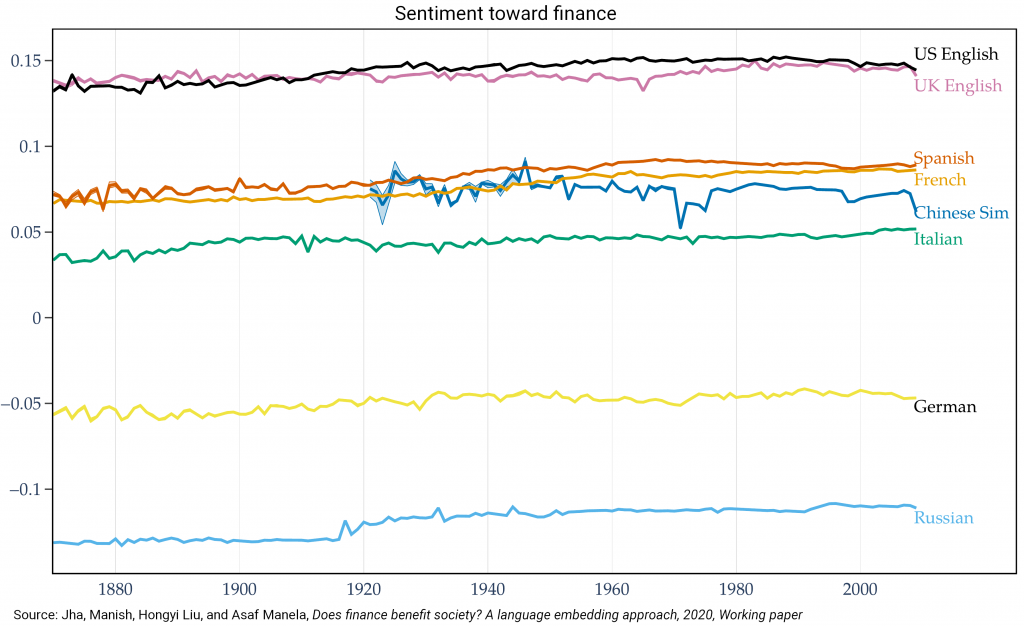

The following figure shows how our measure of sentiment toward finance looks like for the eight languages in our sample. Each line corresponds to a different language, with higher values indicating a more positive sentiment toward finance. The 95 percent confidence interval is quite tight and hard to see because we rely on a very large body of text.

Our first finding, apparent from the figure, is that sentiments toward finance are highly persistent. The ordering of the languages over time hardly changes, even though within a language, we see considerable variation over time.

For the most part, books written in the languages of more capitalist countries place “finance” in a more positive context. British and American English books exhibit the most positive sentiment toward finance, followed by Spanish, French, Chinese, Italian, and German, with Russian at the bottom, with consistently negative sentiment.

In the paper, we discuss some major events, like revolutions (the Russian Revolution of 1917, the collapse of the USSR), and how finance sentiment changes around them. But revolutions (and financial crises) can be the result, rather than outcome, of changes in sentiment toward finance. For example, if many people suddenly lose trust in banks, bank runs could start.

So how can we figure out what causes finance sentiment to change? We study the effects of severe natural disasters on finance sentiment. Natural disasters provide useful experiments because their incidence is pretty much random, thus alleviating concerns about reverse causality. By contrast, had we studied events like financial scandals, we may worry that those tend to be revealed during financial crises, which would confound the effects of the scandal itself.

In the paper, we focus on 60 severe disasters that occurred between 1900 to 2009 and classified into 11 distinct types. Of these, 32 percent are epidemics, 30 percent are earthquakes, and 15 percent are floods.

Our second finding is that the average severe natural disaster worsens sentiment toward finance. But this hides a lot of heterogeneity across disaster types. Disasters such as epidemics and earthquakes, which are rarely insured, strongly decrease finance sentiment, while relatively well-insured disasters, such as floods and landslides, tend to increase it.

One explanation for these disparate effects is that finance facilitates risk-sharing of some types of risks through insurance, securitization, or derivatives, but financial contracts and institutions are often designed to prevent renegotiation after the fact. Insured disasters tend to help spread the costs across households and generations. But when uninsured disasters hit, their damage is borne by parts of the population, destroys fragile businesses, and generates resentment against financial intermediaries. We are already seeing glimpses of resentment against insurers and hedge funds generated by Covid-19.

These findings beg the question: Does any of this matter? To answer this question, we combine our text-based measure of finance sentiment with data on GDP and credit growth. Our third finding is that increases in finance sentiment have long-term positive effects on economic growth. This result holds controlling for unobserved differences across countries.

What does it all mean for the Covid-19 pandemic? Putting together our estimates of how epidemics change sentiment toward finance, and how the latter affects economic growth, we expect a contraction in finance sentiment due to Covid-19 that will exacerbate its long-term economic damage.

Specifically, our estimates suggest that beyond its severe health effects, the Covid-19 pandemic may reduce credit growth by about 2 percent, and reduce GDP growth by 1 percent over the next five years due to worsening public perception of the financial sector.