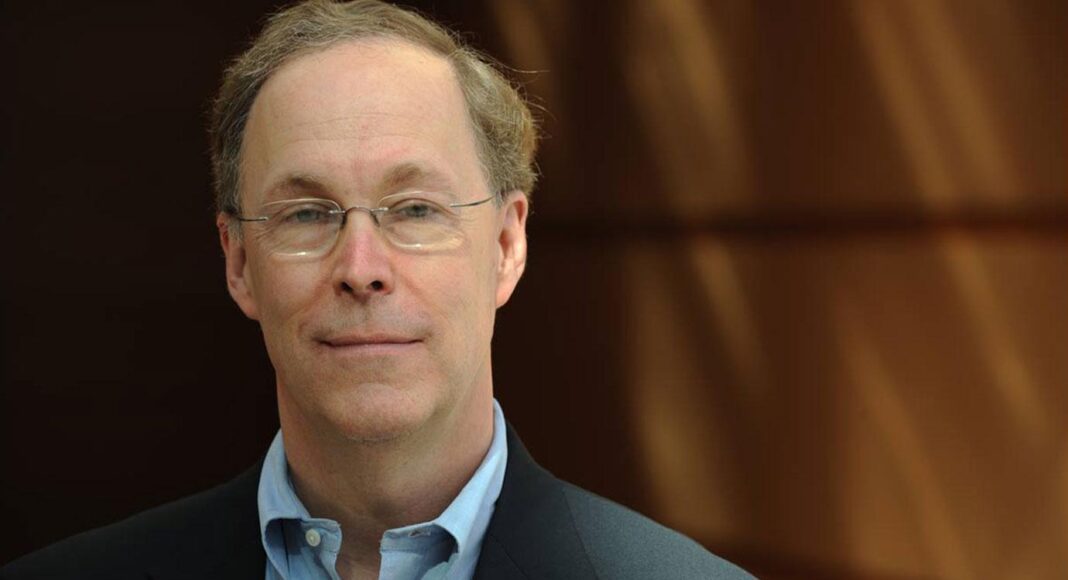

Raghuram Rajan writes about the insights of Nobel winner Douglas Diamond’s research, as well as his relationship with Doug as a colleague.

It is fitting that the Nobel Committee recognized Douglas Diamond, along with his co-author, Philip Dybvig, as well as Ben Bernanke, for the 2022 Nobel Prize in Economics. In many ways, Doug is the father of modern banking theory. His 1983 work with Philip Dybvig explains how the important value banks provide –allowing investors to benefit from the high returns from long-term investing while allowing those who need liquidity to withdraw their money without experiencing large losses — also exposes banks to depositor runs. Put differently, bank fragility comes from the function banks perform. You cannot get one without the other.

Similarly, his 1984 paper on delegated monitoring explains how diversified banks save on the costs of monitoring firms. Essentially, instead of savers each having to incur costs of monitoring borrowing firms, the bank does it for them. But that leads to an obvious question. Who monitors the monitor? Doug’s answer is simple but illuminating. Because the bank diversifies lending across a lot of borrowers, the bank’s returns are more predictably smooth than the return for any individual borrower. As a result, the bank can issue debt to savers, which they do not need to monitor. Under most circumstances, the bank will make debt repayments, under very rare circumstances, it will default, but since the penalties associated with default are so high, it will never do so willfully. Overall, the bank is an institution that saves on transaction costs, explaining why its form has survived across millennia.

“For me, Doug embodies the ideal university professor, and he has been a mentor and a friend since the day I interviewed with him (and Rob Vishny) for a position at Chicago.”

The insights in these papers are deep, and a few generations of researchers (including me) have spent careers writing papers that build on them. The papers have also influenced policy makers – Ben Bernanke, a fellow laureate, later said that Diamond-Dybvig was required reading as the Fed grappled with the financial crisis in 2007-2009.

I have known Doug since I joined Chicago in 1991. He is one of the smartest people I know (I say “one of” to avoid upsetting anyone). He is incredibly quick in understanding ideas and getting their essence. But unlike many academics with that kind of capability, he is also very modest and extremely kind. He is generous with his time, as verified by the legions of Ph.D. students he has had, and who remember their time with him fondly. Doug has a wicked sense of humor, delivering zingers in seminars and faculty lunches with a deadpan expression, but never at anyone’s expense. His colleagues also know him as the person who knows everything that is worth knowing, ranging from obscure papers on arcane subjects to which laptops one should order, and which credit cards offer the best deals.

For me, Doug embodies the ideal university professor, and he has been a mentor and a friend since the day I interviewed with him (and Rob Vishny) for a position at Chicago. The Nobel Prize is, of course, richly deserved because of the intellectual and practical influence his work has had. It also could not have gone to a better person.