University of Michigan professor Daniel Crane: “The story that somehow antitrust law is dead, that it’s been killed, is wrong. It hasn’t. It’s very active.”

In recent years, following decades of marginalization, wealth inequality has entered the political discourse in America in a major way. It has spawned countless articles, op-eds, best-selling books, policy reports, and, more recently, political campaigns. In the past year, it has become a central theme of the 2016 presidential election. A recent poll by Marketplace and Edison Research found that an overwhelming majority of Americans, 71 percent, believe that the U.S. economy is “rigged.”

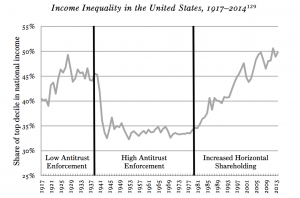

As inequality continues to make headlines, a number of economists and public intellectuals, such as Thomas Piketty and Joseph Stiglitz, have suggested that the rise in U.S. wealth inequality, now approaching levels last seen during the Gilded Age, is related to market power and a lax enforcement of antitrust laws. A growing body of literature has suggested the same. In 2015, Jonathan Baker and Steven Salop identified market power as a likely contributor to the growth in U.S. wealth inequality, along with globalization, the erosion of the purchasing power of the minimum wage, and executive compensation. “While other factors may play a greater role, market power likely has an effect… market power contributes to the development and perpetuation of inequality,” they wrote.((Jonathan B. Baker and Steven C. Salop, “Antitrust, Competition Policy, and Inequality”, The Georgetown Law Journal Online, 104, no. 1 (2015).))

Baker and Salop add: “The returns from market power go disproportionately to the wealthy—increases in producer surplus from the exercise of market power accrue primarily to shareholders and the top executives, who are wealthier on average than the median consumer.” They go on to recommend a number of measures to strengthen antitrust enforcement, among them retaining consumer welfare (as opposed to economic efficiency) as the goal of antitrust law, and increasing the budget of antitrust agencies as a way to reduce inequality in conjunction with other tax, labor, and trade policies. “In that market power contributes to inequality, more aggressive antitrust enforcement might play a remedial role,” they write.

A forthcoming paper by Lina Khan and Sandeep Vaheesan also explores the effect of monopoly and oligopoly power on economic inequality((Lina Khan and Sandeep Vaheesan, “Market Power and Inequality: The Antitrust Counterrevolution and its Discontents,” Harvard Law & Policy Review, forthcoming.)). Inequality, they argue, not only harms efficiency, but also has a much more pronounced distributional effect, in which firms use their market power to raise prices “above competitive levels to consumers and push prices below competitive levels for small producers.” This redistributive effect, according to Khan and Vaheesan, “tends to be regressive,” as managers and owners of monopoly firms are “typically wealthier” than the consumers buying the products that their firms sell. “Market power can be a powerful mechanism for transferring wealth from the many among the working and middle classes to the few belonging to the 1 and 0.1 percent at the top of the income and wealth distribution,” they write.

Harvard Law School professor Einer Elhauge also argued recently that horizontal shareholding (“when a common set of investors own significant shares in corporations that are horizontal competitors in a product market”) likely leads to anti-competitive price raises and causes regressive wealth redistribution((Einer Elhauge, “Horizontal Shareholding”, Harvard Law Review 129 (2016): 1267-1317.)). Horizontal shareholding, according to Elhauge, can help explain “fundamental economic puzzles,” including the rise in economic inequality. In an interview with ProMarket, Elhauge said that “the level of antitrust enforcement could have a large effect on economic inequality and likely has a significant or noticeable effect on it, but not for sure.”

Daniel Crane, the associate dean for faculty and research and the Frederick Paul Furth Sr. Professor of Law at the University of Michigan, disputes the monopoly regressivity claim. He also disputes the growing notion that a more rigorous antitrust enforcement can diminish wealth inequality, arguing that “more antitrust is not the answer to wealth inequality.”((Daniel A. Crane, “Is More Antitrust the Answer to Wealth Inequality?”, Regulation 38, no. 4 (Winter 2015-2016): 18-21.))

In a recent paper, Crane challenges what he deems as an oversimplification, claiming that that the relationship between antitrust law and wealth inequality is “far more complex” and that the relationship between income distribution and market power is “subtle, circumstantially contingent, and, at least for a developed economy, extremely difficult to generalize.” Crane then goes on to argue that more antitrust can in fact lead to greater inequality, and that “when it comes to wealth equality and social justice in a developed economy, antitrust law cannot be calibrated to help, but it can be calibrated not to harm.”((Daniel A. Crane, “Antitrust and Wealth Inequality,” Cornell Law Review 101 (2015).))

That the U.S. economy is suffering from increasing concentration levels, and that this rise in concentration has led in some cases to significant price increases, has been established in recent years by a growing number of studies. A recent paper by José Azar, Martin C. Schmalz, and Isabel Tecu((José Azar, Martin C. Schmalz, and Isabel Tecu, “Anti-Competitive Effects of Common Ownership” (Ross School of Business Paper No. 1235, University of Michigan, 2016).)) showed that ticket prices are 3-11 percent higher due to common ownership among airlines. A similar paper by Azar, Schmalz, and Sahil Raina that looked at common ownership in U.S. banking((José Azar, Sahil Raina, and Martin C. Schmalz, “Ultimate Ownership and Bank Competition” (working paper, 2016).)) found that that the largest U.S. banks share identical top shareholders, and that reduced competition in banking leads to worse service for consumers in the form of higher fees for deposit accounts and lower savings interest rates.

In health care, studies show that consolidations among hospitals led to significant price hikes. A 2015 study by Zack Cooper, Stuart Craig, Martin Gaynor, and John Van Reenen found that in markets where hospitals have a monopoly, prices are 15.3 percent higher than in more competitive markets that have four or more hospitals.((Zack Cooper, Stuart Craig, Martin Gaynor, and John Van Reenen, “The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured” (NBER Working Paper No. 21815, December 2015).))

To be sure, Crane does not completely dispute the idea that antitrust enforcement (or lack thereof) is related in some way to growing wealth inequality. What he does dispute, he says, is the “simplistic” version of the relationship between wealth inequality and antitrust, in which consumer-to-producer wealth transfers, enabled by lax antitrust enforcement and rent extractions, create regressive distributional effects. “In a complex, advanced economy, the lines of exploitation and profiting run in too many complicated and cross-cutting directions to permit broad generalization,” he writes in the paper.

“I am not claiming that there is no relationship between wealth inequality and antitrust or market competitiveness,” Crane tells ProMarket. “I am also not claiming that there couldn’t be certain antitrust interventions that would reduce wealth inequality. I think that there could be. All I am saying is that the overall picture, this facile assumption that more antitrust means greater equality and wealth is just way over-broad. The interactions between the distribution of wealth in society and market competitiveness are very complex and cross-cutting, and there are a number of ways in which more antitrust would actually increase wealth inequality.”

He adds: “I am not going to argue that there could never be case in which it would be appropriate to rationalize antitrust enforcement because of the inequality factor—if inequality is your priority, you could try to make a case—but it’s just that there are countercurrents where the effects are much more complicated than the people understand.”

In his paper, Crane disputes one of the key arguments for more antitrust enforcement–that shareholders and senior corporate managers are the main beneficiaries of monopoly rents. The literature on these issues, he argues, is ambiguous. Shareholding is something tens of millions of Americans do across social classes, as part of their 401(k)s and other retirement plans. It is far from clear that shareholders reap the lion’s share of monopoly profits, he notes, and a number of studies have shown that mergers don’t necessarily produce positive returns to the shareholders of the acquiring firm.

Some empirical studies, he claims, have actually shown that CEO compensation declines as markets become less competitive. Labor unions have also supported anti-competitive mergers in the past, he notes—such as the merger between US Airways and American Airlines—expecting that higher concentration would lead to a monopoly wage premium.

“When it comes to regressivity in monopoly, there are two questions: who bears the brunt—who is the effective payer of monopoly overcharges—and who obtains the gains. If you look at CEOs, for instance, the economic literature on CEOS earning a higher wage or stock option in more concentrated markets is very weak. In fact, there’s some literature that suggests that CEOs actually earn a lower wage in monopoly markets. If it’s a monopoly market, they’re less valuable to the firm, because it’s easier to generate income. There’s some literature suggesting it’s precisely where you see highly paid corporate executives that markets are very competitive, because then special talent is most beneficial to shareholders,” he says.

Moreover, Crane argues, antitrust cases have been brought not only against abusive corporations, but against middle-class professionals, such as music teachers, dentists, and lawyers. As an example, he points to a case brought by the Department of Justice against the National Association of Realtors in 2005, a case that concerned restrictions on home buyers to search for listings online.“If you look at statistics on the income of relators and the income of people selling homes, the income profile of a home-selling family is roughly twice the income profile of a realtor, on average,” he says. “Which means that if these allegations were correct, this is a huge wealth transfer from much-richer home sellers to much poorer realtors, and the enforcement action would have actually been regressive.” His point, he stresses, is not to dispute the case, but the notion that antitrust enforcement necessarily leads to progressive wealth redistribution.

Another factor that is often not taken into account, he argues, is government purchasing. Monopolists, he notes, often sell to “large intermediary organizations, which may distribute the incidence of monopoly charges progressively.” In the US, federal procurement accounts for roughly one-seventh of the GDP, not including state and local governments. Government, he argues, pays these monopoly overcharges and ultimately transmits them to taxpayers. Since the U.S. tax code is generally progressive, he argues, those overcharges are being borne progressively. Meaning: wealthy people should, in theory at least, pay a greater share, “which actually means that an antitrust intervention that diminishes anticompetitive conduct in government procurement actually has the effect of increasing wealth inequality.”

When it comes to the issue of price discrimination, says Crane, the relatively wealthy tend to be exploited proportionally more than the relatively poor. “According to most economic accounts, price discrimination has progressive distribution effects, meaning that a greater share of the higher prices charged by price discrimination comes from wealthier individuals than from poorer ones. That’s not uniformly true, but as a generality, in a market characterized by less competition, as monopolists are increasing their prices they are going to be charging proportionally higher prices on higher-income people, on average.”

The proponents of government antitrust action, argues Crane, ignore private efforts to curtail monopoly power. Government, he argues, should “get out of the way” of these private efforts. In the paper, he writes: “When it comes to wealth equality and social justice in a developed economy, antitrust law cannot be calibrated to help, but it can be calibrated not to harm.”

“I think it’s just a mistake, as a general matter, to include reducing wealth inequality as one of the goals of antitrust law,” says Crane. “I’m resisting the idea that somehow talking about wealth inequality will improve antitrust enforcement. If anything, it will just distract, making it a political hot potato, but I don’t think it will have any appreciable effect on wealth inequality. Antitrust law works best when it’s concerned with economic efficiency and the protection of consumer welfare. That has been the consensus by economists, people in the field, and antitrust agencies for several decades now. My concern [is] that at a political level, people are looking for new scapegoats for wealth inequality, and particularly in recent times people have been looking at weak antitrust enforcement.”

Q: Are you disputing the claim that U.S. antitrust enforcement has been lax in the past thirty years?

I don’t think it’s been lax at all. I think overall, antitrust enforcement has been properly focused on economic efficiency, and it has led to certain interventions and certain non-interventions.

I am reacting to the suggestion that we should start telling the antitrust agencies here’s a bunch more money for you, because we think it would decrease wealth inequality. First, I am not sure it would. And secondly, it could do so by destroying efficiency.

I think that antitrust law should remain focused on doing what it does relatively well, which is focusing on economic efficiency and consumer welfare. Although I think there could be a case when resources are scarce and the agencies prioritize cases to go after really regressive violations. I am not saying never do it, but as an overall point I am saying it is just misguided to be focusing on wealth inequality as something antitrust systemically does.

Q: In April, the White House’s Council of Economic Advisers issued a report that found that higher levels of concentration in the U.S. economy led to anticompetitive behavior and overprices products and services for consumers. It seems even the government, charged with enforcing antitrust law, does not believe that focusing on consumer welfare is working. Does that not contradict what you just said?

That report is not a piece of scholarship. It is very, very light, and very thin. One of the issues with it is when we talk about concentration levels, you got to look at actual relevant markets. They look at industry sectors, which tell you very little about relevant markets in terms of concentration levels.

Assuming that consumers are paying more money, who are those consumers? They could be consumers of Rolex watches and ski resorts, or financial services, which are bought by wealthy people, or health care. The current health insurance system is progressive in its wealth redistribution effects. So who is really bearing the very incidences of monopoly overcharges? The plausible claim is that actually it’s richer households that are disproportionally bearing a higher and higher share of these rising costs. Is more competition really going to create more equality, or is more competition going to basically allow rich people on average to save more money than they are currently spending on health insurance?

Q: In the case of the American health care system, studies have shown that concentration and consolidation has led to a big rise in costs. A recent paper by Yale economists showed that hospital prices are 15 percent higher in monopoly markets. So at least when it comes to health care, consolidation has led to price increases on average consumers.

I don’t disagree at all. I am not arguing against antitrust enforcement, just the wealth inequality question. I have no quarrel with preventing mergers where the FTC has concluded that they’re not in the interest of consumers.

If you’re saying because hospital mergers has raised health care prices, does if follow that it is necessarily regressive? I don’t know that it is. Who’s actually paying? How are health care costs really borne? If you look at the claims that the Obama administration has made about the Affordable Care Act, one [intended] effect was to get richer households to bear a larger share of health care costs.

If the entire system of health care payments is filtering monopoly overcharges and then passing along the incidences of those things in a progressive way, then the less competitive the market becomes, the more progressive the whole system becomes.

The leap from this is bad for consumers to therefore it is regressive, I think, is a very big leap. Who’s bearing the incidence of monopoly overcharges and who obtains the benefits of monopoly pricing? It’s a very, very complicated set of interactions.

Q: You said that you don’t think antitrust enforcement has been lax. How do you explain the perception that it has been extremely lax, and that this has contributed to a rapid rise in economic concentration?

That’s bogus. Antitrust enforcement has three or four big buckets. The one that no one is talking about is anti-cartel enforcement, which in the last 20 years has boomed. If you look at fines, imprisonment levels, and the level of activity of anti-cartel enforcement, it is leaps and bounds larger than any time previously in history. We are enforcing antitrust laws today more effectively and vigorously against cartels than any time in our history.

On the merger side, there you can have a real discussion whether anti-merger enforcement is adequate. That’s a mixed story.

Remember, the Justice Department does not enforce monopolization law. Obama brought one case, the Bush administration brought zero cases over eight years, the FTC has brought a few cases.

But there are hundreds and hundreds of private monopolization cases filed every year. One of the complete disconnects that the Krugmans and Stiglitzes of the world who talk about weak antitrust government, their focus is on government enforcement. They completely ignore that in the U.S. we have ten private cases for every government cases. We have literally hundreds of private antitrust cases a year.

Q: Isn’t that, in itself, evidence of lax government enforcement? Private individuals, businesses and organizations are forced to take the mantle and pursue antitrust cases, in lieu of concerted government action. There is also the question of whether private bodies, even firms, really win a legal battle against monopolies with no government backing.

I am not a huge fan of private enforcement. I am actually one of the big critics of private litigation. All I’m saying is, if you’re look at what the U.S. antitrust system actually does, there is a huge amount of activity. There was a study by Joshua Davis and Robert Lande that showed sixty recent settlements from private antitrust litigation brought $35 billion in recovery.

Is it optimal? No, I don’t think it’s optimal. I’ve been a big critic of our system. But the story that somehow antitrust law is dead, that it’s been killed, is wrong. It hasn’t. It’s very active. In some ways, it’s too active.

Q: You write: “More competition does not inherently lead to greater equality.” It may be true, but that is really the one tool regulators have to commit bad behavior.

A very competitive market can help police fraud, but if we really thought competition solves all externalization problems then we’d have a super-minimal state. There are certain kinds of harms, environmental harms for instance, that might actually be spurred by competition.

I am not an absolutist about competition. I like competition, I think it should be the general rule of the land, but unfettered competition does not produce the distribution of results that we find socially acceptable. There are certainly situations in which through regulation we have limited competition, saying there are certain things we value more instead. The easiest case of this is minimum wage laws. The reason we have minimum wage laws is because competition among labor leads to labor premiums or labor rates being driven down towards marginal cost. The reason we have all these conversations about minimum wage laws is precisely because competition among workers leads their labor to be priced lower than politicians or the public in general thinks is morally or socially acceptable

So this idea that more competition leads to more equality is very, very strange. Most regulatory bodies we have that protect people from different kinds of harm are based on the assumption that competition in the markets does not create the optimal levels of protection.

Q: You write: “there are many legitimate reasons other than wealth inequality to take on monopolies and cartels.” Is concentrated political power one of them?

That’s another point. There have been theories proposed, most notably by Robert Pitofsky in 1979, that antitrust always has and always had a political content. In the 1940s, Congress was very concerned that fascism in Germany and Japan had been enabled by concentrated economic power.

But that’s not the equality point, it’s a political vision of antitrust that says even if a political merger creates increases in consumer welfare by creating efficiency and lower prices, it might still be undesirable if that merger leads to an increase in economic power that has political ramifications. You can see this in media in particular, that’s why the FCC goes beyond consumer welfare in a narrow sense and says there are times where diversity in media is important politically, regardless if consumers are paying higher prices.

I don’t necessarily resist that entirely. I do think antitrust is better kept focused narrowly, but I do think there are times where political decision need to be part of these things and may not be in the interest of consumers in terms of prices. Airline mergers approved during the Obama administration are a real case study where prices have gone up because of reduced competition, but the Department of Transportation had other priorities in terms of maintaining the stability of these carriers in the middle of an economic crisis.

I think there could be a political content to antitrust that would make some sense in some context. I don’t think it’s spurious to say that in a super concentrated market, it is easy to get concentrated political power.

It is a complicated story. I don’t mean to be a reductionist and say there is one thing we should do. There are many different policy interventions you can undertake to achieve more competition. Antitrust law is only one of them, and it’s often an imperfect one.