Looking back at the March 2023 collapse of Silicon Valley Bank and the subsequent banking crisis, Stephen G. Cecchetti and Kermit L. Schoenholtz highlight two lessons that should guide the reform of bank regulation.

The collapse of Silicon Valley Bank in March 2023 triggered a panic among regional banks. Cascading failures, which included the second, third and fourth largest banking failures in the history of the United States, ended only after emergency government interventions that protected virtually all depositors and a large swath of effectively insolvent banks. Clearly, the regulatory reforms that followed the financial crisis of 2007-09 had failed to make the U.S. banking system safe or to eliminate the government’s incentive to bail out fragile banks.

The principal source of the 2023 panic was immediately apparent: banks can survive risky assets or volatile funding, but not both. Uninsured deposits flee as soon as depositors question the solvency of their banks. And, banks that risk deposit flight cannot rely on a stream of future profits—say, from a high net interest margin—as a hedge against interest rate risk. In the end, liquidity and capital concerns are inextricably related.

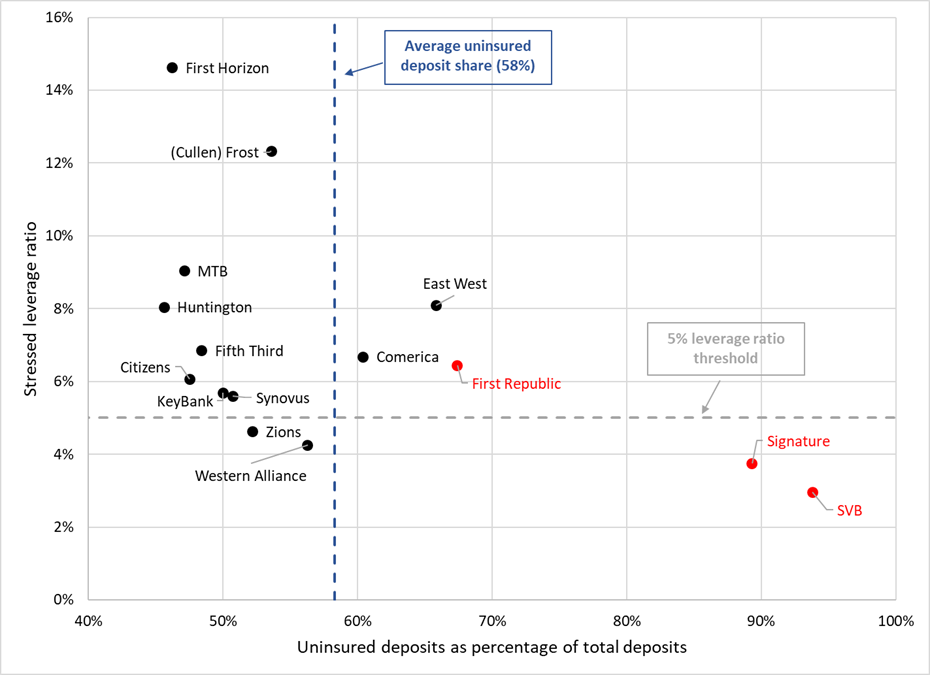

The critical importance of the nexus between uninsured deposits and solvency is evident in the following chart that is based on information which was publicly available well before the panic began. The figure, a version of which appeared 10 days after SVB’s failure, shows the share of uninsured deposits for a group of mid-sized banks at the end of 2022 plotted against a market-based measure of each bank’s capital adequacy (the “stressed leverage ratio”). The message is clear: the panic (and the bailouts) began with the runs on the two outliers, SVB and Signature Bank (shown in red). Both had extremely high shares of runnable deposits and, conditional on broad financial market stress, an exceptionally modest cushion of equity to absorb losses. Moreover, despite near-blanket protection for deposits, authorities put the bank with the next-highest share of uninsured deposits, First Republic (also in red), into resolution just six weeks later on May 1.

Figure 1. Stressed leverage ratio and uninsured deposits, December 2022

In the aftermath of SVB’s collapse, it was immediately clear that a range of astonishing failures had contributed to the fragility of the banking system. Executives at many banks had failed to hedge interest rate risk, counting on uninsured deposits to remain sticky even at banks that were effectively insolvent. Depositors shared that complacency until they suddenly panicked. Supervisors failed to compel the banks to manage the simplest and most obvious risks. And, despite knowledge of widespread capital shortfalls, the authorities failed to prepare for an orderly liquidation even at the worst-managed and most vulnerable institutions.

So, what have we learned over the year since SVB failed and what do authorities need to do to address the extreme moral hazard they have created? We see two key lessons. First, a banking system that relies heavily on supervisory discretion is unlikely to prove resilient. Second, authorities with emergency powers to bail out intermediaries during a panic will generally do so. Put differently, government officials will favor bailouts over bail-ins, the latter of which imposes losses on creditors.

While supervision is essential and needs to be improved, that will never be enough. A combination of incomplete rules, difficulties in detecting risk taking, a high burden of proof on the supervisor, and a coordination problem within and across agencies leads us to conclude that supervision alone is doomed to be inadequate. Furthermore, a succession of supervisors with changing tolerances for risk means discretion will create inevitable fluctuations in the rigor with which rules are interpreted and enforced, leaving the system vulnerable to crisis.

It also is now obvious that when the system is under stress, authorities will opt for a bailout—even for medium-sized banks—so long as that option exists. Importantly, the banks that failed in 2023 were treated as systemic only in death, not in life. Yet, blaming the supervisors for a lack of foresight misses the key point: when faced with disruptions that threaten the payments system or the supply of credit to healthy borrowers, most officials will do anything in their legal power to avoid becoming the parent of the next Lehman disaster.

The combination of these two problems—the inadequacy of supervision and the inability of policymakers to commit to not provide a bailout—inevitably fuels moral hazard. Even if shareholders and executives know that the risks they take could raise the chances of a bank’s failure, they can expect to benefit disproportionately from the upside, and be confident that the costs of failure will be borne substantially by others. The longer such perverse incentives persist, the greater the risk of systemwide fragility.

So, how can we address the supervision and commitment problems that the 2023 crisis exposed? The answer is to make it so that banks—even the very largest ones—can fail in an orderly way. That means allowing some creditors to absorb losses without threatening the system.

To meet this objective, first and foremost, bank supervision needs to be more rule-based and less reliant on the insight and agility of supervisors. Simple, robust rules—including, but not limited to, more rigorous capital, liquidity and disclosure requirements—have a broad range of benefits. Importantly, they can mitigate the commitment problem by raising the bar for bailouts and narrowing discretion. A rule-based system is more credible since it is clear when authorities are following them and when they are not, making it easier to identify violations and to enforce remedies. Furthermore, tightly specified rules are less susceptible to changes in interpretation that accompany the periodic turnover of those in charge. Finally, a set of well-defined rules can limit “risk migration” by making it possible to apply the same standards to nonbanks engaging in bank-like activities. In fact, clear rules are a prerequisite for the application of the increasingly important principle of “same activity, same risk, same regulation.”

Second, the March 2023 episode made clear the need for larger capital and liquidity buffers. Among other things, large buffers:

- make insolvency and illiquidity less likely, reducing the risk of bank failures;

- lower the need for bailouts—whether through emergency resolutions that protect depositors of failed banks or through central bank lending programs that allow fragile banks to keep operating;

- substitute for the unavoidable weaknesses in supervisory discretion;

- guard against the inevitable gaming associated with a set of stable rules and help counter other forms of regulatory arbitrage, and;

- guard against uncertainties in asset valuations that can lead to overestimation of actual net worth.

A number of related reforms would complement simple increases in capital and liquidity requirements. For example, mark-to-market accounting would improve the regulatory measure of bank capital, allowing for more effective supervision and for timely resolution, thereby contributing to market discipline. For the same reason, bank stress tests need to address interest rate risk, not just credit risk. In addition, liquidity rules should be made sensitive to capital adequacy, so that banks with more volatile assets are not allowed to rely on runnable liabilities. For example, the assumed runoff rates in the liquidity coverage ratio could vary inversely with a bank’s net worth. For banks like SVB, such a redesigned liquidity requirement could have reduced dependence on uninsured deposits at least a year before the bank failed. Finally, eliminating the role of the Federal Home Loan Banks as a lender-of-next-to-last resort would provide the Federal Reserve—as the official lender of last resort—earlier insight and greater influence over banks that face liquidity issues.

Our conclusion is that, while the sources of the banking panic of 2023 were clear virtually from the start, experience over the past year has helped clarify the remedies needed to make the banking system safe. Above all, policymakers need to address the limits of supervision and their inability to commit credibly not to bail out fragile banks in a crisis. For this purpose, the most effective reforms will be rule-based—especially higher capital requirements and liquidity requirements that are capital-sensitive.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.