The implementation of central bank digital currencies as the primary medium of exchange would exacerbate the flaws of our current fiat system which encourage banks to overextend credit and create liabilities that they cannot redeem. This will worsen the already recurring cycles of financial crises, writes Vibhu Vikramaditya.

The Bank of England recently proposed a reform of its monetary system, advocating for the eventual elimination of cash and the adoption of digital currency as the primary medium of exchange. This proposal has significant implications for the financial and banking system and requires careful debate and discussion among policymakers, economists, and the general public. While the Bank of England highlights potential benefits, such as increased efficiency and security in payment systems, better monetary policy implementation, and reduced risks associated with the shadow economy, there remain concerns about potential negative effects, such as increased fragility and inflation and an increase in moral hazards. Therefore, thorough examination and consideration of the implications are necessary before implementing such a fundamental shift in the way money is used and managed in the modern economy.

Liability Redemption and Money Supply Growth

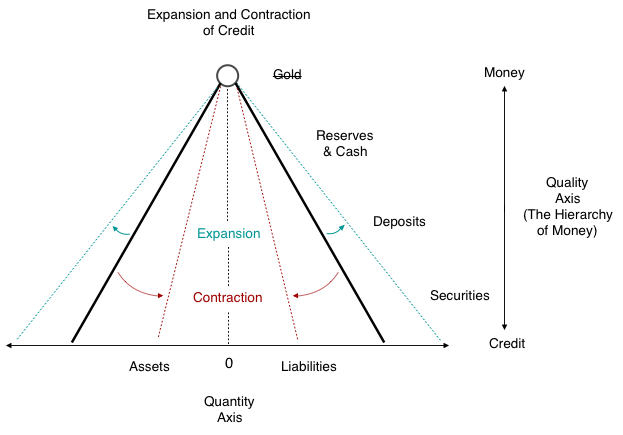

The “pyramid of money” is a conceptual framework that illustrates the relationship between money, credit, and liability redemption in an economy. At the top of the pyramid lies the form of money that is most widely accepted and redeemable, such as gold or fiat money. They are widely accepted and trusted by individuals and institutions alike, and they serve as the foundation upon which the rest of the pyramid is built.

Figure 1. Pyramid of Money

Below this top layer are different layers of credit extended by various institutions, which are built upon the acceptance and redemption of liabilities, such as loans. In other words, they are based on the trust that borrowers and lenders have in each other’s ability to meet their obligations.

The width and height of the pyramid in the economy are not constant and can vary with economic conditions and institutional environments. During times of economic and credit expansion, the pyramid of money tends to expand both in width and height. This is because credit becomes readily available and easily accessible, leading to the proliferation of credit instruments and the extension of credit by various institutions. As a result, the economy experiences growth.

However, the expansion is not necessarily always stable, and in times of financial crisis or in an economic downturn, the layers of credit in the pyramid can quickly unravel, as borrowers and lenders lose confidence in each other’s ability to meet their obligations. This can result in a sudden collapse of the money supply, as was the case during the Great Depression, when an estimated 9,000 banks failed in the United States, causing the country’s money supply to contract by as much as one-third between 1929 and 1933.

One of the key factors that influence the expansion and contraction of the pyramid of money is the concept of liability redemption. Liability redemption refers to the commitment of institutions to allow redemption of their liabilities, such as banknotes or deposits, for a specific asset, such as gold or silver. In systems where liability redemption is effectively enforced, institutions are incentivized to assess the creditworthiness of borrowers and lenders carefully, as they are responsible for redeeming their liabilities with valuable assets. This helps to ensure that credit is extended prudently and that the height and width of the pyramid of money remain within sustainable levels.

Historical examples of free banking systems that worked under commodity standards (in which gold and/or silver are the means of final redemption) include Scotland and the U.S. in the 18th and 19th centuries. Their experiences provide evidence of how liability redemption can help limit the expansion of the pyramid of money. In these systems, banks were required by competition (not by government mandate) to maintain adequate reserves to meet their redemption obligations, and excessive expansion of credit could result in a drain of reserves and potential insolvency. This helped to prevent the pyramid of money from expanding beyond sustainable levels, contributing to relatively stable money supply growth and low inflation rates.

The Scottish free banking system was characterized by a high degree of competition, which incentivized banks to maintain prudent levels of reserves and to assess the creditworthiness of borrowers and lenders carefully. From 1755 to 1845, Scotland’s population grew from 1.2 million to 2.6 million, and its GDP per capita increased by a factor of 3.5. Its economy grew extensively while also experiencing low and stable inflation rates, with an average annual inflation rate of 0.2% from 1750 to 18

Similarly, in the U.S., during the period of free banking from 1837 to 1863, the country experienced low and stable inflation rates, with an average annual inflation rate of 1.4% from 1830 to 1860. The U.S. free banking system was also characterized by a high degree of competition, which incentivized banks to maintain prudent levels of reserves the and to assess the creditworthiness of borrowers and lenders carefully. From 1830 to 1860, the country’s population grew from 12.9 million to 31.4 million, and its GDP per capita increased by a factor of 2.6.

The growth of the pyramid of money under a free banking system is stable due to competition, which promotes liability redemption as banks compete to attract depositors and borrowers. Competition serves as an additional check on the expansion of credit on top of the scarcity of money for final redemption. Banks that issue too much currency or extend credit indiscriminately risk losing depositors and borrowers to other banks that are perceived as more creditworthy. This competitive pressure can similarly incentivize banks to assess the creditworthiness of borrowers and lenders carefully and to maintain prudent levels of reserves to meet their liability redemption obligations.

The Structure of Money and Credit with Cash as the Foundation of the Money Pyramid

Under a fiat standard, the connection between overexpansion and liability redemption is not as straightforward. In a fiat system, the currency is not backed by any physical commodity, and therefore, there is no incentive for depositors to rush to redeem their liabilities, reducing discipline.

Moreover, fiat money structures the payoffs in such a manner that banks that don’t expand during a boom are at a disadvantage. When the economy is expanding, there is an increase in the demand for credit, as individuals and businesses seek to invest and expand their operations. Banks that expand their lending are better positioned to capture this demand and generate profits, as they can charge interest on the loans they make. Additionally, banks that expand their lending can increase their market share and gain a competitive advantage over other banks that do not by reducing their need for reserve cash, due to reducing deposit outflow.

This creation of new money gives expanding banks a competitive advantage by drawing in and creating deposits in a booming economy, while those that do not expand their lending are limited in their ability to generate new deposits, which can limit their ability to compete with banks that are expanding their lending and creating new money.

The combination of these factors means that the redemption of liabilities into final money is limited, reducing the discipline of lending standards. The strategic pay off for banks in a fiat system is to expand and increase their market share and profitability, which can be achieved by expanding credit and creating more money. This leads to competition among banks during the boom to expand credit and creates an incentive structure that, as several historical episodes have shown, is not conducive to maintaining low and stable inflation rates.

Implications of Central Bank Digital Currencies for the Economy

The historical occurrence of price stability loss and the rise of fragility following periods of high inflation due to an overextension in credit and liabilities suggests the possible implications of central bank digital currencies (CBDCs) at the top of the pyramid. CBDCs as a replacement for cash can lead to excessive deposit creation further breaking the market correction process and leading to increased fragility over time. CBDCs would change the fiat system, where cash remains a tangible commodity of final redemption, to one which digitizes all “value” and acts of redemptions, leaving no room for redemption or alternative holdings of value.

Under a CBDC system, liability redemption would be completely eradicated. This is because there is no physical commodity except the trust backing the CBDCs, and therefore, there is no incentive for depositors to rush to redeem their liabilities in times of crisis. Since CBDCs are a liability of the central bank, depositors would not be able to redeem their liabilities for anything other than other CBDCs. Expanding banks would gain larger market shares over time only due to trust in their worthiness which, in a world with imperfect information, will lead to the accumulation of errors.

The elimination of liability redemption under CBDCs will encourage even more aggressive expansion during periods of growth and create a significant risk for the financial system. Without the natural check on the expansion of credit created by liability redemption, over-expanding firms may be able to continue operating for longer periods of time, potentially leading to more severe systemic failures down the road during times of contraction, such as the 2007 financial crisis.

In conclusion, the digitization of value through CBDCs as a replacement for cash can have various unintended consequences on the functioning of the economy. It can disrupt the natural discovery process of the market economy, reduce the self-correcting mechanism of runs and redemption, and lead to the concentration of financial power in a few large banks, generating high inflation levels. It is important to carefully consider the implications and potential risks associated with the implementation of CBDCs to mitigate any adverse effects on the stability and efficiency of the financial system.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.