Critics of the Federal Trade Commission’s lawsuit last week to block the Kroger-Albertsons merger claim that the agency incorrectly limits the relevant buyer-side market to unionized grocery workers. Steve C. Salop argues that the critics are wrong, and that standard antitrust analysis shows the FTC has it right.

The Federal Trade Commission’s complaint in the Kroger-Albertsons merger includes an allegation that the merger will reduce buyer-side competition in the labor market for grocery store workers. There is a long history of supermarket acquisitions and mergers leading to harm to workers, even going back to the Safeway leveraged buyout in the 1980s and the more recent Albertsons-Safeway merger in 2015. The FTC complaint alleges a relevant buyer-side market restricted to the employment of unionized workers, predominantly workers who are members of the United Food and Commercial Workers (“UFCW”).

A pro-merger skeptical reader might ask: How can this be? Can’t unionized grocery store workers easily take other jobs that are not unionized or not involving grocery stores? Even if not, by focusing on workers who belong to a single union, isn’t the FTC alleging what amounts to a single-firm (UFCW union) market? This sort of anti-merger, ends-oriented, gerrymandered market definition to preference union workers obviously makes no economic or legal sense, the pro-merger skeptical reader might claim.

Calm yourself down, dear skeptical reader. In fact, the FTC’s relevant market makes perfect economic sense. Rather than being gerrymandered, the relevant market that just considers unionized workers satisfies the hypothetical monopolist test (HMT) and the “line of commerce” provision of Section 7 of the Clayton Act.

Applying the Hypothetical Monopsonist Test

The skeptical reader may have been erroneously focused on sell-side markets, where merger investigations usually occur. But for antitrust analysis, relevant markets also may be defined on the buy-side for workers, where the relevant price is the wage rate an employer pays to acquire workers’ labor, where the hypothetical monopolist test becomes a hypothetical monopsonist test, and where the potentially harmed counterparties are the workers selling their labor. For example, a cartel of universities might push down faculty salaries or financial aid. A cartel of unionized grocery store employers might push down workers’ wage rates. In these cases, instead of a “small but significant non-transitory increase in prices” (SSNIP), the HMT would be based on a small but significant decrease in price (SSNDP) or wages (SSNDW).

Consider a hypothetical employer cartel (or monopsonist) comprising all the unionized grocery stores in an area, stores that competed by negotiating independently with the unions for workers in the pre-merger world. Suppose these competing grocery stores begin to set wages collectively, reducing wage rates by a SSNDW. Unless a sufficient number of workers would substitute to non-union grocery stores or non-grocery store jobs, or migrate to other areas, the wage decreases would be profitable and the proposed relevant market would satisfy the buy-side version of the HMT.

Whether defection of workers would be sufficient to prevent a wage reduction is an empirical question that is very unlikely to be satisfied if the workers are unionized. This is because collective bargaining by the union (or unions) likely would succeed in raising the wage rates of the unionized workers above the wage rates in their next-best alternative employment opportunities. After all, that is the goal of unionization.

Defining a single market for multiple types of workers also makes economic sense. The employer/union negotiation to set the wage rates for these workers amounts to a “bundled” sale. When a bundle of products is purchased together, Ian Ayres coined the term “transaction complements” to apply to the components of the bundle. For both these reasons, the potential criticism that grocery store employees differ in their alternative employment opportunities, and that separate markets must be defined for each group, is erroneous.

A Flawed Liability Rebuttal Argument

The skeptical reader might protest that this analysis has falsely acted as if all the grocery stores are unionized. Walmart is non-union. So if the unions tried to negotiate a higher wage rate in the per-merger world, that strategy would be unprofitable because the now-higher-cost supermarkets would lose considerable business to Walmart, which would lead to substantially lower union employment.

However, there are two fatal problems with this rebuttal argument. First, the argument assumes that the union has no impact on the pre-merger wage rate. But I expect that the FTC will show that the UFCW negotiates wage rates above the wage rates paid by Walmart and other non-union stores. The FTC complaint observes that unions can whipsaw the grocery store chains by striking one chain and then leveraging the higher wage agreement at that store for higher wages at another chain, a common union tactic.

Second, even if the pre-merger equilibrium wage rate lands at the competitive rate, collective action by a hypothetical group of unionized grocery store chains generally would find it profitable to exercise some monopsony bargaining power and push down the wage rate. Some workers would decide to seek employment elsewhere. That is the nature of the exercise of classical monopsony power. But a SSNDW to a sub-competitive level would only be unprofitable if the supply of labor is nearly perfectly elastic, that is, if virtually all workers would rapidly leave if grocery store wages were slightly reduced. This is an empirical question, but the assumption of a nearly perfectly elastic supply is highly unlikely to be true. And remember, the market definition test is based on a simultaneous wage reduction by all the unionized chains, not just one of them.

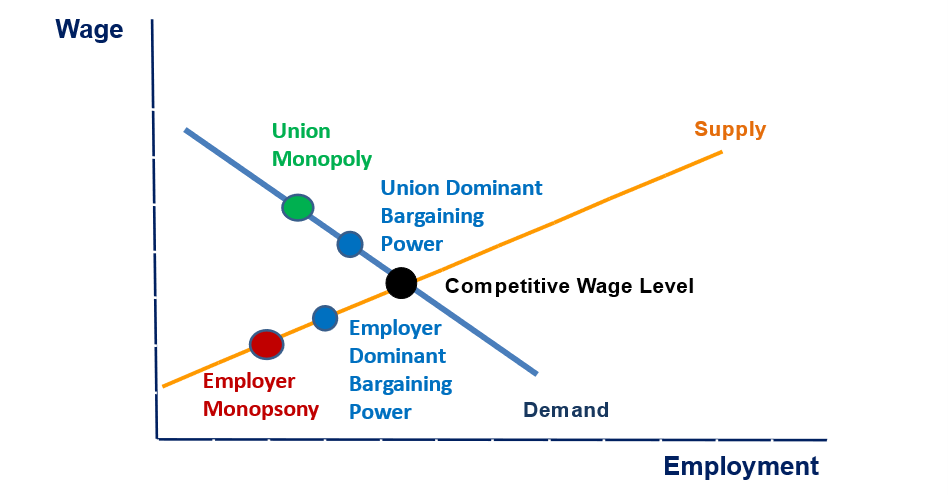

This analysis also does not require that the unions have achieved something close to the cartel outcome in the pre-merger world. In a negotiation market, a shift in relative bargaining power in favor of the stores would enable them to increase profits by reducing the wage, regardless of whether the pre-merger bargaining equilibrium was at the cartel (i.e., classical monopoly) output, the competitive market outcome, or even one where the stores had dominant bargaining power. As explained in my article with Doug Melamed and illustrated in Figure 1, the bargaining equilibrium wage rate depends on the relative bargaining power, along with the levels of employment that occur when the negotiations involve the wage rate, but where the level of employment is set by the employer.

Figure 1. Range of Bargaining Equilibria

There is one possible theoretical exception. Wages could not be profitably pushed down after the merger if the grocery stores had achieved the full classical monopsony outcome before the merger. This is unlikely. And even here, the court would recognize that defining the market on the basis of a further SSNDW would be an erroneous variant of the cellophane fallacy. A modern court would recognize that the merger would reduce the likelihood of future competition causing wages to rise above this pre-merger classical monopsony level.

Is Countervailing Union Power Procompetitive?

Unable to rebut the relevant market definition, the skeptical reader might counsel Kroger to claim that the union wage rate is supra-competitive, which leads to an anticompetitive outcome. Kroger might then defend the merger as facilitating the ability of Kroger and Albertsons to improve competition by countervailing the market power of the UFCW and the other unions. By forcing down the wage rate, Kroger-Albertsons will gain lower costs, which will lead to lower grocery prices, increased grocery store output, along with benefits to grocery shoppers and economic efficiency.

This argument also should fail. The antitrust laws are clear that anticompetitive conduct cannot be justified on the claim that it is countervailing legitimately obtained market power. That claim was rejected in Apple eBooks. Naked wage-fixing by two firms, for example, could not be justified on the grounds that it would lead to increased employment, albeit at a lower wage. That is especially true in this case, where the market power of the unions is obtained legitimately and in furtherance of labor law. Merger law is no different. Courts have recognized since Philadelphia National Bank that claimed out-of-market benefits are not “cognizable” procompetitive merger efficiency benefits, as discussed by Scott Hemphill and Nancy Rose, This approach was applied in the recent Bertlesmann publishing merger case, where the court looked only to the effect on authors, not book purchasers.

Because union market power is exercised legitimately, a merger that undoes that power is not a cognizable benefit, even if it benefits downstream shoppers as well as the employers. In the Anthem/Cigna merger, for example, the D.C. Circuit Court rejected the claimed merger benefits of using its new muscle to countervail the legitimately-obtained market power of health care providers. While then-Judge Brett Kavanaugh dissented there, his views may have evolved since. In his Alston concurrence in 2021, he opined that “traditions alone cannot justify the NCAA’s decision to build a massive money-raising enterprise on the backs of student athletes who are not fairly compensated.”

Kroger might try the following variant: By pushing down the wage rate to a level modestly below the labor cartel level, the merged firm would have the incentive to increase employment, as can be seen from Figure 1. This lower wage thus would benefit the newly employed workers who now have better jobs or have escaped unemployment.

This argument is better in that the efficiency claim would involve “within market” effects, not “out-of-market.” But this version surely would face a very high hurdle here. Even if the wage reduction would lead to more employment (i.e., higher labor market “output”), it is not clear that workers overall would benefit. This is because the mass of currently employed workers would be harmed by the lower wages, while only a few “marginal” workers would gain from the resulting increase in grocery store employment. In this situation, where the great majority of workers are harmed, it is hard to see how the merging firm could carry its rebuttal burden of showing that workers overall would benefit.

A similar claim of “within-market” worker efficiency benefits from an agreement among employers that restrains workers is made by McDonald’s in the Deslandes no-poach case. McDonalds argues that the no-poach agreement benefits workers by incentivizing greater worker training and leads to higher wages as a result. Aside from the possible lack of supporting facts, the problem with this theory is that there are less restrictive alternatives. First, labor economics teaches that training costs can be saved by paying higher post-training wages to reduce the quit rate, in which case no agreement is necessary. Second, a less restrictive agreement instead could require a franchisee that hires away a worker from another store to compensate that store for its lost training cost. Third, McDonalds itself could provide most of the training costs for its franchisees. The Supreme Court soon will decide whether to take up this case.

Author’s note: Steve Salop is Professor of Economics and Law Emeritus, Georgetown University Law Center and Senior Consultant, Charles River Associates. He would like to thank A. Douglas Melamed and Eric Posner for helpful comments and suggestions.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.