IG Farben used to be the world’s largest chemical company and a major innovator—until it was broken up in one of the largest antitrust events in history. My research finds that the breakup increased innovation activity in postwar Germany.

The 21st century has seen two notable trends: “Big companies” are now bigger than ever, and the pace of innovation is slowing. Large superstar firms may be responsible for notable innovations at first, but they also have the potential to erode innovation incentives later. The classic Schumpeterian refrain of economic growth through “creative destruction” has become murkier recently, as incumbent firms have become increasingly persistent. Are megafirms good or bad for innovation? How do concentrated markets relate to the pace of innovation? If large firms are broken up, how will the breakup impact innovation? Empirically, these are challenging questions because the connection between concentration, the presence of dominant firms, and innovation is hard to pin down. The concentration level in a market is almost certainly related both to innovation and to other factors that impact innovation, making the true effect of competition on innovation challenging to investigate.

In cases like the breakups of Standard Oil or AT&T, the government has stepped in to restructure the market, which allows researchers to investigate the effects of these direct changes to the market. Yet, such cases are rare. The breakup of IG Farben offers important lessons.

Rise and Fall of IG Farben

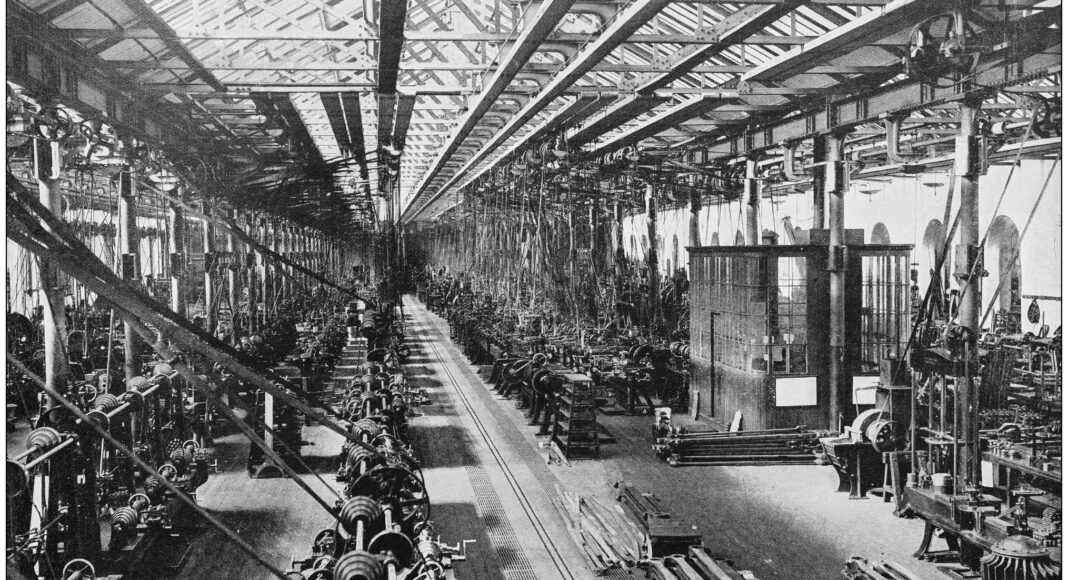

In the early 20th century, IG Farben was one of Germany’s most innovative firms and the world’s largest chemical company. The company was home to three Noble Prize winners, who were awarded prizes for developing the world’s first commercial antibiotics (1939) and for work in high-pressure chemistry (1931) that enabled the production of artificial fertilizer through nitrogen fixation. Both developments had a considerable impact on the chemical industry and on every industry that utilizes its products. Overall, IG Farben played a critical role in the German innovation system, accounting for 5.8% of all patents by German inventors (16.5% in chemistry).

IG Farben was formed in 1925 in a mega-merger between several of Germany’s largest chemical companies, which had earlier formed a cartel. With the merger, the companies aimed to increase the efficiency of their operations and rationalize production. Nonetheless, the unified company maintained a practice called “centralized decentralization” with redundancies and many spatially distributed research laboratories. Due to its industrial capabilities regarding synthetic fuel, rubber, and explosives, the firm was critically important to the German war machine and became deeply involved in the atrocities at Auschwitz. This ambivalent history has long captured the interest of historians and led to the perception of IG Farben as “Hell’s cartel”.

In the aftermath of World War II, the victorious Allied Powers worried that IG Farben’s economic influence would give it undue political power. After years of deliberation, in 1952 the Allies broke IG Farben into a dozen small businesses and three large new companies: BASF, Bayer, and Hoechst. The major successors were largely organized according to the Allied occupation zones in Germany, each containing major production and R&D facilities of IG Farben. Suddenly, exposure to concentration in chemical markets and technology fields had changed.

Analysis of the Breakup

The IG Farben breakup is particularly instructive because it was externally imposed and implemented and because it was unexpected by the breakup target. Typically, breakup cases (and mergers) result from strategic considerations of firms and antitrust authorities that deliberate about the state of competition and potential outcomes—including the effects on innovation. In the IG Farben case, breakup enforcement was not done by antitrust authorities but through a series of laws of the Allied High Commission overseeing the post-war administration of Germany. Considerations were strongly related to political factors: first the impression left by the company’s involvement in the war, and later the distribution of IG Farben factories across occupation zones in light of the looming cold war. Since IG Farben had not expected the breakup and had not directed investments according to such expectations, the case allows conclusions to be drawn about competition and innovation in a much more rigorous fashion than in other cases or post-mortem merger analyses. Finally, the breakup had a geographical structure, and redundancy in technology and product portfolios between the successor companies led to horizontal competition. Relative to the breakup of AT&T, where the vertical separation between the research unit and distribution network is central for an innovation analysis, the breakup of IG Farben highlights a different, and arguably more relevant, facet.

One way to think about the IG Farben breakup is from the perspective of a merger. Breakups and mergers both change who owns the assets used to produce a good or service. In a merger, the effect on innovation is ambiguous, as it depends on the market structure and on any synergies the two joining firms might achieve. In a breakup, not only will the “new” firms born from the large incumbent react to the breakup, but so will all other firms in the industry. If the breakup increases innovation by the successors, all other firms will simultaneously face new competition in the product market and see technology spillovers. Competitors’ choices to respond strategically determine the aggregate impact on innovation from a breakup. Theoretically, the response by outside incumbents would be ambiguous, as technology spillovers increase innovation while product competition may decrease innovation.

For the analysis, I digitize data from over 1.2 million German patents and product catalogs for the German chemical industry. With this data, I can describe the landscape of technology fields and product markets well and over time.

German patent 703500, owned by IG Farben, with highlighted key information about technology class, inventor and applicant location, and application year.

1952 product catalog entry of a chemical substance offered by both Bayer and Hoechst (entries 3 and 4), indicating direct post-breakup product market competition.

My main results show an increase in aggregate innovation post-breakup. Empirically, I analyze how innovation—measured as the quality-weighted patent count—reacts to changes in concentration caused by the breakup. I measure breakup exposure with the concentration change resulting from the breakup. Before 1952, patenting in technologies that were later affected by the breakup was trending in the same way as in unaffected technologies. In the post-war period, patterns diverged substantially, suggesting a positive innovation effect from the breakup. Additional analyses juxtaposing technology-level and product-level exposure to the breakup suggest that technology spillovers, rather than product market interactions, were driving the rise in innovation.

For IG Farben itself, I also find positive innovation effects. Comparing the patent output of IG Farben and its later successors to a synthetic control group of companies from the German electronics industry, I again document a parallel pre-war and pre-breakup development and large increases in innovation output after the breakup. The electronics industry, like the chemical industry, was a high-tech industry with a relatively large concentration. Its duopoly of AEG and Siemens was affected by many of the same post-war difficulties as IG Farben, yet it was not broken up. Further, these firms operate in technologically different areas, so there is little product market overlap. Therefore, the electronics industry provides a relevant comparison group.

Of course, there are several potential confounding factors for which a variety of robustness checks are included in the paper. Most importantly, the analysis takes place within chemistry, comparing technologies and firms with different exposure levels. Consequently, the analysis inherently accounts for macro-trends. Nonetheless, in a series of robustness checks and historical discussions, I control for effects of war destruction, Allied occupation, competition policies, and location within or outside the Soviet sector. While there may be other historical details to consider, the observed effects only materialize after the breakup, and the effects are driven by technologies in which the breakup increased competition, making it unlikely that any single factor can explain the increase in innovation better than the breakup itself.

Implications

While the breakup of IG Farben occurred 70 years ago, the implications of a megafirm breakup remain relevant. Large companies with enormous in-house research investment are still driving technology and innovation. Recent high-profile mergers in the chemical industry like ChemChina-Syngenta, Dow-DuPont, or Bayer-Monsanto only underscore the importance of understanding the relationship between competition and innovation. This paper also highlights the importance of technology spillovers and the need to analyze the effects of mergers and breakups beyond those few firms that are directly involved.

IG Farben is one example of a successful government-mandated breakup. It demonstrates the usefulness of such breakups as a last-resort instrument in antitrust policy toolkits. A policy of repeated breakups, however, would most likely reduce each company’s incentives to invest in innovation and to grow. In the IG Farben case, the German government later introduced formal competition legislation, like the US model, and committed to a policy environment without further breakups. Future research should study how the potentially negative dynamic incentives of breakups can be avoided or mitigated. Nonetheless, the IG Farben case highlights the importance of market and technology competition and of a robust antitrust policy for innovation.

Read about our disclosure policy here.