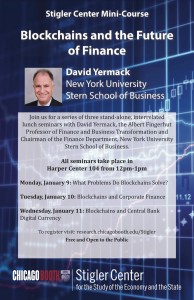

Yermack, the Albert Fingerhut Professor of Finance and Business Transformation at New York University Stern School of Business, will teach a mini-course of three stand-alone lunch seminars on the potential implications of blockchain technologies at the Stigler Center next week.

The blockchain, the technology that underpins cryptocurrencies like Bitcoin, has generated an immense amount of interest within the financial and tech industries in recent years. With over $1 billion invested in Bitcoin and blockchain startups so far, a growing number of economists and technologists argue that the blockchain (also known as distributed ledger technology) has the potential to reshape the financial system.

While the first and by far largest application of blockchain technologies remains Bitcoin, numerous studies, papers, and reports in recent years have pointed to the wide-ranging implications that the adoption of blockchains could have for banking, and for areas like health care and artificial intelligence.

In a recent paper, New York University professor David Yermack argued that blockchains could have far-reaching implications for corporate governance as well, potentially altering the balance of power between directors, managers, and shareholders. In another recent paper, he argued that central banks could use the blockchain as a platform to launch their own digital currencies, potentially removing the need for fractional reserve banking.

“Bitcoin was really the first financial application of this and it is still by far the largest, but there are many variations on it, and people are beginning to use it for a wide range of things, from issuing equity to supply-chain management. There are also many applications in the pubic sector in terms of registering property and validating people’s IDs and so forth,” says Yermack, who has studied the subject extensively. “We really should think of this as a new way of keeping track of data. That is a major step forward, comparable, I think, to the arrival of double-entry bookkeeping 500 years ago.”

Yermack, the Albert Fingerhut Professor of Finance and Business Transformation at New York University Stern School of Business, will teach a mini-course of three stand-alone lunch seminars on the potential implications of blockchain technologies at the Stigler Center next week:

Yermack, the Albert Fingerhut Professor of Finance and Business Transformation at New York University Stern School of Business, will teach a mini-course of three stand-alone lunch seminars on the potential implications of blockchain technologies at the Stigler Center next week:

-

Monday, January 9 in C08: What Problems Do Blockchains Solve?

-

Tuesday, January 10 in C25: Blockchains and Corporate Finance

-

Wednesday, January 11 in C10: Blockchains and Central Bank Digital Currency

All seminars will take place between 12 p.m. and 1 p.m. in the Harper Center at the University of Chicago Booth School of Business (5807 S. Woodlawn Ave., Chicago, IL 60637). Register here.