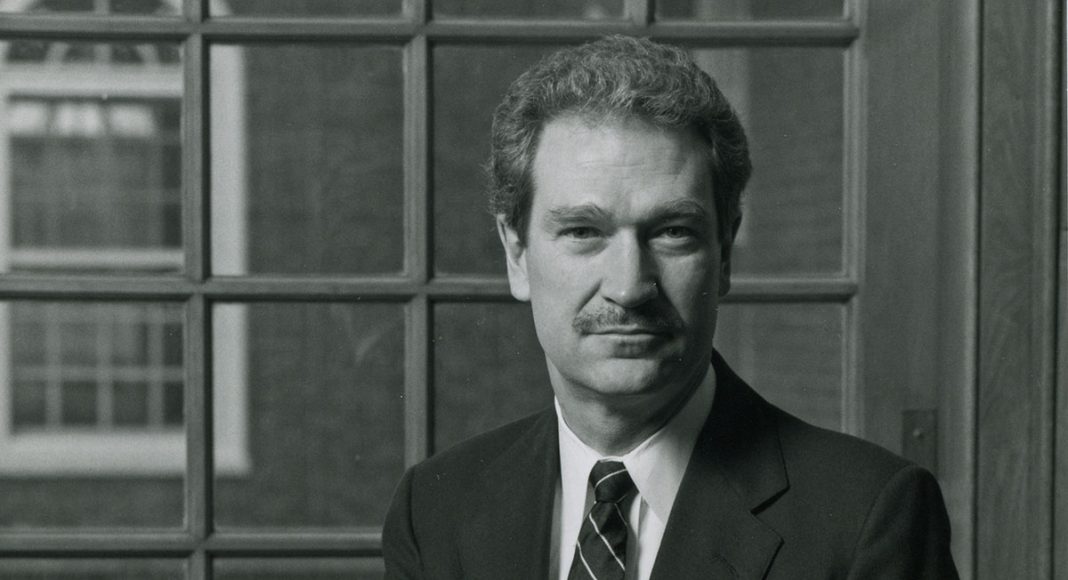

Nobel Laureate Eugene F. Fama pays tribute to economist Michael C. Jensen, who recently passed. Fama reminds us of Jensen’s unmatched career as a researcher and founder of the Journal of Financial Economics and SSRN.

Mike Jensen died Tuesday April 2, 2024. He was 84 years old.

Mike was a top student in the University of Chicago, Graduate School of Business (now the Booth School) Ph.D. program in the late 1960s. He was in an unmatched group of students who thereafter play a major role in the transformation of academic finance into a scientific discipline.

Mike’s research contributions put him in the highest echelons of academic finance and economics. His 1976 Journal of Financial Economics paper with William Meckling, “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure” is a seminal piece (130,867 Google citations). It set the bar for the extensive literature on agency theory.

He and I published two agency theory papers in the 1983 Journal of Law and Economics. “Separation of Ownership and Control” is my most highly cited paper (53,207). It is only third on Mike’s list.

Mike’s major work is in agency theory, and most of his research is theory, but early on he wrote or was involved in ground-breaking empirical contributions. His 1968 Journal of Finance paper, “The performance of mutual funds in the period 1945-1964,” is his Ph.D. thesis (9,299 Google citations). It is the first paper to use the Sharpe-Lintner asset pricing model to evaluate the risk-adjusted performance of mutual funds. The main result is that passive combinations of a risk-free security and the market portfolio outperform most actively managed portfolios. Mike’s approach and conclusions survive the test of time in many updates by others.

Mike is also a coauthor with Lawrence Fisher Richard Roll and me of the 1968 International Economic Review paper, “The adjustment of stock prices to new information” (8,833 Google citations). This is a study of stock splits. To my knowledge, it is the first event study. Event studies proliferated thereafter in the finance and accounting literatures. Most use the techniques developed in FFJR, eventually without attribution.

Google citations are a common metric used to evaluate research impact. Only the hardy (or foolhardy) will compare their Google cites to Mike’s (341,444 as of April 3, 2024: 94,800 since 2019).

One can argue that Mike’s personal research is not his major research contribution. Two others we now take for granted stand out.

First, early on Mike decided that the Journal of Finance needed competition to drag it into the era of scientific research. Despite a chockful personal research agenda, Mike started the Journal of Financial Economics that he edited for 20+ years. After its 1974 debut, the JFE quickly became the top journal in finance, and it had the desired effect of upping the game of the JF.

Second, Mike’s foresight was unmatched. With the arrival of the internet, he predicted it would become the conduit for the distribution of new research. He launched SSRN (Social Science Research Network), supported it financially, and guided it for many years, never doubting it would succeed. His unfailing faith was eventually vindicated.

To me and others, Mike was a brother, intellectually and personally, for many years. He will be missed.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.