Firms in more environmentally friendly sectors are better able to attract and retain talent and at lower wages. Millennials and Gen Z, who are climbing the corporate ladder, have more pronounced preferences for sustainability. Investing into environmentally friendly policies thus has increasingly important consequences for firms’ human resources strategies and firms can potentially do well by doing good.

Investor and corporate interest in sustainability—or more generally, in environmental, social, and governance (ESG) issues—has never been higher. Institutions that have committed to sustainability principles now hold half of global institutionally owned public equities. In a similar spirit, survey evidence suggests that only seven percent of Fortune 500 CEOs believe that firms should mainly focus on making profits and not be distracted by social goals. In their 2017 paper, Oliver Hart and Luigi Zingales argue that this is perfectly consistent with the fiduciary duties of corporate directors: Companies should maximize shareholder welfare, not value.

At the same time, research by Roland Benabou and Jean Tirole suggests investing in sustainable business practices can actually contribute positively to firm value, and thus firms can do well by doing good. For instance, more sustainable firms can sustain higher margins if sustainability aware customers are willing to pay higher prices. Similarly, firms with better sustainability policies can potentially also benefit from lower cost of capital. Prior finance research has also found that publicly listed US firms with higher employee satisfaction, an important social dimension of sustainability, outperform on a risk-adjusted basis.

In our recent paper, we uncover and provide evidence of a new channel through which a firm’s sustainability policies can affect its bottom line: the sustainability wage gap channel. We hypothesize that a firm’s sustainability policies can have a beneficial effect on a firm’s bottom line by lowering the firm’s labor costs. The main idea is that workers with preferences for sustainability are willing to accept lower wages to work in more sustainable firms.

Workers in More Sustainable Firms and Sectors Earn Lower Wages

To test the sustainability wage gap hypothesis, we use employer-employee matched wage data from Sweden, which are extremely detailed. We combine the administrative wage data with a measure of the environmental sustainability of firm’s primary economic activity. We develop this sustainability measure explicitly for the analysis in our paper by asking survey participants to classify economic activities in terms of environmental sustainability. The survey-based sustainability classification covers 95 economic sectors that make up 98 percent of employment in our administrative wage data. The survey yields a highly plausible ranking with the most sustainable activities relating to health, education, and recycling. In contrast, activities related to fossil energy sources, production involving chemicals, and air transportation are ranked as being most unsustainable.

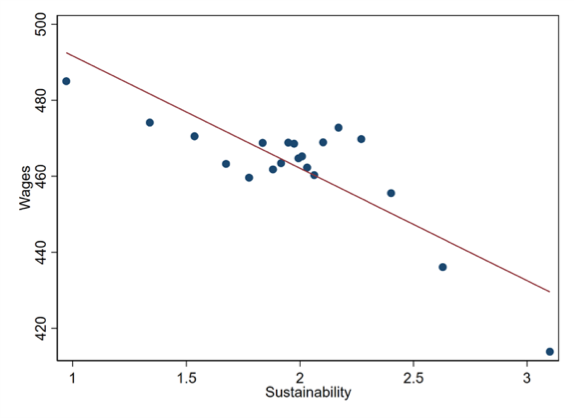

Figure 1 illustrates our main result graphically. The binned scatterplot displays a strong negative association between wages and our environmental sustainability measure. The relation is particularly pronounced in the tails of the sustainability distribution.

Next, we use regression analysis to examine the effect of sustainability on wages in a more comprehensive way. We find robust evidence that workers in firms that belong to the most sustainable sectors earn about 10 percent lower wages. Importantly, these regressions control for detailed demographic and job-related variables including usually unobservable measures of cognitive and non-cognitive ability as well as occupational information. We also examine heterogeneity in the documented sustainability wage gap and find that the wage gap is larger for workers that are more skilled. The data also suggest that the sustainability wage gap for the most skilled workers is increasing over time.

An alternative reading of our hypothesis is that, fixing a wage, more sustainable firms are better able to attract and retain workers that are more talented. In further analysis, we also find that more sustainable firms are better able to attract and retain workers that are more talented as measured by educational attainment and our measures of cognitive and non-cognitive skills. Providing a battery of additional tests, we argue that our results are difficult to reconcile with many alternative interpretations suggested in prior research.

“In further analysis, we also find that more sustainable firms are better able to attract and retain workers that are more talented.”

Our primary measure of sustainability is at the sector-level. We construct this measure by letting survey participants classify economic sectors in terms of their environmental sustainability. We choose this survey-based measure at the sector-level as our main measure because firm-level sustainability (or ESG) ratings are generally only available for large and listed firms in the most recent periods. In addition, recent research has shown that there are potential methodological issues with such ratings. In contrast, our sector-level sustainability is based on an intuitive, straightforward, and transparent methodology, which is also available for private companies.

Despite the shortcomings of ESG ratings, we still complement our analysis with tests that use firm-level ESG rating data from two prominent ESG data sources, which have been used in prior finance research. Consistent with the evidence based on our sector-level sustainability measure, we find that firms with better ESG ratings (especially with better E—environmental—ratings) pay lower wages, highlighting the important idea that improving environmental policies can be beneficial to the bottom line of firms because it allows attracting and retaining higher skilled workers at lower wages.

While many prior studies document a positive correlation between a firm’s sustainability characteristics and its financial performance, few studies manage to credibly identify actual mechanisms through which sustainability translates into higher financial performance. In contrast, we provide and identify a very specific mechanism through which sustainability can positively affect a firm’s bottom line—i.e., via lower labor costs and the sustainability wage gap channel. We argue that most other explanations such as a customer awareness channel or lower discount rates are not consistent with our evidence on wages. Moreover, we exploit detailed worker-, occupation, and sector-level data as well as heterogeneity of workers’ preferences to address remaining concerns related to omitted variables.

Our findings are particularly relevant today as younger cohorts such as Millennials and Gen Z are entering the labor market and climbing the corporate ladder. Accommodating the sustainability preferences of these younger workers—who arguably care more about sustainability aspects than preceding generations such as Baby Boomers or the Silent Generation—might be a decisive factor for firms to attract and retain the most talented workers and hence remain competitive in the future.