Booming stock markets and the collapse of house prices in the aftermath of the 2008 financial crisis have increased wealth inequality in the US to a new historical high. Meanwhile, the racial wealth gap has stayed put for over 70 years, with virtually no progress in reducing wealth inequality between black and white households.

With high and rising income and wealth inequality, the causes and consequences of inequality have jumped to the forefront of any public, policy, and academic debate. At the center of these debates are the long-run trends towards higher income and wealth concentration at the very top of American society, the income and wealth shares of the richest 1 percent of American households.((Piketty and Saez (2003), Kopczuk et al. (2010), Saez and Zucman (2016).))

With high and rising income and wealth inequality, the causes and consequences of inequality have jumped to the forefront of any public, policy, and academic debate. At the center of these debates are the long-run trends towards higher income and wealth concentration at the very top of American society, the income and wealth shares of the richest 1 percent of American households.((Piketty and Saez (2003), Kopczuk et al. (2010), Saez and Zucman (2016).))

Focusing on just 1 percent of American households, however, keeps us in the dark about how the income and wealth distribution for the vast majority of American society, the bottom 99 percent, changed over time. When discussing inequality, previous researchers have also kept the focus narrow and discussed trends in income or wealth inequality in isolation, leaving their joint evolution largely unexplored. Yet the joint evolution of income and wealth inequality constitutes a key puzzle piece to complete the picture of the causes of inequality and its drivers over time.

Our current research, “Income and Wealth Inequality in America, 1949-2016,” fills these gaps. We investigate the joint evolution of income and wealth inequality and document changes in the income and wealth distribution among the bottom 99 percent of American households over the past seven decades.

What allows us to take this different perspective on trends in inequality is a newly compiled dataset that combines household-level information spanning the entire US population. We unearthed historical waves of the Survey of Consumer Finances (SCF) that were conducted by the Economic Behavior Program of the Survey Research Center at the University of Michigan from 1949 to 1977. Through extensive data work, we linked the historical survey data to the modern SCFs that the Federal Reserve redesigned in 1983.((The modern SCF data is the most widely used data to study the income and wealth distribution in the United States today. See Bricker et al. (2016) and Wolff (2017) for recent contributions based on the modern SCF data.)) We refer to this new resource for inequality research as the SCF+. The SCF+ complements existing datasets for long-run inequality research based on income tax and social security records, but it also goes beyond them in a number of important ways. For example, the SCF+ contains granular demographic information that can be used to study dimensions of inequality—such as long-run trends in racial inequality—that so far have been out of reach for research.

In the first step of our analysis, we explore the developments in the lower parts of the income and wealth distribution by looking at changes at the 25th, 50th, and 75th percentile of the distribution. We document that the period from the 1970s to the 1990s was disappointing for the American middle class in terms of income growth: The 25th and 50th percentile experienced real income losses while incomes at the 75th percentile stagnated (Figure 1a). While all households saw a return to real income growth from the mid-1990s to mid-2000s, only incomes at the 75th percentile have recovered from the income drop that occurred during the 2008 crisis.

Looking at wealth, we find a picture that is markedly different (Figure 1b). First, wealth for households in the bottom 90 percent started to persistently diverge only in the 2000s, not in 1970s as in the case of income. Second, all households in the bottom 90 percent saw major wealth drops after 2007, from which they so far have not recovered. For the 25th percentile of the wealth distribution, we find that the financial crisis wiped out all wealth gains that have been made since 1971. These wealth drops also showed considerable variation. The outcome is a substantial polarization of wealth and a pronounced widening of wealth inequality among the bottom 90 percent of American households.

When we explore the joint evolution of income and wealth, we find results that appear puzzling at first glance. Sorting households according to their position in the wealth distribution and looking at the bottom 50 percent, the middle class (50-90 percent), and the top 10 percent, we find that income inequality has been on the rise since the 1970s, but wealth inequality in 2007 was still at the level it was in 1971. The incomes of middle-class households increased between 1971 and 2007 by less than 40 percent, those of households in the bottom 50 percent stagnated in real terms, but incomes of the top 10 percent more than doubled.

However, when it comes to wealth, the picture changes. Despite zero income growth, wealth doubled for the bottom 50 percent of the wealth distribution between 1971 and 2007. For the middle class and the top 10 percent, wealth grew at roughly the same rate until the eve of the financial crisis. This symmetry changed substantially and quickly in the decade after the 2008 crisis, when wealth inequality increased to a new historical high.

To explain these findings, we highlight a driver of wealth inequality that has attracted little scrutiny so far as a determinant of the evolution of wealth inequality: Changes in asset price induce large shifts in the wealth distribution. Using the SCF+ data with their detailed information on household balance sheets, we document portfolio differences that persisted over the past seven decades (Figure 2).

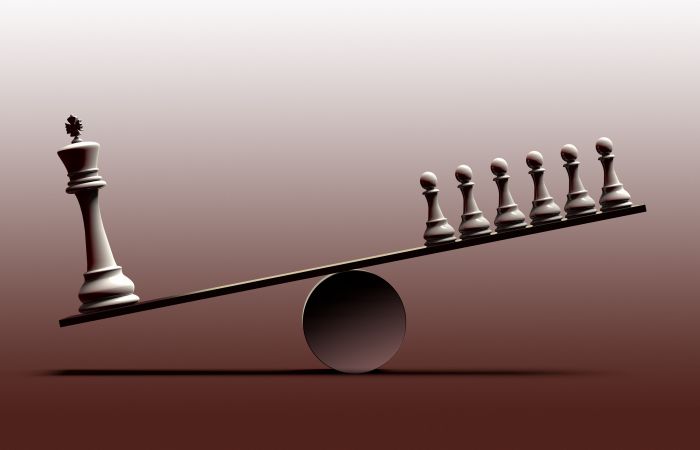

What assets households hold and how much they are leveraged varies systematically along the wealth distribution. Portfolios at the top of the wealth distribution have a large share in corporate and non-corporate equity, making them very exposed to the stock market; while households in the bottom 90 percent, including the typical middle-class household, are heavily exposed to the housing market with the largest share of assets being housing. What increases the exposure to the housing market further is that household leverage increases the further we move down the wealth distribution. These stylized facts persisted over the entire post-war period so that at any point in time the top 10 percent of the wealth distribution own more than 90 percent of all stock holdings among US households.

These systematic portfolio differences have consequences for changes in the wealth distribution when stock and house prices change. The top of the distribution benefits from stock market booms while the leveraged bottom 90 percent of the wealth distribution experiences the largest wealth growth during a boom in the housing market. Portfolio heterogeneity along the wealth distribution leads to what can be described as a race between the housing market and the stock market with respect to wealth inequality: Booming housing markets and wealth gains for the middle class tend to decrease wealth inequality, while booming stock markets with wealth gains at the top of the distribution tend to increase wealth inequality.

We demonstrate that over much of postwar American history, such portfolio valuation effects have been predominant drivers of shifts in the distribution of wealth. In the decades before the financial crisis, such effects account for a major part of the wealth gains of the middle class and the lower middle class.

We estimate that between 1971 and 2007, the wealth of the bottom 50 percent grew by 97 percent only because of price effects—essentially a doubling of wealth without any (active) saving (Figure 4a). For the bottom 50 percent, virtually all wealth growth during that period came from higher asset prices; and even in the middle and at the top of the distribution, asset price-induced gains led to wealth growth of 60 percent, or close to half of total wealth growth over this time period.

When house prices collapsed during the 2008 crisis, the same leveraged portfolio position of the middle class brought about substantial wealth losses, while the quick rebound in stock markets boosted wealth at the top (Figure 4b). Relative price changes between houses and equities after 2007 have produced the largest spike in wealth inequality in postwar American history. In turn, surging post-crisis wealth inequality might have contributed to the perception of sharply rising inequality in recent years.

Race remains an important stratifying dimension regarding financial well-being in the United States. The demographic detail of SCF+ data allows us to shed new light on the long-run evolution of these racial inequalities. Our analysis adds to what we know about their long-run evolution along three dimensions. First, we study household income from all sources. Second, we look at households, so that we capture the effects of changing marriage patterns and higher labor force participation of women, as well as changes in transfers, education, and retirement decisions of households. Third, the SCF+ data also allow us to analyze the long-run evolution of wealth differentials between black and white households. So far, the racial wealth gap has remained uncharted territory, as long-run data were simply not available.((Wolff (2017) studied racial wealth differences in the modern SCF data starting in 1983. Bayer and Charles (2017) provide long-run evidence on a very persistent earnings gap between black and white working-age men.))

Figure 5 shows income and wealth trends for the typical (median) black and white households. Three facts stand out. First, income has grown at a comparable rate for black and white households. This means that pre-civil rights era disparities have largely persisted as black income growth did not accelerate relative to white households. Second, the size of the racial income divide remains substantial. The median black household has about half of the income of the median white household. Third, the wealth gap is much larger than the income gap, and it is equally persistent. The median black household owns only 12 percent of the wealth of a median white household. When we compare where the typical black household would rank in the wealth distribution of white households, we find that the typical black household remained poorer than 80 percent of white households. Our main conclusion is that virtually no progress has been made over the past 70 years in reducing wealth inequality between black and white households.

Moritz Kuhn and Moritz Schularick are both professors of economics at the University of Bonn. Ulrike Steins is a PhD candidate in economics at the Bonn Graduate School of Economics.

Disclaimer: The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.