New research on the effectiveness of protests on government distributions provides insights into the political incentives of a country’s leadership and the resulting economic consequences.

In 2020, millions of people around the world watched footage of one of the most brutal recorded instances of police brutality in recent US history when an African-American man named George Floyd was killed after a white police officer knelt on his neck for multiple minutes during a routine arrest in Minneapolis. The brutality of the event and others like it directed toward Black citizens reignited a series of protests against racism and police brutality and for distributive justice under the Black Lives Matter (BLM) movement. More than 15 million people are estimated to have participated in the BLM protests in 2020 alone and the protests and others like it over the past decade, resulting in the 2010s period being labeled “the decade of protest.” These protests have had many stated goals over the years, but many of them have highlighted distributive justice claims, through, for instance, reparations to descendants of African slaves in the BLM movement, and the redistribution of economic capital in the 2011 Occupy Wall Street protests.

But as protesters turn out in the streets to demand that their governments and leaders do more to promote distributive justice, a key question remains: do protests matter at all for shifting government policy? And in particular, can protests actually lead to meaningful changes in government policy, especially around the redistribution of economic resources? This is a difficult empirical question to answer, partly due to both the complexity of fiscal systems around the world and the paucity of data on subnational public financing. In new research, we answer these questions using evidence from Nigeria, Africa’s most populous country and the 6th most populous country in the world by United Nations estimates.

Nigeria is an informative region to study the effects of protests on economic redistribution for four main reasons: First, the country’s highly centralized fiscal system allows us to study how governments might directly disburse fiscal resources in response to citizen-led protests. Second, not only is Nigeria’s fiscal system highly centralized, the vast majority, around 80 percent, of the federal government’s revenues come from oil receipts. This means the majority of revenues available to the federal government is more dependent on changes in the international price of crude oil and less dependent on internal tax collection from domestic residents. This gives the federal government even more leeway in determining how it uses these resources, being less directly sourced from citizens. Third, Nigeria has rich data on subnational financing that allows us to construct a new dataset from 26 years of archival records on public finance from 1988 to 2016, assembling data on revenues and expenditures, along with geocoded data on protests to test our hypotheses on the effects of protests on fiscal redistribution. Finally, Nigeria’s rich political history, including both autocracies and electoral rule, allows us to explore questions of whether or not autocratic governments respond differently from democratic governments to citizen-led protests.

To understand why governments may choose to respond to protests by redistributing fiscal resources, it’s useful to fix ideas with a simple conceptual framework, as follows. Why might a federal government leader care about protests? Protests serve as a threat to the federal government’s regime stability by signaling citizen discontent with the ruling government. This might then increase the risk of coups (under autocratic regimes) or reduce the probability of re-election (under democracy). Hence, we assume that a primary objective of the federal government leader faced with protests is to quell these protests. Now the federal government leader cannot do this alone- and needs the help of subnational/local government leaders to do this. Under a system where a federal government leader has full control of disbursement over centrally controlled revenues, they can use fiscal resources to incentivize these subnational (e.g., state level) government leaders to exert the effort needed to quell protests in their region. So, in other words, the federal government leader can choose to disburse more or less fiscal resources to state government leaders in areas with more protests, depending on the [perceived] expected level of the state government leader’s effort in quelling the protests. Politically aligned agents or state government leaders aligned with the federal government leader have more incentive to keep their person in office and will, presumably, exert more effort to quell protests in their region. In return, these politically aligned agents will receive a higher share of fiscal transfers from the federal government leader. The opposite occurs for non-aligned leaders. A key insight here is that the federal government leader’s goal is to quell the protests, regardless of the reason for the protest.

“Do protests lead to more fiscal redistribution? Yes, though the direction depends on the political alignment of the state government leader in the region protesting”

Do the predictions of this framework pan out in the data? As mentioned earlier, Nigeria provides an informative region to explore these issues particularly because of its centralized fiscal system where the federal government controls the disbursement of fiscal resources to state and local government entities. This system (known in the political economy literature as “fiscal federalism”) is not uncommon in the world and many countries around the world have similar revenue sharing schemes at a different level of government (a famous example is school financing in the US).

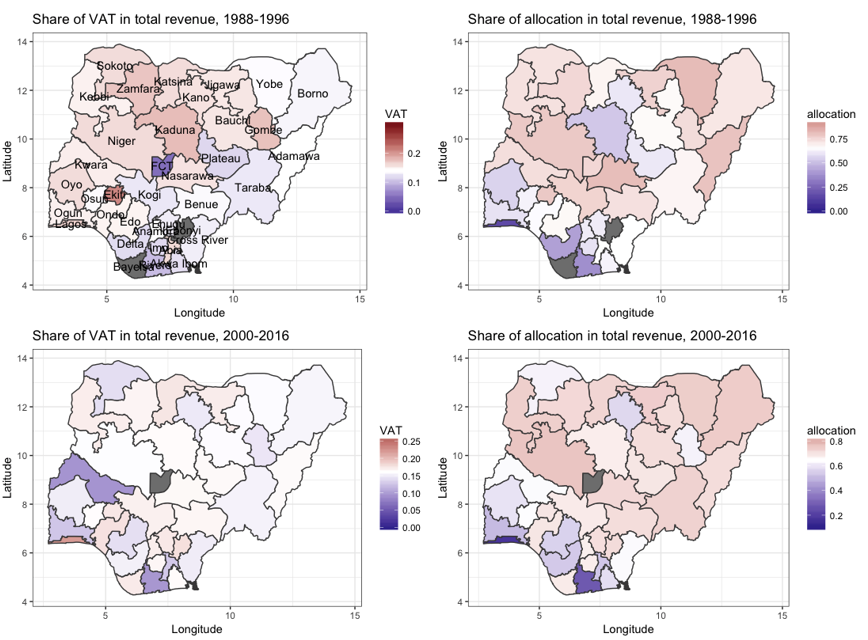

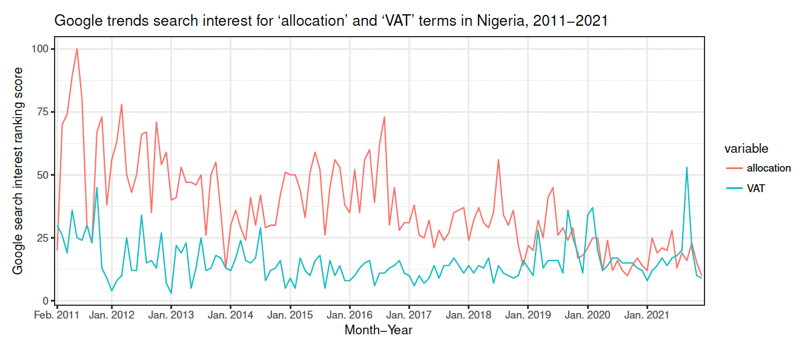

In Nigeria’s case, the country, comprised of a democratically elected federal government and 36 official states with a capital at Abuja, operates under this fiscal federalist system and has a longstanding revenue-sharing scheme. Following Nigeria’s discovery of oil in 1956, independence from British colony status in 1960 and a civil war from 1967 to 1970 partly over control of oil resources, the country experienced almost 3 decades of military rule from 1970 to 1999, followed by democratic governance after 1999. Under both regimes, revenue disbursement was and continues to be extremely centralized. Apart from a constitutional requirement that 13 percent of gross oil revenue be shared among oil-producing states in proportion to their production volumes, all revenues are remitted to the federal government. The remaining revenue is paid into a Federation Account. Included in the Federation Account are revenues from oil, corporate income taxes, custom and excise duties and, notably, VAT revenue from state governments under Nigeria’s highly centralized fiscal system. Given the significant share of revenues from oil in the Account, the gross amount in the Account fluctuates closely with plausibly exogenous changes in the export price of oil. Revenues are then shared by the federal government among the three levels of government according to a formula. While the formulas have changed slightly over the years, the basic components have remained relatively stable. Generally, the federal government gets the majority of revenues and then assigns revenues to state and local governments according to an allocation formula. Two principles—the population of states and the notion that each state should get an equal share account for between 70-100 percent of the share of revenues each state received between 1981 and 2016. State governments are heavily dependent on these federal government transfers for revenues, with total transfers from the federal government comprising 80 percent of state revenues on average over 1981-2016. The transfers received by states are divided into 2 parts, known as the Allocation transfer (the part coming directly from oil receipts, about 65 percent of transfers on average) and VAT transfer (the part from VAT remittances from states to the federal government, about 15 percent of transfers on average). In contrast internally generated revenues (e.g., from income taxes) account for a relatively small share of state revenues (at around 20 percent on average) as shown in Figure 1 below. While the formula is ostensibly known, in practice the components of the formula are opaque, and potentially subject to political manipulation by governments. The VAT transfers are particularly opaque as suggested in the Google Trends search rankings for “allocation” versus “VAT” terms in Nigeria between 2011 and 2021 shown in Figure 2. This lack of transparency allows us to examine how federal governments may use the transfer system to respond to protests within the country, despite the formula.

So how do federal governments use this fiscal transfer system to respond to protests in Nigeria and are the predictions of our framework actually borne out in the data? Nigeria has had numerous protests over the period of our data from 1988 to 2016. In the 1980s and 1990s, during military rule, one of the more famous or infamous protests were the “economic riots” of the Structural Adjustment Program (SAP) era where Nigerians and Africans across the region protested increased food prices and worsened economic conditions in light of programs from international financial institutions like the IMF and World Bank that mandated free-market policies as a condition for loans to African countries. The democratic period since 1999 has also seen a number of protests, with the 2012 Occupy Nigeria Street and the most recent 2020 End SARS protests against police brutality and economic conditions as the most recent ones. Many of the protests over the years have highlighted poor economic conditions, with labor union public sector workers protesting non-payment of salaries and poor work conditions and students protesting high tuition as some prominent actors in these protests. The responses to these protests from the Nigerian government have been, under both military and democratic rule, a mixture of concession/appeasement, generally in the form of economic transfers to protest leaders or retractions of policies, and repression through state-sponsored violence and security clampdowns.

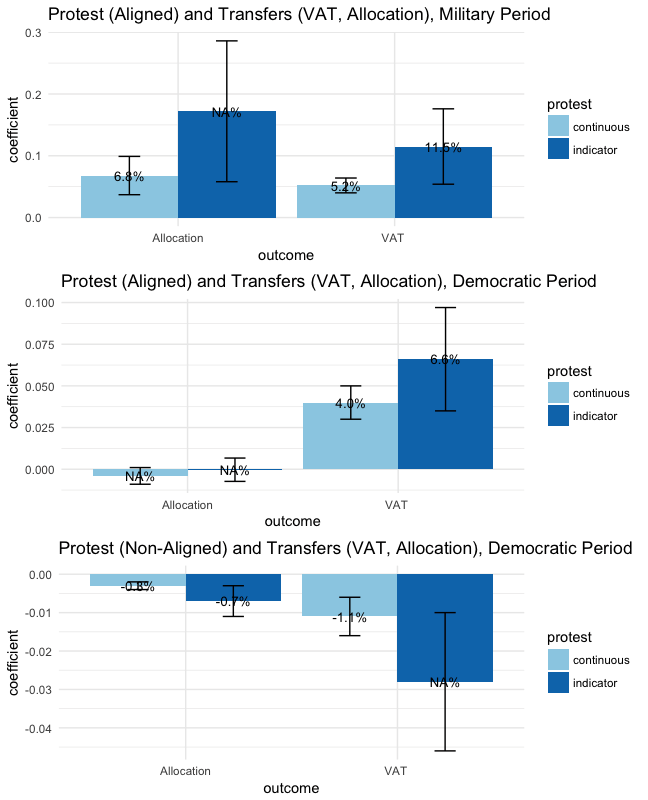

Do protests lead to more fiscal redistribution? Yes, though the direction depends on the political alignment of the state government leader in the region protesting, in line with our framework. We find that higher levels of protests in a state are associated with both increases and decreases in revenue transfers from federal governments to protesting states over the military and democratic periods. Over the military period, protests increase one transfer outcome, called VAT transfers, by between 5.2 percent and 11.5 percent, and increase a separate transfer outcome, called allocation transfers, by 6.8 percent. Over the democratic period, protests decrease allocation transfers by between 0.5 percent and 0.7 percent.

We explore political alignment, or whether the federal government leader or president and the state government leader or governor come from the same political party, as a channel that may explain the heterogeneity in the effects of protests on transfers following our conceptual framework. While there is no variation in alignment in the military period, due to all military state governors being direct political appointees and hence, by our definition, politically aligned with the president, we can examine results by alignment in the democratic period with the introduction of electoral politics. We find that protests increase VAT transfers in aligned areas by between 4 percent and 6.6 percent, but decrease VAT transfers by around 1 percent in non-aligned areas. The results on decreased allocation transfers in protesting states are almost entirely driven by protests in non-aligned states. We conduct a number of falsification tests on our results and show that there is no significant association between other conflict events and transfers. We also show that there is no association between protests and non-transfer revenue like internally generated revenue (IGR). Our results are summarized in Figure 3. Finally, given that responses to protests by governments are not only fiscal and can include increased violence against protesters, we examine the effects of protests on policing. We find suggestive evidence that protests increase policing and police violence against protesters, particularly in states that are not politically aligned with disbursing federal governments. In contrast, protests are associated with decreased police violence against protesters in aligned states.

The results provide evidence that protests can influence fiscal redistribution. The ways in which they do this depend on the political relationships within governments and between disbursing federal governments and protesting regions. Governments can also respond to protests with increased state violence against protesters. More monitoring of fiscal resources by citizens may be an important feature of determining how fiscal resources are distributed and used in response to protests.

Read more about our disclosure policy here.