In new research, Taylor Begley, Peter Haslag, and Daniel Weagley find that when firms begin sharing a common director, there is a significant reduction in the number of employees that switch jobs between the two companies. The reduction is largest when the firms compete in the same labor market and for those employees who are most costly for firms to replace. The results show the link between overlapping board members and anticompetitive labor practices is a surprisingly widespread phenomenon.

The average public firm shares the members on its board of directors with multiple other firms, in what is called “interlocking directorates,” despite a recent crackdown on the practice by the Federal Trade Commission and Department of Justice. Two firms sharing a common board member provides an avenue for information sharing and coordination that has costs and benefits for the two connected firms. One way firms can take advantage of their connections is to collude by forming anti-poach agreements to avoid competing for employees, thus reducing turnover and suppressing workers’ wages. An enlightening example of anti-poaching agreements occurred in the late 2000s, when eight prominent tech firms—including Google, Apple, Intuit, and LucasFilms—were investigated by the DOJ for enforcing anti-poaching agreements that stifled worker mobility. The seven publicly listed firms in the group shared several directors, and all eight settled an ensuing lawsuit for $415 million and additional fines.

Recently, the DOJ has taken a greater interest in the competition for valued employees. Last year, the DOJ and the U.S. Department of Labor signed a memorandum of understanding to protect workers from collusive behavior and ensure competitive labor markets that afford sufficient labor mobility. An emerging stream of research has begun to unpack the competitive effects of shared directorship on product market choices, yet we know very little on how these connections affect labor market competition.

In a recent paper, we ask if overlapping directors leads to a restriction in labor mobility due to collusive behaviors, particularly formal or informal policies not to poach or hire from each other’s firms. Using resume data for over 45 million workers in the United States, we find that the number of employees transitioning jobs between a pair of publicly traded firms drops by around 20% after the firms begin sharing a director. The effect is sudden and persistent, with no indication that the flow of employees between firms, or changes in the firms’ product market strategies, precede this drop.

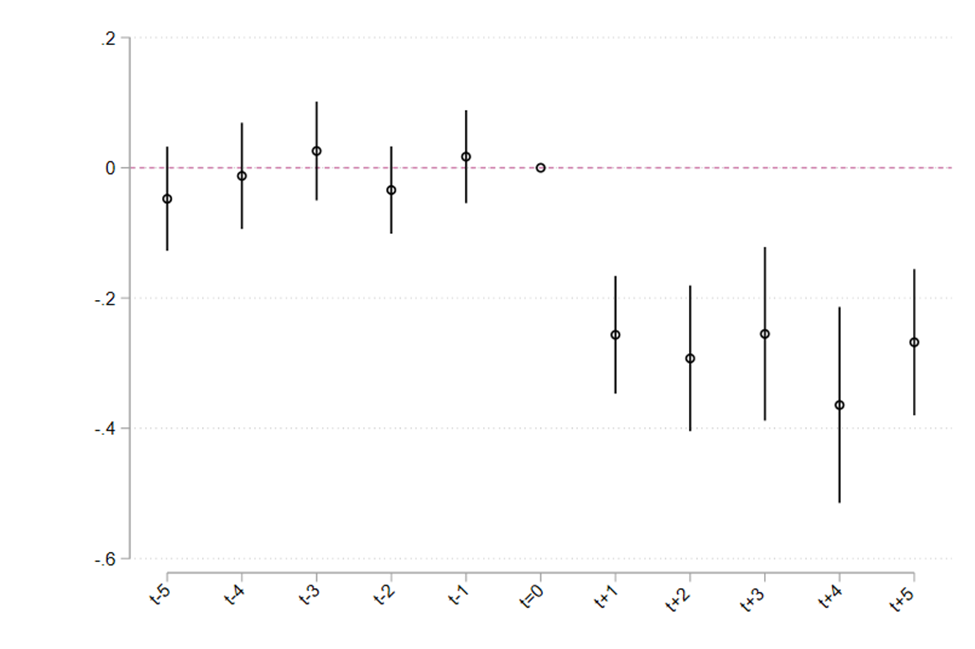

Figure 1: Dynamic Effect of Board Overlap Relative to Board Connection

Our detailed data and empirical methodology allow us to isolate the effect of board overlap while controlling for changes in personnel decisions at both the employees’ origin and destination firms and for the typical, baseline movement of employees between firms during the sample. In other words, our statistical analysis accounts for origin firm-year effects (e.g. capturing Apple employees’ proclivity to leave in 2006), destination firm-year effects (e.g. capturing Adobe’s overall hiring strategy in 2006), and firm-pair effects (e.g., capturing the average employee flows from Apple to Adobe). Therefore, to affect our interpretation, there must be a time-varying change that occurs exactly as board overlap is initiated and presents a sudden shift in hiring practices.

We also find the drop in the movement of employees between firms is strongest where firm pairs are most likely to benefit from lower competition for each other’s employees: firms that have similar workforces, are located near each other, operate in the same product market, and which have a history of losing substantial numbers of employees to one another. The effect is also strongest for higher-skilled employees who are more costly to replace and are most important to the success of the firm.

How might sharing a director lead to greater labor market coordination? As we saw from the tech-firm collusion scandal, directors may use anti-poaching agreements explicitly. Even though such explicit behavior is illegal in most circumstances, there are other methods through which firms can coordinate that can be facilitated through a shared director. For instance, unilateral agreements are a legal way to reduce the likelihood of competition for labor. As pointed out by Michael Lindsay and Katherine Santon, an employer can legally maintain its own “do not call” list to avoid bidding wars within its industry or the broader labor market.

To determine if the connected firms are utilizing their shared connection to limit employee flows or if an alternative factor explains changes in employee flows, we examine how the relationship between board overlap and employee flows differs based on the firms’ ability to retain their employees through other means. In particular, we examine whether the documented relationship depends on the level of enforcement of non-compete agreements in the firms’ headquarters state. There’s notable variation in how states enforce these agreements. We hypothesize that firms will be more likely to exploit their board overlap connection when they cannot write enforceable non-compete agreements with their employees. If they could, they would not need to suppress employee movement through implicit or explicit non-poach agreements, reducing the explanatory power of board overlap. Indeed, we find the effect of board overlap is more pronounced when the connected firms are in states with less stringent enforcement of non-compete arrangements.

In other tests, we find that our results cannot be explained by coincidental changes such as shifts in product market strategy or the types of employees the firms are hiring, as we do not find evidence of such shifts when the boards of companies begin to overlap. Overall, the results suggest that shared directors facilitate collusive behavior in the labor market.

Our final analysis explores the impact of board overlap on overall employee turnover rates at the interconnected firms. We find that firms sharing a director with a labor market rival experiences 1-2% relatively lower turnover rates. This underscores the firm’s incentive to engage in such policies. This reduction in overall labor mobility may also adversely affect employee outcomes in the long run.

Our results show that shortly after firms begin to share at least one director, there is a sharp decline in the flow of employees between the connected firms. Supporting evidence shows that the decline is greatest for firms with the most to gain from collusion. This analysis provides evidence that the recent enforcement of Section 8 of the Clayton Act is likely to help facilitate greater labor mobility. It also justifies the role of antitrust enforcement in the labor realm.

This article draws from a September 5 blog post featured on Columbia Blue Sky Law Blog.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.