A new paper by Oliver Hart and Luigi Zingales argues that a company’s objective should be the maximization of shareholders’ welfare, not value.

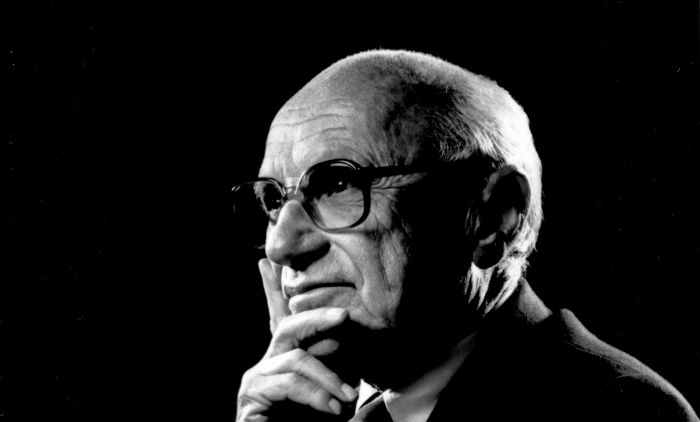

In 1970, Milton Friedman famously argued that corporate managers should “conduct the business in accordance with [shareholders’] desires, which generally will be to make as much money as possible while conforming to the basic rules of the society, both those embodied in law and those embodied in ethical custom.”

Since then, Friedman’s view that the sole social responsibility of the firm is to maximize profits—leaving ethical questions to individuals and governments—has become dominant both in finance and law. It also laid the intellectual foundations for the “shareholder value” revolution of the 1980s.

Friedman’s position has been attacked by many critics on the grounds that corporate boards should consider other stakeholders in their decisions. Yet, if the owner of a privately held firm is under no obligation to care about anybody’s interest but her own, why should it be different for a publicly traded company?

In a new Stigler Center paper, Harvard Professor and Nobel laureate Oliver Hart and University of Chicago Booth School of Business Professor Luigi Zingales (Faculty Director of the Stigler Center and one of the editors of this blog) take a novel perspective to this question. While agreeing with Friedman’s premise that managers should care only about shareholders’ interest, Hart and Zingales reject the view that shareholders only care about money. A company’s ultimate shareholders are ordinary people who, in addition to caring about money, are also concerned about a myriad of ethical and social issues: They purchase electric cars to lower their carbon footprint, they buy free-range chicken or a fair trade coffee because they view this as the ethical—albeit more expensive—choice. They are, in other words, prosocial in their day-to-day life—at least to some effect. “If consumers and owners of private companies take social factors into account and internalize externalities in their own behavior, why would they not want the public companies they invest in to do the same?” Hart and Zingales ask.

As the above quote suggests, Friedman recognizes that in some cases shareholders may have different objectives, but he concludes these objectives are better pursued by the shareholders on their own. This is certainly the case for Friedman’s leading example: corporate charity. Ignoring tax considerations, according to Friedman, it is preferable that the money spent in corporate philanthropy is paid out to shareholders in forms of dividends and then allocated by them to charity, rather than allocated by corporate managers directly.

As Hart and Zingales show, this conclusion holds only under the assumption that shareholders can individually reproduce or undo any corporate decision, without incurring any additional cost. This assumption holds for charity: a dollar in charity is the same whether it is donated by an individual or by a corporation. But it does not hold for most other social objectives: an individual cannot generally undo corporate pollution at the same cost that a company would have paid to avoid it. In this more general case, Hart and Zingales conclude that a company’s objective should be the maximization of shareholders’ welfare, not value.

Can This Rule Be Applied?

One of the beauties of Friedman’s rule, according to Hart and Zingales, was its simplicity. Profits are a relatively easy objective to communicate and measure. How can we measure welfare? Even more importantly, who decides what other objectives besides money should enter the objective function of a company?

Hart and Zingales think this problem can be solved by voting. Do Walmart shareholders prefer to limit the sale of high-capacity magazines of the sort used in mass killings, at the cost of some missed sales? This is an ethical question that can only be resolved by asking investors for their preferences. Without a vote, managers would have to impose their own preferences or settle to the minimum common denominator: money. In other words, without a system of voting, public companies will naturally drift toward an amoral stand.

There are, of course, costs to the shareholding voting option. One risk is that shareholders put forward too many frivolous proposals, but this can be significantly minimized by requiring that proposals get the support of a certain share of shareholders before they are put to a vote. Another is that company money will be spent in promoting management’s agenda, but this can also be minimized by restricting manager’s ability to use corporate resources for campaigns. Also, while in the past it would have been costly to attempt reaching a consensus among investors on the non-monetary objectives a company should pursue, technology has made polls extremely cheap and easy to organize.

Another question Hart and Zingales raise has to do with the effectiveness of aggregating individual preferences into social ones, and whether voting is even the appropriate method to establish such preferences. “Given well-known collective choice problems, it is possible that market value maximization can be justified as a second-best objective in a world where the social preferences of shareholders are sufficiently heterogeneous. We cannot rule this out,” they write. “But in the absence of evidence establishing this conclusion to be correct, we believe that shareholder welfare maximization should replace market value maximization as the proper objective of companies.”

Finally, some might argue that it is too burdensome for shareholders to make all these decisions. In practice, however, it would be mutual and pension funds voting, and the only thing investors would have to do is choose the fund that most mimics their social values. For pension funds, where investors are captive, a vote would be necessary, but it would be an occasional vote on general objectives rather than a vote on every single company issue.

The Origin of Responsibility

As Hart and Zingales point out, the impact of prosocial investors on corporate decisions depends crucially upon the way prosocial preferences are modeled. Much of the literature on social investing assumes prosocial shareholders value less shares of sinful/dirty companies. Under this assumption, non-prosocial investors will have a higher valuation for any company generating some negative externality. As a result, most “sinful” companies’ marginal investors (i.e., the investor whose valuation of shares equals their market price) will be the most prosocial of all shareholders. Thus, a value maximizing company will maximize the valuation of its most prosocial investor, and this will naturally lead it to act in a somewhat prosocial way.

Hart and Zingales think this conclusion is too optimistic: “In reality, many investors are prosocial even though they are willing to hold the shares of tobacco or gun companies.” To capture this aspect, they assume that “each individual puts some weight on doing the right or socially efficient thing, but only if he feels responsible for the action in question.”

When does a shareholder feel responsible for a corporate action? Hart and Zingales explore different answers. Interestingly, these answers have a direct link to moral philosophy. On the one hand, if shareholders are consequentialist (the doctrine according to which the morality of an action is to be judged solely by its consequences), companies will drift towards an amoral behavior, unless hostile takeovers are prevented. On the other hand, they argue, if shareholders follow the Kantian categorical imperative (“Act only according to that maxim whereby you can, at the same time, will that it should become a universal law”), all problems are resolved. Yet—as Hart and Zingales point out—if economic agents follow the Kantian categorical imperative, the majority of economic analysis (from free-riding to collective action) would be irrelevant.

In fact, one of the novel aspects of Hart and Zingales’ contribution is precisely to establish a link between moral philosophy and corporate policy.

Invest and Engage

Another novelty of Hart and Zingales’ work is the counterintuitive implication on investment policy. Most socially engaged investors advocate divestment from “sinful” stocks. Yet, they write, “if the divestment of prosocial investors were to depress the stock price of a targeted company…it would move controversial stocks into the hands of the least prosocial investors, who will maximize the negative externality.”

For this reason, Hart and Zingales criticize the divestment movement and favor an “invest and engage” approach, i.e., prosocial investors should engage and be vocal about corporate decisions, rather than shy away. As for the political arena, those who abstain increase the political power of those who vote. For this strategy to work, however, moral issues should be regularly brought up for a shareholders’ vote, something that does not happen today.

A major obstacle is regulation: under the SEC’s shareholder proposal rule (rule 14a-8), the requirement to include shareholders’ proposals in companies’ proxy material is limited to “proper subjects for action.” It is about time that the SEC opens it up to any proposal with a significant backing by shareholders.