Since the coronavirus crisis began, firms have dramatically reduced employee hours. By March 28, total hours declined over 70 percent in states with the earlier stay-at-home orders. A new study finds that hours reductions are primarily explained by firm shutdowns and hours reductions, not layoffs.

How has the Covid-19 crisis-affected hourly workers at small businesses?

We’ve been working with Homebase, a scheduling and time clock software for US small businesses, to find out. Homebase is sharing timeclock data from its customers to provide a high-frequency picture of employment.

We use these data, building on Homebase’s previous work, to document four facts:

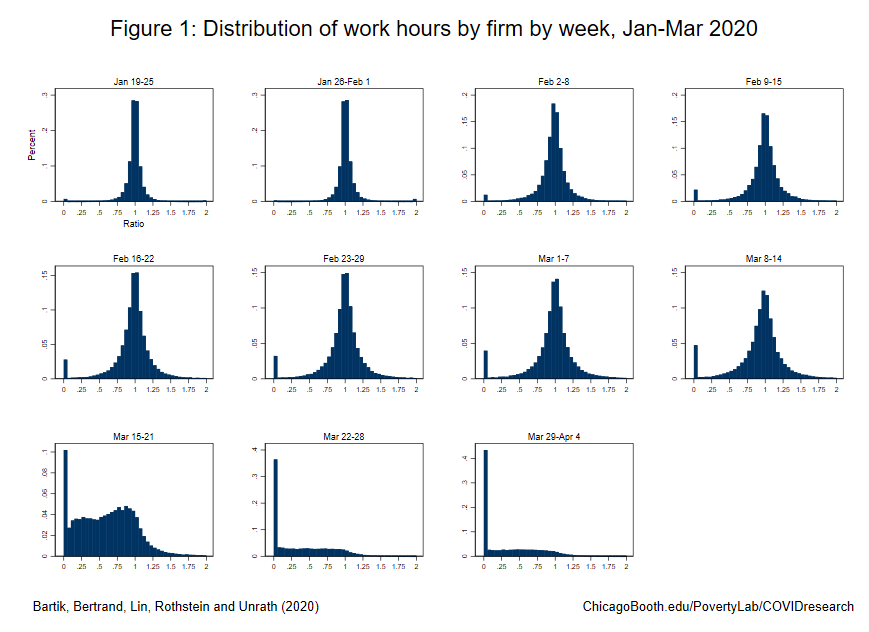

Fact 1: Firms have dramatically reduced employee hours. Each sub-plot in this figure shows the distribution of hours across firms, measuring relative to average hours per week. By March 22, over 40 percent of firms shut down entirely.

Fact 2: Hours reductions vary by industry’s ability to operate under stay-at-home orders. Hours reductions are largest in Beauty and Personal Care/Leisure and Entertainment, declining over 90 percent, and smallest in Home and Repair/Transportation (even those hours declined by 50 percent).

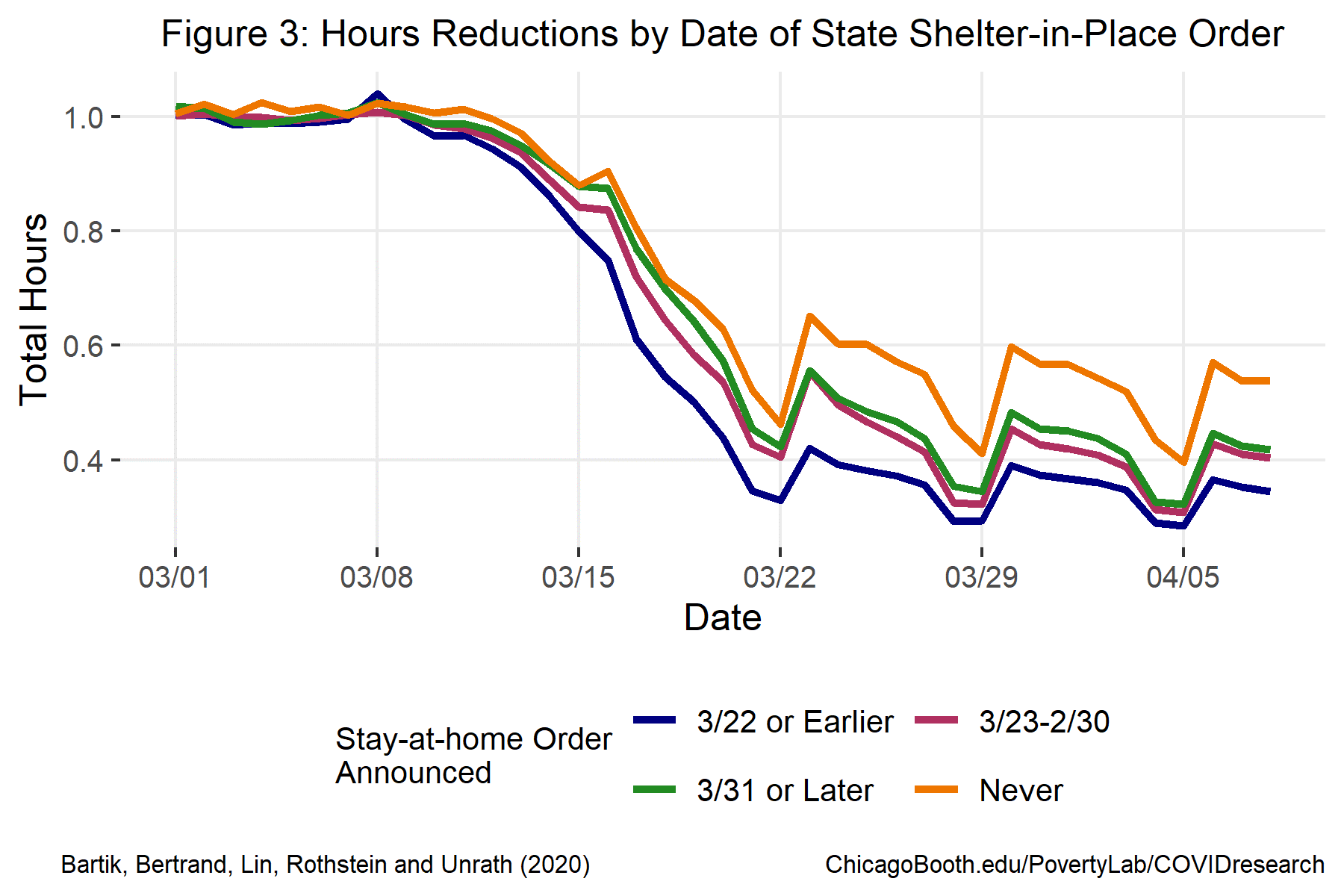

Fact 3: Hours start falling earlier in states with stay-at-home orders, but fall sharply by March 16 in almost all states. By March 28, total hours declined over 70 percent in states with the earlier stay-at-home orders, over 15 percentage points more than states without them.

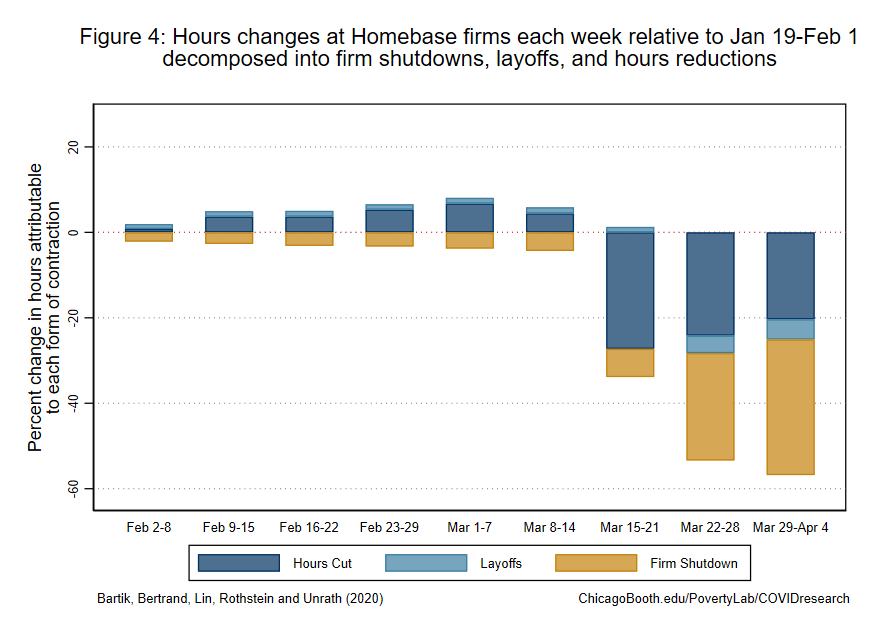

Fact 4: Hours reductions are primarily explained by firm shutdowns and hours reductions, not layoffs.

The greater detail and higher frequency of these data come at some costs; Homebase’s customer base is disproportionately composed of small firms in food service, retail, and other sectors that employ many hourly workers.

We’re working to understand the representativeness of these data and how much they tell us about the broader labor market.

We’ll post regular updates of this analysis and other labor market data at ChicagoBooth.edu/PovertyLab/COVIDresearch

This work was made possible thanks to Homebase and the teams at the Institute for Research on Labor and Employment (IRLE) and the California Policy Lab at the University of California, Berkeley, as well as the University of Chicago Poverty Lab, and Chicago Booth’s Rustandy Center for Social Sector Innovation.

Alexander W. Bartik is an Assistant Professor Economics, University of Illinois at Urbana-Champaign, and Research Affiliate, UChicago’s Poverty Lab. Marianne Bertrand is the Chris P. Dialynas Distinguished Service Professor of Economics, University of Chicago Booth School of Business, and Faculty Director, Chicago Booth’s Rustandy Center for Social Sector Innovation and UChicago’s Poverty Lab. Feng Lin is a Research Professional, Chicago Booth. Jesse Rothstein is a Professor of Public Policy and Economics, University of California, Berkeley, and Director, Institute for Research on Labor and Employment (IRLE) and California Policy Lab. Matt Unrath is a PhD Candidate at UC Berkeley and a Research Fellow at California Policy Lab.

ProMarket is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.