In new research, Dominic Smith and Sergio Ocampo show that retail concentration has increased in most markets across the United States, with the expansion of large retail chains driving the trend toward a more concentrated retail landscape. Their findings are based on new product-level census data for all U.S. retailers. They explain the implications of this increased concentration for the everyday shopping experience of clothing, electronics, groceries, and much more.

There has been a steady shift in how Americans shop: the corner grocery stores or local clothing boutiques of the 1980s and 1990s have given way to a smaller number of big-name national chains. Despite increases in population and the overall number of firms in the United States, the number of retail firms fell by 12 percent between 1992 and 2012. The result of these changes is that consumers potentially face fewer choices regarding where to buy groceries, clothing, or electronics. What is driving these changes in the retail sector? How have they affected the shopping experience of Americans and the competition landscape of the sector?

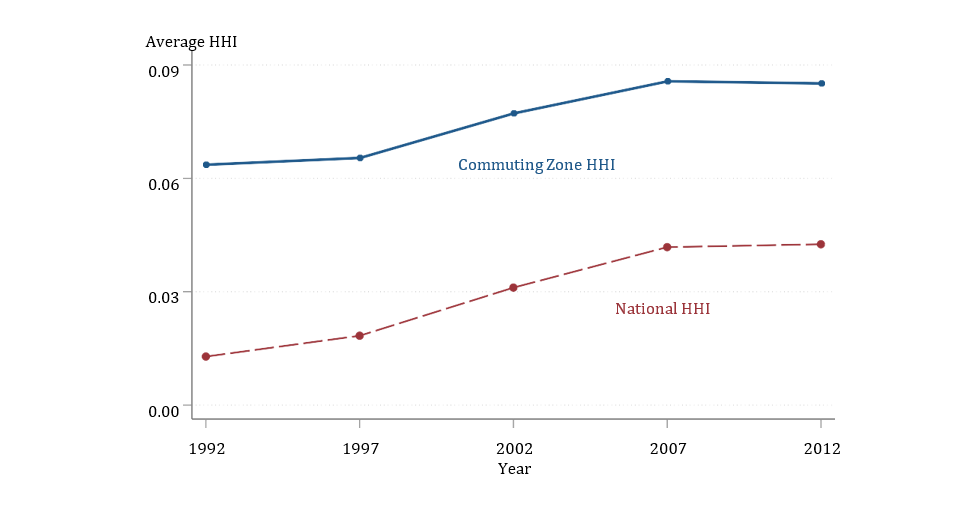

In our new research published in the American Economic Journal: Macroeconomics, we show using data from the Census of Retail Trade that changes in the retail landscape have resulted in a sustained increase in the concentration of retail sales at the national level. For instance, the national Herfindahl-Hirschman concentration index (HHI)—a common measure of market concentration used in antitrust—more than tripled in the retail sector, reflecting that consumers increasingly buy retail products from the same retailers.

National vs. local retail concentration: why it matters

Unlike competition in manufacturing, financial services, and other sectors that operate with a national scope, competition in the retail sector takes place in local markets. In fact, concentration in local markets (as opposed to national concentration) is a key measure of how competitive the retail sector is because consumers typically shop at nearby stores. We find that, despite the decrease in the total number of retail firms in the U.S., consumers in local markets have almost as many choices of retail stores as they did in the early 1990s. This is because the average number of stores per retail firm has increased due to growth of national chains by opening new stores and acquiring existing firms.

Figure 1. National and Local Concentration

But the number of stores people have in their local markets tells only part of the story. The rise of national chains, firms that operate at least 100 stores in the U.S., means that, no matter where someone lives, they are likely to be choosing between a similar set of retailers, homogenizing the shopping experience across the U.S. Moreover, as national chains consolidate their presence in new markets, capturing a larger share of local retail sales, they drive up local retail concentration. Ultimately, we find that both local and national retail concentration have increased since the 1980s.

Concentration is rising, almost everywhere

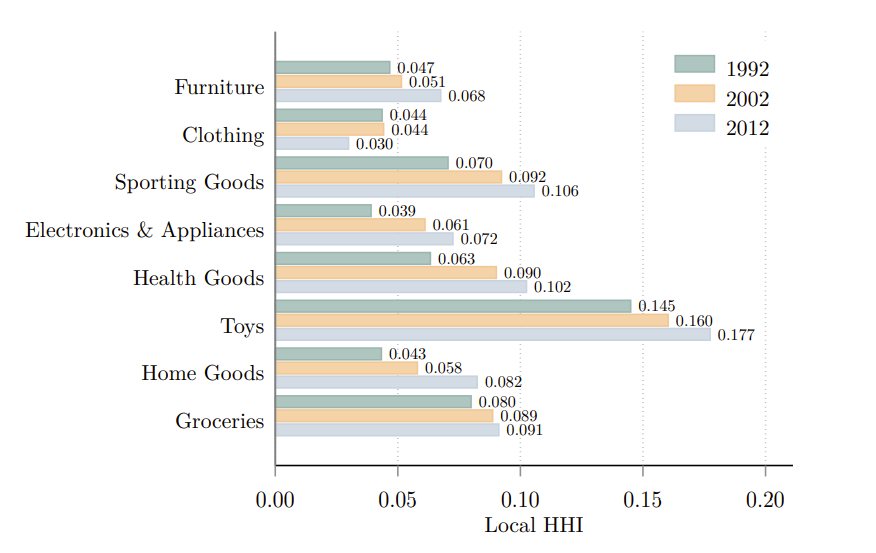

Retail concentration is rising across almost all dimensions, whether dividing markets by their geographical definition (such as commuting zones or counties) or based on the products that retailers sell. Retail sales concentration increased in 72 percent of commuting zones between 1992 and 2012, with markets with increasing concentration accounting for 66 percent of retail sales in 2012. Concentration also increased for seven of the eight major product categories in retail, like groceries, electronics, and home goods. Clothing, the product area with the most national chains, was the lone exception. All told, retail markets have become less competitive over time.

Moreover, the increases in concentration were substantial, with 40 percent of markets presenting increases in their HHI of more than 5 percentage points. For reference, an increase of 1 to 2 percentage points is considered to “raise significant competitive concerns and […] warrant scrutiny” according to the 2010 merger guidelines of the U.S. Department of Justice and Federal Trade Commission. These increases in concentration reduced the levels of local competition, explaining up to one-third of the increase in retail markups between 1992 and 2012.

Figure 2. Local Concentration Across Product Categories

The role of expansion and consolidation of multi-market retailers

To understand the drivers of the evolution of the retail sector towards higher concentration, we follow changes in which retail stores operate in each geographical market and how their sales have changed over time. The trends of increasing national and local concentration are linked by the expansion and consolidation of multi-market retailers. That is, by retailers opening stores in new locations, thus increasing their national sales shares by expanding into new markets, or by increasing the sales in their existing stores, thus [1] consolidating their local position. Rising national concentration reflects a change in the ownership structure of retail stores, as the stores in local markets are increasingly likely to be owned by a multi-market retailer. In fact, the expansion of large retail chains across markets accounts for 89 percent of the increase in national retail concentration between 1992 and 2012, the last year for which we have data on local retailers. The remaining 11 percent is accounted for by the consolidation of these retailers in the markets they enter as they increase their local market share. In this way, national concentration has increased because consumers in different markets increasingly buy from stores of the same firms, adding to mounting evidence on the role of the expansion of large firms in explaining changes in the U.S. economy.

Concentration across the economy

The changes in the retail sector that we document show that it has not escaped the economy-wide trend towards a more concentrated business landscape, spearheaded by the rise of super-star national firms. The role of these superstar firms, which account for a growing share of sales and employment, is in fact one of the defining factors of business dynamics in the U.S. over the last decades. However, recent research shows that while national concentration has increased in all sectors of the economy, local concentration has actually decreased in most of them. Retail is different. The expansion of large multi-market retailers has driven increases in both national and local concentrations in sales (and in employment). This directly affects how people shop and the level of competition actually faced by retailers in the local markets in which customers buy.

E-commerce has a limited impact through 2012

The emergence of e-commerce, which generally carries a national footprint, has reshaped the retail sector in the last decade, with recent research showing that the share of e-commerce in retail has returned to its pre-pandemic trend after spiking during the lockdowns of 2020 and 2021. However, e-commerce did not play a role in the transformation of the sector towards higher national and local concentration through 2012. Online sales grew rapidly after 2000, but they still accounted for less than 10 percent of overall retail sales by 2012. Thus, their impact on concentration remains limited in this period. That said, accounting for the possible effects of online sellers, we found that online sales might be moderating the rise in local concentration in some categories, like electronics and clothing, where e-commerce grew most rapidly in the early 2000s.

What will happen to the retail sector going forward?

The room for expansion-driven increases in concentration is now mostly exhausted, after decades of multi-market retailers increasing concentration by opening new stores in new markets across the country. However, there is still room for the consolidation of national retailers in local markets to drive further increases in retail concentration. National e-commerce players that can reach all local markets simultaneously are likely to play a central role in this new phase in the evolution of retail concentration, making inroads in the sales of all retail products, including groceries. The main difference between expansion- and consolidation-driven changes in retail is that consolidation directly leads to higher local concentration, while expansion need not immediately affect local retail markets.

Nevertheless, even if retail stores become more concentrated, this does not necessarily limit the products available to consumers. Research on the brands Americans buy shows that the concentration in the ownership of those brands has decreased over time, and that firms are selling more diverse sets of products. American consumers as a whole are simultaneously purchasing a wider variety of brands from a wider variety of producers. All of this while they buy those products from a smaller set of retailers, so that large retailers now enjoy more market power with consumers and better negotiating power with suppliers.

Authors’ Disclaimer: This article summarizes research results. The article does not represent an official BLS statistical data product or production series. The Census Bureau has ensured appropriate access and use of confidential data and has reviewed these results for disclosure avoidance protection (CBDRB-FY20-P1975-R8604). The views expressed here do not reflect those of the Census Bureau.

Authors’ Disclosures: The authors report no conflicts of interest. You can read our disclosure policy here.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.

Subscribe here for ProMarket’s weekly newsletter, Special Interest, to stay up to date on ProMarket’s coverage of the political economy and other content from the Stigler Center.