Ronald Coase is typically thought of as one of the Chicago School’s brightest lights. But Coase’s relationship with Chicago was always an uneasy one, even during his decades-long tenure at the University of Chicago Law School. The root of the disagreement between Coase and other prominent members of the Chicago School was methodological in nature and revolved around how economists go about doing economics.

Editor’s note: The current debate in economics seems to lack a historical perspective. To try to address this deficiency, we decided to launch a Sunday column on ProMarket focusing on the historical dimension of economic ideas. You can read all of the pieces in the series here.

That there is, or was, a “Chicago school” of economics has for many decades been widely accepted by economists, historians, and sundry other commentators, with references to it proliferating across scholarly articles and books, history of economics textbooks, and even the popular media. The “school” label at once connotes the perception of a certain commonality of purpose among the school’s members and a distinctiveness within the field. But the use of such labels can be misleading and even dangerous, for it can often mask what are, in reality, important differences among those associated with the Chicago School, calling into question both the correctness of associating certain individuals with it and even whether, with that heterogeneity recognized, it is even useful to speak of such a school in the first place.

For present purposes, it is sufficient to focus on three features that traditionally have been said to make the Chicago school distinctive. The first is the view that individuals are rational maximizers and so allocate their resources in a way that they expect will provide them with the greatest net benefit. Second, the competitive markets model, with its vision of a smoothly functioning market process, provides a reasonable approximation of virtually all economic activity. Though the competitive model is replete with unrealistic assumptions, the test of the validity of a model is its ability to predict well, rather than the realism of its assumptions, and the competitive model satisfies that criterion. Third, given that competitive markets operate efficiently, the efficiency of real-world market outcomes can be presumed. This means that market failure is a rarity, obviating the need for extensive governmental corrective measures.

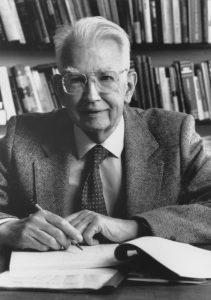

To see the problems that the “Chicago School” labeling can pose, one need only look at Ronald Coase. Though typically thought of as one of the School’s brightest lights, Coase’s relationship with Chicago was always an uneasy one. Yes, he numbered several Chicago faculty members and prominent alumni among his friends before moving to Hyde Park in 1964, but his vision for “good economics,” as he called it, was at odds with what his colleagues subscribed to.

The overt identification of Coase with the Chicago School predates his arrival at the university. Laurence Miller’s article “On the Chicago School of Economics,” published in the Journal of Political Economy in 1962, first fingered Coase as a member, based largely on his 1959 analysis of the Federal Communications Commission’s regulatory activities. Here, Coase protested the FCC’s control over the use of the frequency spectrum and suggested that it instead consider creating property rights in broadcast frequencies and allowing these rights to be traded in the marketplace—a recommendation that eventually helped to stimulate the use of spectrum auctions. Miller’s decision to associate him with the Chicago School came as a shock to Coase, however, who noted in a 1963 seminar talk at the University of Virginia that “John F. Kennedy, finding himself described as a member of the Church of England, could not have been more surprised.” In fact, so displeased was Coase by Miller’s claim that he devoted a large share of this talk to explaining why he was not a Chicago schooler.

The truth of the matter is that, despite his many years spent on the Chicago faculty, Coase was never a natural fit with Chicago economics. The department itself never showed any interest in hiring him, and Coase spurned an offer from the Law School—nearly burning his bridges there permanently—already in the mid-1950s. When he finally did accept a second offer from the Law School nearly a decade later, it had far more to do with the opportunity to edit the Journal of Law and Economics than with joining forces with the Chicago economics faculty. Indeed, the Journal editorship was at the heart of Coase’s interest in making the move. Though still a very new and struggling journal with nothing like the prominent reputation that it would later come to have—due in no small part to Coase’s work as editor—it would provide Coase with the opportunity to encourage and support the type of detailed studies of the legal–economic environment that so much interested him and that were the focus of his own research.

“The truth of the matter is that, despite his many years spent on the Chicago faculty, Coase was never a natural fit with Chicago economics.”

Coase spoke on multiple occasions about how Chicago economists had little interest in the type of work that he was doing, an attitude that Coase more or less reciprocated. His disagreements with Chicago were, at their heart, methodological, going to the very foundation of how economists go about the business of doing economics. Milton Friedman’s 1953 essay “The Methodology of Positive Economics” had famously suggested that the choice among economic theories should be driven by their predictive power, and that the realism of their underlying assumptions did not matter. This became Chicago gospel and one of the handfuls of ideas most closely associated with the School. Coase, for his part, had recoiled from Friedman’s position when he first heard Friedman talk on the subject in London a couple of years before the essay’s publication, and the passage of time did nothing to soften his views on the matter. Coase’s Chicago school talk at Virginia offered a blistering commentary on Friedman’s position, and he repeated his arguments two decades later in an American Enterprise Institute talk subsequently published as How Should Economists Choose? (1982).

For Coase, the ultimate purpose of theory is not prediction, but instead “to give you an insight into what is going on—to give you understanding—to give you a base for thought.” A theory that is applicable to the real world, then, must have reasonably realistic underlying assumptions to facilitate analysis, to elaborate the causal chains that explain economic activity, and allow one to properly evaluate the potential effects of policy proposals. Absent this, Coase argued, we are left with “blackboard economics,” Coase’s disparaging term for analysis that exists only on the economist’s blackboard and has little actual bearing on the world in which we live. To assume that the competitive markets model provided a reasonable approximation of actual markets was, for Coase, simply the Chicago variant of what he regarded as the profession’s misguided approach to economic reasoning.

But Coase also had relatively little faith in the type of empirical work fancied by his Chicago colleagues and, thus, in claims regarding predictive power. Though certainly not opposed to empirical analysis, broadly defined, Coase’s preferred brand of such work was of the qualitative kind—pouring through government documents, legal cases, and the like. He was clearly averse to modern statistical techniques and the conclusions that economists drew from them, noting in a 2010 interview that “A regression with aggregated statistical data will not tell you much about the way the economy works.” Equally troublesome, for Coase, was the propensity of economists to end up with empirical results that fit their priors, an attitude reflected in his now well-known quip, in How Should Economists Choose? that “If you torture the data enough, nature will always confess.”((Coase’s original version of this statement, found in his 1963 Virginia lecture, was that “All hypotheses are likely to be confirmed (partic [sic] after you have finished torturing the data). Nature may be reluctant to confess—but it confesses in the end.”)) To say that Friedman was displeased with Coase’s position would be an understatement, and that displeasure spilled out across a four-page, single-spaced letter addressed to “Ronald” rather than Friedman’s usual “Ronnie” once Friedman had the chance to read the text of Coase’s AEI lecture.

One of the hallmarks of Chicago economics has been its efforts to push the boundaries of economics beyond its traditional domain. Gary Becker, George Stigler, Richard Posner, and William Landes played key roles here, and Coase’s name, too, is often prominently associated with this work. But the reality is that Coase had little sympathy for these efforts. Becker considered economics an “approach” to the analysis of human behavior and applicable to virtually the entire spectrum of individual choices, including contexts as varied as education, family life, sex, law, politics, religion, and addiction. Coase, however, saw economics as a “subject matter,” the study of the operation of the economic system, and he had little confidence that applying economic analysis outside of its traditional boundaries would, or even could, bear fruit. He considered the rational choice model woefully inadequate for the analysis of human behavior outside of the economic realm, and even for analyzing decision making within it. Compounding the problem, he argued, was the fact that economists lacked the subject-matter knowledge to be effective core contributors to these other fields. Given these deficiencies, Coase predicted that economists would not be able to compete effectively against professionals from other fields in the marketplace of ideas.

Though often referred to as one of the founders of the economic analysis of law, Coase had little use for attempts to apply the rational actor model to every nook and cranny of the legal realm—an area of research in which his Law School colleagues, Posner and Landes, have loomed so large. His interest in “law and economics,” instead, involved examining the effects of legal rules on economic activity, and this was the perspective that he brought to his two decades spent editing the Journal of Law and Economics. Posner has roundly criticized Coase for his antipathy to the economic analysis of law (as well as his more general distance from the Chicago methodology), and the trends in economics scholarship over the past four decades suggest that Coase was a very poor prognosticator, at least on this score.

“Coase had relatively little faith in the type of empirical work fancied by his Chicago colleagues and, thus, in claims regarding predictive power.”

All of this assists us in understanding the divergent reactions of Coase and Chicago to the idea most prominently associated with Coase’s name: the Coase theorem. The theorem tells us, in a nutshell, that the market system will efficiently resolve externality problems if the exchange process is costless. Under those conditions, it matters not whether, for example, polluters have the right to pollute or people have the right to be free from pollution-related harms; we will get the same, efficient amount of pollution in either case, as any inefficiencies will be resolved via negotiation.

For Coase, this result was a legal and economic fiction, a means to an end. It demonstrated that, in the frictionless world of economic theory circa 1960, the tax or regulatory remedies that economists deemed essential for dealing with externalities are not required; the market system itself will resolve these problems efficiently. But this was merely “blackboard economics.” In the real world, he argued, both markets and government remedies are costly and imperfect, meaning that the operative policy issue is to select the course of action that maximizes the net social benefit—whether that be utilizing the market, implementing one of the policy instruments available to government, or doing nothing at all about the problem on the grounds that the cure is likely to be worse than the disease.

But this was not the message that many people, including Coase’s colleague and friend, George Stigler, took from the analysis. For Stigler, who gave Coase’s result its name, the Coase theorem informs us that we can trust competitive markets to generate efficient outcomes, even in the presence of externalities. Yes, transaction costs are non-zero in the real world, but on average they tend to be low enough to be safely assumed away—Friedman’s dictum in action. Time and again, Coase lamented the attention paid to the Coase theorem instead of to his message about the importance of transaction costs and the need for their careful examination. Though there can be little question that Coase shared with certain of his colleagues a predisposition for the market, his position was not grounded in market success so much as in government failure. Indeed, Coase devoted no small amount of energy over the course of his career to showing the imperfections associated with markets and thinking about how various institutional structures had evolved or could be designed to overcome them.

In an interview conducted around his 100th birthday, Coase admitted that he had not been “aggressive enough to push [his] vision of economics at Chicago” against “the strong presence of Milton Friedman, George Stigler, and other weighty figures.” Had he done so, he seemed willing to believe that, in the end, “what [he] called good economics might well have prevailed at Chicago.” That it did not, in Coase’s mind, tells us much about Coase, but also about the problematics of generalizations about a “Chicago School.”