Corruption, lobbying, corporate malfeasance, and frauds: a weekly unconventional selection of must-read articles by investigative journalist Bethany McLean.

Happy Saturday, or whatever day it is. Does it matter any more? This is a thoughtful, statistic-laden look at the other ways in which the virus is taking lives, beyond the obvious one:

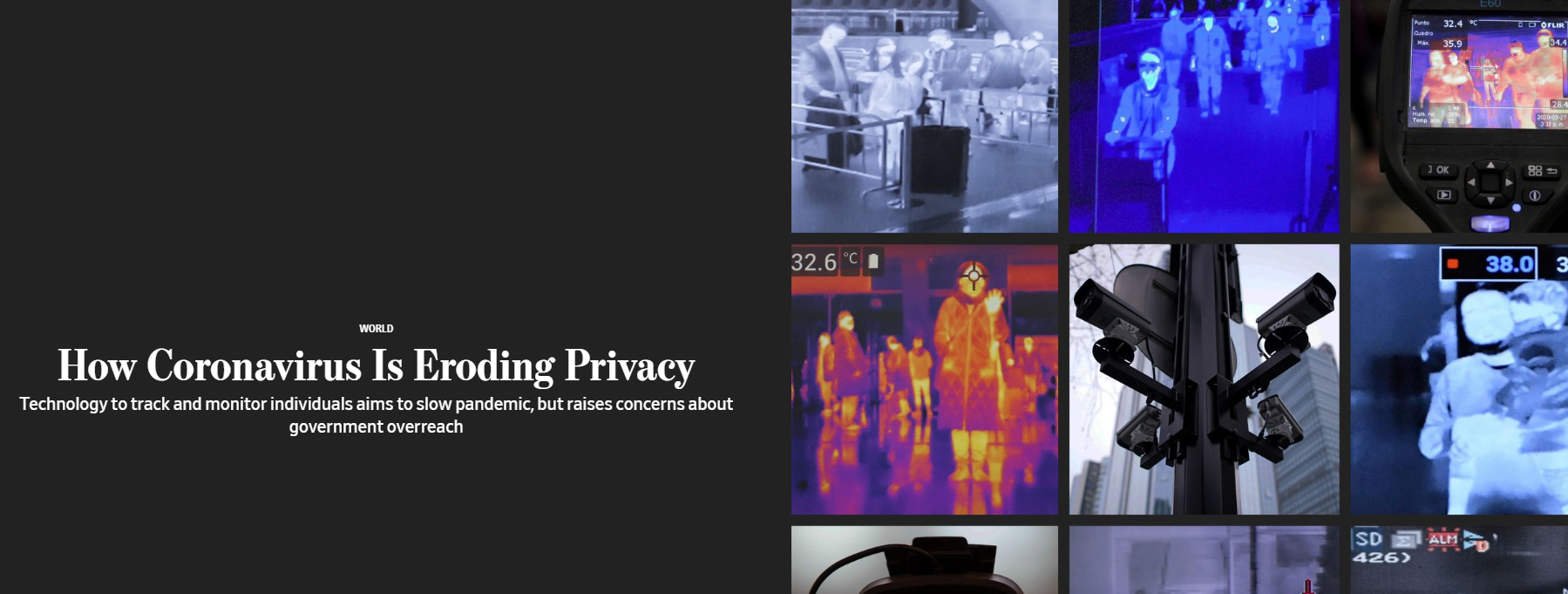

Remember the old days of privacy debates, of worries about Alexa’s ability to listen to our conversations and Google’s ability to read our emails? Aren’t those concerns so quaint? Well, yes, compared to what’s coming.

It seems that in the name of safety, we’ll be willing to accept just about anything:

On a brighter note. Newton discovered gravity during the Great Plague! Shakespeare wrote King Lear. And wow, are people doing a lot. It’s inspiring:

The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.