In this second article on real estate in the current high-interest-rate environment (see here for the first article), Joseph L. Pagliari Jr. explores banks’ exposure to commercial real estate, who might help fill the credit void as bank funding dries up, how the work-from-home phenomenon impacts commercial real estate prices, particularly the office sector, and what risks large urban centers face with emptied office buildings.

This second article on real estate in the current high-interest-rate environment (see here for the first article) takes a granular look at particular issues facing certain commercial real estate (CRE) assets. These include banks’ exposure to CRE loans and the risk of bank failure due to default, the possibility that the private (non-bank, private equity) debt market rescues certain CRE lenders, the work-from-home phenomenon’s contribution to CRE prices, and the risks empty office space pose to large urban areas (or “doom loop”).

The Banks’ Exposure to Commercial Real Estate

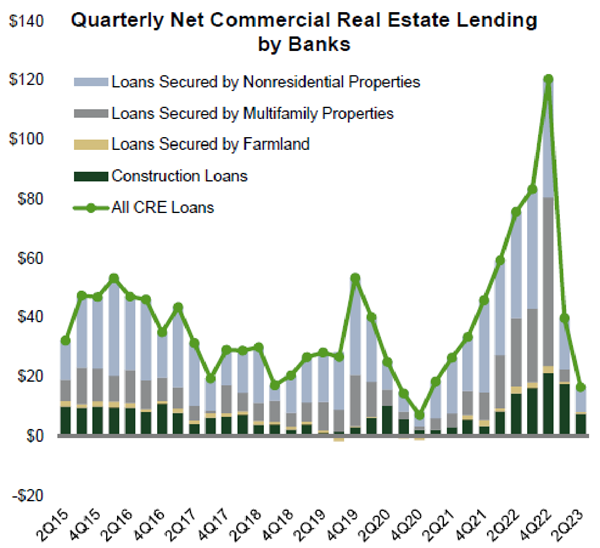

Earlier this year, the Federal Reserve released its 2023 stress testing scenarios, used to gauge the ability of 23 large banks to withstand both baseline and severely adverse economic outcomes. While the Fed’s baseline projection forecasts that commercial property values will rise by 3%, their “severely adverse” projection forecasts that commercial property values will fall nearly 40% – with most of the damage concentrated in offices, business-oriented hotels, shopping malls, and strip malls. Much of the banks’ risk emanates from borrowers unable to refinance maturing balances without injecting fresh equity. Given falling property values and tighter loan underwriting, some borrowers will be unable to refinance the current loan balance. For those borrowers still with positive equity, they contribute fresh capital (a “cash-in refi”) or simply sell the property. For those borrowers with negative equity, the likely decision will be to default (“hand back the keys”). Clearly, it is this latter cohort that most concerns the banks..

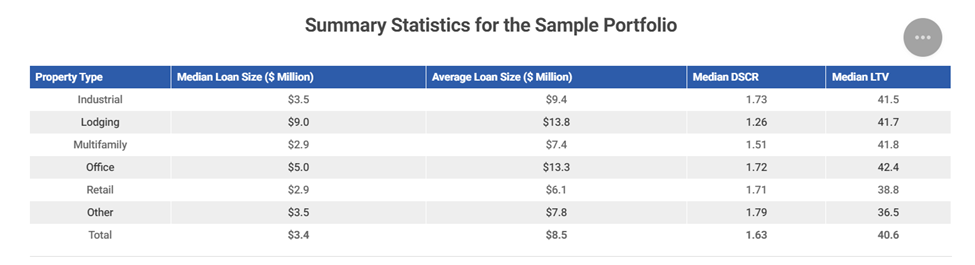

Trepp, a provider of analytics to the commercial real estate lending market, used these two Fed forecasts and integrated them into their database to estimate the banks’ ability to withstand both the baseline and severely adverse economic outcomes in the current calendar year.

As the table above shows, Trepp estimates that the banks’ overall expected losses according to the Fed’s baseline projection is fairly benign: 0.7%. However, there is substantial variation by property type – with the lodging sector expected to fare the worst (a 2.6% expected loss), while the other main property sectors are expected to experience losses of less than 1%. Additionally, the more recently underwritten loans (i.e., the newer vintages) are expected to perform better than older loans. The last two columns reflect the Fed’s “severely adverse” projection; unsurprisingly, and as one can tell, the expected losses jump dramatically under these scenarios.

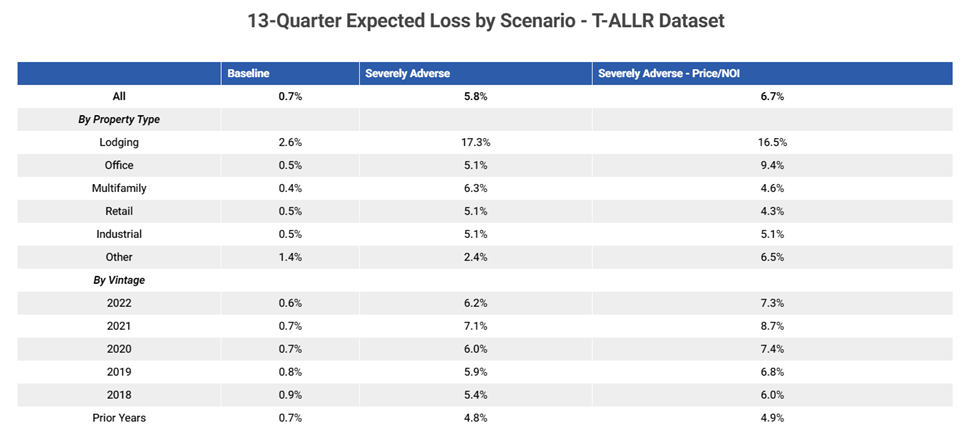

Another important element when attempting to understand the banks’ exposure to commercial real estate is to consider loan originations by property type. As shown in the graphic below, multifamily loans dominate CRE bank lending. Lodging, though forecasted to be the most problematic property type, represents a fairly small percentage of overall bank lending on CRE assets.

Consequently, it is not surprising that the Fed concluded in its 2023 stress test that all 23 large banks subject to the test “have sufficient capital to absorb more than $540 billion in losses and continue lending to households and businesses under stressful conditions.”

Of course, the usual caveats about forecasts should be considered here, including that these are largely by the same people who initially insisted that an increase in the inflation rate was to be considered “transitory.”

Private Equity to the Rescue?

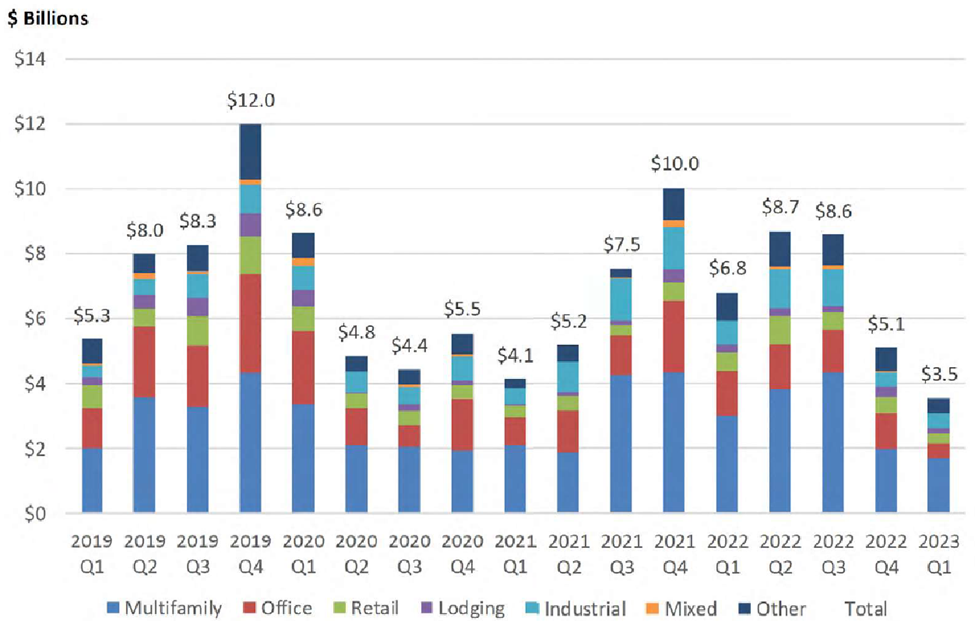

At the moment, bank lending on CRE projects is well below its average, which increases the risk that borrowers default on existing loans:

So, who is to make up the slack? As of August, Green Street, a research firm, identifies 70 private-market high-yield (HY) real estate debt or credit funds currently in the marketplace looking to raise nearly $81.3 billion to refinance mortgage loans. Of this amount, more than $42.5 billion has been raised – but only $16.1 billion has been invested so far (there are also 41 publicly traded mortgage REITs, but most of their balance sheets are already committed to previous mortgage loans). Despite that rather “chilly” year for fundraising so far, let’s assume that $80 billion is eventually raised (ignoring the possibility of new CRE funds on the horizon). And, let’s further assume that – on average – these HY funds provide 15% of a particular property’s capital stack. Then, there is in excess of $500 billion of potential CRE loan re-financings. As a general comment, the investment managers of these new HY debt funds optimistically view the upcoming environment; one in which these funds work with banks (and other lenders) to refinance existing CRE loans. These managers envision an environment in which property values have fallen significantly, thereby providing some level of downside protection, widening spreads vis-à-vis the duration-matched risk-free rate, and improving the strength of loan covenants.

To provide some concreteness, let’s consider two cases: a) a first-mortgage loan had initially underwritten a particular loan at a 70% loan-to-value (LTV) ratio, and b) a first-mortgage loan had initially underwritten at a 60% LTV ratio. Then and in both cases, consider current market conditions in which property values have fallen 40%. In addition, lending/underwriting standards tighten such that first-mortgage lenders are now unwilling to provide more than a 65% LTV loan.

In this first example, the aggressive (initial) first-mortgage lender is now “underwater” to the tune of 10% of the project’s initial value (i.e., a first-mortgage loan with, say, a $70 million book value is secured by a property which is now worth $60 million). The current lender presumably forecloses on the defaulting borrower and then sells the asset for $60 million (ignoring transaction costs and ongoing cash-flow considerations) and books a $10 million loss.

In this second example, the conservative (initial) first-mortgage lender has a loan on its books equal to the property’s current value. Assuming that the (non-recourse) borrower transfers the deed to the lender, the current lender sells the asset for $60 million (again, ignoring transaction costs and ongoing cash-flow considerations) and books neither a gain nor a loss. The new owner borrows a $39 million first-mortgage loan, secures $9 million in mezzanine debt, and supplies $12 million in equity. Given a CRE world which generally favors high financial leverage, the HY debt is the lubricant that makes the wheel go round.

While the HY lenders are clearly unwilling to finance inflated CRE valuations, their existence helps place a floor on CRE prices – thereby helping to avoid the contagion effects seen during the 2007-8 global financial crisis.

The Work-from-Home Phenomenon and the “Doom Loop”

The emergence of the COVID pandemic in early 2020 led many employers to engage in a massive experiment with a large swath of their employees working from home for extended periods of time, primarily those employees loosely part of the “laptop community.” Absent the pandemic as well as certain evolving technologies, it seems quite unlikely that such a massive experiment would have taken place. The impacts – while still unfolding – have been profound.

From the standpoint of commercial real estate, the office sector has been the most adversely affected by the work-from-home (WFH) phenomenon. (While the hotel sector was the property type most immediately harmed by the pandemic, many of the non-urban/non-business hotels have fully recovered.) Initially, there were concerns about whether certain employers (the airline and lodging companies were prominent examples) would have their business models so adversely affected by the pandemic that they could not meet their lease (and other financial) obligations. In many instances, the federal government intervened (e.g., the Paycheck Protection Program (PPP)) to avert a cascade of financial defaults. Yet, as the pandemic subsided and the markets recovered, many employees found themselves preferring to work from home for much of the workweek and, in turn, employers found themselves with excess office space (Multiple sources suggest that office occupancy was about 50% as of spring 2023). The financial consequences of lowered demand for office space are still playing out – everything from the conversion of office space to residential units to corporate announcements of return-to-work policies (with varying conditions/mandates). This is not to suggest that the office sector is fading away, but does suggest that it has permanently changed (and not necessarily for the better from the perspectives of investors and lenders holding these investments in their portfolios; one 2022 study found that office values might be 39% lower than their 2019 levels in the long run).

The fall in office values is part of a larger concern in which major urban markets enter a vicious downward cycle – also dubbed the “doom loop” – in which falling office usage leads to declining numbers of office workers commuting to (or living in) these urban centers; in turn, this underutilization of office space leads to a wave of negative externalities. The earlier-discussed fall in the valuations of office buildings inevitably leads to increases in property taxes for other types of real estate and/or decreases in government-provided services (e.g., police, fire, education, infrastructure, etc.). For example, commercial properties currently pay more than 35% of all property taxes in the city of Chicago. If commercial property values fall by half (and the residential values remain unchanged), the residential property owners face an approximately 20% increase in their property taxes. (Perhaps a more likely political reality is that residential property owners face both significant increases in their property taxes and significant decreases in government-provided services.)

Continuing the doom loop, fewer workers in their respective office buildings leads to less retail (including food-and-beverage facilities) demand – not only also lowering these property values but also reducing the accompanying sales taxes. The downward spiral extends to ridership on local forms of public transportation (a substantive decline in revenue combined with the heavy fixed costs of providing such services contributes to a particularly vexing problem). The former vibrancy of these urban centers is further hollowed out by less pedestrian traffic, which then heightens crime and public disorder (thereby increasing the costs to business owners and to local police budgets). It is not difficult to understand why many residents (particularly those shouldering a large share of the tax burden) have already decided to relocate. And so, in theory, the maladies mount. The solutions (which politicians often demagogue until too late) to this vicious cycle include painful choices: raising taxes (of all sorts), cutting services and/or declaring bankruptcy.

Concluding Remarks

Like the old military adage about generals fighting the last war, maybe the fear about a bank contagion is overblown, or the vicious cycle facing certain major urban areas is the next “war.” This vicious cycle presents a knotty problem. Should the worst effects of the doom loop be realized, proposed solutions will likely fall along political lines. In the one camp, a federal government bailout of certain financially troubled state and local governments will likely be opposed because it: a) imposes costs on other taxpayers who had no role in the profligate ways of troubled state and local governments, and b) leads to future moral hazard problems – thereby exacerbating subsequent financial problems. Supporters of this viewpoint may point out that the spendthrift ways of those state and local entities in dire financial troubles existed well in advance of the COVID pandemic. In the other camp, a federal government bailout of certain financially troubled state and local governments will likely be supported because it: a) avoids imposing costs on “innocent” public-sector works (e.g., police officers, firefighters, teachers, etc.), and b) follows the precedent created in other settings (e.g., perhaps most notably: the federal bailout of certain banks and automotive companies during 2007-08). Should the federal government ultimately bailout certain financially troubled state and local governments leads to the follow-on consideration: what if any restrictions (e.g., mandated taxation levels, spending cuts, etc.) ought to be imposed on the governmental entities? Supporters of this viewpoint may likely point out that COVID pandemic created a nearly unprecedented hardship on urban America. It is not difficult to imagine that these thorny problems will further the political divide, perhaps even leading to inconsistent treatment as evolving state and local financial difficulties surface as the levers of federal power swing back and forth between the two major political parties over the election cycles.

A more optimistic perspective notes that not all cities face the same risk of the doom loop. For those cities that do face heightened risks, some companies will require employees to return to the office, there is the possibility of converting some office space into residential apartments or other uses (though this avenue seems limited), and new tax and other incentives may draw new businesses or more resilient amenities (such as universities) to their city centers. Markets are resilient, and the urban core is an important part of the national fabric. As a case in point with regard to resiliency, New York City was on the verge of bankruptcy in the 1970s; then, a variety of civic and business leaders coalesced to both reform New York’s fiscal problems and restore its image across the country (and around the globe). However, such resiliency is not guaranteed; consider the collapse of “Detroit muscle.”

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.