A new study by the United Nations Conference on Trade and Development argues: The “endemic rent-seeking that stems from market concentration, heightened corporate power, and regulatory capture” has spread beyond the United States, leading to the emergence of “global rentier capitalism.״

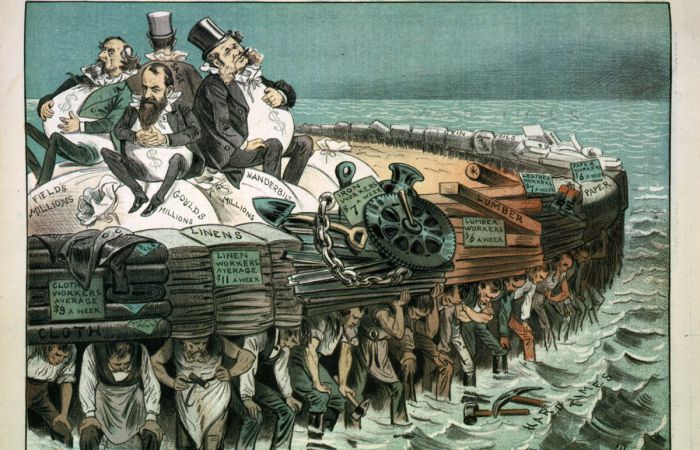

Earlier this year, a Stigler Center paper by Luigi Zingales [Faculty Director of the Stigler Center and one of the editors of this blog] argued that market concentration can lead to a vicious circle, in which companies use market power to gain political power that in turn allows them to gain more market power, and vice versa. Zingales called this the “Medici vicious circle”: “Money is used to gain political power and political power is then used to make more money.”

A new UN report shows that this vicious circle is now a prominent feature of the global economy. Thirty years of hyperglobalization, according to the report, have led to sharp increases in global market concentration and a proliferation of rentierism, whereby the world’s largest corporations attempt to protect their market power through a variety of rent-seeking activities, such as lobbying or systematic abuse of intellectual property laws. While many of these companies are headquartered in the United States, the “endemic rent-seeking that stems from market concentration, heightened corporate power, and regulatory capture” has spread much further, leading to the emergence of “global rentier capitalism.”

The annual report of the United Nations Conference on Trade and Development (UNCTAD) has expressed growing concerns regarding concentration and rent-seeking behavior in financial markets in recent years. This year’s report, however, is unusual in that it devotes an entire chapter to the issue of market power and its contribution to inequality worldwide. “While we have always been concerned with power imbalances and inequality in the global economy, the more extensive analysis of market concentration is a fairly recent concern for us,” Stephanie Blankenburg, chief of the Debt and Development Finance Branch at UNCTAD and co-author of the section on market power, tells ProMarket. “It was triggered by concerns about concentration trends in U.S. markets, particularly among economists.”

While the past two years have seen an explosion of interest around concentration and corporate rent-seeking among a growing number of economists, journalists, and politicians, the debate has so far remained largely confined to the US economy, where a substantial body of research has linked diminished competition to some of America’s biggest economic and political problems, like inequality, the decline of labor’s share of national income, and regulatory capture. Outside of the United States, as the European Commission’s chief competition economist Tommaso Valletti recently noted, research on this issue has been limited so far—partly due to a lack of data.

UNCTAD’s research is among the first to assess the rise in market concentration on an international scale. It also attempts to measure the growth of rents—that is, the income that large companies derive solely from the ownership and control of assets, rather than from innovation.

In order to do that, UNCTAD built a database comprised of financial statements made by publicly traded non-financial companies in 56 developed and developing countries between 1995 and 2015. Measuring the size of corporate rents is difficult due to the scarcity of data and the wide variety of rent-seeking activities companies can engage in, but the UNCTAD research team tries to approximate their magnitude by estimating surplus profits within specific sectors. Using the median value of firms’ rate of return on assets (ROA), they estimate the median performance of firms within a given industry. The difference between this estimate and the actual profits firms made is the surplus profit.

In the past two decades, the authors find, the world economy has seen a sharp increase in both surplus profits and market concentration. Concentration has increased markedly in terms of revenues, assets (both physical and non-physical), and market capitalization: in 2015, the combined market cap of the world’s top 100 firms was 7,000 times that of the bottom 2,000 firms, whereas in 1995 the same multiple was 31. At the same time, the share of surplus profits grew significantly for all firms in the database, from 4 percent of total profits in 1995–2000 to 23 percent in 2009–2015. For the top 100 firms, the share of surplus profits grew from 16 percent of total profits in 1995–2000 to 40 percent in 2009–2015.

The trend toward concentration, the authors note, has not extended to employment. Between 1995 and 2015, as the market cap of the world’s top 100 firms quadrupled, their share of the job market didn’t even double—a finding that echoes the results of previous studies that linked the decline of labor’s share to the rise of market power. This, they argue, lends support to the view that market concentration strongly contributes to inequality and leads to “profits without prosperity.”

“These are approximate results, of course, meant to get an idea of the rough magnitude. But the trend is extremely clear and quite scary,” says Blankenburg. “What we observe is an almost-normalization of rent-seeking behavior, fêted by market power.”

Market power begets political power, which begets further market power

Market concentration, regulatory capture, and rents are incontrovertibly connected, the authors argue. As firms become bigger and more profitable, they are able to hire vast armies of lobbyists and capture regulators and elected representatives, securing generous government subsidies and lax antitrust enforcement, which in turn allow them to become bigger and more profitable. They are also better able to use intellectual property laws in their favor, extending the life of patents to protect their market domination, and hire better lawyers to avoid paying their fair share of taxes. These mechanisms, the authors argue, have essentially made the world’s biggest firms into a “rentier class.”

Not all surplus profits, the authors acknowledge, can be described as rents. Many economists, for instance, argue that rising concentration is mainly driven by new technologies that enable greater efficiencies. In order to examine this claim, the authors focus their research on the tech sector.

Their findings do lend some support to the technological argument: the productivity performance of the top 100 nonfinancial firms was much higher than all other firms in the sample in the period after 2002, in which the number of software and IT firms among the top 100 more than doubled.

Nevertheless, says Blankenburg, “the data show very clearly that the means used to obtain these profits cannot be reduced to the use of productive technologies.” Other mechanisms, such as lobbying or mergers and acquisitions, the authors find, have played a significant role in enhancing the market power of dominant companies. “You can show quite clearly how surplus profits increase with mergers and acquisitions, or how changes in regulation that favor control over intellectual property rights for large corporations have a pretty-instant impact on the profit performance of those companies,” she adds. Regulatory capture is a significant factor as well, as many of these regulatory changes are driven by governments and international institutions which are increasingly influenced by large corporations.

Another important factor is hyperglobalization, the relentless drive to make financial returns the sole arbiter of economic decision-making, that accelerated in the early 1990s. The proliferation of bilateral and regional trade and investment agreements, the report argues, has endowed corporations with wide-ranging powers to shape regulatory policies, leaving nation-states substantially weakened and setting in motion a process that led to the rise of market power.

Throughout history, Blankenburg notes, economists and political theorists, from Adam Smith to John Maynard Keynes, have raised concerns that capitalism has a tendency to be captured by rentiers. The UNCTAD report echoes these historical concerns. “Rentier capitalism means that there isn’t just a few annoying rentiers in some countries that a bit of government intervention can rein in or neutralize,” says Blankenburg. “It is becoming an endemic part of capitalism, a new normal—at least for powerful corporations.”

The authors offer several remedies to tackle the rise of market power, among them tougher antitrust enforcement, the revision of existing trade agreements (and avoidance of signing new ones), and labor market interventions that focus on reducing inequality. “A good start,” they write, “would be to recognize that both knowledge and competition are first and foremost global public goods, and that their manipulation for private profit should be effectively regulated.”

Disclaimer: The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.