In new research, Yonghong An, Michael A. Williams, and Mo Xiao find that increases in an academic journal’s subscription price and its publisher’s market share lead to fewer article citations, hindering knowledge creation and research collaboration.

Sir Issac Newton famously said, “If I have seen further, it is by standing on the shoulders of Giants.” But what if the Giants had a gatekeeper, and the gatekeeper asked Newton to pay an entrance fee that he could not afford?

The academic publishing industry has become the gatekeeper of the Giants. Researchers across academic fields face exorbitant access fees and other restrictions imposed by academic publishers to read their journal articles and manuscripts. Without access to the Giants, scholarship, productivity, and innovation suffer.

In a new study, we quantify the effects of such access barriers on knowledge dissemination, knowledge creation, and research collaboration. For the field of economics, we find that a 1% increase in journal subscription fees leads to a 0.83% decrease in the citation count of a journal article published five year ago and a 1.07% decrease in the number of authors who cite this article. Interestingly, most of these effects come from foregone citations from collaborative research ventures where coauthors may have different or unequal access to journal articles. Moreover, these negative effects are much larger for lower-ranked academic institutions and developing countries who may struggle to pay the fees to access new scholarship. Lastly, an increase in a publisher’s market power (measured by its share of the number of articles published each year in a given academic field) causes a consistent reduction in the volume of article citations and citations from collaborative research projects from all ranks of academic institutions.

Academic publishers are intermediaries connecting content providers with content consumers, as publisher Simon & Schuster does for Stephen King and his readers. Taking a closer look at the publication process in academia, a typical publisher’s “production function,” however, is full of conflicts and flaws. A researcher or a team of researchers produce knowledge, often using public funding, and other researchers provide critical input as referees and editors, often without pay. Researchers pay submission fees to get published, and then universities pay subscription fees to get access to journals. Quite often, the public pays to fund the research, and pays again (as taxpayers who fund public universities) to fund university libraries’ budgets. The publishers seem to have only a light role in organizing editorial boards, copy editing, typesetting, and distribution, and yet, they enjoy large profits. In 2020, the academic publishing industry, dominated by powerhouses such as Elsevier, Wiley-Blackwell, Taylor & Francis, Springer Nature, and SAGE, garnered $19 billion in revenue. Elsevier has a roughly 40% profit margin, comparable to highly profitable companies such as Microsoft, Google, and Coca–Cola. No wonder academic researchers fret about publishers taking advantage of them, and this frustration often escalates to fury, unleashed in the forms of public protests, breakdowns in contract renegotiation, and editorial board resignations.

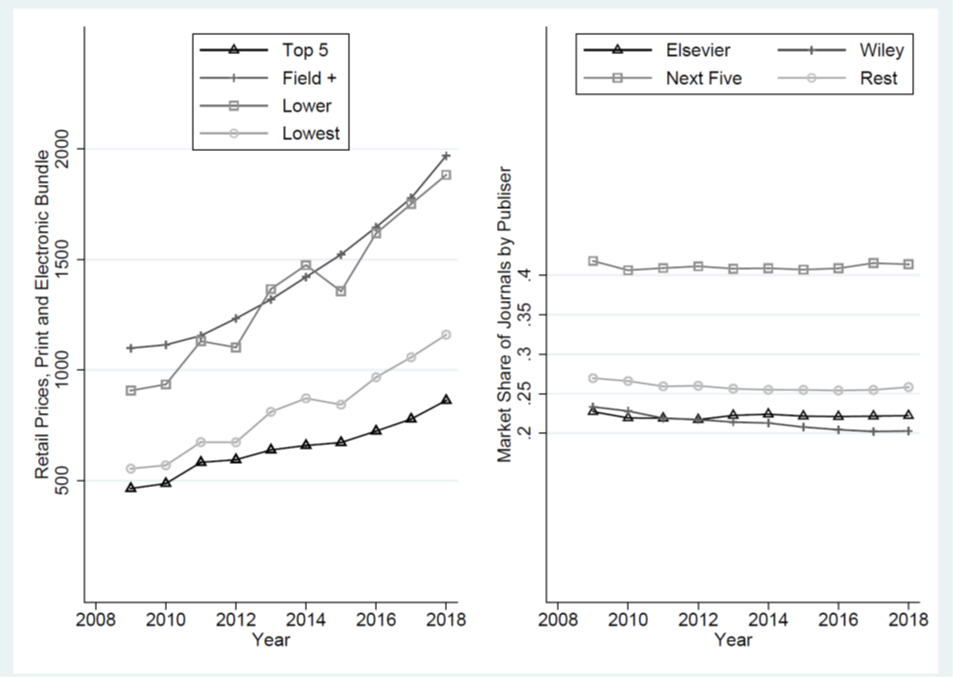

Aiming to provide quantitative evidence about the effects of elevated prices and substantial publisher power, we collected data from three distinctive academic fields — economics, physics (in fact, two subfields in physics), and electronic engineering—where journal publications (rather than conference proceedings or books) are deemed as the major research output in the field. For every article published in the majority of journals in these fields from 2009 to 2018, we collected data on the number of citations and authors who cited these journal articles for each article. We manually collected data on journals’ retail prices and attributes as well as data on publishers’ journal portfolios. The data are quite comprehensive: for economics, we cover 240,209 articles published in 363 journals by 64 publishers; for physics, 389,421 articles, 98 journals, and 36 publishers; and for electronic engineering, 495,403 articles, 266 journals, and 64 publishers. For all three fields, journal prices increased significantly from 2009 to 2018. Taking economics as an example (as shown in Figure 1), the average retail annual subscription fee (for a print and electronic bundle) nearly doubled from $713 to $1,403 (in 2020 dollars), while publishers’ market shares remained stable.

Figure 1: Journal Prices and Publishers’ Market Share in Economics

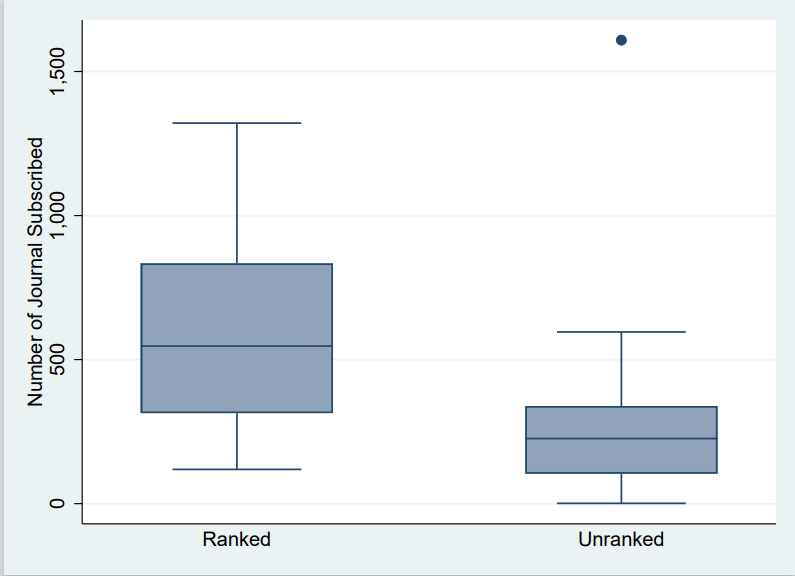

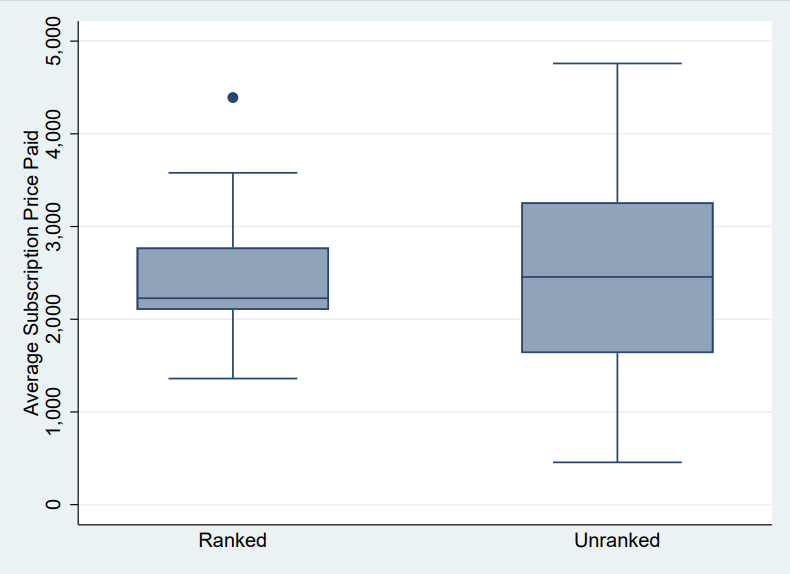

We focus on two measures of barriers to journal access: journal retail prices and publishers’ market shares of published articles. These two measures jointly determine what universities pay to publishers and the number of journals they subscribe to in their negotiated contracts. University libraries generally negotiate highly customized contracts with publishers, rather than purchasing a pre-specified bundle of journals. Typically, universities and publishers negotiate a base bundle, then choose individual journals to add on. Journals’ retail prices serve as the basis for the price of the base bundle, as well as for negotiated prices for the add-on journals. During the negotiation process, the concentration of ownership in the publishing market tilts the negotiations toward large publishers. Larger publishers not only have more negotiation power versus university libraries when setting prices, but also push for “big bundles” that leave fewer dollars left over in library budgets to purchase journals from entrants in the academic publishing industry. We obtained the contracts between Elsevier and major public universities to examine the inner workings of these contracts. As Figure 2 shows, universities ranked by Quacquarelli Symonds in 2020 subscribed to more than double the number of journals their unranked counterparts did; unranked universities, however, paid slightly more, on average per journal, than ranked ones.

Figure 2: What’s in the Contract: Ranked vs. Unranked Universities

Notes: The left graph is based on 70 Elsevier-University Library contracts; the right graph is based on 48 such contracts as not all contracts report the negotiated journal prices.

Using these two measures of access barriers, we conduct a separate analysis for each of the three fields to quantify the effects of increasing journal prices and publishers’ market power on the volume and distribution of article citations and research collaboration across institutions and countries. As discussed above, in economics the adverse effects of increasing journal prices are substantial. In physics, these adverse effects are even larger. A 1% increase in journal subscription fees leads to a 1.46% decrease in the citation count of a journal article published five years ago and a 1.96% decrease in the number of authors citing this article. The market power of physics journal publishers, however, does not have an effect on citations. In electronic engineering, surprisingly, the negative effect of access barriers all comes from publishers’ market power. A 1% increase in a publisher’s article market share leads to a 4.67% decrease in citations and a 6% decrease in the number of citing authors (in economics: 0.31% and 0.35%, respectively). Across all three fields, the incidence of the cost falls more heavily on lower-ranked institutions and institutions in developing countries.

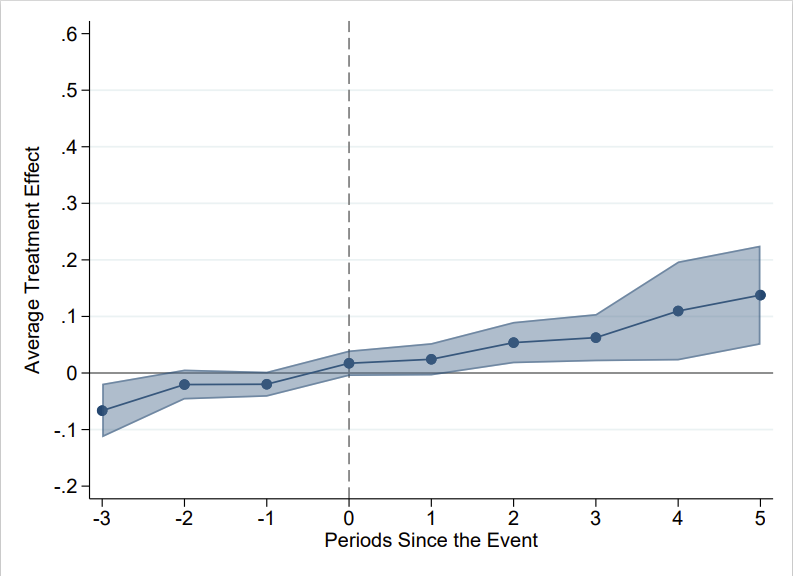

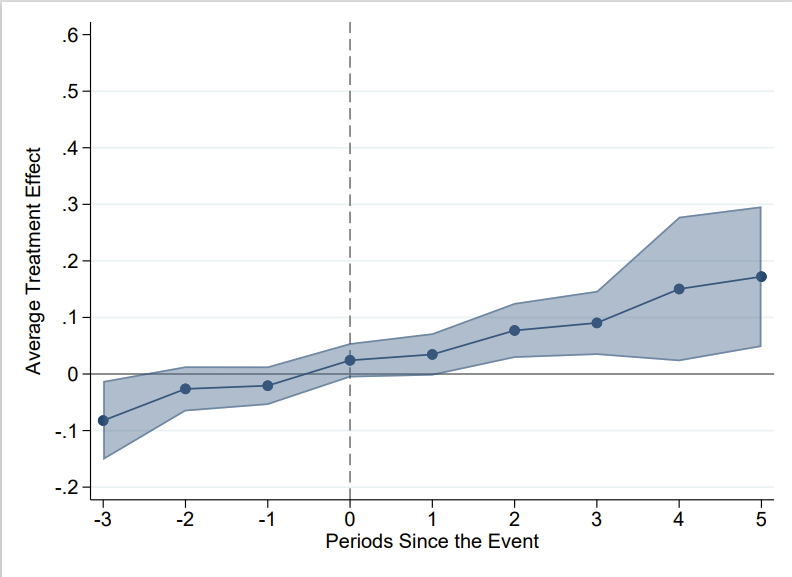

How do we know our results are driven by restrictions in access? We exploit the timing of economics journals moving out of publishers’ paywalls. “JSTOR,” short for “Journal Storage,” provides a low-price alternative to individuals and institutions to access academic journals and is well known in the economics profession. Access through JSTOR is delayed, with a “moving wall” between a journal publication date and the availability of its content on JSTOR. The moving wall delay is set by a journal’s publisher and ranges from zero to ten years, although the majority of journals have a moving wall of three to five years. We leverage the differential timing of journals moving into JSTOR and find an immediate increase in the annual growth in the number of citations of an article when the article becomes available on JSTOR. This effect grows over time: as shown in Figure 3, for the cohort of articles that were published in 2009, two years after becoming available on JSTOR, the annual growth in the number of citations increased by roughly 5%; by 15% five years into JSTOR access; and the effect of JSTOR circulation on the number of authors citing these articles is even larger. This finding provides strong evidence that access is the bottleneck for knowledge dissemination.

Figure 3: Effects of JSTOR Circulation

Notes: the left graph shows the effect of JSTOR access (period 0) on the number of citations for economics articles published in 2009 (as the log of the change in the number of citations); the right graph shows the effect on the number of citing authors for economics articles published in 2009 (as the log of the change in the number of citing authors).

We borrowed the title of our paper from the “Cost of Knowledge” movement, spearheaded by Timothy Gowers, a renowned mathematician and Fields Medalist. The movement called for a boycott of Elsevier as a response to growing discontent within the academic community regarding the practices of major academic publishing companies. The movement’s name, “Cost of Knowledge,” reflected the belief that the financial and intellectual costs imposed by traditional academic publishing practices hindered the progress of science and scholarship. Our research provides quantitative evidence for this belief. In summary, the academic publishing industry has restricted the dissemination process of created knowledge and disproportionately harmed researchers already at a disadvantage. However, the adverse effects imposed by the academic publishing industry are the inevitable consequences of how this market was designed. To be fair, we may not want to put all the blame on a single component of that market design. To some degree, it is the “publish or perish” environment that creates a captive audience from which academic publishers reap the monetary rewards.

Authors’ Disclosures: The authors have no relevant or material financial interests that relate to the research described in this article or the underlying research paper.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.