Due to a change in how the FDIC resolves failed banks, uninsured deposits have become de facto insured. Not only is this dangerous for risk in the banking system, it is not what Congress intends the FDIC to do, writes Michael Ohlrogge.

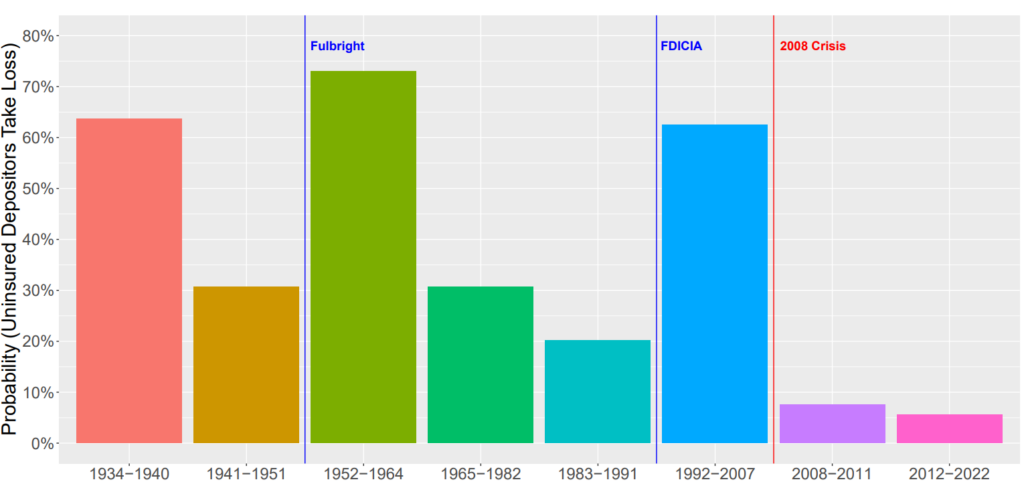

The recent failures of Silicon Valley Bank and First Republic have drawn attention to how rare it is for uninsured depositors at a failed bank to bear losses. Over the past 15 years, uninsured depositors have experienced losses in only 6% of United States bank failures. In a newly released paper, I show that ubiquitous rescues of uninsured depositors represent a recent phenomenon dating only to 2008: for many years prior to that, uninsured depositor losses were the norm. I also show that the rise of uninsured depositor rescues has coincided with a dramatic increase in Federal Deposit Insurance Corporation costs of resolving failed banks, which I estimate resulted in at least $45 billion in additional resolution expenses over the past 15 years.

The growth of uninsured depositor rescues raises serious concerns about moral hazard as well as fiscal costs. It also risks violating the FDIC’s statutory requirement to resolve failed banks and protect insured depositors in the least expensive way possible. I present evidence that the best explanation for the growth of uninsured depositor rescues is that the FDIC has experienced “mission creep,” resulting in the rescue of uninsured depositors far more frequently than Congress intended. This mission-creep occurred twice in the past, and Congress successfully intervened to stop it in 1951 and 1991. It may now be time for a third such intervention from Congress.

The Least-Cost Resolution Requirement and the Systemic Risk Exception

Current law requires the FDIC to resolve failed banks in the least expensive way while still protecting insured depositors. As a reminder, the law stipulates that deposits up to $250,000 held at any FDIC-insured bank are backed by the federal government. Sometimes, rescuing uninsured depositors may in fact be the cheapest way to protect insured depositors. For instance, suppose the failed bank will be purchased by another bank who will continue to operate it. The purchaser might prefer to keep customers of the failed bank happy by honoring even uninsured deposits, and thus might pay more for the failed bank’s assets if uninsured depositors are made whole. If the extra amount the acquirer will pay for the failed bank’s assets is greater than the cost of reimbursing uninsured depositors, then it will be cost-effective to fully compensate even uninsured depositors.

Frequently, however, uninsured depositor rescues increase the total resolution costs. If the FDIC believes it is necessary to rescue uninsured depositors, despite it not being the lowest cost option, then it must invoke the “Systemic Risk Exception.” This requires authorization from two thirds of the FDIC Board, two thirds of the Fed Board, the Treasury Secretary, and the U.S. president. The FDIC has invoked this only twice for failed banks: SVB and Signature, both of which failed in 2023. Thus, the systemic risk exception is not invoked lightly. In this paper, I argue that the FDIC has rescued uninsured depositors at hundreds of failed banks in situations where doing so is not least cost, yet without going through the Congressionally mandated procedures for invoking the Systemic Risk Exception.

Reasons to Worry About Excessive Uninsured Depositor Rescues

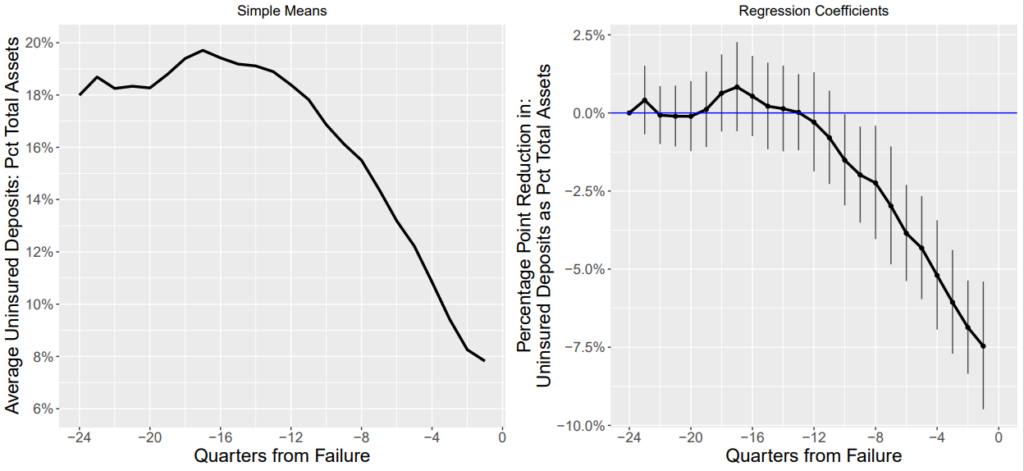

Beyond increasing costs of resolving failed banks, excessive rescues of uninsured depositors run the risk of reducing the incentives of uninsured depositors to monitor banks, which can encourage banks to take excessive risks. Existing research shows significant evidence, over many different time periods, that uninsured depositors play an active role in monitoring and disciplining banks. (See the full paper for a list of this research, which includes work by Anthony Saunders, Berry Wilson, Charles Calomiris, Joseph Mason, Andrew Davenport, Christopher Martin, Manju Puri, and Alexander Ufier.) The data I analyze confirm these results. Figure 1 considers data from all banks that have failed over the past 30 years. Panel (a) shows that on average, starting 4 years prior to failure, the percent of bank’s total assets that are funded with uninsured depositors begins dropping, with banks losing roughly half or more of their uninsured deposits by the time they fail. Panel (b) presents similar results in a regression form. The regression shows that banks that fail lose significantly more uninsured deposits compared to banks that are similarly sized and in similar geographic regions that do not fail. Thus, uninsured depositors appear to be aware of how safe the banks they deposit money in are, and they flee poorly run banks. This does not guarantee that banks will always be prudently run, but it creates incentives for bankers to pursue safe strategies, which helps to promote financial stability.

Figure 1: Flight of Uninsured Depositors from Failing Banks

If uninsured depositors do not wish to monitor the safety of banks, there are other ways they can protect their funds. Sweep accounts, for instance, automatically move balances beyond a specified limit (such as the FDIC insurance limit) into Treasury money market mutual funds (MMFs) or similar investments at the end of each day. This enables the convenience of checking accounts along with the safety of Treasury securities. Thus, imposing loses on uninsured depositors at failed banks does not mean that every person or business with more than $250,000 must necessarily put their money at risk.

Reasons to Believe the FDIC Now Favors Uninsured Depositor Rescues

Although I cannot prove it with complete certainty, I show that there are numerous reasons to believe that the FDIC has begun rescuing uninsured depositors even when doing so substantially increases resolution costs.

Reason #1: FDIC costs have risen dramatically at the same time uninsured depositor rescues have become ubiquitous.

- Starting in 1992 (when Congress adopted the current version of the least-cost resolution requirement) through 2007,, the average cost of resolving failed banks, as a percent of the failed banks’ assets, was 10%. Uninsured depositors experienced losses in 63% of bank failures.

- From 2008 onwards, average costs of resolving failed banks have risen to 18.2% of failed banks’ assets, and uninsured depositors have experienced losses in only 6% of bank failures.

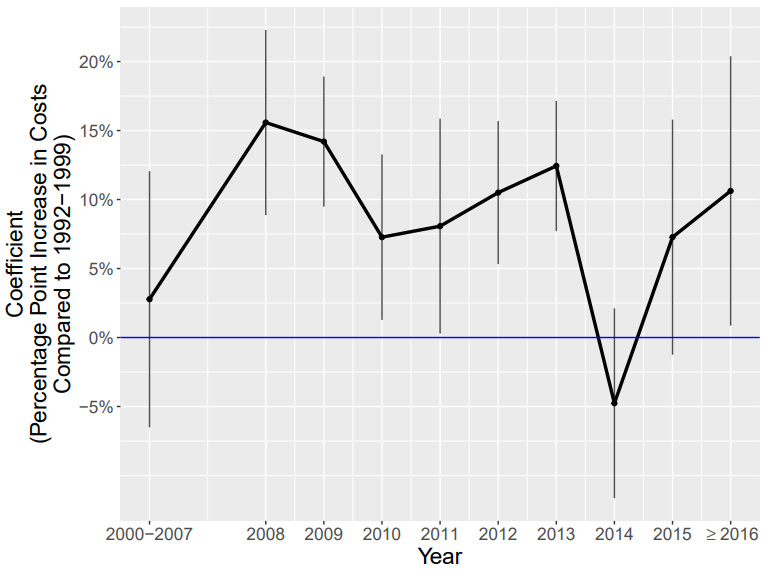

- Since I measure costs as a percent of failed bank assets, changes in the number or size of failed banks will not directly impact them. Furthermore, the elevation in the FDIC’s costs persists well past the end of the 2008 financial crisis. It likewise persists in regression analyses that control for the amount of insured deposits banks have, bank size, the quality of bank assets at the time of failure, and the set of institutions available to bid on a failed bank’s assets. Figure 2 plots yearly coefficient estimates from these regressions that measure the change in FDIC resolution costs compared to costs from 1992-1999 (the period immediately after Congress adopted the current version of the least-cost resolution requirement).

- While the tight correlation between rising costs and rising uninsured depositor rescues does not prove causation, there are strong theoretical reasons to believe that uninsured depositor rescues would cause costs to rise. Furthermore, neither the FDIC nor any other writers have proposed other explanations that can account for the FDIC’s dramatic rise in costs.

- I also show that the rise in costs the FDIC experienced in 2008, when it seems to have ceased following least-cost resolution requirements, is comparable to the drop in costs the FDIC experienced in 1992, when it began following the modern version of the least-cost test mandated by Congress.

Figure 2: FDIC Resolution Costs Compared to 1992-1999

Reason #2: The FDIC has twice in the past acknowledged that it adopted a preference for rescuing uninsured depositors, even when doing so increased resolution costs.

- Congress intervened in 1951 and 1991 to rein in what it viewed as excessive depositor rescues, leading to high costs and moral hazard. Figure 3 plots the frequency of losses by uninsured depositors before and after these Congressional interventions. The full paper provides more details on these interventions.

Figure 3: Probability of Uninsured Depositor Loss, Given Bank Failure

Reason #3: Recent statements by the FDIC appear to acknowledge that it favors resolution methods that rescue uninsured depositors, even when doing so is not least-cost.

- The FDIC has said that starting in 2009, when it conducted auctions of a failed bank’s assets, resolutions that rescued uninsured depositors were “often the only [option] offered to potential acquirers.”

- The FDIC has also stated that it favors resolution methods that rescue uninsured depositors because they promote “financial stability,” even though Congress has been clear that if the FDIC wishes to rescue uninsured depositors on account of financial stability concerns, it must seek authorization through the Systemic Risk Exception.

Reason #4: If it were least-cost to impose losses on uninsured depositors in 63% of failures from 1992-2007, why would it now only be least-cost to impose losses in 6% of failures?

- Such a dramatic change would suggest some fundamental shift in the nature of banks or the banking industry. Yet there is no available evidence of such a shift that could explain this.

Reason #5: Mechanisms for transparency and accountability are absent or have disappeared.

- Prior to 2008, the FDIC conducted least-cost audits with some regularity, examining past failures to determine whether it had resolved the banks in the most cost-effective means. Post-2008, these audits have essentially ceased. The FDIC has provided no explanation for the cessation.

- The FDIC maintains strict secrecy regarding the methods it uses to compute the costs of different resolution methods, making it impossible for outsiders to verify the FDIC’s claims that rescuing uninsured depositors has now essentially always become the cheapest way to protect insured deposits.

Additional Considerations

In the full paper, I consider several other possible explanations for changes in the FDIC’s costs and resolution methods over the past fifteen years. Here, I briefly survey some of those considerations.

Consideration #1: Is the FDIC simply responding to broader political forces that favor rescuing uninsured depositors?

- If the FDIC’s deviations from the least-cost requirement reflect a broader political consensus favoring uninsured depositor rescues, then the potential lack of statutory adherence may seem less troubling.

- This is unlikely. Since 2008, there have been 12 failures of banks with over $1 billion in assets where uninsured depositors still took a loss. If there were a broader political consensus in favor of rescues of uninsured depositors, the FDIC could simply have asked for Systemic Risk Exception authorization to rescue uninsured depositors in these cases.

Consideration #2: Can lack of FDIC capacity help explain rising FDIC costs or depositor rescues?

- In 2008, the FDIC experienced significant staffing shortages that took until 2010 to resolve.

- It is possible that these staffing shortages led the FDIC to favor selling failed banks as a whole, a method that rescues uninsured depositors and that is simpler and easier for the FDIC to implement.

- Nevertheless, as Figure 2 and Figure 3 show, elevated costs and depositor rescues persist long after these staffing shortages were resolved.

- For this and similar reasons I present in the paper, I conclude that FDIC capacity may explain a small amount of the change in FDIC costs and depositor rescues, but that it is implausible that it is a dominant driver of the dramatic changes shown in Figure 2 and Figure 3.

Policy Reforms

There are several reforms that can improve adherence to the FDIC’s least-cost resolution requirement, and thus reduce resolution costs and moral hazard.

Firstly, Congress should require Government Accountability Office audits of the FDIC’s compliance with the least-cost resolution requirement.

Secondly, when banks bid to acquire a failed bank’s assets, Congress should prohibit the FDIC from knowing whether the bidders intend to rescue uninsured depositors. Instead, if the winning bidder wishes to use their funds to rescue uninsured depositors, they can do so on their own accord. This will help ensure the FDIC selects bids that are truly least cost, rather than giving preference to bids that will rescue uninsured depositors.

Finally, Congress should grant insured deposits priority over uninsured deposits, matching the system in place in much of Europe. This contrasts with the status quo in the U.S., which gives equal priority to insured and uninsured deposits. This could further reduce FDIC resolution costs while improving incentives for depositor discipline.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.