On their store shelves, Walmart has its own products under the “Great Value” brand, and Tesco has its own “Everyday Value” products. Is Amazon any different when it offers its “AmazonBasics” products on its marketplace?

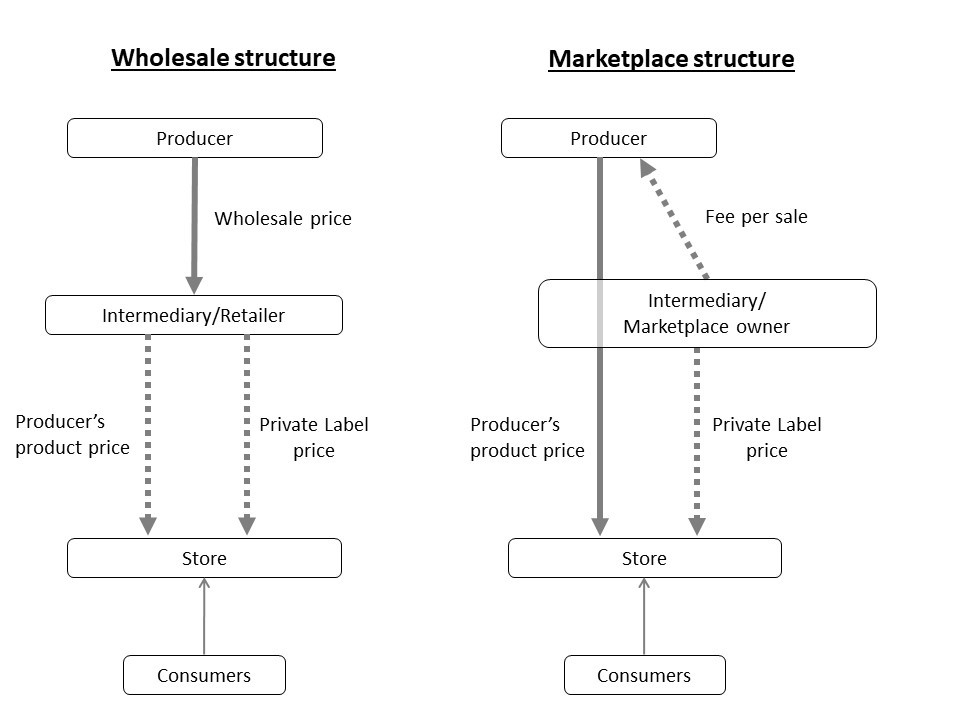

Private labels such as these have been a part of brick-and-mortar retailers’ business strategy for decades. A private label is a product owned and controlled by a distribution intermediary, typically a lower-quality version of an outside manufacturer’s product, aimed at consumers with lower willingness to pay. In the classic wholesale vertical structure used by these retailers, a manufacturer sells its product at a wholesale price to the intermediary/retailer, who then resells to consumers. There is wide theoretical and empirical literature studying the effects of private labels within this traditional structure. Studies show that introducing a lower-quality private label improves the retailer’s profits not only because of the new revenue channel, but also because the retailer can now offer an alternative to the manufacturer’s product. This motivates the manufacturer to decrease its wholesale price, allowing the retailer to reduce the price for the higher-quality product in the store. Consumers are better off thanks to both the lower price of the higher-quality product and the increased variety.

Online marketplaces like Amazon have a different vertical organization. There, a manufacturer can sell directly to consumers through the marketplace, keeping control over the price that consumers pay. As an intermediary providing the platform on which this trade happens, Amazon charges and collects fees from those sales. When Amazon introduces a private label on the marketplace, it competes directly with the manufacturer for the demand of consumers. How does this different vertical organization matter for consumers, manufacturers, and intermediaries?

“While in the wholesale structure the intermediary acts as multi-product monopolist and determines end-consumer prices for all consumers, in the marketplace structure the intermediary competes in prices against the manufacturer.”

Regulation authorities in both the US and EU have raised policy-relevant concerns when a large dominant marketplace operator offers a private label through its own marketplace. For instance, Amazon in 2021 held around 41.4 percent of all US e-commerce sales, and a survey estimated that 26 percent of its active third-party sellers relied on Amazon as their only source of income. When, in addition to determining the cost of participating on its marketplace, the marketplace operator introduces a product that competes with the offering of a manufacturer, this creates a certain conflict of interest: The marketplace owner may have an incentive to distort competition to make it harder for the manufacturer to compete. In a more extreme case it could lead to exclusion from the marketplace. Such an outcome can be especially concerning when the manufacturer affected is a new seller that brings an innovative product to the market.

In my paper “Private Labels in Marketplaces,” I build a theoretical model to, first, analyze the differences between the two structures in the presence of a private label; and second, address the policy question regarding competition. I do this by assuming a natural setting where consumers differ in how much they value quality, with some willing to pay more than others. I focus on one manufacturer who uses the services of an intermediary to reach customers, while the intermediary introduces a lower-quality private label. With this simple setting I compare the outcomes for prices, consumers, and firms.

In the absence of a private label, the two vertical structures have been thoroughly compared and summarized in the literature. In both structures, there is one firm on each level of the vertical chain who chooses the markup to charge over its costs, resulting in so called double-marginalization. The outcome is extra high prices for consumers and low demand for the manufacturer’s product, as consumers with lower willingness to pay prefer not to buy. In the wholesale structure, the manufacturer sets the wholesale price at which it sells its product to the intermediary, while the intermediary collects its margin by determining the end-consumer price. In the marketplace structure, the intermediary collects its margin by charging a per-sale fee, and the manufacturer sets the end-consumer price. The only difference between the two is that the intermediary (manufacturer) collects a higher share of total industry profits in the marketplace (wholesale) structure.

The wholesale and marketplace structures diverge, however, after the introduction of a private label. While in the wholesale structure the intermediary acts as multi-product monopolist and determines end-consumer prices for all consumers, in the marketplace structure the intermediary competes in prices against the manufacturer.

When a brick-and-mortar intermediary introduces a lower-quality private label, it takes into account the competition arising between itself and the manufacturer. As a multi-product monopolist, it sets the monopoly price for its private label as if it were the only product offered in the market. This price, due to the product’s lower quality and lack of double-marginalization, is lower than the price it sets for the manufacturer’s product. When some consumers switch to the private label, the manufacturer’s best option is to decrease the wholesale price of its product—and so decrease the price the intermediary sets for it—in order to retain some of the sales.

When a marketplace owner introduces a lower-quality private label, it competes in prices with the manufacturer for consumers. Thus, one might expect more competition and lower prices than in the wholesale structure. However, this is not necessarily the case. The manufacturer decreases its price in response to the new competing product. The intermediary sets a markup for its own product, but faces a so-called opportunity cost—each sale that its private label steals away from the manufacturer is a fee revenue lost. Because the fee is a direct cost for the manufacturer, it restricts how much the manufacturer can decrease its price. In order to protect revenues from the manufacturer’s sales, the marketplace owner has an additional incentive to increase the price of the private label, and may charge an even higher price than what a monopolist, or an intermediary in the wholesale structure, does.

When adjusting the fee after the introduction of the private label, the marketplace owner actually has a twofold incentive to decrease it. First, much like in the wholesale structure, some consumers switch to the lower-quality product, decreasing the possibility to extract profits. Second, there are now two separate firms competing in prices downstream, further limiting what the marketplace owner can extract. Still, the marketplace owner can always extract at least as much as it generates through its private label. However, because its product generates lower profits due to its lower quality, the final result is that the per-sale fee decreases.

In both structures, the intermediary could exclude the manufacturer from the market by making its own private label a perfect copy of the manufacturer’s product. However, the intermediary prefers to offer a lower-quality product and have both products in the market. In the marketplace setting, the incentives to differentiate the offer are stronger, resulting in even lower quality.

In reality, the fees on Amazon’s marketplace are more complex. The assumption about the per-unit fee is a simplification, but captures well the essence of a cost imposed on a seller. In practice, Amazon collects a variable ad-valorem fee—a percentage share of the final price that consumers pay. This share is a de facto cost to the manufacturer, but varies in its absolute amount when the manufacturer changes its price. Thus, when the manufacturer decreases its price in response to the private label, it also decreases the revenues of the marketplace operator, who then increases the percentage in order to recover some—but not all—of the lost revenue, resulting in lower extracted revenue per sale then before. The price of the private label is still higher, and the quality lower, than in the wholesale structure.

To sum up, a private label strategy in an online marketplace consists of a lower-quality product, which has a relatively higher price compared to a brick-and-mortar retailer operating in wholesale mode. Consumers always benefit from the increased variety. However, due to the higher price and lower quality in the marketplace structure, consumers are worse off compared to the wholesale structure. An interesting auxiliary result is that, under particular demand conditions in the market, even though for a given quality of the private label the manufacturer will enjoy higher profits in the wholesale structure, this result gets reversed after the intermediary chooses the quality—the manufacturer is actually better off in the marketplace setting.

When a marketplace operator like Amazon introduces a private label, due to its revenue interest in the original product, it has less incentive to promote its own product than a classic retailer like Walmart does, and it will not necessarily want to foreclose the manufacturer. In this sense, if Amazon is held accountable for its private labels, so must be all intermediaries. There have been allegations that Amazon has used third-party data in order to perfectly copy products of sellers selling through its marketplace. Still, some case studies reveal that, even though the products are similar, they have lower ratings than the original product, consistent with a classic private label strategy.

Disclosure: I want to thank the Austrian Science Foundation FWF for financial support under project FG6.

Read more about our disclosure policy here.