Startups are a major driver of innovation, but many startups are acquired by large incumbents. Do these acquisitions stifle innovation or promote it? While the prospect of an acquisition might generate incentives for entrepreneurs to create more new businesses, some incumbents might acquire startups only to subsequently drop their innovative ideas. The authors explore the positive and negative effects of startup acquisitions on innovation and growth and find that negative effects slightly dominate. This article first appeared on VoxEU

Startups are drivers of economic activity. They are responsible for a large share of new jobs and make an important contribution to aggregate productivity growth. Understanding the behavior of startups is therefore key to designing policies that seek to boost macroeconomic performance.

Individually, startups have an uncertain fate. While some grow to become large and successful companies, many end up transferring their operations to older incumbents through an acquisition. In recent years, such acquisitions have attracted the attention of media and policymakers alike. This is especially true in the tech sector, a highly concentrated industry in which, according to the U.S. Federal Trade Commission, the giants Alphabet, Amazon, Apple, Meta, and Microsoft acquired more than 600 small firms between 2010 and 2019. Both the FTC and the Department of Justice have announced inquiries and filed lawsuits against some of these high-profile acquisitions, and the U.S. Congress is debating legislation to prohibit acquisitions by certain large technology platforms.

While such actions are often motivated by concerns about market power, regulators are also increasingly nervous about the effects of acquisitions on innovation. Recent studies support these concerns. For instance, in the pharmaceutical industry, research has shown that some acquirers drop their target’s research projects that overlap with their own. These “killer acquisitions” might well have a negative impact on aggregate innovation.

However, acquisitions might also have some positive effects. Many industry lobbyists argue, for example, that the prospect of an acquisition is an attractive exit strategy for entrepreneurs. If so, this incentive might promote startup activity and lead to more new ideas being created.

To determine the overall effects of startup acquisitions, policymakers need to consider the net balance of these forces. Our recent paper aims to shed some light on this. We develop a new dynamic macroeconomic model of economic growth with heterogeneous firms and startup acquisitions and discipline it with microdata. We then use this model to quantify the effects of various policies limiting startup acquisitions on aggregate innovation, economic growth, and welfare.

The channels of startup acquisitions on growth

In our model, a change in policy regarding startup acquisitions affects innovation and growth through three margins: (i) changes in the startup rate, (ii) changes in the percentage of startup ideas that are implemented, and (iii) changes in the own innovation rate of incumbents. What drives these three margins?

- First, limits to acquisitions decrease the rate of startup creation, as they remove the lucrative possibility of selling a promising idea and receiving some of the incumbent’s rents as compensation.

- Second, the lower startup rate increases the value of being an incumbent firm. Indeed, with fewer startups around, the incumbent is less likely to see its business threatened or to be forced to do a costly acquisition. This increase in their value incentivises incumbents to innovate more on their own.

- Finally, acquisitions have an effect on the implementation of startup ideas. On the one hand, incumbents may be more efficient users of ideas than startups, e.g. because they have more experience or more customer capital, or they can benefit from network effects. On the other hand, once an acquisition takes place, incumbents might kill the startup’s idea. Thus, the overall effect of acquisitions on the implementation of startup ideas is unclear.

We seek to quantitatively assess the relative importance of these three forces.

The effect of acquisitions on patent citations in the US

We use data on startup acquisitions and startup innovation in the U.S. to calibrate our model (relying on the work of Guzman and Stern (2020) and other sources). For instance, we match the fact that 4% of innovative startups get acquired within six years of their creation. We also match our evidence on the effect of acquisitions on idea implementation, using data on startup acquisitions and patents.

To measure implementation, we track the evolution of citations to existing patents after an acquisition. We interpret an increase in the citations of an acquired patent as evidence for the patent being further developed and built upon and a decrease as evidence for the patent being shelved.

Comparing patents belonging to acquired and non-acquired startups (but otherwise sharing the same observable characteristics), we find that, on average, acquired patents experience a 22% increase in citations after the acquisition. In our model framework, this suggests that incumbents have a technological advantage in implementing startup ideas which outweighs their incentives for killing them. The boost to citations is lower if the acquirer has a high market share, or if the acquirer and the startup belong to the same industry.

Lessons from policy experiments

With these patterns in mind, we conduct a series of experiments to assess the effects of policies that limit startup acquisitions on innovation and aggregate productivity growth.

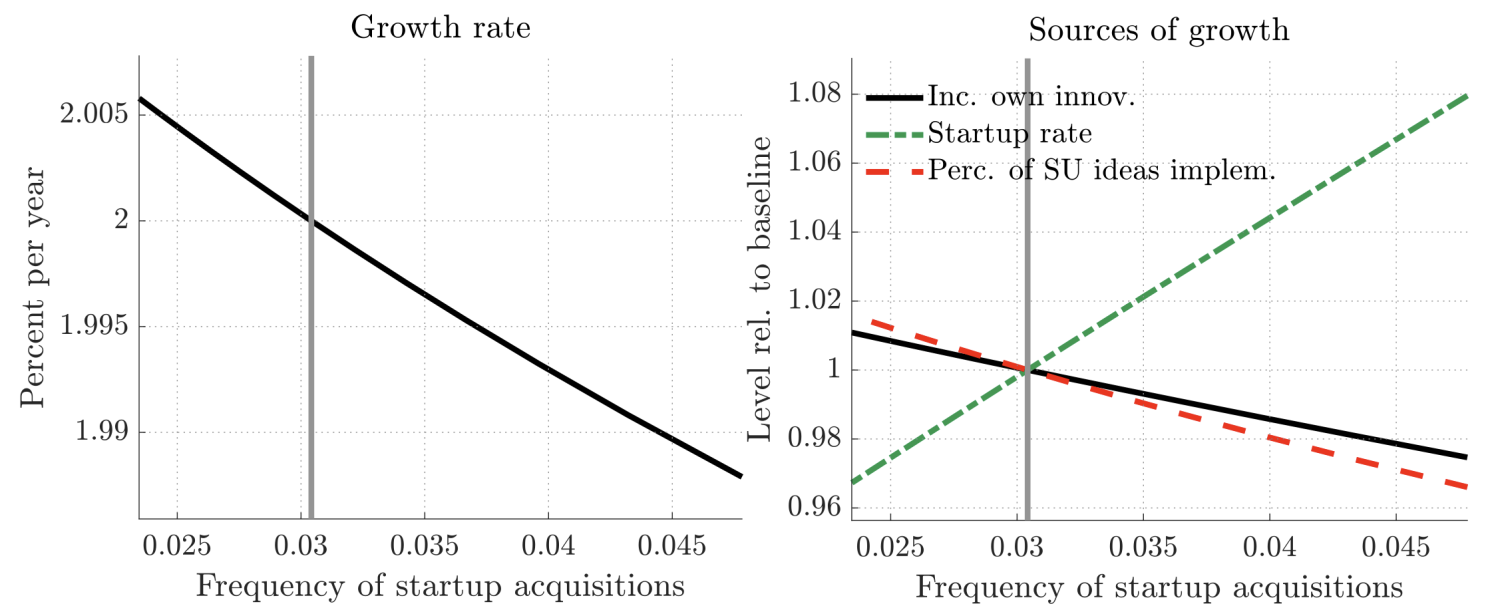

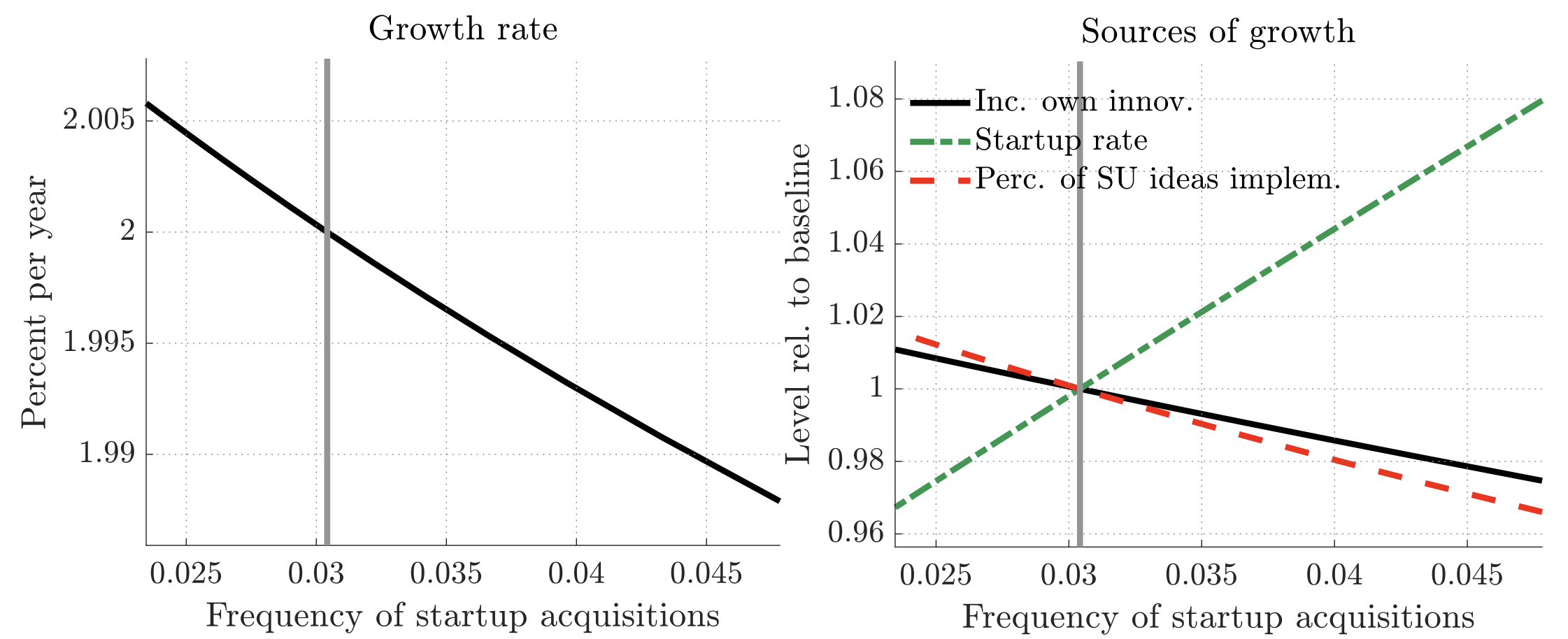

Figure 1 Effect of limiting startup acquisitions on innovation and aggregate productivity growth

To interpret our results, we consider the three margins listed above. In line with our intuitions, when startup acquisitions are limited, the startup rate falls (by up to 15%) as entrepreneurs are less motivated to create new businesses that can be later sold off. However, as incumbents face a lower likelihood of their rents being destroyed or shared with a startup, they innovate more on their own (by up to 5%).

Though the marginal effect of acquisitions on the share of startup ideas that are implemented is positive, the increase in incumbent value from limiting acquisitions leads, in general equilibrium, to an increase in the share of startup ideas that are implemented (by up to 8%). Ultimately, this last effect, and most of all the increase in incumbents’ own innovation, outweigh the decrease in the startup rate.

On the net, we find that limiting acquisitions would lead to an increase in the rate of economic growth by up to 0.03 percentage points per year, from 2% up to 2.03%. The model also suggests that the policy increases welfare by up to 1.6% in consumption-equivalent terms.

Conclusions

Our results suggest that in the U.S., the positive innovation effects of limiting startup acquisitions might outweigh the downsides of such a policy. However, our analysis also shows that the net effect of acquisitions depends on the context. In particular, in circumstances or industries where incumbents have very strong implementation advantages, a low ability to come up with their own ideas, or high bargaining power, limiting acquisitions is less beneficial. Ultimately, policymakers and antitrust authorities will need to assess the specificities of individual cases or markets. Our study can hopefully provide a roadmap for this complicated task and provide a first idea of the quantitative magnitude of the different forces at play.

This article originally appeared on VoxEU. The ProMarket version has been slightly edited for style.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.